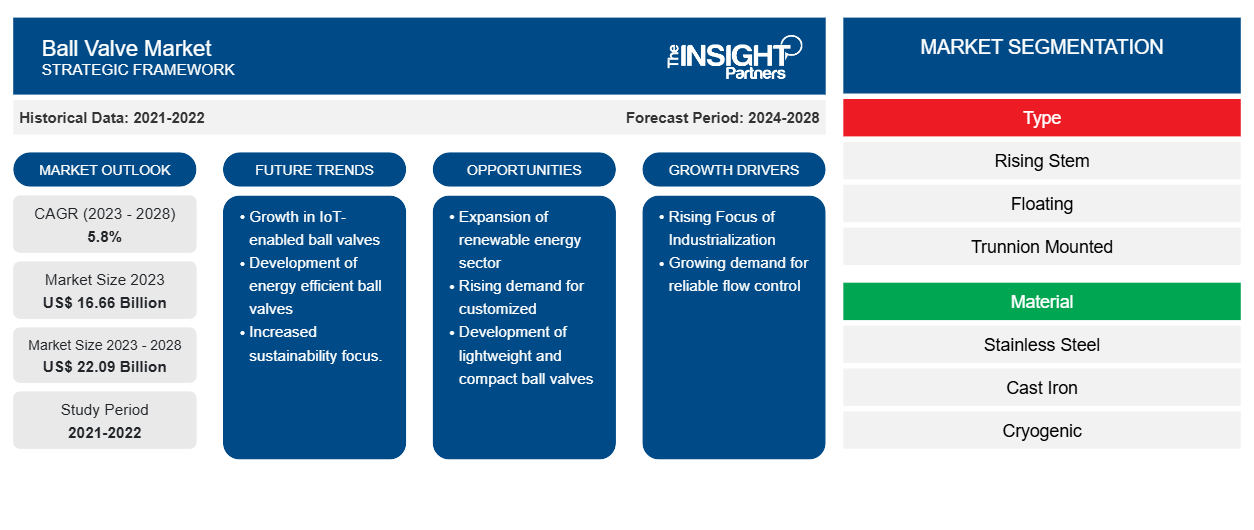

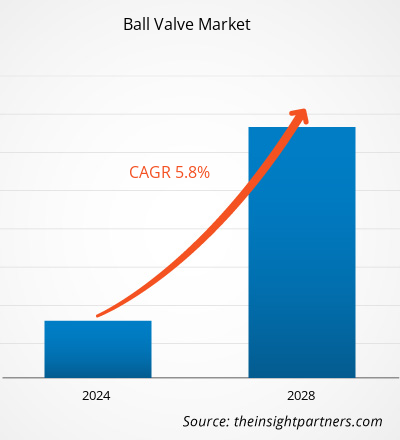

[Research Report] The ball valve market is projected to reach US$ 22.09 billion by 2028 from US$ 16.66 billion in 2023 and is expected to record a CAGR of 5.8% during 2023–2028.

Analyst Perspective:

The ball valve market is a thriving industry that plays a crucial role in various sectors, including oil and gas, water and wastewater treatment, chemical processing, pharmaceuticals, power generation, and many others. Ball valves are mechanical devices used to control the flow of fluids through a pipeline or system using a rotating ball with a hole in it. They provide excellent shut-off capabilities, low maintenance requirements, and high durability, making them popular in many applications. The market for ball valves has witnessed substantial development in recent years, driven by several factors. One of the primary drivers is the increasing demand for energy resources, particularly in emerging economies. The oil and gas industry, in particular, has been a major contributor to the growth of the ball valve market. Ball valves are extensively used in pipelines, refineries, and offshore platforms to regulate the flow of oil and gas, ensuring efficient operations and safety. The rising focus on infrastructure development and industrialization has also fueled the demand for ball valves in water and wastewater treatment, power generation, and chemical processing. Ball valves offer reliable and efficient flow control, essential for these industries to maintain smooth operations. The market has also experienced technological advancements, with manufacturers introducing innovative designs and materials to enhance the performance and efficiency of ball valves. For instance, the development of materials such as stainless steel and alloys has improved ball valves' durability and corrosion resistance, expanding their applications in demanding environments. Furthermore, the growing awareness about environmental concerns and the need for sustainable solutions has led to the adoption ball valves in green energy sectors like solar and wind power. These valves help control the flow of fluids in these systems, ensuring optimal efficiency and minimizing energy losses.

Market Overview:

A quarter-turn valve with a hollow, perforated, and pivoting ball to control the flow is called a ball valve. The valve is open when the ball's hole is in the flow line; when the handle pivots the hole 90 degrees, the valve is closed. Additionally, when it is open, the handle is perpendicular, flat in alignment, and closed. Ball valves have a prolonged lifespan, are responsible, close securely, or continue to function properly even after extended periods of inactivity.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ball Valve Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ball Valve Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Focus of Industrialization to Drive Growth of Ball Valve Market

The rising focus on Industrialization has played a vital role in driving the growth of the ball valve market. As countries and regions increasingly prioritize industrial development, there is a growing demand for efficient and reliable flow control solutions, leading to the widespread adoption of ball valves. Industrialization involves establishing and expanding various manufacturing and processing facilities across different sectors, such as oil and gas, water and wastewater treatment, chemical processing, and power generation. These industries require robust and effective flow control mechanisms to regulate the movement of fluids through pipelines and systems. Ball valves offer several advantages, making them an ideal choice for industrial applications. They provide excellent shut-off capabilities, allowing for precise control of fluid flow. This is crucial for ensuring operational efficiency and safety in industrial processes. Ball valves can be quickly and completely closed or opened, minimizing the risk of leaks or spills, which can harm production and the environment. The ball valves have low maintenance requirements, reducing downtime and operational costs. Their simple and robust design makes them less prone to wear and tear, resulting in longer service life and increased reliability. This is particularly beneficial in industrial settings where continuous operation is essential. Furthermore, ball valves can handle high pressures and temperatures, making them suitable for demanding industrial environments. They resist harsh chemicals, corrosive fluids, and abrasive materials, ensuring long-term performance and durability. Industrial processes often involve aggressive substances, and ball valves' ability to withstand such conditions is vital for maintaining operational efficiency and avoiding costly downtime. Also, the scalability and adaptability of ball valves make them well-suited for industrial applications. They can be designed and manufactured in various sizes, pressure ratings, and materials to meet specific requirements. This versatility enables seamless integration into different industrial systems and pipelines. The rising focus on Industrialization, especially in developing economies, leads to increased investments in infrastructure development and manufacturing facilities. As a result, there is a growing demand for ball valves to ensure efficient and reliable flow control in these industrial processes. This, in turn, drives the growth of the ball valve market.

Segmental Analysis:

Based on material, the ball valve market is segmented into stainless steel, cast iron, cryogenic, alloy, and others. The stainless steel segment held the largest share of the ball valve market in 2023, whereas the alloy segment is anticipated to register the highest CAGR in the market during the forecast period. The stainless steel segment is prominent in the ball valve market, holding the largest share. This is primarily due to stainless steel's excellent corrosion resistance, durability, and strength. Stainless steel ball valves can withstand harsh environments and demanding operating conditions, making them a preferred choice in industries such as oil and gas, chemical processing, and power generation. Additionally, stainless steel offers hygienic properties, affordability, and versatility, further contributing to its dominance in the market.

Regional Analysis:

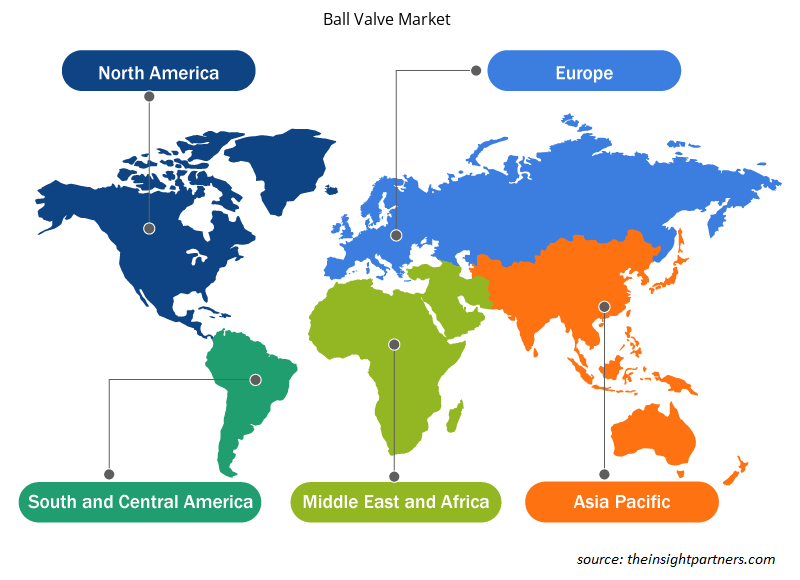

The Asia Pacific ball valve market was valued at US$ 6.61 billion in 2023 and is projected to reach US$ 9.54 billion by 2028; it is expected to grow at a CAGR of 7.6% during the forecast period. Due to several key factors, the Asia Pacific region has emerged as the dominant force in the ball valve market. Firstly, the region has experienced rapid industrialization and urbanization, increasing demand for infrastructure projects, including oil and gas, power generation, water and wastewater treatment, and chemical processing. Ball valves are crucial in these industries, offering reliable and efficient flow control solutions. Secondly, countries in the Asia Pacific region, such as China, India, and Japan, have witnessed substantial economic growth and rising disposable incomes. This has increased the energy demand, fueling the expansion of oil and gas exploration, production, and refining activities. As ball valves are essential components in the oil and gas industry for controlling the flow of fluids, the market for these valves has witnessed significant growth in the region. The Asia Pacific region has also become a major manufacturing hub for various industries. With numerous manufacturing facilities, there is a constant need for ball valves in process industries such as chemicals, petrochemicals, and pharmaceuticals. These valves ensure reliable and precise control of fluids and gases, contributing to the efficiency and productivity of manufacturing processes. Furthermore, governments in the region have been investing heavily in infrastructure development projects, including water supply and treatment plants, power generation facilities, and transportation networks. The construction of these projects requires installing ball valves to control the flow of various fluids and gases. As a result, the demand for ball valves has surged in the Asia Pacific region. Moreover, the presence of many ball valve manufacturers and suppliers in countries like China and Japan has further fueled the market's growth. These manufacturers offer various ball valves with different specifications, catering to the diverse requirements of industries across the region. The availability of locally manufactured valves at competitive prices has boosted their adoption in various sectors.

Key Player Analysis:

The ball valve market analysis consists of the players such as Velan Inc, Neway Valve Suzhou Co Ltd, KITZ Corp, IMI Plc, Flowserve Corp, Curtiss-Wright Corp, Crane Co, Emerson Electric Co, Schlumberger NV, and Valvitalia SpA. Among the players in the ball valve Flowserve Corp and Schlumberger NV are the top two players owing to the diversified product portfolio offered.

Ball Valve Market Regional Insights

Ball Valve Market Regional Insights

The regional trends and factors influencing the Ball Valve Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ball Valve Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ball Valve Market

Ball Valve Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 16.66 Billion |

| Market Size by 2028 | US$ 22.09 Billion |

| Global CAGR (2023 - 2028) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Ball Valve Market Players Density: Understanding Its Impact on Business Dynamics

The Ball Valve Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ball Valve Market are:

- Velan Inc

- Neway Valve Suzhou Co Ltd

- KITZ Corp

- IMI Plc

- Flowserve Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ball Valve Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the ball valve market. A few recent key market developments are listed below:

- In 2019, Emerson bought CIRCOR International's Spence and Nicholson product lines to enhance its range of steam system solutions for industrial industries and commercial buildings.

- In 2019, PBM, a maker of valves and specialty valves for both sanitary and industrial uses, was purchased by IMI plc. All of these purchases would raise competition in the ball valves industry.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The country anticipated to grow with the highest CAGR are US, Germany, and India.

The growing adoption of automation in end-use industries will push ball valve manufacturers to produce smart ball valves. SCADA systems can monitor oil flow and ensure the pipeline’s pressure remains optimal.

The key players holding majority shares in the ball valve market include SLB, Emerson Electric Co., Curtiss-Wright Corporation, KITZ Corporation, and IMI Critical Engineering.

The US held the largest market share in 2022, followed by China.

In the oil & gas industry, ball valves help ensure the safe and efficient operation of various processes in upstream, midstream, and downstream sectors. Ball valves regulate fluid flow, maintain pressure and temperature levels, and provide isolation and control for various industrial applications involving liquids, such as pipeline and distribution infrastructure.

The ball valve market was estimated to be USD 15,849.23 million in 2022 and is expected to grow at a CAGR of 5.8 % during the forecast period 2023 - 2028.

APAC is anticipated to grow with the highest CAGR over the forecast period.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Ball Valve Market

- Velan Inc

- Neway Valve Suzhou Co Ltd

- KITZ Corp

- IMI Plc

- Flowserve Corp

- Curtiss-Wright Corp

- Crane Co

- Emerson Electric Co

- Schlumberger NV

- Valvitalia SpA

Get Free Sample For

Get Free Sample For