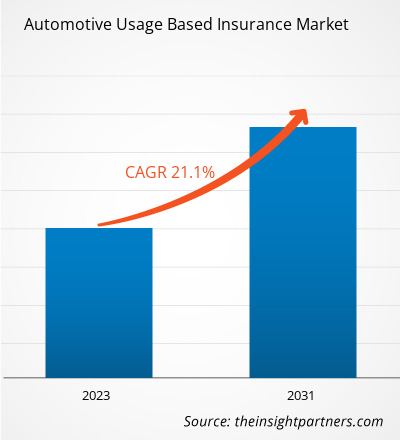

The automotive usage based insurance market size is projected to reach US$ 240.8 billion by 2031 from US$ 52.1 billion in 2023. The market is expected to register a CAGR of 21.1% in 2023–2031. Advanced telematics technologies to accentuate the demand for UBI and a wide variety of insurance premiums are among the key factors fueling the automotive usage based insurance market.

Automotive Usage Based Insurance Market Analysis

With the constant evolvement of the telematics industry and its rapid adoption within the automotive sector, new partnerships are developing amongst insurers, automotive manufacturers, device OEMs, and telematics solution providers. These partnerships are aimed at taking advantage of the emerging data-driven technology. The young population most commonly adopts automotive usage based insurance as they are more comfortable with technology and open to benefit from lower premiums. In Italy and US markets, UBI is aimed at a diverse range of drivers. Furthermore, awareness has been a hurdle to growth particularly in the UK market, where UBI has been aimed chiefly at the fleet market as well as young drivers. However, with the increasingly rewarding programs introduced by the UBI players, the market is witnessing immense traction. With the increasing growth in connected cars and the ADAS industry, it is expected that all new cars will be equipped with pre-installed telematics devices in the near future. This growth is expected to provide a boost to the automotive usage based insurance market.

Automotive Usage Based Insurance Market Overview

In the current automotive insurance industry, the UBI or telematics insurance is at a nascent stage, as very few countries have adopted the technology heavily. Automotive insurance companies are increasingly partnering with telematics companies to expand their telematics insurance or UBI segment in the current market scenario and also for the future. Additionally, several companies operating in the global automotive usage based insurance market are constantly taking initiatives to attract consumers with various attractive policies and technologies. The market is highly fragmented as the industry is captured by several well-established companies as well as emerging players across the globe. From the investment scenario, the insurance companies and the telematics companies operating in developing countries, as well as developed countries, are scoring significant investments, which is helping the market to witness the upswing in recent times. The governments of several countries are simplifying their insurance legislation, which is another factor driving the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Usage Based Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Usage Based Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Usage Based Insurance Market Drivers and Opportunities

Adoption of Mobility-as-a-Service (MaaS)

Since the past few years, consumer behavior towards intercity and intracity transit has transformed to a newer level. A significant percentage of travelers across the globe are no longer willing to drive their vehicles with the objective of avoiding traffic. This has given rise to various other transit practices, such as car sharing and ride-hailing, in developed countries and developing countries. These practices are known as mobility as a service, as the consumer avails the vehicle and the driver from a third-party service provider. Mobility-as-a-Service aims to provide the consumer end-to-end transportation with the use of different modes of transportation, thereby, making substantial use of the existing transportation infrastructure in an area. The increasing traction of MaaS among consumers is leading third-party service providers to procure an increased count of vehicles so as to enhance the customer experience. This factor is also increasing the number of service providers across the globe; some of the prominent mobility-as-a-service providers are Uber, Lyft, Zipcar, Car2go, Beeline Singapore, UbiGo AB, and Smile Mobility, among others.

Increasing Partnerships among Telematics Companies and Insurance Companies

The automotive usage based insurance market is maturing significanlty over the years in the countries, namely the US, Italy, and the UK. The insurance companies offering telematics insurance are constantly leveraging various factors to enhance the solutions and deliver their customers with better schemes. One of the significant trends in the global automotive usage based insurance market is the raising number of partnerships among telematics and insurance companies. These partnerships are expanding the usage based insurance ecosystems in various economies, and the same trend is projected to increase the market size in the coming years. Some of the significant partnerships among the insurance companies and telematics companies are:

- In November 2022, Ford partnered with CerebrumX Lab Inc., an AI-led automotive data services and management platform. This partnership aimed at incorporating Ford connective vehicle data as a part of its usage-based insurance initiative for insurers.

- In November 2022, Wejo Group Limited signed an agreement with Ford Motor Company. This agreement aimed at expanding end-to-end insurance offerings to consumers across the US.

- In February 2022, Ford partnered with State Farm company. This partnership aimed at the development of usage-based insurance products for Ford and Lincoln vehicle owners with eligible connected vehicles.

Apart from the partnerships mentioned above, several other insurance players, telematics companies, and automotive OEMs across the globe are partnering increasingly to bolster the market for UBI. This practice of increasing partnerships in the automotive usage based insurance market ecosystem is anticipated to help the automotive usage based insurance market to soar over the next couple of years. Additionally, telematics companies are interested in the automotive industry in developing regions across the globe, which is also fueling up the revenue generation stream of the global automotive usage based insurance market.

Automotive Usage Based Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive usage based insurance market analysis are technology fitted and policy type.

- Based on technology fitted, the automotive usage based insurance market has been divided into smartphones, black box, dongles, and others. The dongles segment held a larger market share in 2023.

- Based on the policy type, the automotive usage based insurance market has been divided into pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD). The PHYD segment held a larger market share in 2023.

Automotive Usage Based Insurance Market Share Analysis by Geography

The geographic scope of the automotive usage based insurance market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

North America has dominated the automotive usage based insurance market in 2023. The North America region includes the US, Canada, and Mexico. The dominance of North America in the global automotive usage based insurance market is owing to the fact that the country has presence of a large number of automotive OEMs, telematics, and insurance companies. Additionally, the trend of adoption of newer technologies and solutions is also high in the country, which has pushed the residents to opt for telematics insurance. Moreover, the region is one of the precursors of mobility-as-a-service across the globe, and the MaaS market has propelled extensively over the years in the region and is constantly witnessing upward trends.

Further, owing to the higher disposable income among the individuals, the pattern of procurement of new vehicles is high in the country. Pertaining to the rise in the number of vehicles, several associated technologies and solutions are also increasing rapidly in the US. These factors have positively influenced the automotive usage based insurance market growth in the US.

Automotive Usage Based Insurance Market Regional Insights

The regional trends and factors influencing the Automotive Usage Based Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Usage Based Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Usage Based Insurance Market

Automotive Usage Based Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 52.1 Billion |

| Market Size by 2031 | US$ 240.8 Billion |

| Global CAGR (2023 - 2031) | 21.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Technology Fitted

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

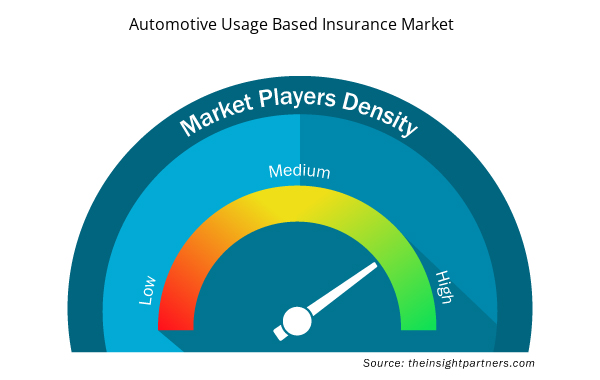

Automotive Usage Based Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Usage Based Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Usage Based Insurance Market are:

- Allstate Insurance Company

- AXA SA

- Allianz SE

- Metromile, Inc.

- Ingenie Services Limited

- Liberty Mutual Insurance Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Usage Based Insurance Market top key players overview

Automotive Usage Based Insurance Market News and Recent Developments

The automotive usage based insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for automotive usage based insurance market and strategies:

- In January 2022, Otonomo partnered with Audi. This partnership aimed to pilot consumer offerings, ranging from pay-as-you-drive insurance to general vehicle status to first notification of loss.

- In September 2021, LexisNexis Risk Solutions signed an agreement with Ford Motor Co. This agreement aimed at ensuring the availability of Ford-connected vehicle data to US auto insurers via the LexisNexis Telematics Exchange.

Automotive Usage Based Insurance Market Report Coverage and Deliverables

The “Automotive Usage Based Insurance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, & country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology Fitted ; and Policy Type and Pay-How-You-Drive ); and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, Germany, Italy, Mexico, RoW, Singapore, South Africa, United Kingdom, United States

Get Free Sample For

Get Free Sample For