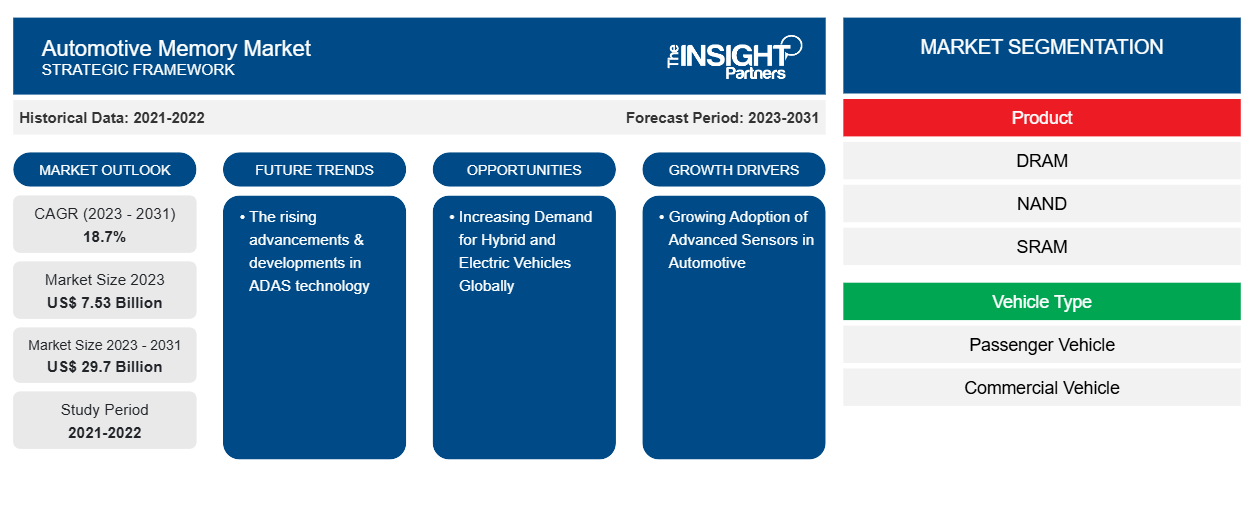

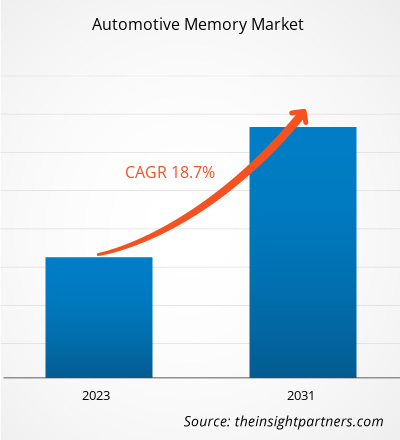

The automotive memory market size is projected to reach US$ 29.7 billion by 2031 from US$ 7.53 billion in 2023. The market is expected to register a CAGR of 18.7% during 2023–2031. The rising advancements & developments in ADAS technology are likely to remain key trends in the market.

Automotive Memory Market Analysis

The rise in demand for automotive telematics and the adoption of sensors in automotive applications is expected to drive the demand for automotive memory, which in turn is expected to fuel the market growth in the coming years. In addition, stringent government norms regarding the deployment of telematics in vehicles are projected to boost the market growth from 2023 to 2031. Moreover, increasing demand for hybrid electric vehicles and electric vehicles across the world is expected to fuel the demand for automotive memories which in turn is projected to create opportunity for the key companies in the market during the forecast period.

Automotive Memory Market Overview

Vehicles are currently integrated with a variety of distributed memory types, such as static random-access memory, dynamic random-access memory, read-only memory, FLASH, and, in some cases, magnetoresistive random access memory (MRAM). Testing. Automotive storage is similar in function to commercial storage but works differently. It is more similar to ECC (Error Correcting Code) memories, which rely on the result of memory access, and the information stored is correct. As more microprocessors are used, distributed DRAM is used, which is locally responsible for signal, information processing, and SRAM or FLASH storage to transfer information between functions in the vehicle.

The new automotive architecture includes a centralized primary central processing unit (CPU) with a huge memory array comparable to that of a normal computer. Based on the data from all driver assistance, engine, and drive subsystems, this unit processes and makes systemic decisions. Unlike home and business computers, which have a lifespan of 2 to 5 years, car storage needs to run continuously for 12 to 20 years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Memory Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Memory Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Memory Market Drivers and Opportunities

Growing Adoption of Advanced Sensors in Automotive to Favor Market

Automotive sensors are essential for the smooth operation of modern automobiles. These sensors provide information about numerous vehicle parameters to the electronic control unit (ECU), maximizing safety, efficiency, and performance. They do this by converting physical quantities into electrical impulses. These sensors are categorized into two main categories: first, by the physical properties they measure, and second, by the underlying technology they use. The sensors help reduce errors caused by wear or contamination, ensure stable measurements, and save space in high-temperature environments. The demand for pressure sensors is expected to surge and drive the industry forward rapidly. Pressure sensors are installed in the side doors of the car that send digital crash signals to the central airbag unit to prevent accidents. Hence, the rise in the adoption of advanced sensors in automotive applications is expected to drive market growth in the coming years.

Growing Demand for Hybrid and Electric Vehicles Globally

The increase in fully electric vehicles (EV) and hybrid electric vehicles, accompanied by the emergence of ADAS, graphic instrument cluster (GIC), infotainment systems, and fully autonomous driving solutions, created a demand for electronic control units (ECU) - automotive controllers used in receiving and process signals from sensors and export control commands to the actuator to execute. For instance, in the US, new electric cars registered in the year 2023 totaled ~1,400,000 units, increased by 40% as compared to 2022. Such a rise in demand for electric vehicles is expected to create an opportunity for the key players operating in the automotive memory market.

Automotive Memory Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive memory market analysis are product, vehicle type, and application.

- Based on product, the automotive memory market is divided into DRAM, NAND, SRAM, NOR, and others. The DRAM segment held the largest market share in 2023.

- By vehicle type, the market is segmented into passenger vehicle and commercial vehicle. The passenger vehicle segment held the larger share of the market in 2023.

- By application, the market is classified into infotainment & connectivity, ADAS, and others. The others segment held a significant share of the market in 2023.

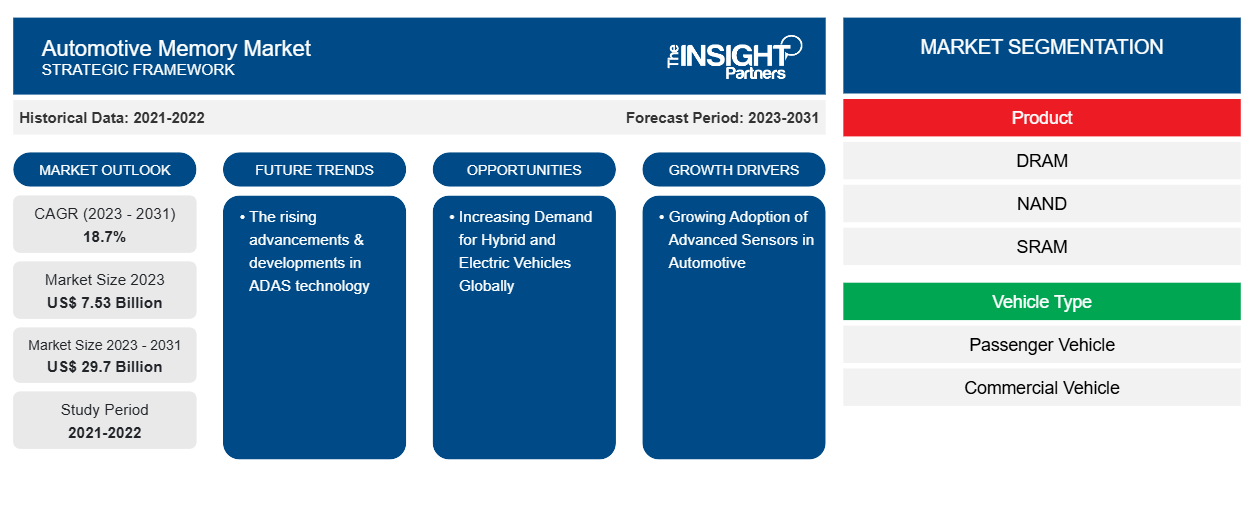

Automotive Memory Market Share Analysis by Geography

The geographic scope of the automotive memory market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The scope of the automotive memory market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South America (Brazil, Argentina, and the Rest of South America). In terms of revenue, Asia Pacific dominated the automotive memory market share in 2023. North America is the second-largest contributor to the global automotive memory market, followed by Europe.

Automotive Memory Market Regional Insights

The regional trends and factors influencing the Automotive Memory Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Memory Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Memory Market

Automotive Memory Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.53 Billion |

| Market Size by 2031 | US$ 29.7 Billion |

| Global CAGR (2023 - 2031) | 18.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Memory Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Memory Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Memory Market are:

- Micron Technology Inc.

- Samsung Electronics Co., Ltd.

- Toshiba Corporation

- Western Digital Technologies, Inc.

- SK Hynix

- Macronix International Co.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Memory Market top key players overview

Automotive Memory Market News and Recent Developments

The automotive memory market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive memory market are listed below:

- Samsung Electronics Co., Ltd. signed an agreement with SemiDrive. Through this agreement, Samsung Electronics Co., Ltd. will supply automotive memory solutions to the SemiDrive. (Source: Samsung Electronics Co., Ltd., Press Release, August 2023)

- Samsung Electronics Co., Ltd. developed a new GDDR7 32 Gbps DRAM. This new automotive memory product will expand the capabilities in applications for AI, HPC, and automotive vehicles. (Source: Club Car, Press Release, March 2023)

Automotive Memory Market Report Coverage and Deliverables

The “Automotive Memory Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive memory market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive memory market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automotive memory market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive memory market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Vehicle Type and, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Asia Pacific dominated the automotive memory market in 2023.

Rising advancements & developments in ADAS technology are the future trend of the automotive memory market.

Micron Technology Inc., Samsung Electronics Co., Ltd., Toshiba Corporation, Western Digital Technologies, Inc., SK Hynix, Macronix International Co., Texas Instruments Inc., Qualcomm Technologies, Inc., Infineon Technologies, Inc., and Renesas Electronics Corporation are some of the leading players in the automotive memory market.

US$ 29.7 billion estimated value of the automotive memory market by 2031.

18.7% is the expected CAGR of the automotive memory market.

Get Free Sample For

Get Free Sample For