Market Insights

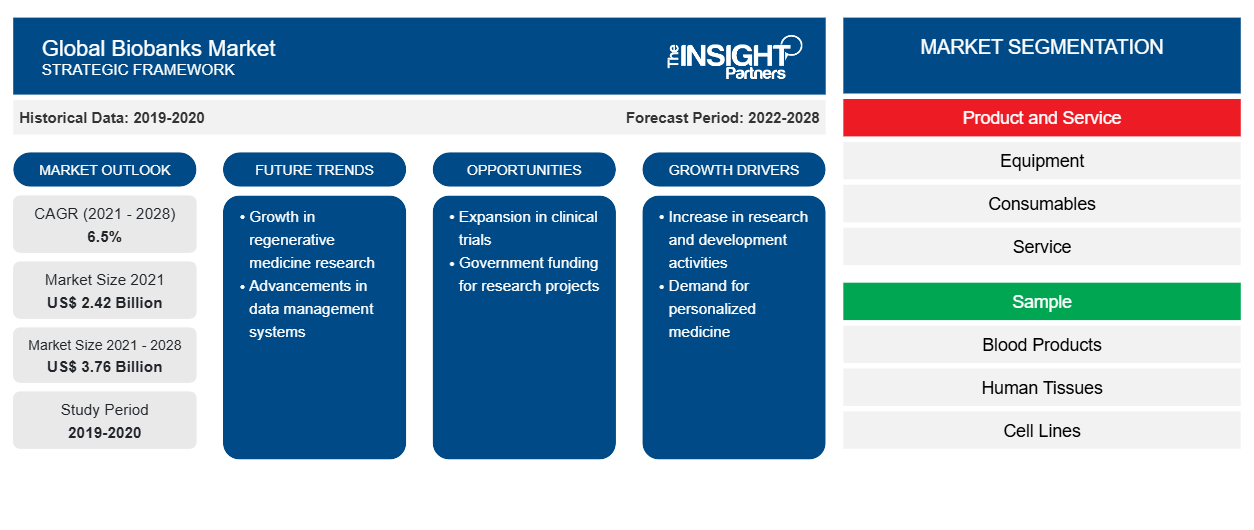

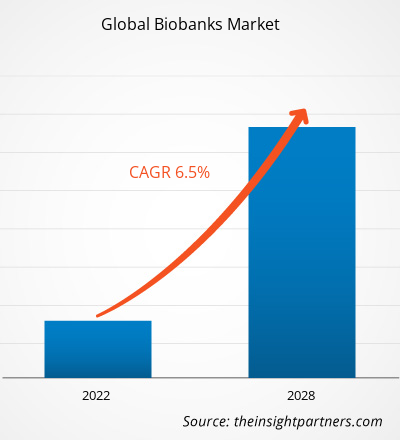

The global biobanks market generated US$ 2,418.31 million in 2021 and is anticipated to account for US$ 3,758.64 million by 2028, expanding at a CAGR of 6.5% during 2021–2028.

The growing funding and genomic research activities for studying diseases, increasing pharmaceutical and biopharmaceutical R&D expenses, and the rising adoption of regenerative medicines are the potential aspects proliferating the biobanks market growth. On the contrary, the high cost of automation hinders the expansion of global biobanks market.

A biobank offers collection of biological samples (such as blood) as well as healthcare data. Biobanks might be vast, including thousands of samples, or small, containing only a few hundred. Different samples and information are collected by different biobanks to evaluate specific functions. Major market players have optimized their growth with several organic and inorganic growth strategies.

Regionally, North America held the largest share of the global biobanks market and is likely to retain its dominance over the forecast period. Asia Pacific is speculated to spur with the highest CAGR during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Global Biobanks Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Global Biobanks Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

COVID-19 Impact

The Application in Sampling, Analysis, and Vaccine Creation Aid the Global Biobanks Market Growth

The global COVID-19 pandemic had far-reaching health-care, economic, and societal consequences around the world. The health-care system in North America faced an immediate issue in estimating the demographics of COVID-19 impact. In the early stage of pandemic, biobanking activities in Canada were considered as non-essential health care services, but with the emergence of research operations, the disease-related studies were permitted and published. The US leveraged virtual care and remote monitoring strategy to assure patients of having full clinical support. Biobanking became a necessary service during pandemic facilitating quicker critical research operations. Global biobanks had to purchase extra personal protective equipment (PPE) kits to safeguard medical personnel from infection. Also, they communicated globally for the material required to collect and store specimens.

In Europe, biobanks proved to be extremely helpful to mitigate COVID-19 as they provided researchers with necessary samples to assess the conditions and create vaccines and therapies. Biobanks played a vital role during pandemic in research, sampling, and vaccination. It would have been impossible to make the genome of the SARS-CoV-2 virus accessible to the entire scientific community and produce vaccination in record time without samples collected from infected patients. Asia pacific biobanks market, which was plagued by ethical difficulties and infrastructure challenges, is likely to grow rapidly in future. The Indian Council of Medical Research (ICMR) approved 16 bio-repositories to collect, store, and keep clinical samples from COVID infected patients.

Future Trends

Virtual Biobanks

A virtual repository provides data extracted and characterized from samples stored in traditional biobank.Virtual biobank’s database offers high-resolution images of samples and other characteristic data. These biobanks can be accessed via specialized software or a web portal. They allow access to recorded data formats negating the requirement of physical samples. Virtual biobanks, often used in bioinformatics, contains 2D and 3D microscopy datasets of valuable clinical biopsy specimens. This system has emerged as a practical option to improve sample visibility and access. Researchers can use virtual biobanks to identify products and services they need to simplify and manage critical phases of the biobanking process. Virtual system integration is likely to bolster the global biobanks market in future.

Drivers

Growing Funding and Genomic Research Activities for Studying Diseases

Genomic sequencing is rapidly transitioning into clinical practice and healthcare systems with an aid of substantial government investments. The national genomic-medicine initiatives are driving transformative changes in medical systems. The UK has announced world’s largest genome project as a part of 200 million public-private collaborations between charities and pharma. The project will fund researchers and industry to combine data and real-world evidence from UK health services. Boston, a Massachusetts-based company received a US$ 4.3 million in seed funding to partner with Veritas Genetics, a genome sequencing company. Biobank has been a significant resource for genomic research on infectious diseases and hosts. Data from biobanks help understand the etiology of multifactorial diseases caused by genetic mutations.

Rising Adoption of Regenerative Medicines

Regenerative therapies help induce the regeneration of cells, tissues, and organs to restore their functions. The Food and Drug Administration (FDA) receives a large number of regenerative medicine applications for human clinical trials every year. Rapid advancements in regenerative medicines to bring out effective solutions for chronic conditions potentially drive the global biobanks market growth. Cell therapy is one of the fastest-growing segments of the regenerative medicine domain. Novartis Kymriah was the first cell therapy solution to treat B-cell acute leukemia. Biobank has been a major asset for regenerative medicines as it provides material for research, development, and therapy. Investing in biobanking can yield considerable cost recoveries to support regenerative medicines and tissue engineering program.

Restraints

High Cost of Automation

Expensive automation has been a major impediment to the growth of global biobanks market. The advanced features and functions have made biospecimen storage instruments high-priced. Also, since the cost of biobanking operations is not limited to automation, companies assess various factors influencing their overall financial stability. The total expenditure of automation include cost of purchasing equipment, other infrastructures, and process improvements as per demand. Automated systems can cost five to ten times the expenses of manual operations in the beginning. For completely maintained automation, the ten-year operating cost is expected to range between US$ 0.57 to 5.66 million. Research companies are paying more for the automation incorporation. Such highly expensive automated systems are likely to curtail the growth of global biobanks market.

Market Segmentation

By Product and Service

Requirement for Storage and Handling Spurred the Segmental Growth

The global biobanks market, by product and service, is split into equipment, consumables, services, and software. The equipment segment occupied the largest market share in 2021 and will continue to dominate till 2028. Equipment plays a vital role in the manufacturing of biobank products. It is crucial at every stage of storage. Therefore, the biomaterial storage, handling, and research management requires different types of equipment. The segment is further categorized into storage, sample analysis, sample processing, and sample transport equipment.

Consumables, the second-largest market captivator is also anticipated to grow with the highest CAGR for the forecast period. Consumables such as petri dishes, test tubes, pipettes, and beakers are used at every step of sample collection, preparation, analysis, storage, and transportation. Besides, they are also required at the time of QC process to assure appropriate testing. The segmental growth is largely accustomed to the use of consumables in research and academic institutes and life science companies.

By Sample

Requirement in Sampling and Analysis Strengthened the Segment’s Dominance

Based on sample, the global biobanks market is segmented into blood products, human tissues, cell lines, and others. In 2021, the blood products segment dominated the market with the largest revenue share and is expected to soar at the highest CAGR during 2021–2028. Blood is one of the most common bio-samples collected in human biobanks for being the source of DNA and RNA. The buffy coat and whole blood samples are required for biobanks in human biospecimens.

Cell lines segment follows blood products to occupy second-largest market share. Patient-derived cell lines are essential for fundamental research, high-throughput drug screenings, and assessment of new pharmaceutical agents. The role of biobanks is crucial in maintaining human embryonic stem cell lines in stem cell research. Many cell lines are unique in nature, for example, induced pluripotent stem cells obtained from patients with Down Syndrome.

Regional Insights

Geographically, the global biobanks market is segmented into North America, Europe, Asia Pacific (APAC), South & Central America (SCAM), and Middle East & Africa (MEA).

North America encompassed the largest market share in 2021 and is projected to retain its dominance till 2028. A highly structured healthcare industry, early acceptance of breakthrough products, prevalence of chronic diseases, breakthroughs in drug discovery, rising investments by government and non-government organizations, and the presence of key players are the potential parameters driving the regional biobanks market. In the US, the regenerative medicine research is getting more focused and advanced making disease reversal feasible. It has been observed that stem cells have the potential to treat a wide range of diseases that were previously considered untreatable. Expanding research institutes, growing interest among students and researchers in various genetic investigations, investment by global firms, and government initiatives are the primary aspects elevating the Canada biobanks market growth.

Asia Pacific biobanks market is likely to expand with the highest CAGR over the forecast period. Biobanking is one of many initiatives aimed at preserving biological resources and data for future research and development in the region. China, particularly has been very active in biobanking activities as a part of government co-ordinated strategic programs. The country has also established a network of Asian biobanks ahead of time to ensure resource and expertise sharing. To develop stable operation systems, biobanks in the APAC standardize operational procedures and diversify financial sources. Indian government sponsored translational research institutes to treat variety of diseases, making country more innovative and sustainable.

Biobanks Global Biobanks Market Regional Insights

Global Biobanks Market Regional Insights

The regional trends and factors influencing the Global Biobanks Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Global Biobanks Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Global Biobanks Market

Global Biobanks Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.42 Billion |

| Market Size by 2028 | US$ 3.76 Billion |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product and Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

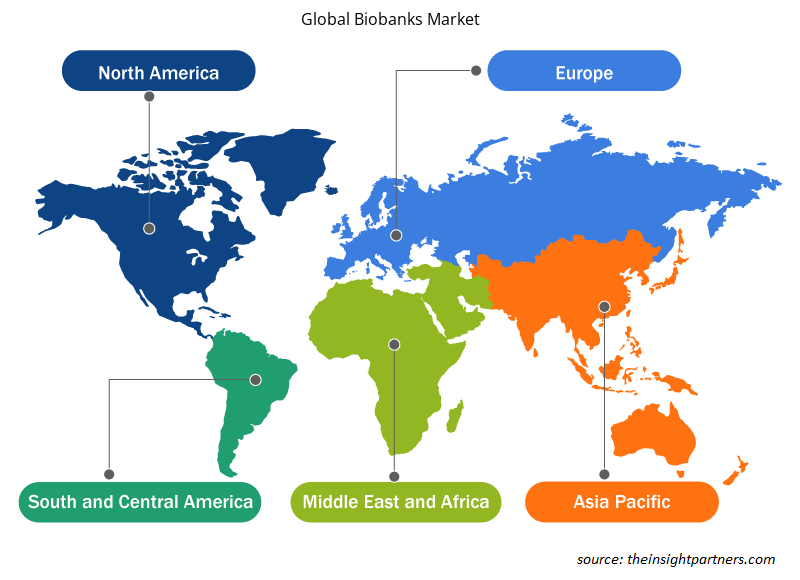

Global Biobanks Market Players Density: Understanding Its Impact on Business Dynamics

The Global Biobanks Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Global Biobanks Market are:

- THERMO FISHER SCIENTIFIC INC.

- Tecan Trading AG

- QIAGEN

- Hamilton Company

- Avantor, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Global Biobanks Market top key players overview

Key Market Players:

- Thermo Fisher Scientific Inc (US)

- Tecan Trading AG (Switzerland)

- QIAGEN (Netherlands)

- Hamilton Company (US)

- Avantor, Inc (US)

- Micronics Japan Co., Ltd. (Japan)

- BD (US)

- Taylor-Wharton (US)

- Brooks Automation, Inc (US)

- Biovault Family (UK)

- Promega Corporation (US)

- SciSafe Inc. (US)

Key Developments:

December 2021:

Thermo Fisher Scientific Inc acquired PPD, Inc., a leading global provider of clinical research services, for US$ 17.4 billion.August 2021:

Tecan Group completed the acquisition of US-based Paramit Corporation and its affiliates for a total purchase consideration of US$ 1.0 billion.January 2022:

QIAGEN announced new additions to the growing number of applications for QI Acuity, its ultrasensitive digital PCR platform that uses nanoplates to process samples in just two hours.July 2021:

BD acquired Tepha Inc., a leading developer and manufacturer of a proprietary resorbable polymer technology.

Report Coverage

The global biobanks market research report provides detailed insights into the market in terms of size, share, trends, and forecasts. It delivers crisp and precise know-how of drivers, restraints, opportunities, segments, and industrial landscape. The COVID-19 impact analysis is discussed with the opportunities observed in global and regional markets. A list of key market players with their respective developments in recent years has been reserved as a special mention.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product and Service, Sample, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The blood products segment dominated the global biobanks market and accounted for the largest market share of 75.47% in 2021.

A biobank is a collection of biological samples (such as blood) as well as health data. Biobanks might be vast, including thousands of samples, or small, containing only a few hundred. Different sorts of samples and information are collected by different biobanks. The information and samples gathered are determined by the biobank's specific function. The term biobank covers collections of plants and animals, including human specimens.

Key factors that are driving the growth of this market are the growing funding and genomic research activities for studying diseases, increasing pharmaceutical and biopharmaceutical R&D expenditures, and rising adoption of regenerative medicines are expected to boost the market growth for the biobanks over the years.

The CAGR value of the biobanks market during the forecasted period of 2021-2028 is 6.5%.

The equipment segment held the largest share of the market in the global biobanks market and held the largest market share of 54.38% in 2021.

The regenerative medicine segment dominated the global biobanks market and accounted for the largest market share of 48.92% in 2021.

The biobanks market majorly consists of players such Thermo Fisher Scientific Inc., Tecan Trading AG, QIAGEN, Hamilton Company, Avantor, Inc., Micronics Japan Co.,Ltd., BD, Taylor-Wharton, Brooks Automation, Inc., Biovault Family, Promega Corporation, and SciSafe Inc. amongst others.

Hamilton Company. and Avantor, Inc. are the top two companies that hold huge market shares in the Biobanks market.

Global biobanks market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. North America held the largest market share for biobanks in 2021. The United States held the largest market in North America for biobanks, and the market is expected to grow due to the increasing adoption of technological advancements and rising innovations in regenerative medicine are projected to accelerate the growth of the biobanks market.

Biobanking became a necessary service as a result of this development, allowing for faster COVID-19 research and the continuation of critical research operations. During the epidemic, navigating the scarce and frequently competing healthcare supply chains was critical for continuous operational demands. Global biobanks have had to purchase extra personal protective equipment (PPE) to safeguard their personnel from COVID-19, and even employees have had to be regularly checked for suspected COVID-19 symptoms. Biobanks had to communicate and search globally for the materials they required to quickly collect and store specimens. Biobanks are critical in collecting and preserving bio samples such as plasma, serum, DNA and RNA, clinical data, and genomic data due to the large number of clinical trials related to COVID-19.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Biobanks Market

- THERMO FISHER SCIENTIFIC INC.

- Tecan Trading AG

- QIAGEN

- Hamilton Company

- Avantor, Inc.

- MICRONICS JAPAN CO., LTD.

- BD

- Taylor-Wharton

- Brooks Automation, Inc

- Biovault Family

- Promega Corporation

- SciSafe Inc.

Get Free Sample For

Get Free Sample For