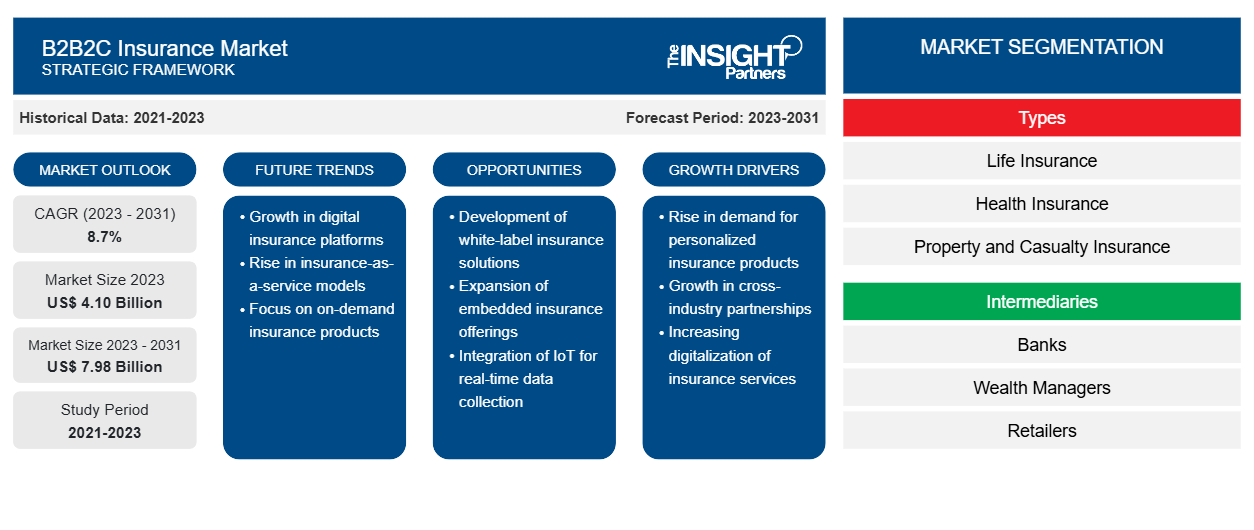

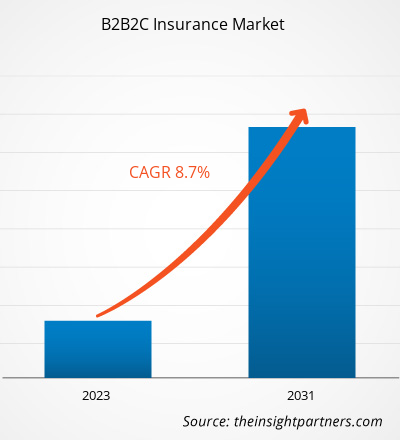

The B2B2C insurance market size is expected to grow from US$ 4.10 billion in 2023 to US$ 7.98 billion by 2031; it is anticipated to expand at a CAGR of 8.7% from 2023 to 2031. Business to business to consumer, or B2B2C, is a type of insurance distribution in which one business sells insurance to another business.

B2B2C Insurance Market Analysis

The B2B2C Insurance market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. However, the B2B2C distribution model has evolved rapidly in recent years, attracting the interest of a growing number of actors both inside and outside the insurance business. Banks, utilities, e-commerce, retailers, and others (such as professional associations) are expressing an interest in offering insurance coverage to their consumers or members in order to differentiate their value propositions and boost margins.

B2B2C Insurance

Industry Overview

- The B2B2C model of insurance distribution, where insurers offer their insurance products by intermediaries such as banks, retailers, e-commerce players, telecom companies, and others, has been successful in many markets. This trend is expected to accelerate in the near future due to improved customer access from digital players and technology advancements that facilitate insurance integration into partner ecosystems. This will result in a significantly larger B2B2C insurance market.

- OEMs, telecom firms, and financial institutions are increasingly interested in distributing financial products, particularly insurance, which offers good margins. Some partners are expanding their offerings to provide more comprehensive insurance options.

- Embedded insurance has already made a considerable impact on property and liability, and while it has yet to fully penetrate the life and health insurance markets, insurers are exploring new ways to embed products and reach their clients.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

B2B2C Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

B2B2C Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

B2B2C Insurance Market Driver

Insurtech to Drive the B2B2C Insurance Market

- In recent years, technology developments have transformed the insurance industry in terms of cost savings, efficiency, and increased tailoring of offerings to individual consumers' needs.

- Digitalization is transforming the B2B2C insurance industry by embracing digital platforms and ecosystems. Access to customer data, including location, purchasing habits, spending habits, and social interactions, allows insurers to create personalized insurance solutions and services for better protection, risk mitigation, claim handling, and timely assistance.

- In November 2023, Chubb announced the debut of its latest innovation, which aims to make it easier for its B2B2C partner organizations to access and test its digital insurance products and services. Chubb Studio aims to improve the integration process, making it quicker and more customizable for partners wanting access to the company's array of digital insurance products and services.

- A German InsurTech that pioneered cross-selling of insurance products at e-commerce points of sale. The firm was founded in Germany in 2012 and raised US$8 million in Series B funding in March 2015. In June 2016, Allianz established an investment collaboration with the startup. They established a collaboration with Assurant in the US and Canada called Assurant Product Protection.

B2B2C Insurance

Market Report Segmentation Analysis

- Based on the intermediaries, the B2B2C Insurance market report is segmented into banks, wealth managers, retailers, and others.

- The banking segment is expected to hold a significant B2B2C insurance market share in 2023. Bancassurance, which sells insurance through banks, has been a successful strategy for many years. Non-insurance players also distribute insurance in several areas.

B2B2C Insurance

Market Analysis by Geography

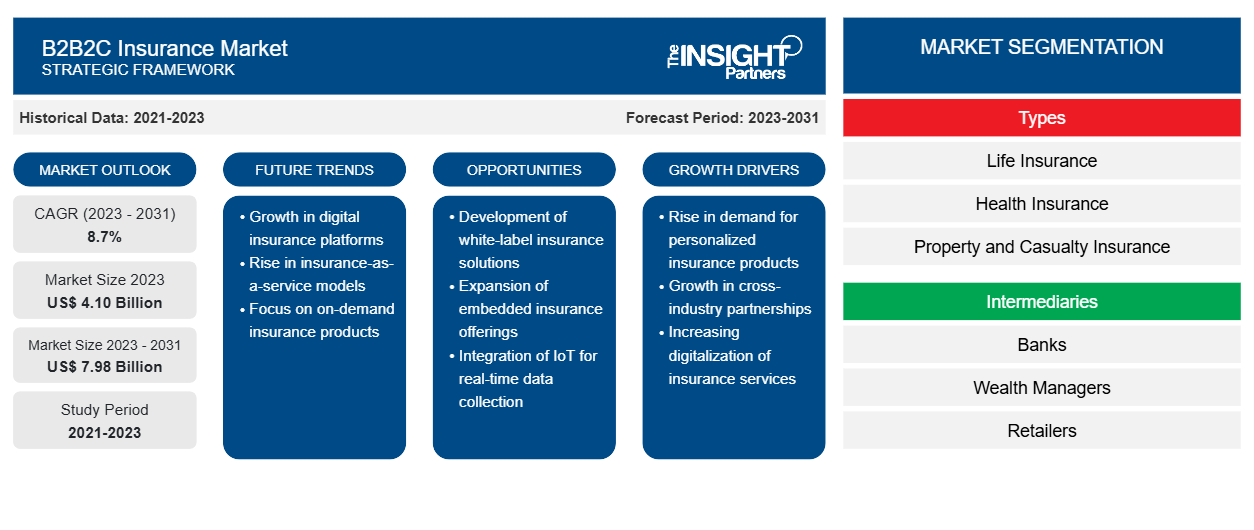

The scope of the B2B2C Insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant B2B2C Insurance market share. Asia Pacific (APAC) is experiencing rapid growth and is anticipated to hold a significant B2B2C insurance market share. The region's significant economic development, growing population, and increasing focus on risk management and insurance have contributed to this growth. APAC is home to many developing countries like India and China, driving the B2B2C insurance market growth.

B2B2C Insurance

B2B2C Insurance Market Regional Insights

The regional trends and factors influencing the B2B2C Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses B2B2C Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for B2B2C Insurance Market

B2B2C Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.10 Billion |

| Market Size by 2031 | US$ 7.98 Billion |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Types

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

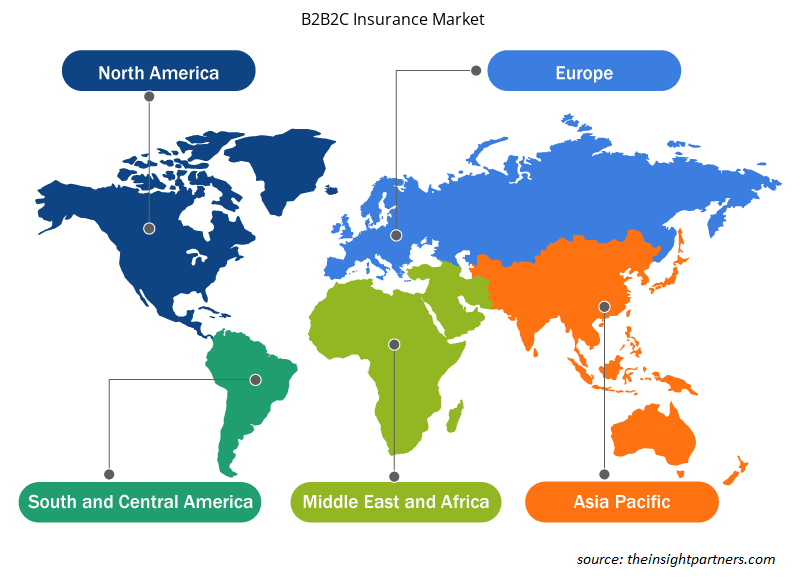

B2B2C Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The B2B2C Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the B2B2C Insurance Market are:

- Edelweiss General Insurance Company Limited.

- AXA SA.

- BNP Paribas S.A.

- Allianz SE.

- Assicurazioni Generali S.p.A.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the B2B2C Insurance Market top key players overview

The "B2B2C Insurance Market Analysis" was carried out based on core investment strategies and geography. In terms of types, the market is segmented into life insurance, health insurance, and property and casualty insurance. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

B2B2C Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the B2B2C Insurance market. A few recent key market developments are listed below:

- In October 2023, Allianz Partners and Bolttech, a worldwide insurtech, formed a relationship to provide embedded device and appliance protection insurance in Asia Pacific and the United States. The strategic partnership agreement intends to use each company's complimentary strengths to provide best-in-class solutions, allowing business partners to add insurance and protection products to customer journeys at the point of need.

[Source: Allianz SE, Company Website]

B2B2C Insurance

Market Report Coverage & Deliverables

The market report "B2B2C Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Types, Intermediaries, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global B2B2C Insurance market are Edelweiss General Insurance Company Limited., AXA SA., BNP Paribas S.A., and Allianz SE.

The global B2B2C Insurance market is expected to reach US$ 7.98 billion by 2031.

The global B2B2C Insurance market was estimated to be US$ 4.10 billion in 2023 and is expected to grow at a CAGR of 8.7% during the forecast period 2023 - 2031.

The use of AI and data analytics is impacting B2B2C Insurance, which is anticipated to bring new B2B2C Insurance market trends in the coming years.

insurtech and expanding digital channels are the major factors that propel the global B2B2C Insurance market growth.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Edelweiss General Insurance Company Limited.

- AXA SA.

- BNP Paribas S.A.

- Allianz SE.

- Assicurazioni Generali S.p.A.

- Berkshire Hathaway Inc.

- ICICI Lombard

- China Life Insurance

- Munich Re Group

- Prudential

- UnitedHealth Group

Get Free Sample For

Get Free Sample For