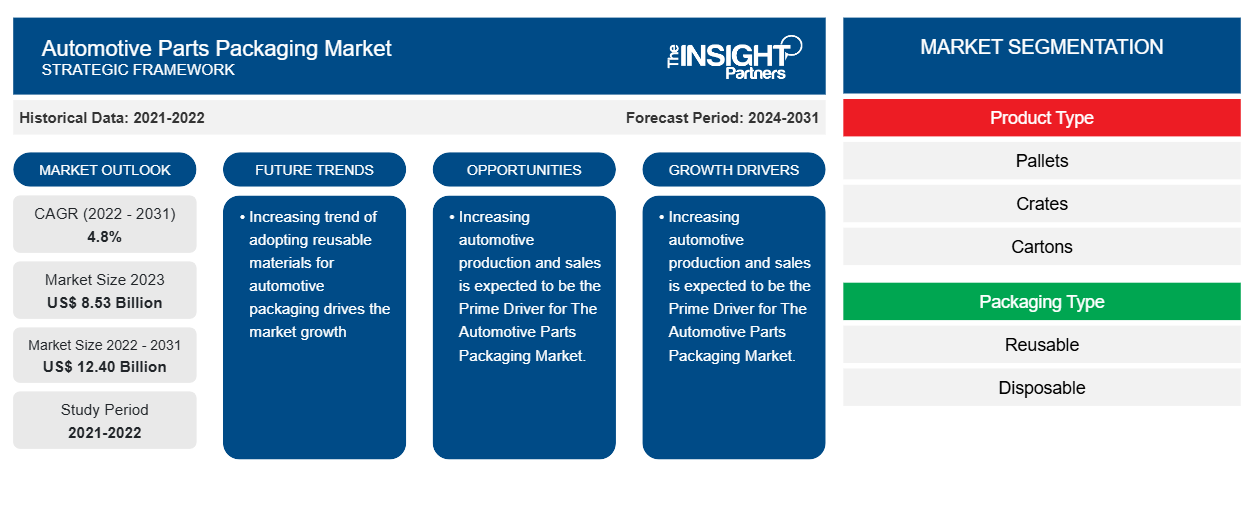

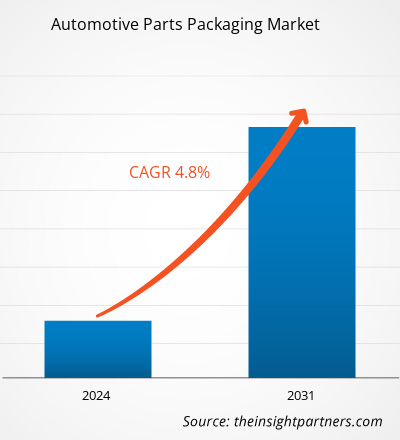

The automotive parts packaging Market size is projected to reach US$ 12.40 billion by 2031 from US$ 8.53 billion in 2023. The market is expected to register a CAGR of 4.8% in 2022–2031. Increasing sales of automotive production and sale drives the automotive parts packaging market growth. The automotive parts packaging market is driven by rapidly increasing urbanization and a surge in the global population. Also, the rising demand for automotive parts manufacturing, such as batteries, cooling systems, transmission systems, and engine components, drives the market growth. The significant shifting of consumers towards sustainable bio-packaging materials owing to increasing concern for environmental protection drives the automotive parts packaging market growth during the forecast period.

Automotive Parts Packaging Market Analysis

Automotive parts packaging play’s significant role in the automotive components industry owing to increasing vehicle sales and production. According to the International Energy Agency, global electric vehicle sales reached 14 million in 2022 increase of 18% compared to 2021. Such growth in electric vehicles and rapid adoption of sustainable materials for automotive components across the globe is expected to create ample opportunity for the automotive parts packaging market growth during the forecast period.

Automotive Parts Packaging Market Overview

Increased demand for protective sustainable packaging across the globe is expected to drive the automotive parts packaging market growth during the forecast period. The growing demand for sustainable reusable packaging drives the automotive parts packaging market. Also, increasing demand and requirement of automobile spare packaging drives the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Parts Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Parts Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Parts Packaging Market Drivers and Opportunities

Increasing automotive production and sales is expected to be the Prime Driver for The Automotive Parts Packaging Market.

Increased demand for protective packaging across the automotive components manufacturing industry drives the automotive parts packaging market growth during the forecast period. The major driving factor for the global automotive parts packaging market is the growing adoption of reusable packaging and the increased adoption of automotive components. Increased demand for automobile component aftersales drives the market growth. Increasing electric vehicle sales and growth in the adoption of passenger cars and commercial vehicles drive the market growth. According to the India Brand Equity Foundations, the global electric vehicles market was around US$ 250 billion in 2021 and is expected to grow by US$ 1,318 billion by 2028. The increased demand for electric passenger cars and rising automotive production drive the market growth.

Increasing Adoption of the Sustainable Material for Packaging Automotive Components to Boost the Market Growth

Sustainable packaging solutions in the automotive industry refer to the use of materials and processes that minimize waste and reduce the industry's carbon footprint. This includes everything from the materials used to package automotive parts and components to the logistics and transportation of those materials. In August 2022, The BMW Group launched sustainable packaging for the folding large load carriers. The company used folding plastic alternatives, which were made from 90% recycled sustainable material. This packaging reduces CO2 emissions by 3,000 tons annually.

Such, adoption of the sustainable material by the leading automotive OEMs is expected to create ample opportunity for the automotive parts packaging market growth during the forecast period.

Automotive Parts Packaging Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive parts packaging market analysis are type, platform, application, and end-user.

- Based on product type, the automotive parts packaging market has been divided into pallets, crates, cartons, bulk containers and cases, corrugated products, bags & pouches, trays, and others.

- Based on packaging type, the reusable and disposable.

- Based on components, the market is divided into battery, lighting components, cooling systems, engine components, electrical, and others.

Automotive Parts Packaging Market Share Analysis by Geography

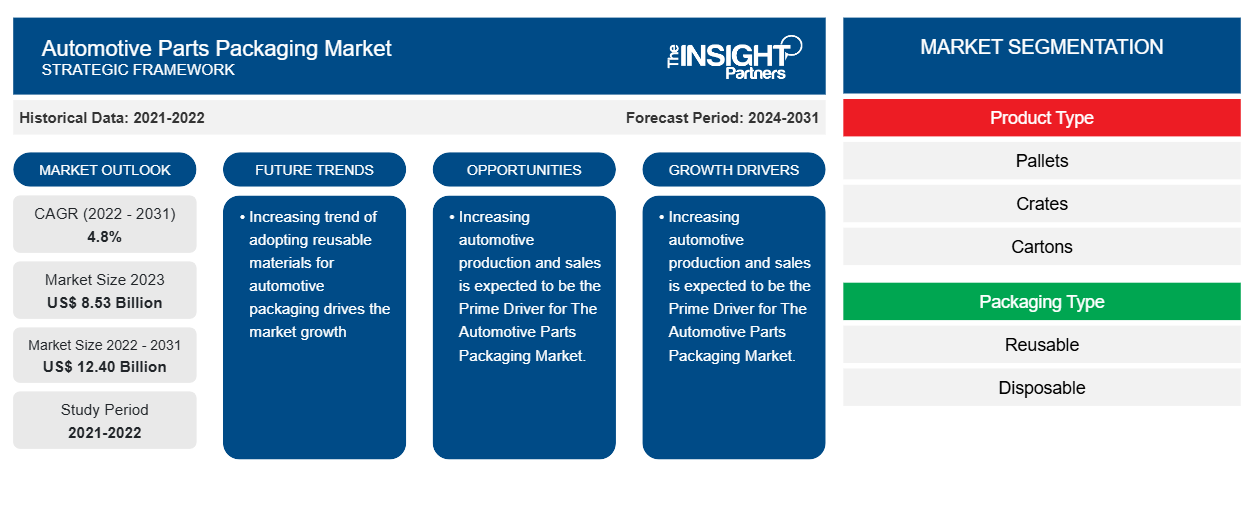

The geographic scope of the Automotive Parts Packaging Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific will dominate the automotive parts packaging market in 2023. This is owing to the increasing number of automotive manufacturers, growing automotive sales, and production in countries such as India, China, Japan, and South Korea. India is growing at a rapid pace for the automotive parts packaging market during the forecast period. India’s passenger cars market was valued at US$ 32.72 billion in 2021, and it is projected to grow to US$ 54.85 billion by 2027, growing with a CAGR of more than 9.0% between 2022-2027.

North America is also growing at a rapid pace, followed by Europe and South America. This is owing to increasing automotive sales and production across the US and Canada drives the market growth. According to the Bureau of Transportation Statistics, new vehicle sales in the US reached 1,259,770 units in February 2024, representing an increase of 16.4% compared to January 2024. Such growth in new vehicle sales across the US has created massive demand for the automotive parts packaging market growth.

Automotive Parts Packaging Market Regional Insights

The regional trends and factors influencing the Automotive Parts Packaging Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Parts Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Parts Packaging Market

Automotive Parts Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8.53 Billion |

| Market Size by 2031 | US$ 12.40 Billion |

| Global CAGR (2022 - 2031) | 4.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

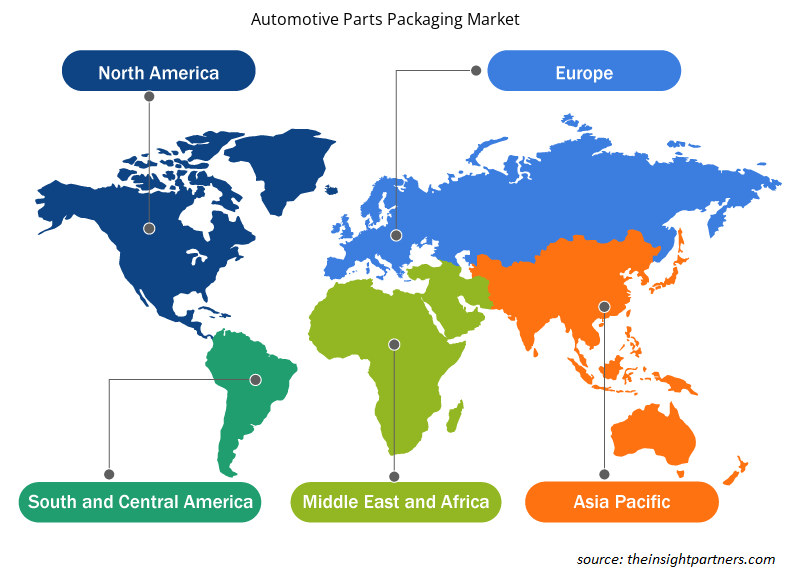

Automotive Parts Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Parts Packaging Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Parts Packaging Market are:

- Pelican Products, Inc.

- Sonoco Products Company

- Huhtamaki Oyj

- WestRock Company

- Nefab AB

- Smurfit Kappa Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Parts Packaging Market top key players overview

Automotive Parts Packaging Market News and Recent Developments

The automotive parts packaging market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Automotive Parts Packaging market and strategies:

- In June 2023, - Spadel, in collaboration with DS Smith, launched new sustainable 5-litre packaging for the automotive industry. The packaging is designed to ensure flexible plastic bags that can store 5 liters of liquid. (Source: Flyability, Press Release/Company Website/Newsletter)

- In March 2024, DS Smith, a sustainable packaging company, launched shop.able carriers reusable and sustainable boxes designed for the automotive and transportation of groceries. The new packaging boxes are eco-friendly and made with the company’s patented Greencoat coating technology.

Automotive Parts Packaging Market Report Coverage and Deliverables

The “Automotive Parts Packaging Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Packaging Type ; and Component

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For