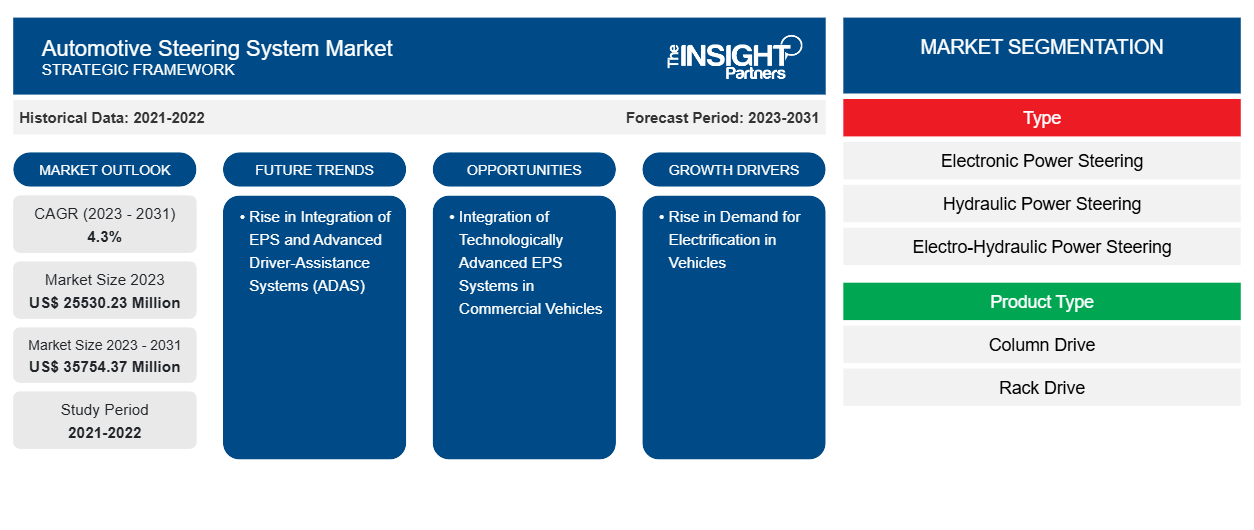

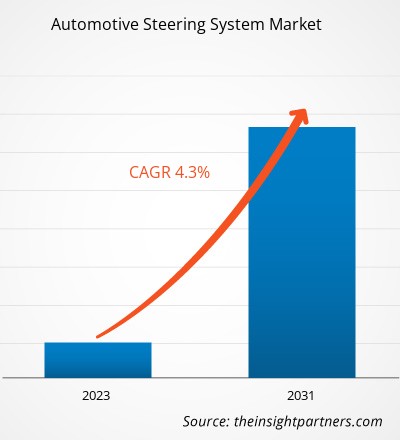

The automotive steering system market size is projected to reach US$ 35754.37 million by 2031 from US$ 25530.23 million in 2023. The market is expected to register a CAGR of 4.3% in 2023–2031. Several governments across the world have enacted strict automotive emission and fuel economy legislations. Fleet-level regulations have been enforced by regulatory bodies such as the National Highway Traffic and Safety Administration in the US and the International Council on Clean Transportation in Europe. Automobile manufacturers must adhere to the average pollution cap decided by these regulations. These regulations have pushed automakers to spend more in fuel-efficient steering systems such as electronic power steering. As opposed to conventional hydraulic steering systems, electrically assisted power steering systems are lighter in weight and have a simpler structure.

Automotive Steering System Market Analysis

According to the US Department of Energy, in ideal conditions, EPS (Electronic Power Steering) systems can improve fuel efficiency by 2% to 4%, reduce fuel consumption by up to 6%, and reduce CO2 emissions by 8 grams per kilometer. As per the estimates by Nexteer Automotive Corporation, EPS systems have saved nearly 3 billion gallons of gas since 1999. Unlike hydraulic systems, which pump fluid continuously when the engine is running, these systems only use power when the wheels are turned. The European region has the highest penetration of electrically assisted power steering, followed by North America and Asia Pacific. Thus, the various stringent government norms for ensuring fuel efficient vehicles on road are expected to influence the demand for EPS, thereby contributing to the market growth over the forecast period.

Automotive Steering System Market Overview

The integration of the Internet of Things in cars is the next substantial digital development in the automotive industry. The advent of autonomous vehicles will bring another revolution in the automotive industry. Electronic Power Steering (EPS) system integrated autonomous vehicles will further bolster the driving experience of the user. The development of connected cars provides promising opportunities for both tech companies and the automotive industry. The development of connected vehicles would promote the use of EPS in the vehicles, thereby contributing to the growth of the global automotive steering system market over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Steering System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Steering System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Steering System Market Drivers and Opportunities

Rise in Demand for Electrification in Vehicles

There is an increase in use of buses and trucks worldwide, especially for logistics and public transportation. In Asia, Oceania, and Europe, public transportation is preferred over private transportation, while in North America, private cars are the primary mode of transportation. As the population in urban areas is growing, there is a need for increased public transit, and the current transportation infrastructure is proving inadequate. OEMs worldwide are now focused on lowering global carbon emissions, which is leading to increase in use of electric cars. Passenger cars and taxis are concentrating more on the introduction of greener technology as the demand increases. The manufacturers are concentrating their efforts on electrification of vehicles, especially passenger cars. Several countries worldwide are putting a lot of work into creating green transportation. For example, in May 2019, China's Ministry of Transport and other ministries jointly released the Green Travel Action Plan for 2019–2022, which encourages the use of green vehicles. In addition, the country will continue to improve public transportation and information systems that promote green transportation.

Governments around the world are taking several steps to minimize CO2 emissions. They are providing tax cuts and incentives to promote the use of electric vehicles in public transportation, such as e-trucks and e-buses. BYD K9, Mercedes Benz electric truck, and Tata Starbus Hybrid e-buses are a few examples of electric vehicle models. Some commercial vehicle manufacturers have recently unveiled electric buses, and others have announced plans to convert full-size trucks and pickup trucks to battery-electric platforms. Thus, the rising demand for electric vehicles is contributing to the growth of the global automotive steering system market.

Integration of Technologically Advanced EPS Systems in Commercial Vehicles

EPS is mainly used in passenger cars and light commercial vehicles, with a small presence in heavy vehicles. With technological advances, EPS systems can carry more weight, and they can be used in commercial vehicles. Due to their higher load-bearing capability than EPS systems, HPS (Hydraulic Power Steering) systems currently dominate the commercial vehicle market. HPS systems use the engine's control, reducing fuel efficiency.

The EPS system is more fuel-efficient and reliable than HPS systems because it draws power from the tank. Increased load-bearing ability will allow this technology to be used in commercial vehicles as well. For instance, Volvo has developed Volvo Dynamic Steering, which uses an electric motor. The steering is regulated 2,000 times per second by the engine. The Torque Overlay platform was used to build this technology. For the pickup truck industry, Nexteer Automotive has designed a rack-assisted electronic power steering system. The Servotwin electro-hydraulic steering system for heavy commercial vehicles was introduced by Robert Bosch, another leading steering system maker. Similarly, in October 2020, Nexteer Automotive Corporation launched EPS systems for commercial vehicles. In the coming years, such advances are expected to generate lucrative opportunities for EPS systems in the commercial vehicle market.

Automotive Steering System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive steering system market analysis are type, product type and vehicle type.

- Based on the type, the market is divided into electronic power steering, hydraulic power steering, and electro-hydraulic power steering. The electronic power steering segment held a larger market share in 2023.

- Based on product type, the global automotive steering system market is divided into below column drive and rack drive. The rack drive segment held a larger market share in 2023.

- Based on the vehicle type, the market is divided into passenger cars and commercial vehicles. The passenger cars segment held a larger market share in 2023.

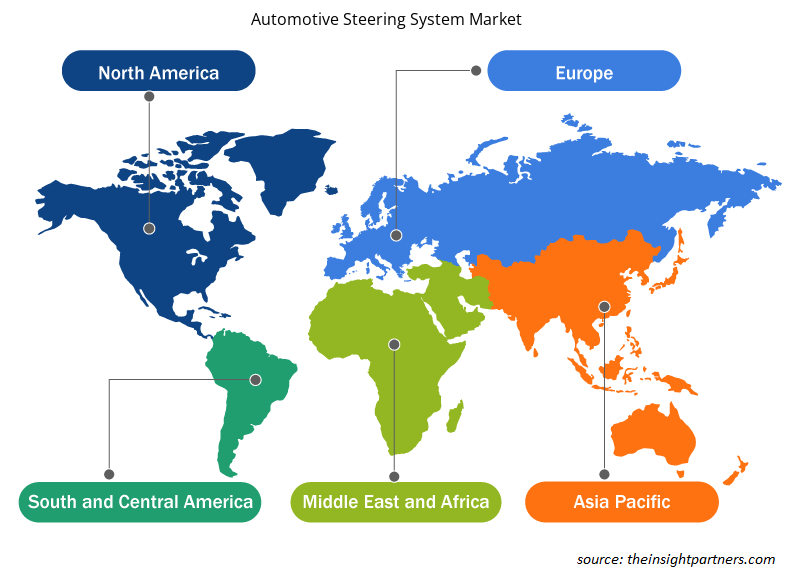

Automotive Steering System Market Share Analysis by Geography

The global automotive steering system market is segmented into five major regions— North America, Europe, APAC, Middle East and Africa (MEA), and South America (SAM). The US, Canada, and Mexico are major economies present in the North American region. The region is one of the largest automotive manufacturing hubs worldwide. The presence of well-established automotive manufacturers and automotive steering system manufacturers in North America is driving the market. The economic growth of the region has positively impacted the sale of commercial vehicles and passenger cars. Automotive steering systems are integrated within passenger cars and commercial vehicles to control the direction of a vehicle in motion. The growing sales of passenger cars and commercial vehicles are raising the demand for automotive steering systems. In 2020, 13,375,622 units of passenger cars and commercial vehicles were produced in the region. Presently, electronic power steering has become an everyday feature in the vehicles. It eradicates the requirement for a power steering pump and hydraulic fluids. Previously, the electronic power steering was designed for high-end vehicles or SUVs. However, the reliability of electronic power steering has accelerated its involvement in all almost types of vehicles. The rising emphasis on electronic power steering system is driving the market in North America.

Automotive Steering System Market Regional Insights

The regional trends and factors influencing the Automotive Steering System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Steering System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Steering System Market

Automotive Steering System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 25530.23 Million |

| Market Size by 2031 | US$ 35754.37 Million |

| Global CAGR (2023 - 2031) | 4.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Steering System Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Steering System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Steering System Market are:

- China Automotive Systems Inc

- Nexteer Automotive

- Hitachi Automotive Systems Americas, Inc

- Hyundai Mobis

- JTEKT Corporation

- Mando Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Steering System Market top key players overview

Automotive Steering System Market News and Recent Developments

The automotive steering system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In Jan 2022, China Automotive Systems Inc launched a new series of EPS for BYD Auto. BYD is replacing racktype EPS of its popular high-end vehicle models with DP-EPS, and China Automotive Systems Inc was contracted to design and supply the same. The latter had already started mass production of DP-EPS and expects to deliver approximately 300,000 units annually. (Source: China Automotive Systems Inc, Press Release)

Automotive Steering System Market Report Coverage and Deliverables

The “Automotive Steering System Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Automotive steering system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Automotive steering system market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Automotive steering system market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Automotive steering system market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Product Type, and Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, United Kingdom, United States

Get Free Sample For

Get Free Sample For