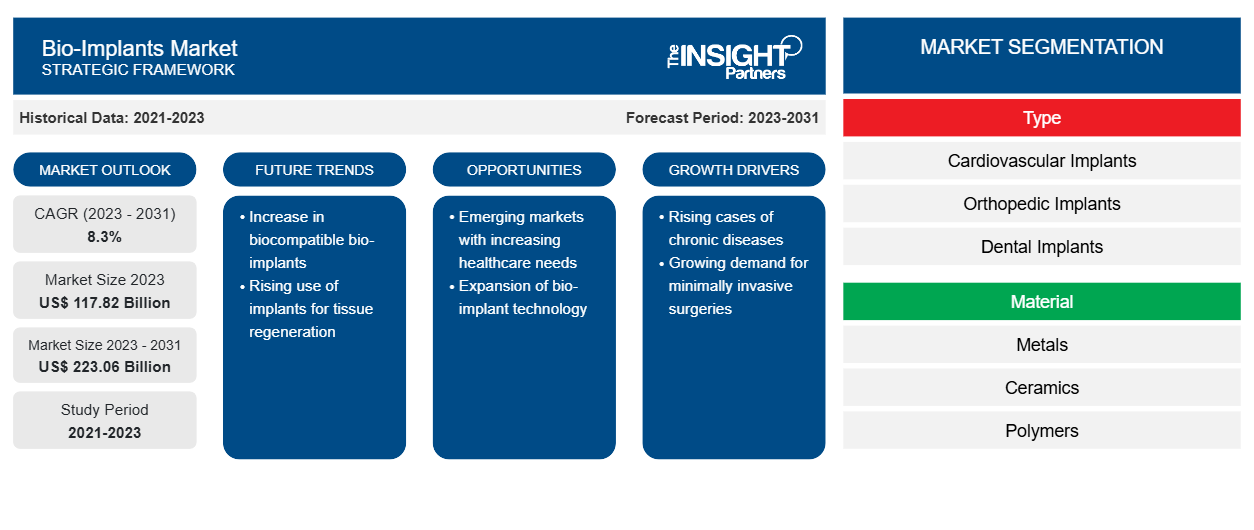

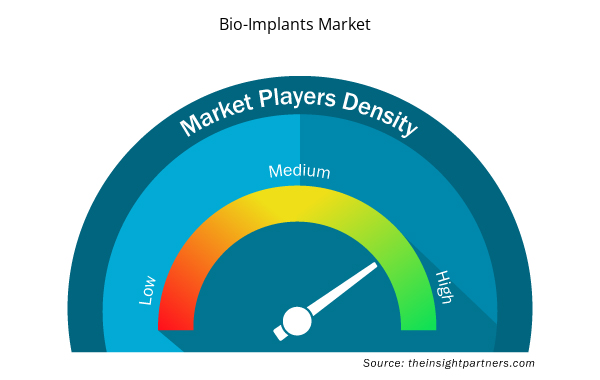

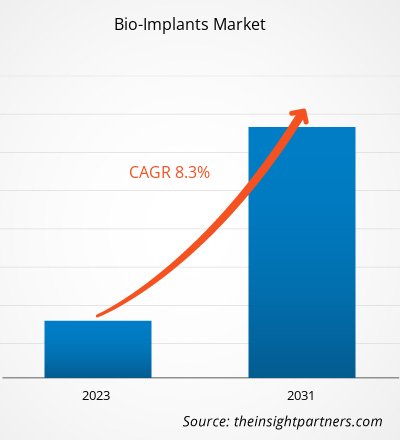

[Research Report] The bio-implants market was valued at US$ 117.82 billion in 2023 and is projected to reach US$ 223.06 billion by 2031; the market is estimated to record a CAGR of 8.3% during 2023–2031.

Analyst Perspective:

The report includes growth prospects in light of current bio-implants market trends and driving factors influencing the market growth bio-implants. The major factors contributing to the growing bio-implants market size include the increasing cases of chronic diseases, particularly in the geriatric population, and increasing disposable incomes. Healthcare infrastructure in developed and developing countries are further expected to improve, significantly driving the bio-implants market.

Awareness about the effectiveness of cosmetic implants and technological advancements has increased among the population across the globe. The market for bioimplants is growing worldwide due to the increasing cases of dental problems. Due to the rising incidences of cardiovascular and orthopedic issues, the demand for orthopedic implants and pacemakers is also increasing. The overall sales of bio implant control in North America are expected to grow due to the robust healthcare infrastructure, increased awareness of cosmetic implants, and major players in the bio-implants market in this region. In addition, Europe is the second largest market for bio-implants in the world due to rapid technological advancements in healthcare, increased demand for noninvasive bio-implants, and a surge in the geriatric population. However, the increasing cost of bioimplant procedures and appropriate utilization of bioimplant products hinder the bio-implants market growth.

Market Overview:

Key factors contributing to the bio-implants market growth include the increasing cases of bone weakening in the elderly population, growing demand for minimally invasive surgeries, and rising cases of lifestyle disorders. Additionally, technological development in healthcare is expected to have a significant impact on the bio-implants market forecast in the coming years. Although the healthcare sector has made significant technological advancements over the years, the rising incidence of serious medical diseases has hindered the market for bio-implants.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bio-Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bio-Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Burden of Lifestyle Disorders Propel Market Growth

Lifestyle disorders such as diabetes, cardiovascular disease, and osteoarthritis are becoming increasingly prevalent worldwide and are major causes of morbidity and mortality. Bio-implants, such as stents and scaffolds, can treat these conditions and are becoming an attractive alternative to traditional permanent implants. According to an article published by the American Heart Association in 2021, ~40,000 children undergo congenital heart surgery in the US every year. The "UK Factsheet January 2022" published by the British Heart Foundation in 2022 stated that ~7.6 million people live with heart and circulatory diseases, and almost 4 million men and 3.6 million women with heart disease and circulatory diseases in 2021. Therefore, the growing prevalence of cardiovascular diseases leads to an increasing need for early diagnosis and treatment, which is expected to fuel the demand for interventional cardiology procedures, as well as cardiovascular implants bio-implants. Further, an alarming rise in oral health problems is expected to increase the demand for bioimplants. For example, according to the World Health Organization (WHO) 2021 Global Burden of Disease Study, oral diseases are expected to affect about half of the world's population. Approximately 3.58 billion people have been affected by dental caries and other dental problems. bio-implants

In addition, bio-implants help in managing and controlling specific drug delivery in conditions such as musculoskeletal disorders. According to an article published by Orthopedic Surgery in January 2021, the overall prevalence of lumbar spondylolisthesis in middle-aged people in the Beijing community was 17.26% (15.98% in men and 18.80% in women). Women aged 60 and above are more likely to suffer from lumbar spondylolisthesis. According to the WHO, musculoskeletal injuries and diseases are widespread and affect 1.71 billion people worldwide, leading to the major cause of disability worldwide. More than 1 billion people are expected to suffer from joint, muscle, bone, ligament, tendon, and spine diseases by 2050, up from about half a billion in 2020, according to a new study published in The Lancet Rheumatology. Due to the growing aging population, the number of people with musculoskeletal conditions and the associated functional limitations is increasing rapidly. This growing musculoskeletal condition among patients leads to an increased demand for more implant procedures and hospitalizations, thereby driving the bio-implants market.

Segmental Analysis:

The bio-implants market analysis has been carried out by considering the following segments: type, material, and end user.

Based on type, the bio-implants market is segmented into cardiovascular implants, orthopedic implants, dental implants, ophthalmic implants, and others. The cardiovascular implants segment held a larger market share in 2023. The growth of the segment is due to rapid rise in research and development activities to develop novel cardiac implant products. For example, in February 2022, Abbott, a medical technology company, announced the world's first patient implantation of a leadless dual-chamber pacemaker system as part of its AVEIR DR i2i pivotal clinical trial. The implantation of Abbott's experimental dual-chamber leadless pacemaker represents a significant technological milestone for leadless pacemaker technology; it is the first in the world to be in a pivotal trial.

The bio-implants market, based on material, is segmented into metals, ceramics, and polymers. The immediate-release capsules segment held the largest market share in 2023. It is further expected to register the highest CAGR during the forecast period. These metals are ideal for implant applications due to their remarkable mechanical strength, corrosion resistance, and biocompatibility. Titanium is an extremely popular material for orthopedic, dental, and cardiovascular implants due to its exceptional durability, lightweight design, and compatibility with human tissue. Because of their malleability, electrical conductivity, and inertness, metals are valued for use in specialized implant applications such as cardiac electrodes and neurological probes. The increasing incidence of chronic diseases and improvements in materials science and manufacturing techniques drive the demand for biomaterial metals in bio-implants. This has solidified the position of biomaterial metals as the most popular material category in the bio-implants market.

Based on the end user, the market is bifurcated into hospitals & clinics and ambulatory surgical centers. The hospitals & clinics segment held a larger bio-implants market share in 2023 and the same is anticipated to register a higher CAGR during 2023–2031. Hospitals & clinics often attract large patient bases, including those requiring specialized implant treatments, due to their extensive medical programs and multidisciplinary approach toward patient care. Hospitals typically partner with research centers and medical device manufacturers to facilitate access to cutting-edge implant breakthroughs and technologies. Hospitals & clinics are important players in the bio-implants market as they provide necessary implant-related services and generate significant demand for the goods and processes associated with bio-implants. Thus, the growing number of hospitals & clinics with the burgeoning demand for medication among people is expected to support the growth of this segment in the market during the forecast period.

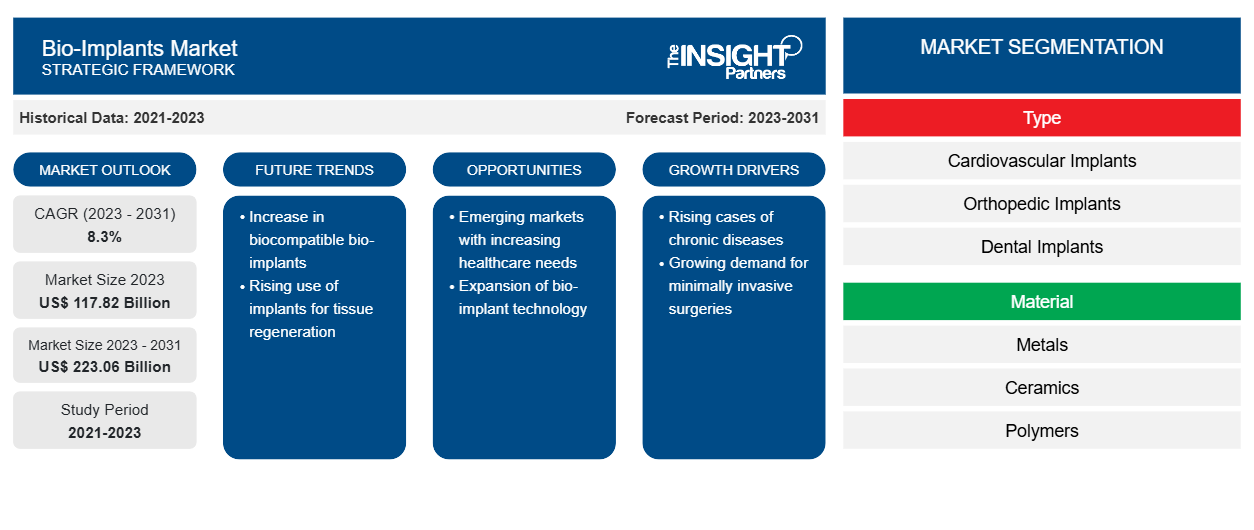

Regional Analysis:

The scope of the bio-implants market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 50.51 billion in 2023 and is projected to reach US$ 96.69 billion by 2031; it is expected to register a CAGR of 8.5% during 2023–2031. The North America market is segmented into the US, Canada, and Mexico. The market growth in North America is attributed to the increasing prevalence of chronic diseases and better healthcare infrastructure. In July 2022, an updated Centers for Disease Control and Prevention (CDC) data shows that coronary artery disease is one of the most common types of heart disease, with approximately 20.1 million adults aged 20 and older living with the disease in the US. Additionally, according to CDC data, every 40 seconds, an individual suffers from a heart attack, i.e., nearly 805,000 people. The increasing number of chronic diseases is expected to increase the overall demand for bio-implants during the forecast period.

According to the Centers for Medicare and Medicaid Services, national healthcare spending is anticipated to reach US$ 6.2 trillion by 2028, growing at an average annual rate (AAR) of 5.4% from 2019 to 2028. As national healthcare spending is expected to increase by 1.1% points, the healthcare share of the economy is expected to increase by 19.7% in 2028, faster than the average annual GDP in 2019–2028. Therefore, the increasing healthcare spending is expected to create opportunities for the market players to develop bio-implants during the forecast period.

Europe accounts for the second-largest bio-implants market share in 2023. The market growth in this region is ascribed to technological advancements in healthcare, increased demand for non-surgical bioimplants, and a growing geriatric population. The market growth in Europe is attributed to the government funding and support of healthcare, increasing incidence of orthopedic diseases, and rising research and development activities in healthcare. Furthermore, the increasing number of cardiovascular surgeries due to the increase in the incidences of cardiovascular diseases in the region is driving the bio-implants market in the region.

Asia Pacific is expected to register the highest CAGR in the global bio-implants market during 2023–2031. The market growth in this region is ascribed to the growing geriatric population, increasing disposable income, rising healthcare investments and expansion by market players, and increasing cases of spinal cord injuries due to the growing number of traffic accidents. Asia Pacific is experiencing significant growth, particularly in emerging markets such as China and India. Expanding healthcare infrastructure and increased investments in this area to provide efficient patient services drive the bio-implants market in the region. For example, approximately 100,000 patients in Japan were paralyzed due to spinal cord injuries, according to a 2019 publication from Japan's Keio University. However, the approval of iPS technology is expected to help these patients in the country in the near future, which is likely to provide opportunities in the bio-implants market in the coming years. According to the United Nations Economic and Social Commission for Asia and the Department of Social Development in the Pacific, in 2016, more than 12.4% of Asia's population was above 60 years old, and this is expected to reach 1.3 billion by the end of 2050.

Bio-implants Bio-Implants Market Regional Insights

The regional trends and factors influencing the Bio-Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Bio-Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Bio-Implants Market

Bio-Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 117.82 Billion |

| Market Size by 2031 | US$ 223.06 Billion |

| Global CAGR (2023 - 2031) | 8.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

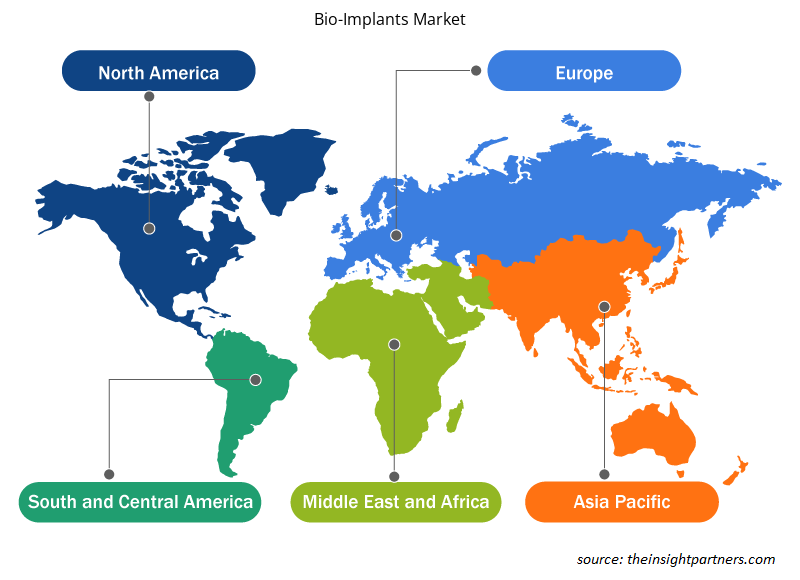

Bio-Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Bio-Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Bio-Implants Market are:

- LifeNet Health

- Smith & Nephew

- Arthrex, Inc.

- Clinic Lemanic

- Alpha Bio Tec

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Bio-Implants Market top key players overview

Key Player Analysis:

LifeNet Health; Smith & Nephew; Arthrex, Inc.; Clinic Lemanic; Alpha Bio Tec; MiMedx Group; Medtronic; St Jude Medical (Abbott); Stryker Cooperation; DePuy Synthes; Biomet (Zimmer); Exactech, Inc.; Cochlear Ltd; and Straumann AG are among the key players profiled in the bio-implants market report.

Recent Developments:

Companies operating in the market adopt such as mergers and acquisitions. As per the company press releases, below are a few recent key developments:

- In February 2023, CurvaFix, Inc., a medical device developer designed to repair fractures in curved bones, announced the launch of its smaller diameter 7.5mm—CurvaFix IM implant. It is designed to simplify surgical procedures and provide strong, stable fixation in small bones and is intended to enable patients with bones.

- In June 2022, ZimVie launched the Food and Drug Administration, approved T3 pro-engineered implants, and Encode Emergence Healing Abutment in the US.

- In June 2021, Intelligent Implants Ltd., a medical device company, was granted a breakthrough by the US FDA for SmartFuse, an orthopedic implant technology. The SmartFuse platform was designed to remotely stimulate, control, and monitor bone growth to make real-time clinical decisions. The product is indicated for first-use patients undergoing lumbar spinal fusion.

- In February 2021, Medtronic launched the TYRX Absorbable Antibacterial Sheath, an absorbable, disposable, antibacterial sheath designed for stabilizing a cardiac implantable electronic device or implanted neurostimulator.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The bio implants market is expected to be valued at US$ 223.06 billion in 2031.

The global bio implants market, based on type, the bio implants market is segmented into cardiovascular implants, orthopedic implants, dental implants, ophthalmic implants, and others. The cardiovascular implants segment held the largest bio implants market share in 2023; it is also expected to register the highest CAGR during 2023–2031. The bio implants market, based on material, is segmented into metals, ceramics, and polymers. The metals segment held the largest bio implants market share in 2023. It is further expected to register the highest CAGR from 2023 to 2031. Based on end user, the market is bifurcated into hospitals & clinics and ambulatory surgical centers. The hospitals & clinics segment accounted for a larger market share in 2023. The same segment is anticipated to register a higher CAGR during 2023–2031.

The bio implants market majorly consists of the players such as LifeNet Health; Smith & Nephew; Arthrex, Inc.; Clinic Lemanic; Alpha Bio Tec; MiMedx Group; Medtronic; St Jude Medical (Abbott); Stryker Cooperation; DePuy Synthes; Biomet (Zimmer); Exactech, Inc.; Cochlear Ltd; and Straumann AG.

The factors driving the growth of the bio implants market include the increasing burden of lifestyle disorders and the growing demand for minimally invasive surgical procedures.

Bio implants are designed to repair the physiological function of a damaged biostructure. The implantation method replaces; supports; and improves a missing, damaged, or existing biological structure. The bio implants market report emphasizes the key factors impacting the market and showcases the developments of prominent players. Increasing incidences of bone loss in the geriatric population, growing demand for minimally invasive surgeries, rising cases of lifestyle disorders, and technological innovations in the healthcare sector are a few factors contributing to the growing bio implants market size. Further, increased R&D activities and aggressive strategies by leading competitors are driving the bio implants market. The high cost of bioimplant procedures and appropriate utilization of bioimplant products hamper the market growth.

The bio implants market was valued at US$ 117.82 billion in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Bio Implants Market

- LifeNet Health

- Smith & Nephew

- Arthrex, Inc.

- Clinic Lemanic

- Alpha Bio Tec

- MiMedx Group

- Medtronic

- St Jude Medical (Abbott)

- Stryker Cooperation

- DePuy Synthes

- Biomet (Zimmer)

- Exactech, Inc.

- Cochlear Ltd

- Straumann AG

Get Free Sample For

Get Free Sample For