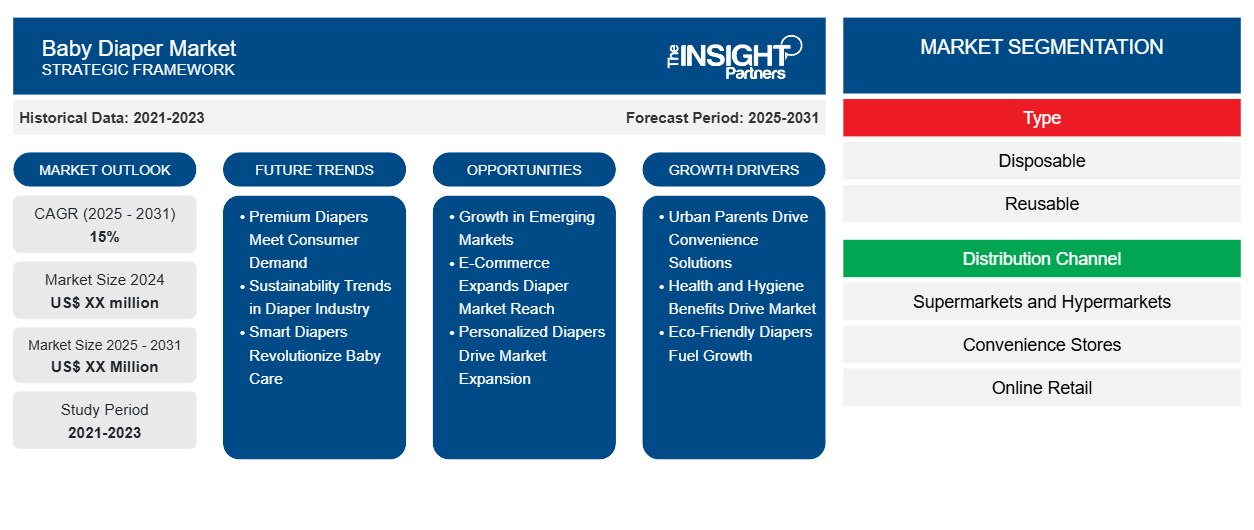

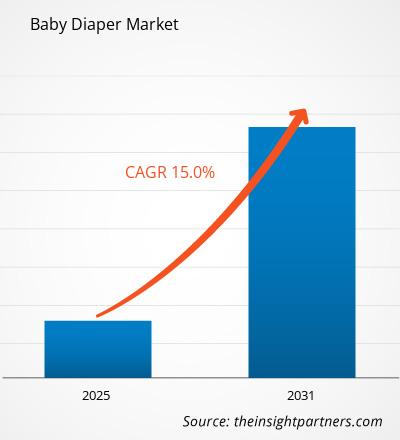

The Baby Diaper Market is expected to register a CAGR of 15% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The Baby Diaper Market report covers Analysis By Type (Disposable and Reusable) and Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others) The global analysis is further broken-down at the regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Baby Diaper Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Baby Diaper Market Segmentation

Type

- Disposable

- Reusable

Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Baby Diaper Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Baby Diaper Market Growth Drivers

- Urban Parents Drive Convenience Solutions: Based on the value chain analysis of the market, it's apparent that this is a significant contribution to global market share since urban parents prefer convenience solutions. This trend shows great potential in brands that position themselves in emerging regions, as happened in recent reports and PEST analysis.

- Health and Hygiene Benefits Drive Market: Parents are increasingly aware of the health and hygiene benefits associated with the use of high-quality disposable diapers. By the Baby Diaper Market analysis, it is evident that this driver does not conflict but combines with the trend of changing consumer preferences, thereby opening up more opportunities for brands to ensure competitive advantage with quality-based products in the global Baby Diaper Market.

- Eco-Friendly Diapers Fuel Growth: Innovations regarding eco-friendly and biodegradable diapers also fuel baby diaper market growth. With more people today being conscious of sustainability, this product addresses environmental concerns, thus attracting all eco-conscious parents and thereby increasing the Baby Diaper Market size and share. Some emerging trends in the market suggest a trend for sustainability, with brands adopting greener product strategies to attract this demand. From the competitive analytical point of view, this is one of the main drivers of the market, with eco-friendly diapers strengthening brand positioning in the global market.

Baby Diaper Market Future Trends

- Premium Diapers Meet Consumer Demand: One of the main trends in the baby diaper market is the increasingly higher demand for premium, organic, and hypoallergenic diapers that focus on quality and safety. The consumer dynamics will lead to a movement into the value segment. Key players have been developing special segments of diapers to meet this demand. SWOT analysis outlines this demand as one of the strengths of the market, which is supposed to address demand in rich demographics. The Baby Diaper Market forecast also proposes a stable growth of premium diaper sales, thus establishing this segment as one of the main growth drivers.

- Sustainability Trends in Diaper Industry: One of the major trends in the baby diaper market is sustainability, wherein manufacturers are shifting to biodegradable materials to minimize the environmental impact of the product. Key players in the market have begun to develop Baby Diaper Market strategies that promote eco-friendly products as a selling proposition due to environmental awareness among consumers. The dynamics of the market portray a positive reception of such products, supported by regulatory trends. Recent forecasts have indicated that the trend of sustainability will continue to drive the industry in the future and fit with the long-term market strategies for growth

- Smart Diapers Revolutionize Baby Care: Smart diapers, monitoring babies' health metrics, have emerged as the current trend in the baby diaper market. Smart diapers attract technology-savvy parents who are looking for a product to deliver real updates about their baby's health. Key players incorporate sensors and connectivity features, and this signals a pretty forward-thinking market strategy. It is anticipated that, with advancements in technology, smart diapers will be more adopted and thus have an impact on Baby Diaper Market dynamics, further widening the scope of the baby diaper industry.

Baby Diaper Market Opportunities

- Growth in Emerging Markets: Growth in the baby diaper market is found in the emerging economies of Asia-Pacific and Latin America, where incomes are higher and lifestyles are changed. As these regions modernize further, the demand for hygiene products such as diapers raises convenience and escalates market share accordingly. Geographical data from the overview of the market illustrate that brands expanding into these regions capture substantial growth in the market. From the insights into the industry landscape, targeting these high-growth areas could turn out to be a profitable strategy-especially as market penetration increases.

- E-Commerce Expands Diaper Market Reach: E-commerce still emanates as an increasing growth opportunity within the baby diaper market, where convenience-shifting is leaning more toward online channels. Online channels have also, over the period, witnessed high growth in share contribution, especially in North America, due to the well-established digital retail infrastructure within the region. Baby Diaper Market Overview data show that online platforms help reach wider audiences for manufacturers through which increasing internet usage is taken into consideration and leaned on. This is drawing the attention of key players who are using these online channels to build scale in the marketplace.

- Personalized Diapers Drive Market Expansion: Personalized diapers can be considered an opportunity for growth in the baby diaper market for newborns up to toddlers. The various developmental needs are met while increasing comfort and functionality, thus making such products more attractive to parents. Industry landscape and competitive analysis point to this trend as increasing Baby Diaper Market share. This geography-based demand further supports the movement in North America and Europe, with the brands expanding their offerings to meet diversified needs.

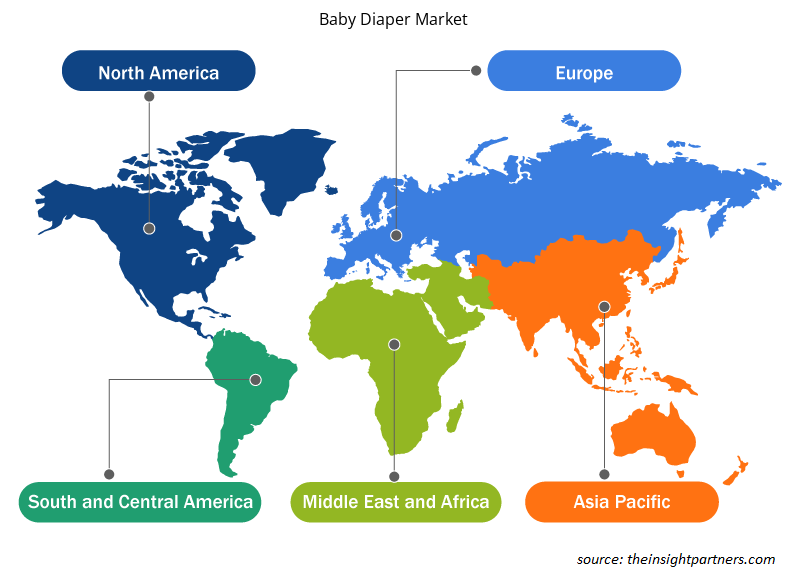

Baby Diaper Market Regional Insights

The regional trends and factors influencing the Baby Diaper Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Baby Diaper Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Baby Diaper Market

Baby Diaper Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 15% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

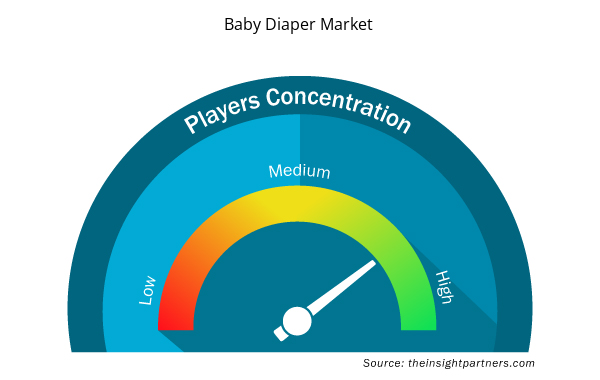

Baby Diaper Market Players Density: Understanding Its Impact on Business Dynamics

The Baby Diaper Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Baby Diaper Market are:

- Bambi (INDEVCO)

- Fine Hygienic Holding

- Johnson and Johnson

- Kimberly-Clark Corporation

- Molfix

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Baby Diaper Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Baby Diaper Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Baby Diaper Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Key companies in this market are: Bambi INDEVCO, Fine Hygienic Holding, Johnson and Johnson, Kimberly Clark Corporation, Molfix, Ontex BV, Procter and Gamble, PureBorn, Queshi Fujian Industrial Development Co Ltd

Key future trends in this market are - Increase in birth rates, Rising demand for eco-friendly products, Growth in disposable hygiene products

The Baby Diaper Market is expected to register a CAGR of 15% from 2023-2031.

The major factors impacting the Baby Diaper Market are: Rising Birth Rates and Urbanization in Emerging Markets, Increasing Awareness of Baby Hygiene, and Product Innovations and Eco-friendly Diapers

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies

- Bambi (INDEVCO)

- Fine Hygienic Holding

- Johnson and Johnson

- Kimberly-Clark Corporation

- Molfix

- Ontex BV

- Procter and Gamble

- PureBorn

- Queshi (Fujian) Industrial Development Co., Ltd.

- Unicharm Corporation

Get Free Sample For

Get Free Sample For