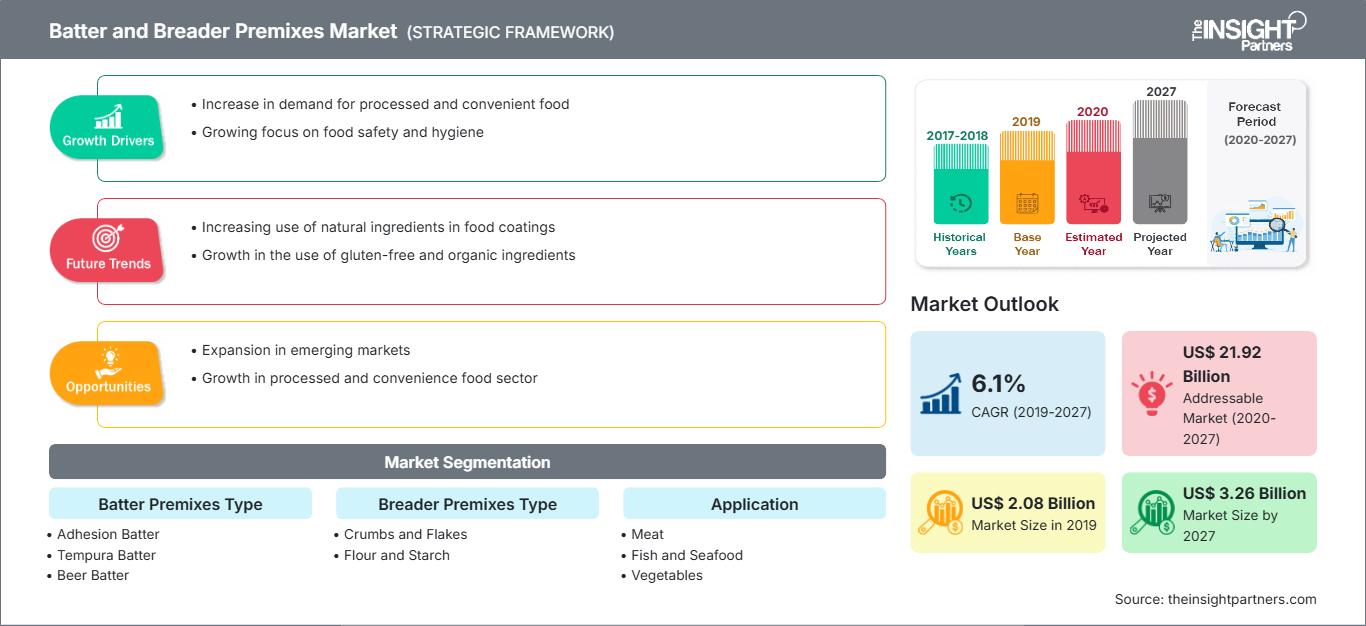

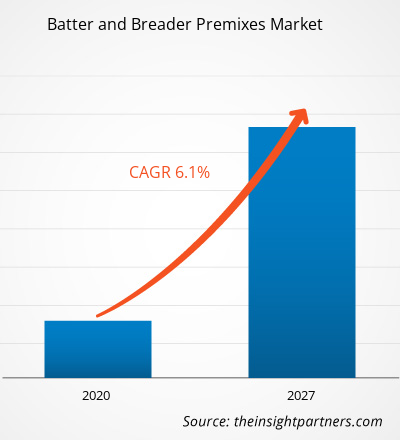

The batter and breader premixes market were valued at US$ 2,082.38 million in 2019 and is projected to reach US$ 3,255.06 million by 2027; it is expected to grow at a CAGR of 6.1% during the forecast period 2020 to 2027.

Rising customer preference for gluten-free and low- carbs items is likely to boost the market for the batter and breader products. The presence of gluten in food products can cause celiac disease that damages the small intestine and increases the risk of long-term health complications. Gluten-free premixes improve product quality, prolong shelf life, and provide a healthy alternative that is the main driver for the industry. Further, rising consumer health awareness, along with an increased incidence of gluten intolerance, is likely to drive batter and breader products demand..

Asia Pacific is also estimated to register the fastest CAGR in the market over the forecast period. The rise in awareness about the benefits offered by batter and breader premixes and the increase in the consumption of seafood & meat, as well as an increase in the acceptance of convenience & seafood products. In addition, an increase in disposable income and mounting urbanization is projected to direct the expansion of the batter and bread plant industry in the Asia-Pacific region. The rise in foreign direct investment provides lucrative opportunities for the batter and breader premixes market in Asia Pacific. Rising expenditure in research & development activities associated with batter and breader premixes and its application in various industries drives the growth of the market. An upsurge in the application base of batter and breader premixes favors the demand for batter and breader premixes in the region. In addition, rising application of batter and breader premixes in ready-to-eat food is expected to boost the growth of the batter and breader premixes in Asia Pacific in the years to come.

The US, India, Brazil, Russia, France, Italy, the UK, Spain, and Argentina are among the most-affected countries in terms of COVID-19 confirmed cases and reported deaths as of December 2020. The pandemic is hindering economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global chemical and materials industry is one of the major industries suffering serious disruptions such as restrictions on supply chain and manufacturing activities. For instance, China is the global manufacturing hub and the largest raw material supplier for various industries. The lockdown of various plants and factories in leading regions such as APAC and Europe is limiting the global supply chains and hampering the manufacturing, delivery schedules, and various goods sales. All these factors are restraining the global batter and breader premixes market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Batter and Breader Premixes Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Demand For Ready-To-Cook Foods

Ready-to-cook food is a food prepared with the assumption that it will be heated/cooked at a given internal core temperature by either a microwave, an oven, a stovetop like a frozen pizza, frozen vegetables, a frozen microwave oven, or ready to bake cookie dough. Ready-to-cook food is typically consumed without any further preparation. It is also portable, has a long shelf life, or offer a combination of such convenient traits. Dual-income customers prefer these type of food items because of the lack of time available for cooking. Moreover, due to hectic work schedules, people around the world are purchasing RTC food and food items that are easy to prepare and less time-consuming. Further, people living in a city or working all day have shown appreciation for RTC food products as they are quick and easy to eat. RTC products can range from batter mixtures and breakfast items to meat products. Increased urbanization is one of the reasons people purchase such goods. Consumers are seeking food that is nutritious, delicious, and gives extra value to them. Battered and breaded coatings provide food with texture and flavor as well as minimized moisture loss and oil uptake.

Batter Premix Type-Based Insights

Based on batter premix type, the batter and breader premixes market is segmented into adhesion batter, tempura batter, beer batter, thick batter, and customized batter. The adhesion batter segment led the market with the largest share in 2019. Adhesion batter is applied as a thin coat that can adhere well to the surface of the meat. This type of batter basically provides a cohesive layer between the breading and the substrate. It also provides color, texture, and flavor to the foods. It helps in controlling the pick-up of breading and also helps in preventing the surface voids through the loss of breading. These batters are mostly starch-based and have a high solid content with low viscosity. The key factor driving the growth of this market is the increased consumption of meat products that are crunchy and fried, which is mostly achieved by using a combination of adhesion batters and breaders.

Breader Premix Type -Based Insights

Based on breader premix type, the batter and breader premixes market is segmented into crumbs and flakes, and flour and starch. The crumbs and flakes segment led the market with the largest share in 2019. Bread crumbs are mostly made up of cereal-based flour, as they provide a crunchier coating layer to the final product. The dry bread crumbs are mostly used for various types of fishes, pork, and chicken in order to provide a crust and firm coating. These crumbs are generally produced by the process of electric induction heating and also by conventional baking. The manufacturers are mostly focusing on producing flavored bread crumbs with various herbs, spices, and seasoning. Fish fingers, goujons, mini fillets, pork escalope and chicken are some of the applications where the breadcrumbs are mostly used and thus, is driving the growth of the crumbs and flakes segment. The crumbs are also used in fried products to increase the stability of the product.

Application-Based Insights

Based on application, the batter and breader premix is segmented into meat and poultry, fish and seafood, vegetables, and others. The meat and poultry segment led the market with the largest share in 2019. The consumption of meat products has increased due to the trend of healthy eating and also because it is readily available and contains micro and macronutrients. The batter and breaded products are coated products containing meat protein components as the core, which is surrounded by cereal base coating. The batter and breader premixes have a variety of applications which involves chicken, pork and beef. They are mostly used in a variety of chicken products, has it provides textual characteristic.

Blendex Company; Bowman Ingredients; Bunge North America, Inc.; Coalescence LLC; House- Autry Mills; Kerry Group; Mccormick And Company, Inc.; Newly Weds Foods; Showa Sangyo Co., Ltd.; and Solina Group are among the key players present in the global batter and breader premixes market. These companies are implementing growth strategies such as product developments, and mergers and acquisitions to expand the customer base and gain significant market share across the world, which permit them to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the global batter and breader premixes market help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the market from 2017 to 2027

- Estimation of global batter and breader premix demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and global batter and breader premix demand

- Market trends and outlook coupled with factors driving and restraining the market growth

- Decision-making process by understanding strategies that underpin commercial interest with regard to the market growth

- Global batter and breader premixes market size at various nodes of market

- Detailed overview and segmentation of the market and its dynamics in the industry

- Global batter and breader premixes market size in various regions with promising growth opportunities

The regional trends and factors influencing the Batter and Breader Premixes Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Batter and Breader Premixes Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Batter and Breader Premixes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 2.08 Billion |

| Market Size by 2027 | US$ 3.26 Billion |

| Global CAGR (2019 - 2027) | 6.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Batter Premixes Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Batter and Breader Premixes Market Players Density: Understanding Its Impact on Business Dynamics

The Batter and Breader Premixes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Batter and Breader Premixes Market top key players overview

Batter and Breader Premix Market, byBatter Premix Type

- Adhesion batter

- Tempura batter

- Beer batter

- Thick batter

- Customized batter

Batter and Breader Premix Market, by Breader Premix Type

- Crumbs and Flakes

- Flour and Starch

Batter and Breader Premix Market, by Application

- Meat and Poultry

- Fish and Seafood

- Vegetables

- Others

Company Profiles

- Blendex Company

- Bowman Ingredients

- Bunge North America, Inc.

- Coalescence LLC,

- House- Autry Mills

- Kerry Group

- Mccormick And Company, Inc.

- Newly Weds Foods

- Showa Sangyo Co., Ltd.

- Solina Group

Frequently Asked Questions

Based on breader premixes type, which segment is leading the global batter and breader premixes market during the forecast period?

Can you list some of the major players operating in the global batter and breader premixes market?

Which region held the largest share of the global batter and breader premixes market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For