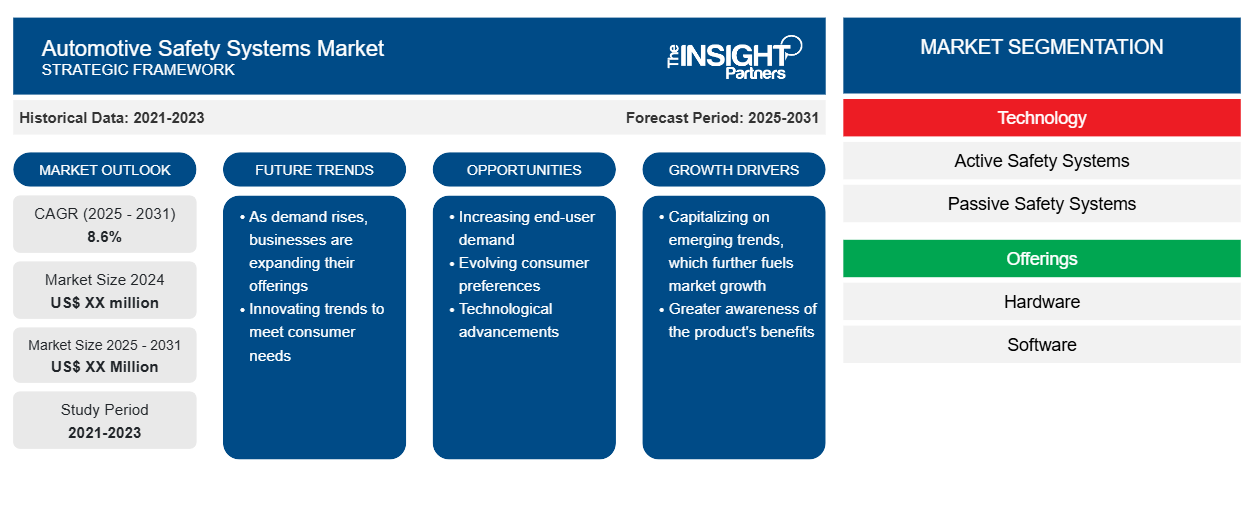

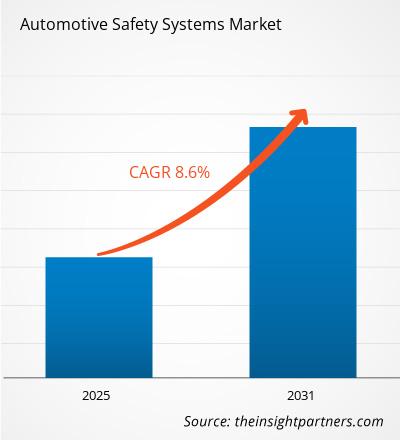

The automotive safety systems market is expected to register a CAGR of 8.6% during 2023–2031. The evolution of advanced technologies and the introduction of high-end vehicles will likely remain a key trend in the market.

Automotive Safety Systems Market Analysis

- An increasing government rules and regulations attributed to vehicle safety, an increase in the number of accidents, a rise in the demand for luxury vehicles, an increase in consumer purchasing power, and an increase in the demand for passenger vehicles in emerging economies are some of the market factors that are anticipated to support the market's growth.

- To reduce road accidents and enhance the safety of both drivers and passengers in both vehicles, new features are constantly being incorporated into automobiles as a result of ongoing technological advancements in the automotive market.

Automotive Safety Systems Market Overview

- The growing passenger safety and security awareness, an increase in the number of vehicles in developing nations, and other factors are major drivers of the global automotive safety system market's growth.

- The number of accidents has increased due to the growing demand for high-speed vehicles. The need for safety feature integration in cars has grown dramatically.

- Blind spot detection, lane maintenance assist, and an antiroll braking system are a few of the safety features. Additionally, due to government safety regulations becoming more stringent, many automotive manufacturers are installing a passive safety system in vehicles.

- The demand for automobiles rises concurrently with integrated safety features, which fuels the growth of the global automotive safety system market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Safety Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Safety Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Safety Systems Market Drivers and Opportunities

Government Regulations Mandates and International Safety Standards to Favor the Market

- Governments and international organizations impose strict regulatory mandates and global safety standards that significantly drive the global automotive safety system market.

- These regulations require automakers to incorporate cutting-edge safety technologies into their vehicles to comply with safety standards that have been set.

- Global safety standards are always changing, which is one of the main factors encouraging innovation and the automotive industry's adoption of new safety technologies.

Pedestrian Detection Features

- Advancements in technology have played a major role in the high demand for active safety systems. These systems are now more dependable and efficient due to the quick development and integration of advanced sensor technologies, machine learning, and artificial intelligence.

- The demand for automotive safety systems is expected to be supported by consumer preferences for automotive active safety features that are dependable and functional. Safety features such as adaptive cruise control, collision avoidance, and pedestrian detection are becoming more and more appealing to manufacturers and customers due to their increased accuracy and performance.

- Furthermore, the price of these technologies has become more affordable which has increased their accessibility for a wider variety of vehicles.

Automotive Safety Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive safety systems market analysis are technology, offerings, and vehicle type.

- Based on the technology, the automotive safety systems market is divided into active safety systems and passive safety systems.

- based on the offerings, the market is divided into hardware and software.

- Based on vehicle type, the automotive safety systems market is divided into light commercial vehicles, passenger cars, and medium and heavy-duty commercial vehicles.

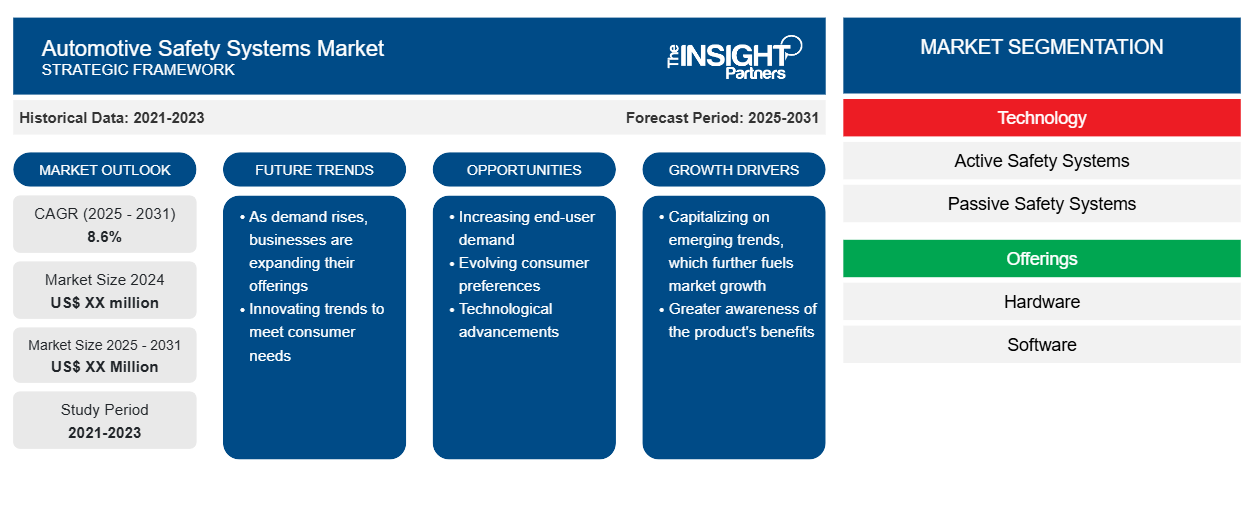

Automotive Safety Systems Market Share Analysis by Geography

- The automotive safety systems market report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering automotive safety systems market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers PEST analysis, which involves the study of major factors that influence the automotive safety systems market in these regions.

Automotive Safety Systems Market Regional Insights

The regional trends and factors influencing the Automotive Safety Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Safety Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Safety Systems Market

Automotive Safety Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 8.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

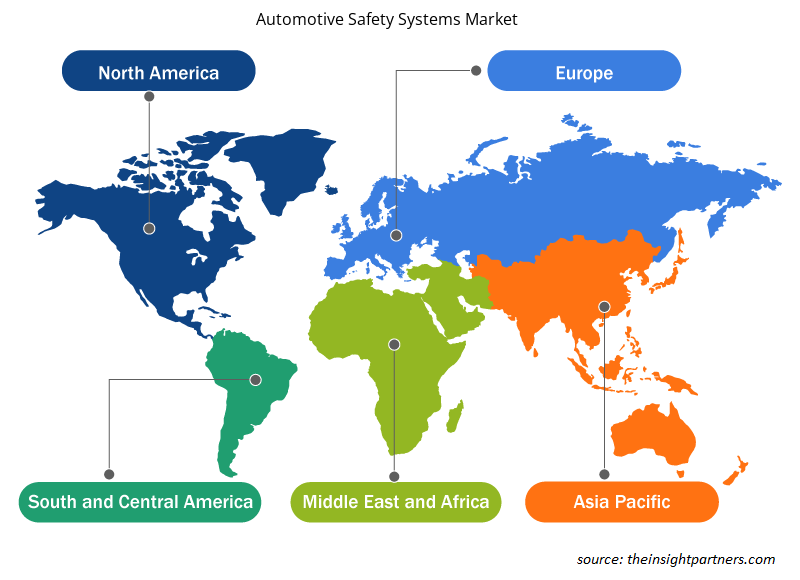

Automotive Safety Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Safety Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Safety Systems Market are:

- Autoliv Inc.

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Joyson Safety Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Safety Systems Market top key players overview

Automotive Safety Systems Market News and Recent Developments

The automotive safety systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive safety systems market are listed below:

- Volvo Buses is launching new and updated active safety systems that help drivers drive safely and avoid situations that could result in accidents. The active safety systems include several features with a special focus on the protection of vulnerable road users such as cyclists and pedestrians. The safety systems exceed the new EU regulations, as well as the legal requirements of most non-EU countries. (Source: Volvo, Company Website, April 2024)

- The automotive technology company Veoneer announced that it has agreed with Magna International Inc., a mobility technology company and one of the largest suppliers in the auto industry. Under the agreement, Magna will acquire Veoneer's Active Safety business from SSW Partners, a New York-based investment partnership ("SSW") for $1.525 billion in cash, subject to working capital and other customary purchase price adjustments. (Source: Veoneer, Company Website, December 2022)

Automotive Safety Systems Market Report Coverage and Deliverables

The “Automotive Safety Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive safety systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive safety systems market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Automotive safety systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the automotive safety systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global automotive safety systems market is expected to grow at a CAGR of 8.6% during the forecast period 2023 - 2031.

An increase in sales of high-end vehicles is anticipated to play a significant role in the global automotive safety systems market in the coming years.

The leading players operating in the automotive safety systems market are Autoliv Inc., Continental AG, DENSO Corporation, Joyson Safety Systems, ZF Friedrichshafen AG, Valeo, Mobileye Global Inc, Robert Bosch GmbH, Infineon Technologies AG, and Knorr-Bremse AG.

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

The rapid technological advancement in the automotive sector is one of the major factors driving the automotive safety systems market.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies

1. Autoliv Inc.

2. Continental AG

3. DENSO CORPORATION

4. Infineon Technologies AG

5. Joyson Safety Systems

6. Knorr-Bremse AG

7. Mobileye

8. Robert Bosch GmbH

9. Valeo

10. ZF Friedrichshafen AG

Get Free Sample For

Get Free Sample For