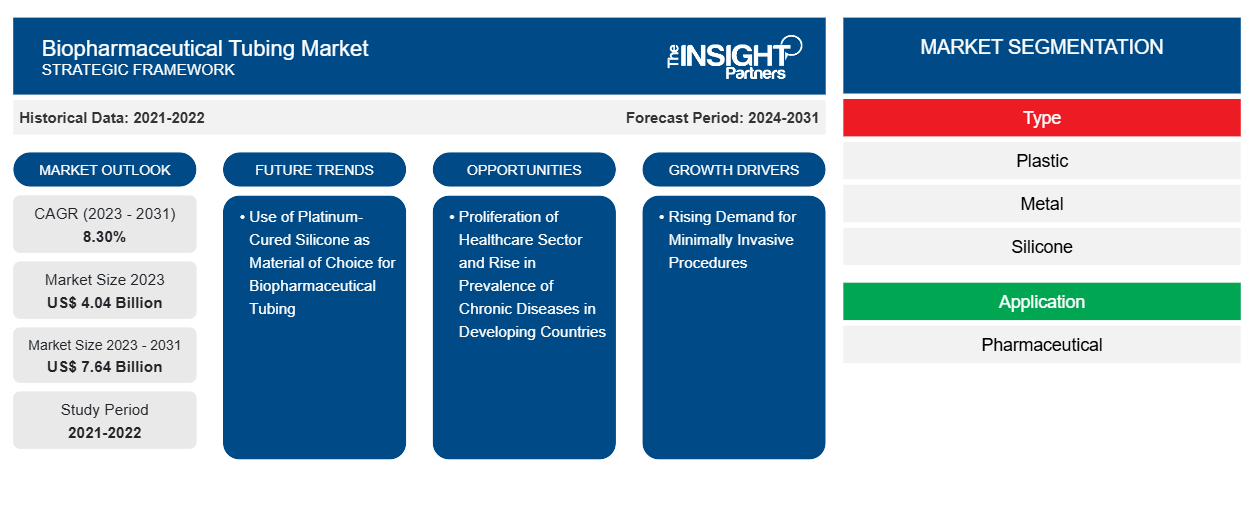

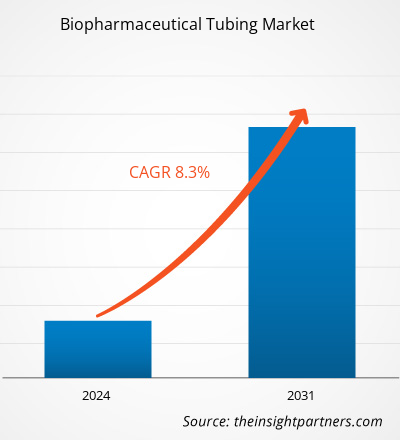

The biopharmaceutical tubing market size is projected to reach US$ 7.64 billion by 2031 from US$ 4.04 billion in 2023. The market is expected to register a CAGR of 8.30% during 2023–2031. Platinum-cured silicone as the material of choice for biopharmaceutical tubing will likely remain a key trend in the market.

Biopharmaceutical Tubing Market Analysis

Biopharmaceutical tubing is a well-established market. However, because there is an increasing focus on better surgical procedure outcomes and related conditions, it is predicted to grow more quickly. The main factors driving the market's expansion are the rising number of minimally invasive procedures and the sharply increasing demand for medical devices that use tubing in the area.

According to estimates, the biopharmaceutical tubing market is expected to grow fastest in Asia. The aging population, pharmaceuticals, and the availability of reasonably priced medical-grade plastics will significantly enhance prospects for profit.

Biopharmaceutical Tubing Market Overview

An increase in life expectancy is contributing to the global geriatric population. The World Health Organization (WHO) projects that by 2050, the proportion of adults over 60 worldwide will almost double, from 12% in 2015 to 22%. The World Population Ageing 2017 report from the United Nations states that there were 962 million adults in the world in 2017 who were 60 or older. That figure is projected to rise to approximately 2.1 billion by 2050. Furthermore, the US Census Bureau projects that the population of Americans 65 and older will increase from 46 million in 2016 to over 98 million by 2060, increasing their population share from approximately 15% to approximately 24% during this time. Europe has the most significant proportion of adults over 60 (25%), according to the United Nations World Population Ageing 2017 report. A considerable portion of the population in every region of the world, except Africa, will be 60 or older by 2050 due to the acceleration of global aging. By 2030, 2050, and 2100, respectively, the global geriatric population is projected to amount to US$ 1.4 billion, US$ 2.1 billion, and more than US$ 3.1 billion. The aging population is causing a rise in geriatric illnesses, which in turn is driving up demand for medication delivery systems and diagnostic tools.

Additionally, it is contributing to the rise in the prevalence of urological disorders that need to be catheterized. In addition, doctors are pushing for self-catheterization to lower hospital stays and costs while lowering the risk of infections linked to healthcare (HAI). A critical contributing factor to the rise in chronic illnesses that may necessitate interventions involving ICU admission is aging. The adoption of biopharmaceutical tubing systems is thus driven by the rapid growth in the geriatric population, which is directly correlated with the growing demand for medical devices that incorporate tubing, drug delivery, dialysis, cardiac bypass, peristaltic pump, and sterile filling and dispensing systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biopharmaceutical Tubing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biopharmaceutical Tubing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Biopharmaceutical Tubing Market Drivers and Opportunities

Rising Demand for Minimally Invasive Procedures Favors Market Growth

A tiny device or an implant is typically inserted into the body through an incision or other anatomical opening during a minimally invasive medical procedure. These procedures have become increasingly popular because they involve small incisions, patients recover more quickly, and patients experience less discomfort. Additionally, these operations are linked to advantages like reduced pain, minimal tissue damage, and less trauma to the muscles, nerves, tissues, and organs.

The need for less invasive procedures has increased due to the rising incidence of cancer, heart disease, and arthritis, all of which need lengthy surgical treatments. Catheters and biopharmaceutical tubing, among other components, are in high demand. Biopharmaceutical tubing systems also help with time-saving procedures and are reasonably priced. For instance, the time needed for the medical or surgical procedure is significantly reduced when catheter tubing is used for cardiac and urine catheterization. Thus, the increasing need for less invasive medical procedures and the emphasis on making these procedures more efficient are significant factors driving the market for biopharmaceutical tubing.

Proliferation of Healthcare Sector and Rise in Prevalence of Chronic Diseases in Developing Countries Creates Significant Opportunities in the Market

Chronic disease prevalence is on the rise in developing nations as a result of significant, gradual changes in lifestyle. Moreover, the prevalence of other health conditions, such as occupational disorders, is rising due to the adoption of modern work cultures and infrastructure. Modern facilities cause their occupants to engage in less physical activity, but the intense competition in the market also contributes to increased stress levels. Thus, the need for catheters and biopharmaceutical tubing will rise in these economies as the prevalence of chronic diseases increases and more people seek medical attention. The economies of Brazil, India, Russia, China, and South Africa (BRICS) are some of the fastest-growing in the world. The aging population, changes in customer demand, and increased awareness of healthcare services are all expected to contribute to the projected rapid expansion of the healthcare sectors in these and other developing economies shortly. The biopharmaceutical tubing market is expected to have substantial potential in the upcoming years due to the growth of this industry. The development of the healthcare sector and the biopharmaceutical tubing market is also anticipated to be aided by higher government spending on healthcare facilities and rising consumer purchasing power.

Biopharmaceutical Tubing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the biopharmaceutical tubing market analysis are type and application.

- Based on type, the biopharmaceutical tubing market is divided into plastic, metal, and silicone. The silicone segment held the most significant market share in 2023.

- By application, the market is categorized into pharmaceutical {single use technology and others, research and development, medical devices, and others. The pharmaceutical segment held the largest share of the market in 2023.

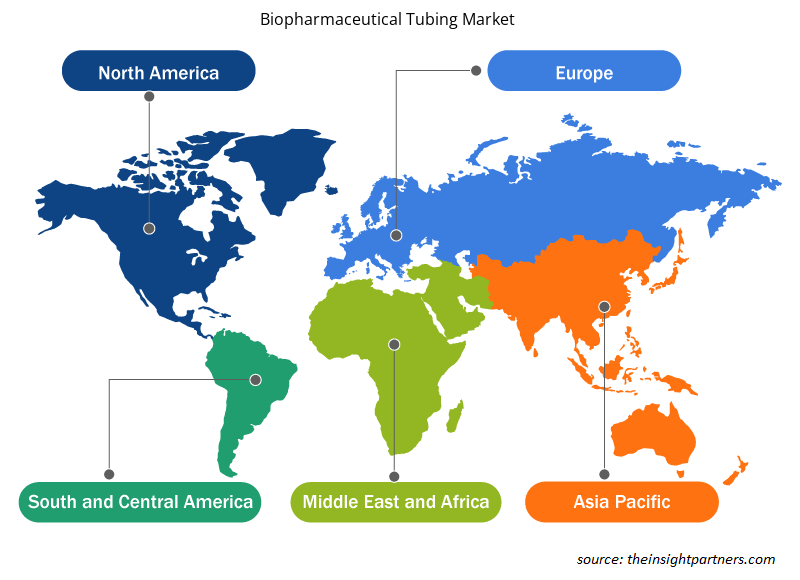

Biopharmaceutical Tubing Market Share Analysis by Geography

The geographic scope of the biopharmaceutical tubing market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America consists of three countries: the US, Canada, and Mexico. The US held the largest share of the rising demand for medical devices that incorporate tubing. The adoption of advanced medical devices, technological advancements, and a shift toward minimally invasive medical procedures are projected to accelerate the growth of the biopharmaceutical tubing market. Moreover, Market players are adopting organic and inorganic growth strategies for market development. For instance, In November 2019, Saint-Gobain Life Sciences completed construction on its new plant in Largo, Florida, marking another key milestone in its €70 million worldwide expansion initiative, which will see seven production locations built and operational by the end of 2020. The 80,000 SF Largo, FL, facility will become an additional manufacturing site for Saint-Gobain’s C-Flex tubing, molded connections, and assemblies used in fluid management for biopharmaceutical manufacturing. Saint-Gobain will continue to produce C-Flexs tubing and related product lines at its existing facilities in Clearwater, FL; Charny, France; and Bangalore, India.

Similarly, in March 2017, AdvantaPure launched the AdvantaSil brand of silicone tubing and hose. AdvantaSil silicone tubing and hose products are for single-use processes, from the reinforced hose, unreinforced tubing wire reinforced suction hose, and pump grade tubing. The products are designed and tested for the pharmaceutical and biopharmaceutical industries.

Thus, owing to the factors mentioned above, the biopharmaceutical tubing market is anticipated to grow in the coming years in the country

Biopharmaceutical Tubing Market Regional Insights

The regional trends and factors influencing the Biopharmaceutical Tubing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Biopharmaceutical Tubing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Biopharmaceutical Tubing Market

Biopharmaceutical Tubing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.04 Billion |

| Market Size by 2031 | US$ 7.64 Billion |

| Global CAGR (2023 - 2031) | 8.30% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Biopharmaceutical Tubing Market Players Density: Understanding Its Impact on Business Dynamics

The Biopharmaceutical Tubing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Biopharmaceutical Tubing Market are:

- W. L. Gore and Associates, Inc.

- Saint-Gobain Sekurit

- Freudenberg Group

- RAUMEDIC AG

- TEKNI-PLEX

- NewAge Industries, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Biopharmaceutical Tubing Market top key players overview

Biopharmaceutical Tubing Market News and Recent Developments

The biopharmaceutical tubing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the biopharmaceutical tubing market are listed below:

- DuPont is accelerating its investments for the future of the biopharmaceutical processing industry by expanding its supply capacity of silicone elastomers and tubing and by enlarging its single-use pharma product lines with new thermoplastic elastomer (TPE) tubing (Source: DuPont, Press Release, April 2022)

- Optinova opened its Optinova Valley Forge plant. The new factory is an investment to significantly increase production capacity for specialty industrial tubing solutions. Optinova Valley Forge can house over 20 extrusion lines at maximum capacity and have 11 extrusion lines up. (Source: Optinova, Press Release, May 2021)

Biopharmaceutical Tubing Market Report Coverage and Deliverables

The “Biopharmaceutical Tubing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Biopharmaceutical tubing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Biopharmaceutical tubing market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Biopharmaceutical tubing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the biopharmaceutical tubing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 8.30% during 2023–2031.

W. L. Gore and Associates, Inc., Saint-Gobain Sekurit, Freudenberg Group, RAUMEDIC AG, TEKNI-PLEX, NewAge Industries, Inc., Optinova, Zeus Industrial Products, Inc., NORDSON CORPORATION, DuPont de Nemours, Inc., Specialty Silicone Products, Inc., Hoshine Silicon Industry Co., Ltd., Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Momentive, Elkem ASA, Wacker Chemie AG

Key factors driving the market are the increasing elderly population worldwide and the rising demand for minimally invasive procedures.

Platinum-cured silicone as the material of choice for biopharmaceutical tubing will likely remain a key trend in the market.

North America dominated the biopharmaceutical tubing market in 2023

Get Free Sample For

Get Free Sample For