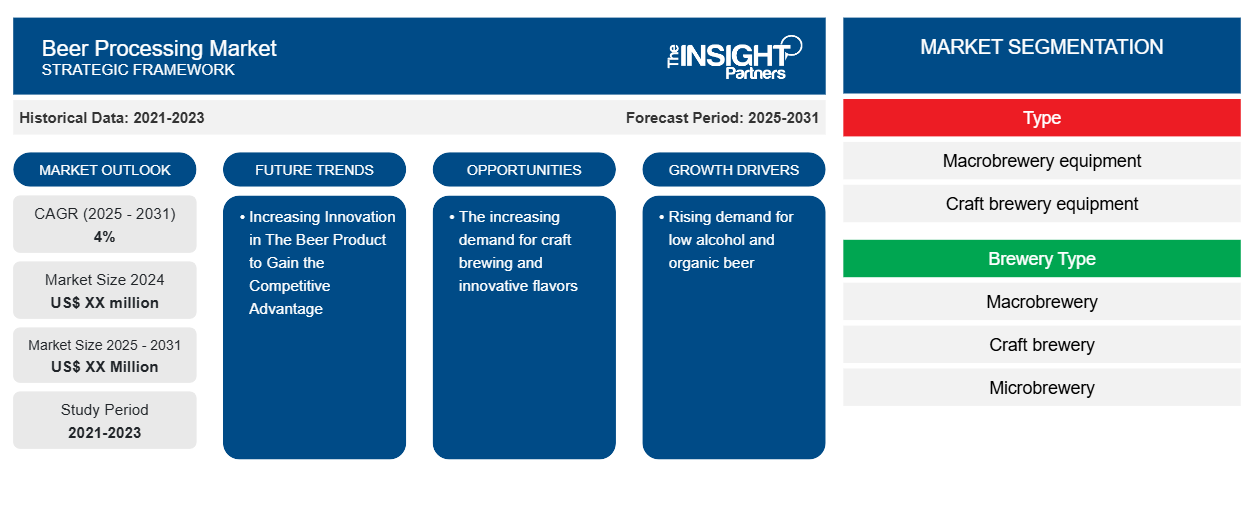

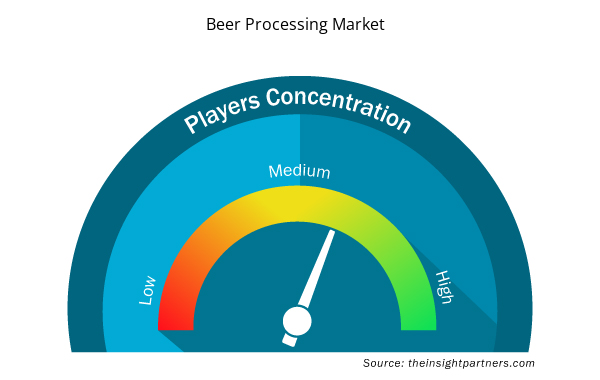

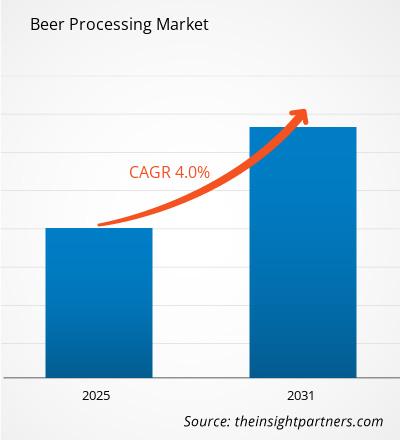

The beer processing market is expected to register a CAGR of 4% during 2023–2031. The increasing demand for craft brewing and innovative flavors is likely to remain a key trend in the market.

Beer Processing Market Analysis:

- The global beer processing market is witnessing a positive impact on the growing consumption of beer.

- In addition, a rise in water treatment techniques, an increase in consumer’s preference towards beer over other alcoholic beverages, and the rising disposable income of consumers in developed and developing countries are driving the market to a new level.

- Prospective factors such as population explosion among the youth and an increasing spenders-ship of female drinkers are expected to drive the market.

- Furthermore, a rise in the number of micro-brewers, on-premises consolidation, and beer brews are also booming the market prospects.

- On the flip side, innovations in brewery equipment and a growing trend of low-alcohol beer and craft beer among consumers have altogether changed the perception of the consumption of alcoholic drinks.

Beer Processing Market Overview

- Owing to the significant growth of artisanal beer and premium, an enhanced number of brewing pubs and microbreweries, as well as the brand building for the brewery machinery, the beer processing industry is boosting with time.

- On the contrary, high maintenance costs, colossal capital expenditure, and rising power costs are expected to decline the market development and simultaneously create new avenues for manufacturers in the beer processing market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Beer Processing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Beer Processing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Beer Processing Market Drivers and Opportunities

Rising Demand for Low Alcohol and Organic Beer

- The rising demand for low-alcohol and organic beer has emerged as a significant driver in the beer processing market.

- Consumers are increasingly gravitating towards healthier lifestyle choices, leading to a surge in interest in beers with lower alcohol content and those made from organic ingredients.

- This trend is prompting breweries to innovate and adapt their production processes to meet these evolving preferences.

- Low-alcohol beers offer the appeal of reduced calorie intake and the ability to enjoy more drinks responsibly.

- In contrast, organic beers cater to environmentally conscious consumers seeking products free from synthetic pesticides and fertilizers.

- As a result, beer processors are investing in new technologies and techniques to create flavorful, high-quality alcohol and organic options, expanding their product portfolios and tapping into this growing market segment.

Increasing Innovation in The Beer Product to Gain the Competitive Advantage

- Furthermore, innovation in beer products can create a lucrative opportunity for companies in the Beer Processing Market to gain a competitive edge.

- Innovation in flavors, ingredients, or brewing techniques can provide a brewery a competitive advantage if it offers a unique flavor, novel ingredients, or brewing technique.

- While it can take various forms, a brewery innovating in new aromatic hops can create a distinct craft beer offering, or a brewery innovating in low-alcohol or alcohol-free brewing can introduce a non-alcoholic beer to market, appealing to low-alcohol or sober curious drinkers.

- Furthermore, using technology to achieve more consistent malting, brewing components, or optimizing the fermentation or filtration processes can lead to more consistent quality with less variance and a more consistent taste.

- This optimization can achieve a cheaper price point due to higher scalability. As such, breweries can create a competitive advantage through innovation in the brewing process, with the result being a more efficient and potentially less expensive process that retains more of the original flavor in the final product.

- In addition to these benefits, consumers’ tastes change, and breweries that innovate and adapt in line with these changes will ultimately capture market share and customer loyalty, gaining a competitive advantage in this exciting beer market.

Beer Processing Market Report Segmentation Analysis

The scope of the global beer processing market is segmented on the basis of equipment type, brewery type, type, price category, and distribution channel.

- Based on equipment type, the beer processing market is divided into macrobrewery equipment and craft brewery equipment.

- On the basis of brewery type, the market is categorized into macrobrewery, craft brewery, microbrewery, brewpub, and others.

- Based on base type, the market is segmented into lager, ale and stout, specialty beer, low alcohol, and beer.

- On the basis of price category, the market is categorized into mainstream, discount, premium, and super-premium.

- Based on distribution channel, the market is segmented off-trade and on-trade

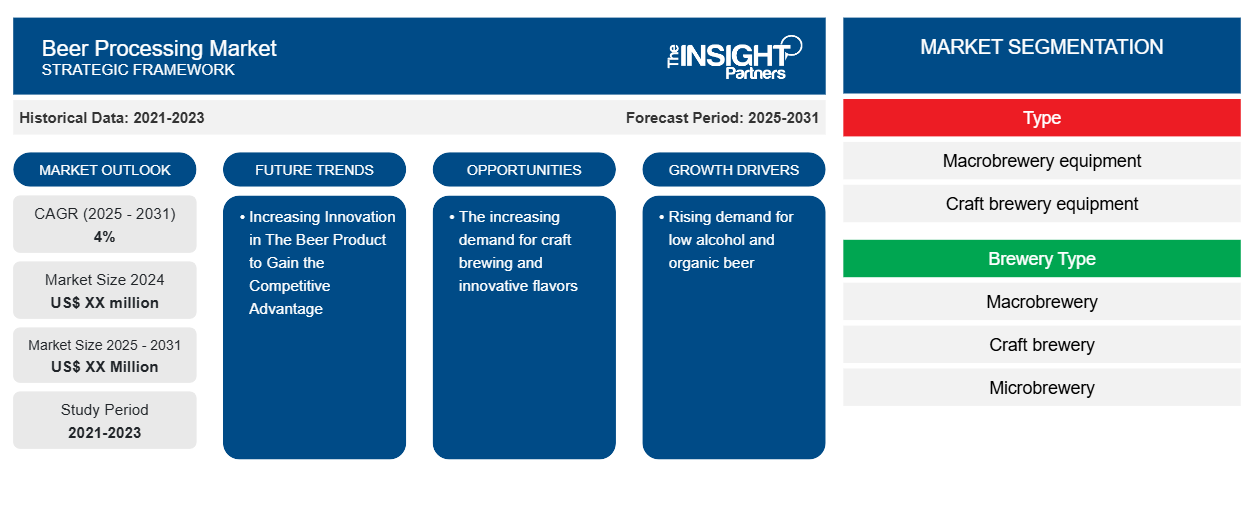

Beer Processing Market Share Analysis by Geography

- Beer Processing Market Report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering beer processing market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers Porter’s Five Forces analysis, which involves the study of major factors that influence the beer processing market in these regions.

Beer Processing Market Regional Insights

Beer Processing Market Regional Insights

The regional trends and factors influencing the Beer Processing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Beer Processing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Beer Processing Market

Beer Processing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Beer Processing Market Players Density: Understanding Its Impact on Business Dynamics

The Beer Processing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Beer Processing Market are:

- Alfa Laval

- GEA Group

- Krones Group

- Molson Coors Brewing Company

- Paul Mueller

- Anheuser Busch Inbev NV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Beer Processing Market top key players overview

Beer Processing Market News and Recent Developments:

The beer processing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- Heineken planned to invest $300 million in Brazil to expand its premium beer portfolio, aiming to boost production capacity for its Amstel, Devassa, and Heineken brands. The investment is part of Heineken's expansion plan, targeting Brazilian beer drinkers as major consumers. (Source: Heineken, Newsletter, May 2023)

- AB InBev has launched a new beer brand called Seven Rivers in India, focusing on locally sourced ingredients and flavors. The product will initially be available in Karnataka and Maharashtra, followed by Delhi, Goa, Haryana, and Uttar Pradesh. The brand will only be available in India for now. (Source: Anheuser Busch Inbev NV, Newsletter, May 2022)

Beer Processing Market Report Coverage and Deliverables

The “Beer Processing Market Size and Forecast (2021 – 2031)” provides a detailed analysis of the market covering below areas:

- Beer processing market size and forecast at global, regional and country levels for all the key market segments covered under the scope

- Beer processing market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Beer processing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the beer processing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global beer processing market is estimated to grow above 4% during the forecast period 2024-2031.

Rising demand for low alcohol and organic beer is one of the major factors driving the beer processing market.

The increasing demand for craft brewing and innovative flavors is likely to remain a key trend in the market.

The leading players operating in the beer processing market are Alfa Laval, GEA Group, Krones Group, Molson Coors Brewing Company, Paul Mueller, Anheuser Busch Inbev NV, Heineken, Carlsberg Group, and Molson Coors Brewing Company.

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies

1. Alfa Laval

2. GEA Group

3. Krones Group

4. Molson Coors Brewing Company (MCBC)

5. Paul Mueller

6. Anheuser Busch Inbev Nv (BUD)

7. Heineken

8. Carlsberg Group

9. Molson Coors Brewing Company (MCBC)

10. Asahi Group Holdings

Get Free Sample For

Get Free Sample For