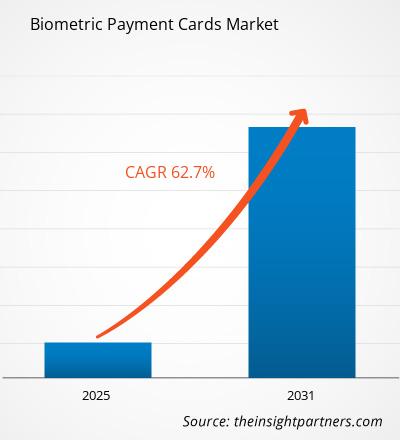

The biometric payment cards market size is expected to grow at a CAGR of 62.7% from 2025 to 2031. The biometric payment card market includes growth prospects owing to the current biometric payment card market trends and their foreseeable impact during the forecast period. The biometric payment card market is growing due to the increasing penetration of the internet adoption of smart devices and increasing government initiatives to promote digital payments. Advancements in biometric technology provide lucrative opportunities for the biometric payment card market growth.

Biometric Payment Cards Market Analysis

Biometric payment cards are regular credit or debit cards but with an added layer of security. Biometric payment cards allow users to use fingerprints instead of using a PIN or signature to authorize transactions. This makes it harder for unauthorized users to access your funds, reducing the risk of fraud. Businesses can benefit from biometric payment cards because they offer increased security and convenience for customers. With fewer fraudulent transactions, businesses can save money on chargeback fees and build trust with their customers.

Biometric Payment Cards Market Industry Overview

- The biometric payment card market is growing steadily, with increasing demand for secure and convenient payment methods.

- These cards use fingerprint or other biometric authentication to verify transactions, providing an extra layer of security compared to traditional cards.

- Major players in the industry include card manufacturers, biometric technology providers, and financial institutions.

- As consumer awareness and acceptance of biometric technology grows, the market is expected to expand further in the coming years.

Biometric Payment Cards Market Driver

Increasing Government Initiatives To Promote Digital Payments To Drive The Biometric Payment Cards Market Growth

- Government initiatives to promote digital payments are fuelling the growth of the biometric payment card market. With more countries pushing for cashless economies, the demand for secure and convenient payment solutions is rising.

- Governments worldwide are implementing various policies and incentives to encourage the adoption of digital payment methods, including biometric payment cards. These initiatives aim to reduce cash usage, combat financial crimes, and promote financial inclusion. For instance, the Indian government's demonetization efforts and the introduction of the Aadhaar-based biometric authentication system have boosted the adoption of digital payments, including biometric cards.

- Similarly, in countries like the UK and Singapore, government-backed campaigns and regulatory measures are driving the adoption of biometric payment cards among consumers and businesses. As a result, major players in the market are ramping up their production capacities and investing in research and development to meet the growing demand for biometric payment solutions.

Biometric Payment Cards Market Report Segmentation Analysis

- Based on card type, the biometric payment card market is segmented into credit cards and debit cards. The debit cards segment is expected to hold a substantial biometric payment card market share in 2023.

- The credit card segment is expected to grow with the highest CAGR over the forecast period.

Biometric Payment Cards Market Share Analysis By Geography

The scope of the biometric payment cards market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant biometric payment cards market share. More people are opting for secure and convenient payment methods, leading to increased demand for biometric cards in the region. Moreover, consumers in North America are becoming increasingly concerned about cybersecurity and identity theft, leading them to seek out more secure payment options like biometric cards. Additionally, the widespread adoption of contactless payment technology has paved the way for biometric cards, as they offer an added layer of security without sacrificing convenience.

Biometric Payment Cards Market Report Scope

The "Biometric Payment Cards Market Analysis" was carried out based on card type, end users and geography. On the basis of card type, the market is segmented into credit cards and debit cards. Based on end users, the market is segmented into retail, transportation, healthcare, hospitality, government, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Biometric Payment Cards Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the biometric payment card market. A few recent key market developments are listed below:

- In March 2024, Fingerprint Cards AB announced the first biometric payment card rollout in Türkiye, supporting Thales, a worldwide leader in digital security, and Garanti BBVA and its customers. The launch marks Fingerprints’ and Thales’ eleventh commercial rollout globally for biometric payment cards.

[Source: Fingerprint Cards AB, Press Release]

- In October 2023, Idex Biometrics announced that they had been selected by South Korean payment card maker Kona I to provide the Pay platform for recycled PVC and metal cards for bank clients around the world. Kona I cards are certified by Visa, Mastercard, JCB, and American Express.

[Source: Idex Biometrics, Press Release]

Biometric Payment Cards Market Report Coverage & Deliverables

The biometric payment card market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Biometric Payment Cards Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Biometric Payment Cards Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 62.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Card Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Excimer & Femtosecond Ophthalmic Lasers Market

- Sterilization Services Market

- Surgical Gowns Market

- Constipation Treatment Market

- Third Party Logistics Market

- Neurovascular Devices Market

- Smart Mining Market

- Nurse Call Systems Market

- Fishing Equipment Market

- Lyophilization Services for Biopharmaceuticals Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For