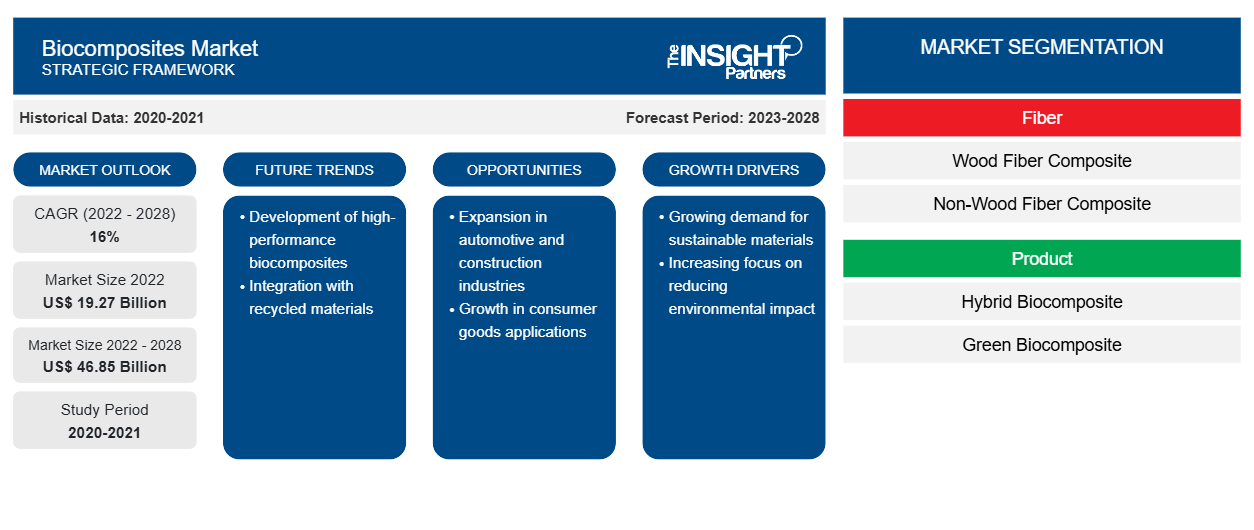

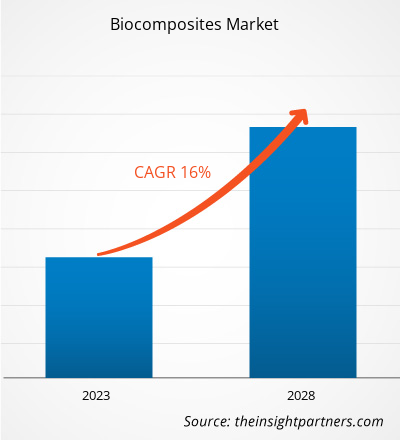

[Research Report] The biocomposites market is expected to grow from US$ 19,268.62 million in 2022 to US$ 46,851.39 million by 2028; it is estimated to grow at a CAGR of 16% from 2022 to 2028.

MARKET ANALYSIS

Biocomposites are materials formed by reinforcement of natural fibers and matrix (resin). The interest in biocomposites is rapidly growing among end use industries as applications in fundamental research, packaging, construction, military applications, aerospace, railway coaches, and automobiles due to many potential benefits such as ease in availability, high specific strength, light weight, biodegradability, recyclability, cheaper in cost, and renewability. The biocomposites are being highly used in the automotive industry for the manufacturing of interior panels. As biocomposites are eco-friendly, they are replacing polymer composites in various applications at a high price.

GROWTH DRIVERS AND CHALLENGES

The increasing use of sustainable building materials has aided the biocomposites market growth. The construction industry is one of the firmest emergent sectors in rapid urbanization owing to the growing population in urban areas. This urbanization makes the industry the most astonishing consumer of materials, most of them from non-renewable resources. According to the report from the Global Alliance for Building and Construction, the construction sector is one of the most harmful to the environment. According to the study, the construction sector is responsible for 39% of the carbon dioxide emissions dispersed in the environment, for 36% of consumption global energy and for 50% of the extraction of raw materials. Emissions are mainly responsible for climate change and increases the earth’s temperature. Conventional construction materials are highly resource and energy-intensive. Hence, there is a rising concern and awareness about hazards from conventional building materials that have both social and environmental impact. In order to address these issues, new materials and technologies are being developed in the construction industry. Biocomposites are sustainable building materials help eliminate non-renewable waste, reduce raw material usage, and cut fossil-fuel consumption. Interest in using biocomposites in the construction industry is increasing globally, as these materials are made from renewable, recyclable, biodegradable sources and have a wide range of uses as structural and non-structural building elements. However, there are few disadvantages of natural fiber composites such as poor fiber-matrix interfacial bonding, poor wettability, and water absorption. These challenges affect the strength and performance of end products. The hydrophilic nature of biocomposites tend to absorb water from the immediate environment which causes the composite to swell. All these factors are expected to hinder the biocomposites market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biocomposites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biocomposites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Biocomposites Market Analysis to 2028" is a specialized and in-depth study with a major focus on the global biocomposites market trends and growth opportunities. The report aims to provide an overview of the global biocomposites market with detailed market segmentation by fiber, product, end use, and geography. The global biocomposites market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of biocomposites worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the biocomposites market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the biocomposites market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative biocomposites market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global biocomposites market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global biocomposites market is segmented based on fiber, product, end use. Based on fiber, the biocomposites market is bifurcated as wood fiber composite and non-wood fiber composite. Based on product, the market is classified as hybrid biocomposite and green biocomposite. On the basis of end use the market is segregated as building and construction, automotive, consumer goods, and others.

Based on fiber, the wood fiber composite segment accounted for a significant biocomposites market share. The main disadvantage of wood fiber composites is their moisture sensitivity however, with increasing research and development manufacturers are producing wood fiber components with higher moisture resistance, greater rigidity and a lower coefficient of thermal expansion. On the basis of product hybrid composite led the biocomposites market with a largest market share. Based on end use building and construction segment is dominating the biocomposite market. Biocomposites in the building are used for framing, walls and wallboard, window frames, doors, flooring, decorative paneling, cubicle walls, and ceiling panels. The use of biocomposites for temporary and adjustable building components reduces landfill waste when interior designs within the structure are modified.

REGIONAL ANALYSIS

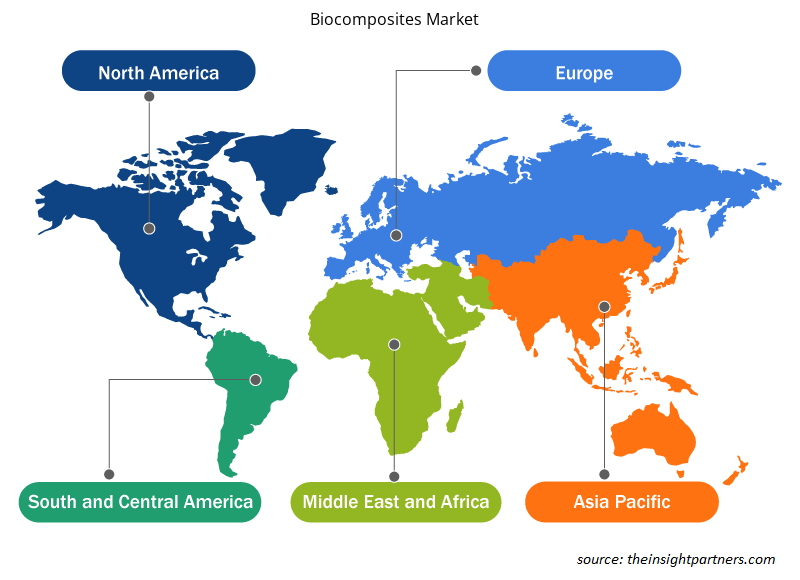

The report provides a detailed overview of the global biocomposites market with respect to five major regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Asia Pacific accounted for a significant share of the market and is valued at more than US$ 9,300 million in 2022. Asia Pacific comprises several developing and developed economies such as China, India, Japan, South Korea, and Australia. The critical factor contributing to its growth is the increasing demand from building & construction and transportation for end-use industries. The high demand for biocomposites is primarily observed in China, Japan, India, and South Korea. Also, the increase in foreign direct investment (FDI) in transportation and infrastructure sectors is expected to drive the demand for biocomposites during the next few years. Europe is also expected to witness considerable growth valued at approximately US$ 11,000 million in 2028, owing to the increasing government spending on infrastructure building. Furthermore, in North America, there has been a widespread usage of biocomposites in residential & commercial construction, consumer products and the automotive sector. This has created lucrative opportunities in biocomposites market. The biocomposites market in North America is augmented to grow at CAGR of 15.0% during the forecast period.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnership, acquisitions, and new product launches were found to be the major strategies adopted by the players operating in the global biocomposites market.

- In May 2022, Arkema planned to launch its new solution for recyclable and ever more efficient composites.

- In Mar 2021, Fiberon announced the launch of wildwood composite cladding, providing the unrivaled beauty and warmth of wood combined with the durability of high-performance, low-maintenance materials.

Biocomposites Market Regional Insights

Biocomposites Market Regional Insights

The regional trends and factors influencing the Biocomposites Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Biocomposites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Biocomposites Market

Biocomposites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 19.27 Billion |

| Market Size by 2028 | US$ 46.85 Billion |

| Global CAGR (2022 - 2028) | 16% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Fiber

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

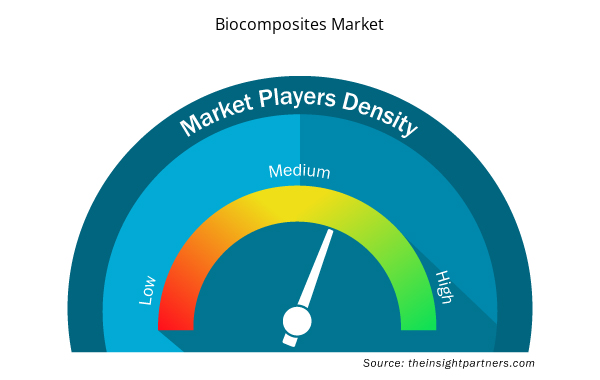

Biocomposites Market Players Density: Understanding Its Impact on Business Dynamics

The Biocomposites Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Biocomposites Market are:

- TTS

- Lingrove

- Bcomp Ltd

- UPM

- Flexform Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Biocomposites Market top key players overview

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA). The crisis disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Further, the international travel bans imposed by various governments in Europe, Asia Pacific, and North America forced several companies to discontinue their collaboration and partnership plans. All these factors hampered the chemicals & materials industry in 2020 and early 2021, thereby restraining the growth of various markets related to this industry, including the biocomposites market.

Before the COVID-19 outbreak, the biocomposites market was mainly driven by the rising demand from automotive and building & construction industries. However, in 2020, various industries had to slow down their operations due to disruptions in value chains caused by the shutdown of national and international boundaries. The COVID-19 pandemic disrupted the supply chain of key raw materials and disturbed manufacturing processes due to restrictions imposed by government authorities in various countries. However, the economies revived their operations. The previously postponed construction projects were resumed, further providing an opportunity for the biocomposite market players to regain normalcy.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Some of the key players operating in the biocomposites market include TTS; Lingrove; Bcomp Ltd; UPM; Flexform Technologies; Tecnaro GmbH; Fiberon; Arkema; Trex Company, Inc.; and HempFlax Group B.V. among others.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fiber, Product, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, UAE, UK, US

Frequently Asked Questions

The green biocomposite is expected to be the fastest-growing segment during the forecast period. Green biocomposites are typically made by combining a biodegradable polymeric matrix with eco-friendly and renewable fibers. Increasing concern for the environment is driving the growth of green biocomposites during the forecast period.

During the forecast period, the automotive segment is expected to be the fastest-growing segment. Many automotive applications use biocomposites to achieve objectives, including light vehicle weight, fuel economy, low battery weight, low CO2 emissions, and high accident safety. Increasing demand for lightweight and fuel-efficient vehicles is propelling the demand for biocomposites during the forecast period.

The key driver fueling the biocomposites market's expansion is the population's increased awareness of the necessity for eco-friendly materials to protect the environment from degradation. Another aspect driving the biocomposites market's expansion is the growing use of biocomposites to lighten vehicles and increase safety. Other reasons that contributed to the market's growth include the introduction of strict government restrictions and safer usage of biocomposites than glass fiber.

In 2021, Asia-Pacific accounted for the largest share of the global biocomposites market. Due to growing environmental concerns, strict government restrictions, and a sense of social responsibility, the commercial and residential construction sector in the Asia Pacific is booming. Increased use of biocomposites in the building and construction sector led to the dominance of the Asia Pacific region in the global biocomposites market.

In 2021, the wood fiber composite segment held the largest market share. Composites made of wood fiber cost less than non-wood composites. These are used in a variety of applications, including residential, commercial, swimming pool, observation decks, and jetties. These are a few of the factors that led to the dominance of wood fiber composites in 2021.

The major players operating in the biocomposites market are TTS, Lingrove, Bcomp Ltd., UPM, Flexform Technologies, Tecnaro GMBH, Green Bay Decking, Fiberon LLC, Arkema, and Procotex.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Biocomposites Market

- TTS

- Lingrove

- Bcomp Ltd

- UPM

- Flexform Technologies

- Tecnaro GMBH

- Green Bay Decking

- Fiberon LLC

- Arkema

- Procotex

Get Free Sample For

Get Free Sample For