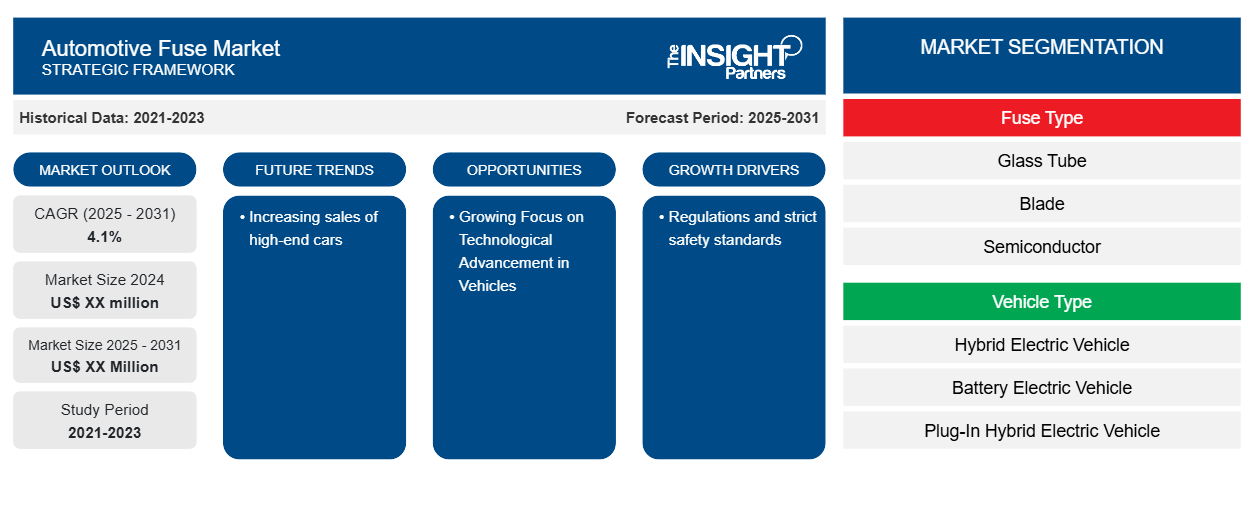

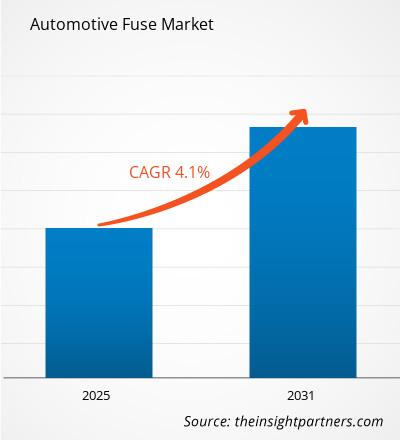

The automotive fuse market is expected to register a CAGR of 4.1% during 2023–2031. The evolution of advanced technologies and the introduction of high-end vehicles will likely remain a key trend in the market.

Automotive Fuse Market Analysis

- The increasing vehicle production and growing electrification in automobiles are all expected to drive the market's expansion shortly.

- Furthermore, the rising significance of safety and comfort features in automobiles is also driving the growth of the automotive fuse market.

- Among all electrical components in an automobile, fuse units are the most frequently used and required. This signifies the rise in demand for cars with advanced technical features.

- To meet rising consumer demand, automakers are increasing the production of these vehicles. Fuse development is becoming more important as electric vehicles with more integrated electronic features gain popularity.

Automotive Fuse Market Overview

- Manufacturers of automotive parts focus on developing advanced systems in response to the growing demand for automobiles in various nations. This is fueling the global growth of the automotive fuse market by increasing demand for efficient automotive parts.

- Additionally, the development of complete insulated clips, the application of tin and nickel-plated brass contacts that ensure resistance to vibration and shock, and technological advancements to ensure soldering are all contributing to the development of advanced automotive fuses, which is driving the growth of the automotive fuse market.

- The growing use of high-power fuses is also supporting global demand for efficient automotive fuses.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Fuse Market Drivers and Opportunities

Regulations and Strict Safety Standards to Favor the Market

- Regulations and strict safety standards continue to positively impact automobile design worldwide.

- An important component of these safety precautions is automobile fuses. They ensure the safety of drivers and passengers by guarding against electrical malfunctions and lowering the possibility of fires.

- To adhere to safety regulations, government agencies, and safety groups require the use of automobile fuses.

- Certain safety requirements that vehicles must meet are mandated by the Federal Motor Vehicle Safety Standards (FMVSS) in the United States.

- Penalties and recalls may occur from noncompliance. The market for fuses is expanding as a result of automakers installing premium fuses to satisfy these requirements.

Increasing Demand for Control Cable

- Global economic improvement has led to a shift in consumers' overall lifestyles. Global passenger car sales are up, particularly for premium vehicles, which signifies that people's lifestyles and financial situations have improved. Families with higher disposable incomes are increasing, and as a result, demands have adjusted to fit their new way of life, changing preferences.

- Global sales of high-end passenger cars have also benefited from factors such as rising per capita income, bettering infrastructure, and growing OEM competition to provide better features.

- In developed nations such as the US, UK, and Germany, consumers have a lot of purchasing power. As a result, buyers can purchase expensive cars. Premium vehicles use automotive fuses more frequently than mid- or low-segment vehicles do due to their added safety and luxury features; the demand for automotive fuses is predicted to rise in tandem with the rising demand for premium cars.

Automotive Fuse Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive fuse market analysis are fuse type, vehicle type, and battery capacity.

- Based on the fuse type, the automotive fuse market is divided into glass tubes, blades, semiconductors, and others.

- based on the vehicle type, the market is divided into hybrid electric vehicle (HEV), battery electric vehicle (BEV), and plug-in hybrid electric vehicle (PHEV).

- Based on battery capacity, the automotive fuse market is divided into <30 kWh, 30-75 kWh, 75-150 kWh, and >150 kWh.

Automotive Fuse Market Share Analysis by Geography

- The automotive fuse market report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering automotive fuse market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers PEST analysis, which involves the study of major factors that influence the automotive fuse market in these regions.

Automotive Fuse Market Regional Insights

The regional trends and factors influencing the Automotive Fuse Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Fuse Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Fuse Market

Automotive Fuse Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ XX Million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2024 - 2031) | 4.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Fuse Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

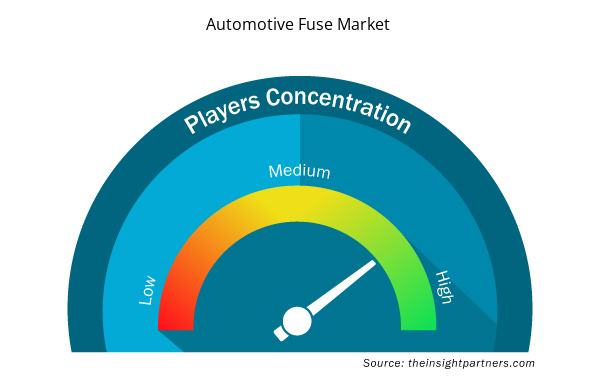

Automotive Fuse Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Fuse Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Fuse Market are:

- ON Semiconductor

- Schurter Holding AG

- Littelfuse, Inc.

- Eaton Corporation Plc

- MersenLittelfuse, Inc.

- OptiFuse

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Fuse Market top key players overview

Automotive Fuse Market News and Recent Developments

The automotive fuse market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive fuse market are listed below:

- Littelfuse, Inc., an industrial technology manufacturing company empowering a sustainable, connected, and safer world, announced the release of its AEC-Q200 Rev E Qualified Fuses, specifically designed for the demanding circuit protection needs of compact automotive electronics and electric vehicle (EV) applications. The new product portfolio includes a range of thin film fuses, Nano2 fuses, PICO fuses, and cartridge fuses, all certified to meet the AEC-Q200 Rev E qualifications for fuses to ensure the long-term reliability of components used in harsh automotive environments. (Source: Littelfuse, Inc, Company Website, July 2023)

- Bel Power Solutions, a Bel group company, today announced the availability of a new line of automotive fuses, most suitable for eMobility applications seen in electric vehicles (EVs), hybrid vehicles, and electrical energy storage (EES).Products in this series include 0AFG, 0AKH, 0AKK, 0AKL, 0AKM, 0AKN, 0AKR, 0AKS, 0ALA, 0ALE. The products are to be made available through distribution beginning December 2022. (Source: Bel Power Solutions, Company Website, December 2022)

Automotive Fuse Market Report Coverage and Deliverables

The “Automotive Fuse Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive fuse market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive fuse market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Automotive fuse market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive fuse market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Architecture Software Market

- Formwork System Market

- USB Device Market

- Space Situational Awareness (SSA) Market

- Artificial Intelligence in Defense Market

- Glycomics Market

- Rugged Phones Market

- Pharmacovigilance and Drug Safety Software Market

- Neurovascular Devices Market

- Saudi Arabia Drywall Panels Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

The leading players operating in the automotive fuse market are ON Semiconductor, Schurter Holding AG, Littelfuse, Inc., Eaton Corporation Plc, MersenLittelfuse, Inc., OptiFuse, Pacific Engineering Corporation and AEM Components (USA), Inc..

An increase in sales of high-end vehicles is anticipated to play a significant role in the global automotive fuse market in the coming years.

The global automotive fuse market is expected to grow at a CAGR of 4.1% during the forecast period 2023 - 2031.

The rapid technological advancement in the automotive sector is one of the major factors driving the automotive fuse market.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies

1. ON Semiconductor

2. Schurter Holding AG

3. Littelfuse, Inc.

4. Eaton Corporation Plc

5. Mersen

6. Littelfuse, Inc.

7. OptiFuse

8. Pacific Engineering Corporation

9. AEM Components (USA), Inc.

10. Mouser Electronics, Inc.

Get Free Sample For

Get Free Sample For