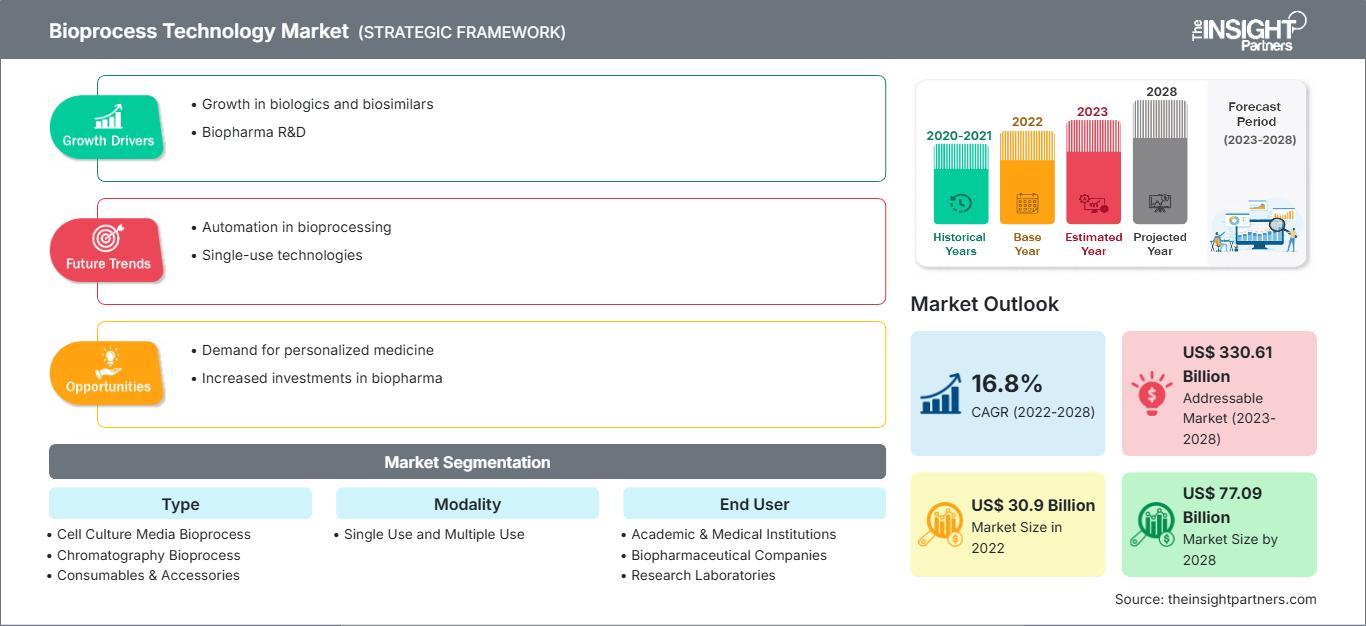

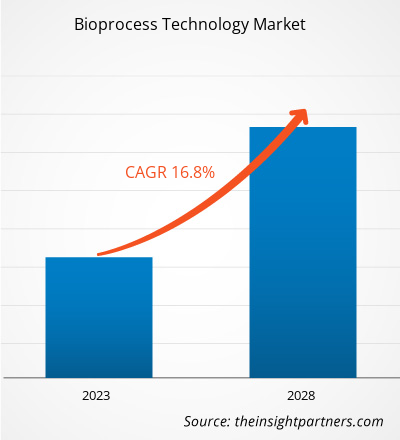

[Research Report] The bioprocess technology market size was valued at US$ 30,897.49 million in 2022 and is projected to reach US$ 77,090.05 million by 2028; it is estimated to register a CAGR of 16.8% from 2023 to 2028.

Analyst’s Viewpoint

The advantages of bioprocess are using lower pressure, lower temperatures, and more conducive pH levels, and the entire process is renewable. Growing R&D spendings to introduce new drug compounds and increasing prevalence of chronic diseases. Stringent regulatory policies are the most impacting factors responsible for influential growth of the bioprocess technology market. Additionally, introducing advanced bioprocess technologies provide lucrative market opportunity for the overall market to grow exponentially during the forecast period. Further, emergence of Automated Real‐Time Flow Cytometry (ART‐FCM) acts as a future trend for the market to grow during 2023–2028. According to the segmentation profiled in the report, based on type segment, cell culture media bioprocess accounts a largest share; likewise, chromatography bioprocess is anticipated to register the highest CAGR during the forecast period (2023–2028). Furthermore, by modality, the single-use segment will account considerable share for the bioprocess technology during the forecast period. In terms of end user, the biopharmaceutical companies’ segment will dominate the bioprocess technology market growth during the forecast period.

Bioprocess technology is a critical part of biotechnology that deals with processes combining living matter or its components with nutrients that produce specialty chemicals, reagents, and biotherapeutics. Different stages associated with bioprocess technology involve substrates and media preparation, biocatalyst selection and optimization, volume production, downstream processing, purification, and final processing. Bioprocess technology is widely used, from food and pharmaceuticals to fuel and chemicals.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bioprocess Technology Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing R&D Spendings to Introduce New Drug Compounds

Pharmaceutical companies are spending huge sum in R&D to introduce new molecules with enhanced medical and commercial potency for various therapeutic applications. In the fiscal year 2019/2020, 16 pharmaceutical companies made it to the list of the world’s Top 50 companies in terms of total R&D investment. Novartis, Roche, Johnson & Johnson, Merck & Co, GlaxoSmithKline, and Pfizer are among the world’s Top 10 companies with high R&D investments.

R&D Investments by Major Pharmaceutical Companies

Company |

R&D Investment in 2022 (US$ Million) |

R&D Investment in 2021 (US$ Million) |

|

Gilead Sciences Inc |

27,305 |

27,281 |

|

Bristol-Myers Squibb Co |

46,159 |

46,385 |

|

Amgen Inc. |

26,323 |

25,979 |

|

Pfizer |

100,330 |

81,288 |

|

Merck & Co |

59,283 |

48,704 |

|

AbbVie Inc |

58,054 |

56,197 |

Note: The currency conversion rates have been considered wherever required.

Source: Annual Reports of Companies and The Insight Partners Analysis

The patent expiry of blockbuster molecules, a limited number of potential products in the pipeline, and the increasing demand for biologics have driven companies to adopt novel technologies, such as single-use bioprocessing technologies, in order to facilitate a quick cost-effective turnaround process for products. Single-use component and system manufacturers typically produce and assemble products in clean rooms to ensure they do not introduce harmful particulates and endotoxins into a bioprocess. Thus, high investments in R&D are made to introduce new drug compounds and aid in the development of bioprocessing technologies; these technologies support emerging biomanufacturing capabilities and related interoperability of raw materials, bioreactors, and unit operations.

Type-Based Insights

Based on type, the bioprocess technology market is segmented into cell culture media bioprocess, chromatography bioprocess, consumables & accessories, and others. The cell culture media bioprocess segment held a largest market share of bioprocess technology in 2022 whereas chromatography bioprocess is anticipated to register a highest CAGR during the forecast period (2023–2028).

Modality-Based Insights

Based on modality, the global bioprocess technology market is bifurcated into single use and multiple use. The single use segment accounted a larger market share for bioprocess technology in 2022. The multiple use segment is expected to grow at a higher CAGR during the forecast period.

End User-Based Insights

In terms of end user, the bioprocess technology market is categorized into academic & medical institutions, biopharmaceutical companies, research laboratories, and others. The biopharmaceutical companies segment held a largest market share in 2022, whereas academic & medical institutions is expected to register a higher CAGR during the forecast period.

Regional Analysis

North America dominated the bioprocess technology market accounting maximum share. The bioprocess technology market growth in this region is attributed due to the presence of large players launching innovative products (particularly related to bioprocess technology), growing product introduction in the region, and technological advancements in bioprocess technology. In North America, the US records maximum share for the bioprocess technology. According to the Food and Drug Administration (FDA) report, over 30 million people in the US suffer from ~7,000 rare diseases, accounting for life-threatening conditions with low treatment options. Drug, biological, and device development in the treatment of rare diseases is challenging due to a lack of understanding of the history of rare diseases and difficulty in conducting clinical trials. Therefore, the growth of bioprocess technologies such as gene and cell therapies (CGTs) and specialty pharmaceuticals represent a radical shift in the treatment of rare diseases. For example, CGTs have revealed significant health benefits than formulated drugs for treating rare diseases. In the US, more than 900 investigational new drug (IND) applications targeting gene therapy products are underway. Also, 10-20 gene therapies are approved annually by the FDA. Likewise, in August 2022, the FDA approved Bluebird Bio's "Zynteglo (betibeglogene autotemcel)." It was the most expensive single-application drug approval in the US intended for the treatment of a rare neurological disorder—cerebral adrenoleukodystrophy (CALD).

Likewise, Asia Pacific region will account highest CAGR for the bioprocess technology market. Among Asia Pacific region, China will hold considerable market share for the bioprocess technology market. The bioprocessing capacity globally has increased at an average of 12% since the past decade, as per the BioPlan Associates Top 1000 Biofacility Index and Biomanufacturers Database report. China is well positioned as a global participant in markets with both small and large-molecule drugs, accounting for second and third position, respectively, worldwide. Also, China is home to several developers of cell and gene therapy due to China's base for contract development and manufacturing organizations (CDMOs), accounting for ~25% of the country's bioproduction capacity. Therefore, China has considerable biomanufacturing capabilities but strict adherence to the global GMP standards that build confidence in the biologics' safety and effectiveness.

Country |

Biomanufacturing Facility (L) |

Global Capacity (%) |

Estimated Capacity CAGR (%) |

|

China |

1.77 million |

10.2 |

15-20 |

Source: Global comparison of biomanufacturing capacity; data from the BioPlan Associates Top 1000 Biofacility Index and Biomanufacturers Database (CAGR = compound annual growth rate).

Bioprocess Technology Market Regional InsightsThe regional trends and factors influencing the Bioprocess Technology Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bioprocess Technology Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bioprocess Technology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 30.9 Billion |

| Market Size by 2028 | US$ 77.09 Billion |

| Global CAGR (2022 - 2028) | 16.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bioprocess Technology Market Players Density: Understanding Its Impact on Business Dynamics

The Bioprocess Technology Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Bioprocess Technology Market top key players overview

Merck KGaA, Sartorius AG, Thermo Fisher Scientific Inc, Corning Inc, STAMM Biotech, Lonza Group AG, Eppendorf SE, Repligen Corp, Danaher Corp, and BioPharma Dynamics Ltd are among the leading players operating in the global bioprocess technology market growth. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The report provides detailed market insights, which help the key players strategize their market growth. A few developments are mentioned below:

- In June 2022, Merck has entered a collaboration with Agilent Technologies to advance Process Analytical Technologies (PAT). PAT, which is strongly encouraged by global regulatory authorities, is a key enabler for real-time release and Bioprocessing 4.0.

- In March 2020, Sartorius launched BIOSTAT STR Generation 3 single-use bioreactor and BIOBRAIN automation platform to introduce innovations that will change the field of biopharmaceutical process development and manufacturing. Biostat STR simplifies biologics production.

Company Profiles

- Merck KGaA

- Sartorius AG

- Thermo Fisher Scientific Inc

- Corning Inc

- STAMM Biotech

- Lonza Group AG

- Eppendorf SE

- Repligen Corp

- Danaher Corp

- BioPharma Dynamics Ltd

Frequently Asked Questions

What is meant by the bioprocess technology market?

What are the driving factors for the bioprocess technology market across the globe?

Which product led the bioprocess technology market?

What is the regional market scenario of the bioprocess technology market?

Who are the key players in the bioprocess technology market?

Which modality segment held the largest revenue (US$ Mn) in the bioprocess technology market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For