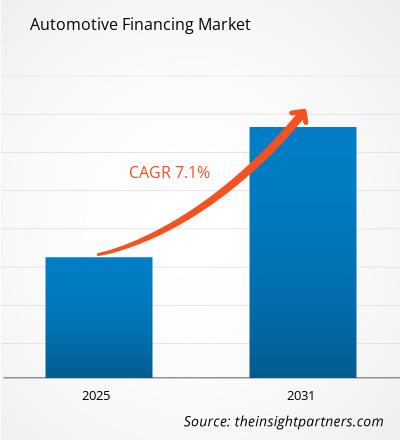

The automotive financing market size is expected to grow at a CAGR of 7.1% from 2025 to 2031. The automotive financing market includes growth prospects owing to the current automotive financing market trends and their foreseeable impact during the forecast period. The automotive financing market is growing due to the huge demand for passenger cars, the huge growth of the automotive industry, and the growth of electric vehicles.

Automotive Financing Market Analysis

Automotive financing refers to the use of a loan to finance the purchase of a new or a used vehicle. While many consumers choose to purchase a car entirely with cash, many more opt for a loan. Rising demand for car loans in tier 2 and tier 3 cities and digitization of the auto financing process are some of the factors driving the automotive financing market growth.

Automotive Financing Market Industry Overview

- Automotive financing is a way to buy a car if someone doesn't have all the money upfront. Automotive financing involves borrowing money from a bank or lender and paying it back over time, often with interest.

- With increasing demand for cars, the manufacturers themselves were engaged in providing loans to facilitate the buyers to purchase their cars at affordable costs. Automotive manufacturers such as Audi, Toyota, Honda, Tata, Ford, Maruti, Skoda, and Volkswagen provide loans to customers for in-house car models. The major advantage of availing of manufacturers' finance is that the loan processing time is reduced, and the buyer can benefit from the better loan terms.

- According to data from RBI in 2022, it has been witnessed that people are shifting towards car loans more than home loans nowadays. Demand for automobiles has increased, exceeding the prior interest in owning a house.

Automotive Financing Market Driver

Growing Adoption Of Electric Vehicles To Drive The Automotive Financing Market

- The demand for electric vehicles is growing at a faster rate from 2021, owing to increasing investment in manufacturing plants. The growing demand for electric vehicles is primarily attributed to the increasing demand for low-emission vehicles, and growing supportive regulations for zero-emission vehicles through subsidies & tax rebates have compelled manufacturers to provide electric cars across the globe.

- Moreover, electric cars are seeing exponential growth. According to the data from the International Energy Agency, there are more than 25 million electric cars in use globally as of 2022. A total of 14% of all new cars sold were electric in 2022, up from around 9% in 2021. China is the frontrunner, accounting for around 60% of global electric car sales.

- This increased demand for electric vehicles leads to more loans being taken out, which means more business for automotive financing. Thus, the growing adoption of electric vehicles drives the automotive financing market.

Automotive Financing Market Report Segmentation Analysis

- Based on the provider type, the automotive financing market is segmented into banks, OEMs, and other financial institutions. The banks' segment is expected to hold a substantial automotive financing market share in 2023.

Automotive Financing Market Share Analysis By Geography

The scope of the automotive financing market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant automotive financing market share. The countries in North America have a developed automotive industry due to the continuous production of passenger vehicles. For instance, as per the Organisation Internationale des Constructeurs d'Automobiles (OICA) 2021 report, the US produced 70,24,288 passenger vehicles in 2021 and 68,64,024 in 2021. Similarly, Canada produced 3,20,605 passenger vehicles in 2021 and 3,18,750 in 2021, as per the same report. As per OICA statistics, the US, Canada, and Mexico are leading in the passenger vehicle production segment across the globe. Thus, with the continuous production of passenger vehicles across the region, there's a constant demand for cars as many people need cars for work, school, and daily life. This has increased the demand for loans to purchase vehicles in North America.

Automotive Financing Market Report Scope

The "Automotive Financing Market Analysis" was carried out based on provider type, finance type, purpose type, vehicle type, and geography. On the basis of provider type, the market is segmented into banks, OEMs, and other financial institutions. On the basis of finance type, the market is segmented into direct and indirect. On the basis of purpose type, the market is segmented into loans, leasing, and others. On the basis of vehicle type, the market is segmented into commercial vehicles and passenger vehicles. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Automotive Financing Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the automotive financing market. A few recent key market developments are listed below:

- In November 2023, OneMain, whose main offering is installment loans for consumers with lower credit scores, has been steadily expanding into the credit card and auto lending sectors.

[Source: OneMain, Press Release]

- In November 2023, Gruppo Campello, the official distributor of the Cenntro brand in Italy, and CA Auto Bank, an international banking group specializing in vehicle financing and mobility, announced a strategic partnership for the marketing of the brand’s products.

[Source: Gruppo Campello, Press Release]

Automotive Financing Market Report Coverage & Deliverables

The automotive financing market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Automotive Financing Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Automotive Financing Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Provider Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For