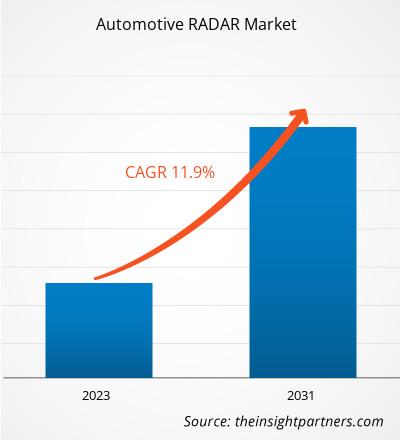

The Automotive RADAR market size is expected to reach US$ 15.7 billion by 2031 from US$ 5.7 billion in 2023. The market is expected to register a CAGR of 11.9% in 2023–2031. The rise in the adoption of automotive RADAR in advanced driver assistance systems to provide capabilities such as adaptive cruise control (ACS), lane change assistance, emergency braking, blind spot detection, and others are among the key factors fueling the Automotive RADAR market growth.

Automotive RADAR Market Analysis

The Automotive RADAR market is expected to experience considerable growth during the analyzed timeframe owing to rise in government regulations concerning vehicle safety, rising adoption of premium vehicles, growing number of radars used in a vehicle. Moreover, the increase in production and adoption of electric vehicles (EVs) are further expected to support the growth of the automotive radar market. It is anticipated that in the coming few years, autonomous driving will be a growing trend. To attain this, several vision technologies increased intending to deliver functionality and safety to the vehicle's drivers and passengers.

Automotive RADAR Market Overview

Radar systems are the most established and trusted technologies in the automotive industry's various vision technologies. Presently, several vehicle manufacturers are engaged in providing 'level 3' automation technology wherein drivers are on standby for a particular time. These vehicles are integrated with five radar systems, including SSR and LLR, for applications that include emergency braking or adaptive cruise control. In addition, the high demand for RADAR technology in the automotive industry, owing to the benefits associated with it, including all-weather performance, direct velocity measurement, non-line-of-sight detection, affordability, and others, is projected to drive the market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive RADAR Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive RADAR Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive RADAR Market Drivers and Opportunities

Increase in the number of Road Accidents.

Road traffic injuries are a key public concern faced by governments across the globe, and the increasing prevalence of the road accidents hinders the development of market in those countries. According to the data by the World Health Organization (WHO), nearly 1.19 million people die due to road accidents. Most of the accidents on the road are occur in developing and developed economies are due to human driving errors. While vehicle safety technology has improved significantly over the past few decades with the advent of advanced driver assistance systems (ADAS) and the prospect of autonomous vehicles, these numbers show that vehicle safety needs to improve at a much faster pace and suggest the need to adopt automated driving technologies can help dramatically reduce the number of fatalities by removing human driver error from the equation. Hence, the rise in the number of road accidents is expected to drive the demand for automotive RADAR systems, which in turn is anticipated to fuel the market growth in the coming years.

Rising Demand for Advanced Imaging Radar

With the mounting number of level 2+ vehicles on the road, the need for advanced and more accurate automotive radar sensors is increasing. This acts as a huge opportunity for OEMs to offer basic-level radar sensors. For instance, Xilinx and Continental announced the first production-ready 4D imaging radar. Theoretically, 4D imaging radar uses echolocation (a mechanism that is observed in dolphins, bats, and several humans) and the time-of-flight measurement principle to capture a space in 3D. Furthermore, these radar systems are designed to fulfill the imaging requirements within the time scale of a fast-moving automobile or a zooming drone. Therefore, the fourth dimension enhances the overall accuracy of a self-driving system. The 4D imaging radar is operational in all types of weather/environmental conditions, including fog, darkness, and heavy rains. Numerous companies are investing in R&D to introduce such advanced radar-based imaging technologies and gain a maximum share in the global automotive radar market.

Automotive RADAR Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Automotive RADAR market analysis are range, frequency, application, and vehicle type.

- Based on range, the Automotive RADAR market has been divided into Long Range Radar (LRR), Medium Range Radar(MRR), and Short Range Radar (SRR)). The short-range radar segment held a larger market share in 2023.

- Based on the frequency, the Automotive RADAR market has been divided into 24 GHz, 77 GHz, and 79 GHz. The 77 GHz segment held a larger market share in 2023.

- On the basis of application, the market has been segmented into adaptive cruise control (ACS), autonomous emergency braking, blind spot detection, forward collision warning system, intelligent park assist, and others. The adaptive cruise control segment dominated the market in 2023.

- Based on the vehicle type, the Automotive RADAR market has been divided into passenger cars, light commercial vehicles, and medium & heavy commercial vehicles. Thepassenger cars segment held a larger market share in 2023.

Automotive RADAR Market Share Analysis by Geography

The geographic scope of the Automotive RADAR market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Asia Pacific has dominated the Automotive RADAR market in 2023. The Asia Pacific region includes China, India, Japan, South Korea, and the Rest of Europe. Government initiatives—such as “Made in China 2025” and “Made in India”—are catalyzing the growth of the automotive sector in the region. Improvements in infrastructure, increases in domestic consumption, and low labor costs in Southeast countries in Asia are the key factors which are attracting automotive companies to this region. In addition, a rise in investment in research and development of automotive technologies is anticipated to fuel the automotive RADAR market growth in the coming years. Moreover, increasing efforts by automotive giants in the optimization of automated cars are expected to significantly fuel the sale of electric vehicles in APAC countries such as India, Malaysia, Singapore, and Thailand. For instance, in October 2022, the US-based company named Magna International invested more than US$ 120 million in establishing and operating new engineering centers in Bengaluru, India.

Automotive RADAR Market Regional Insights

The regional trends and factors influencing the Automotive RADAR Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive RADAR Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive RADAR Market

Automotive RADAR Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.7 Billion |

| Market Size by 2031 | US$ 15.7 Billion |

| Global CAGR (2023 - 2031) | 11.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Range

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

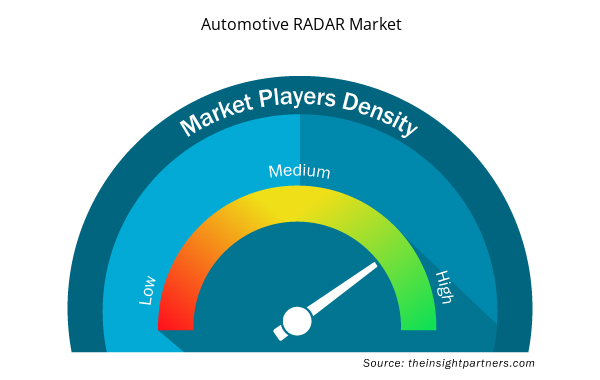

Automotive RADAR Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive RADAR Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive RADAR Market are:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv Plc

- Hella GmbH & Co. KGaA

- Valeo

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive RADAR Market top key players overview

Automotive RADAR Market News and Recent Developments

The Automotive RADAR market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Automotive RADAR market and strategies:

- In January 2021, The company introduced next generation level 1-3 capable advanced driver assistance systems (ADAS) platform. This ADAS solution is cost effective and efficient hence strengthened the product portfolio of the company.

- In September 2023, Valeo partnered with Mobileye. This partnership aimed at development of software-defined best-in class imaging radars for next-generation driver assist and automated driving features.

Automotive RADAR Market Report Coverage and Deliverables

The “Automotive RADAR Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Range , Frequency , Application , and Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, Turkey, United Kingdom, United States

Get Free Sample For

Get Free Sample For