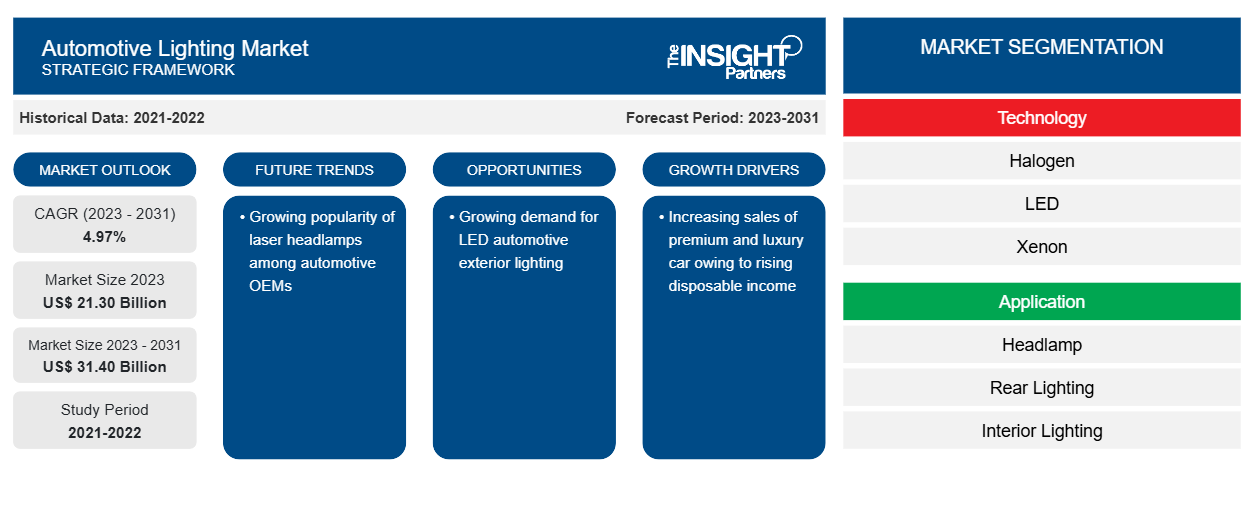

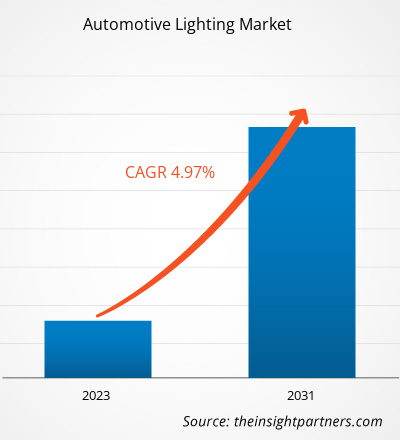

The automotive lighting market size is projected to reach US$ 31.40 billion by 2031 from US$ 21.30 billion in 2023. The market is expected to register a CAGR of 4.97% in 2023–2031. The surge in the sales of premium and luxury cars is driving the automotive lighting market, and it is also providing growth prospects to lighting suppliers.

Automotive Lighting Market Analysis

The automotive lighting ecosystem consists of the following major stakeholders, namely: raw material suppliers, automotive lighting manufacturers/OEMs, and end-users. The raw material suppliers include vendors who provide key raw materials components for automotive lighting such as copper, aluminum, LEDs, and Laser diodes, among others. Automotive lighting manufacturers/OESs such as Osram-Continental, Lumileds, Hella, Valeo, and Automotive-Lighting, among others, integrate and develop automotive lighting for various types of vehicle types. Automotive OEMS share the vehicle-specific headlight, taillight, and signaling lights or blueprints with the vendors. The vendors come up with unique quotations to bid for the supplier's agreement. The vendor who got selected then provides the vehicle-specific lighting systems throughout the tenure of the tender agreement. OEMs integrate these lighting components into their final vehicle.

Automotive Lighting Market Overview

Currently, LED matrix lighting solutions dominate the total automotive lighting implementations. The matrix laser technology is anticipated to further enhance roadway illumination through its high resolution characteristics. The matrix laser technology is based on the LaserSpot for high-beam lamps. With the matrix laser technology, it has become possible to converge the projector technology in the headlamps of the passenger cars. The luminance factor of the lasers is approximately five-times greater than other light sources available in the market, and therefore, the laser headlamps provide higher beam ranges to the vehicle drivers. The beam range of a typical laser headlight ranges above 500 m. The BMW i8 and BMW 7 are the other car series of passenger cars that feature laser-integrated headlights.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Lighting Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Lighting Market Drivers and Opportunities

Increasing sales of premium and luxury car owing to rising disposable income

In the developed countries where consumers have huge disposable incomes, it has been witnessed that with the rise of the vehicular population, consumer preferences for buying passenger cars differs. As a result, cost- and fuel-efficiency are no longer the primary criteria for the purchase of these cars; instead, the purchases more depend on the comfort and luxury provided with them. Moreover, consumers are increasingly evaluating lighting systems and car ergonomics while making the selections.

Growing demand for LED automotive exterior lighting

As per the data from National Highway Traffic Safety Administration (NHTSA), despite only 25% of the total driving time of passenger vehicles at night, ~50% of all passenger vehicle fatalities occur in the dark. This has been mainly due to the inappropriate visibility and improper illumination on roads, and insufficient illuminations provided by the headlamps of the vehicles. Safety concerns have bolstered the automakers to look for a safer alternative. The LEDriving fog lights by OSRAM are remarkable in terms of innovation, design, and performance. Moreover, Philips has AirFlux and AirCool technologies to offer, which help control the heat produced by LED fog lights. These are smart cooling systems that avert heat from the light's critical component, thereby increasing heat resistance and effectively extending the lifespan of LEDs.

Automotive Lighting Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive lighting market analysis are technology, application, and vehicle type.

- Based on technology, the automotive lighting market has been divided into halogen, LED, xenon, and laser. The LED segment held a larger market share in 2023.

- Based on application, the automotive lighting market is segmented into headlamp, rear lighting, interior lighting, CHMSL, fog lamps, and small lamps. The headlamp segment held the largest share of the market in 2023.

- Based on vehicle type, the automotive lighting market has been divided into passenger cars, LCV, and MCV & HCV. The passenger cars segment held a larger market share in 2023.

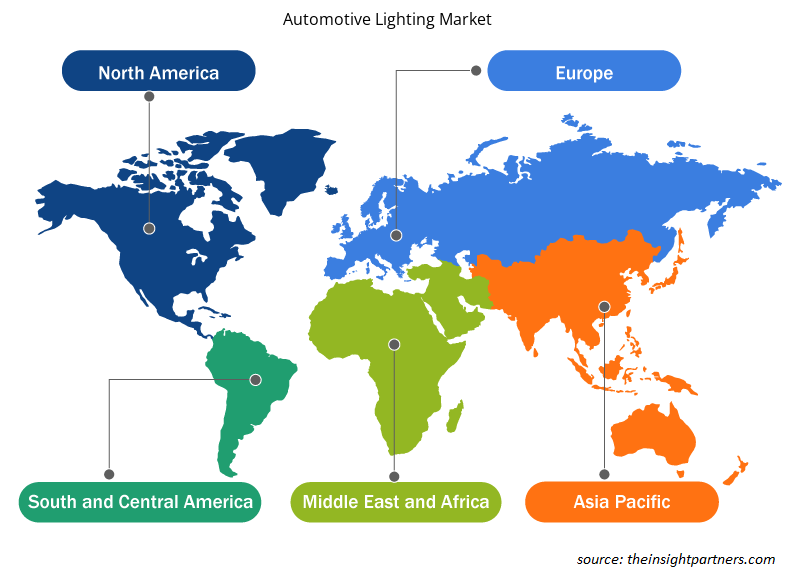

Automotive Lighting Market Analysis by Geography

The geographic scope of the automotive lighting market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The scope of the automotive lighting market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, APAC dominated the automotive lighting market share in 2023. Europe is the second-largest contributor to the global automotive lighting market, followed by North America.

Automotive Lighting Market Regional Insights

The regional trends and factors influencing the Automotive Lighting Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Lighting Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Lighting Market

Automotive Lighting Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 21.30 Billion |

| Market Size by 2031 | US$ 31.40 Billion |

| Global CAGR (2023 - 2031) | 4.97% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

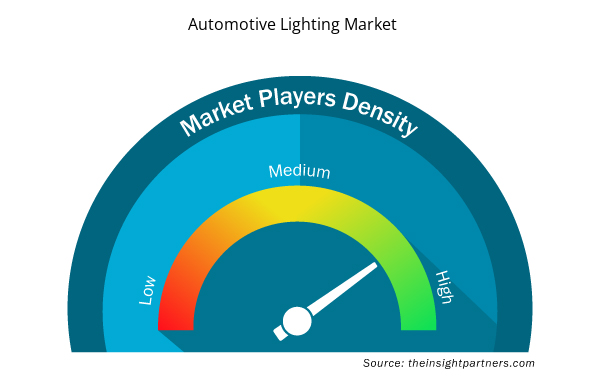

Automotive Lighting Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Lighting Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Lighting Market are:

- Automotive Lighting LLC

- Hella GmbH & Co. KGaA

- Koito Manufacturing Co.

- Ltd.

- Lumileds Holding BV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Lighting Market top key players overview

Automotive Lighting Market News and Recent Developments

The automotive lighting market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for automotive lighting market and strategies:

- On July 2023, Marelli, together with ams OSRAM launches a ground-breaking innovation in automotive front lighting, introducing the h-Digi® microLED module, which is now in series production. This digital lighting solution, based on a new type of intelligent multipixel LED, enables fully adaptive, dynamic headlight operation and image projection, while being an affordable technology, available for a wider range of vehicles. (Source: Marelli, Press Release/Company Website/Newsletter)

- On December 2023, OLEDWorks announced that it will showcase the latest OLED lighting technology for the automotive industry and redefine the landscape with the launch of an exciting new brand at CES 2024. The OLEDWorks team, comprised of OLED technical experts and customer solution strategists, eagerly anticipates welcoming attendees to booth #3225 in the West Hall of the Las Vegas Convention Center, where they can experience the cutting-edge innovations that will shape the future of automotive lighting. (Source: OLEDWorks, Press Release/Company Website/Newsletter)

Automotive Lighting Market Report Coverage and Deliverables

The “Automotive Lighting Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Compounding Pharmacies Market

- Advanced Planning and Scheduling Software Market

- Pressure Vessel Composite Materials Market

- Surgical Gowns Market

- Extracellular Matrix Market

- Passport Reader Market

- Formwork System Market

- Medical Enzyme Technology Market

- Grant Management Software Market

- Procedure Trays Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology ; Application ; Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, United Kingdom, United States

Get Free Sample For

Get Free Sample For