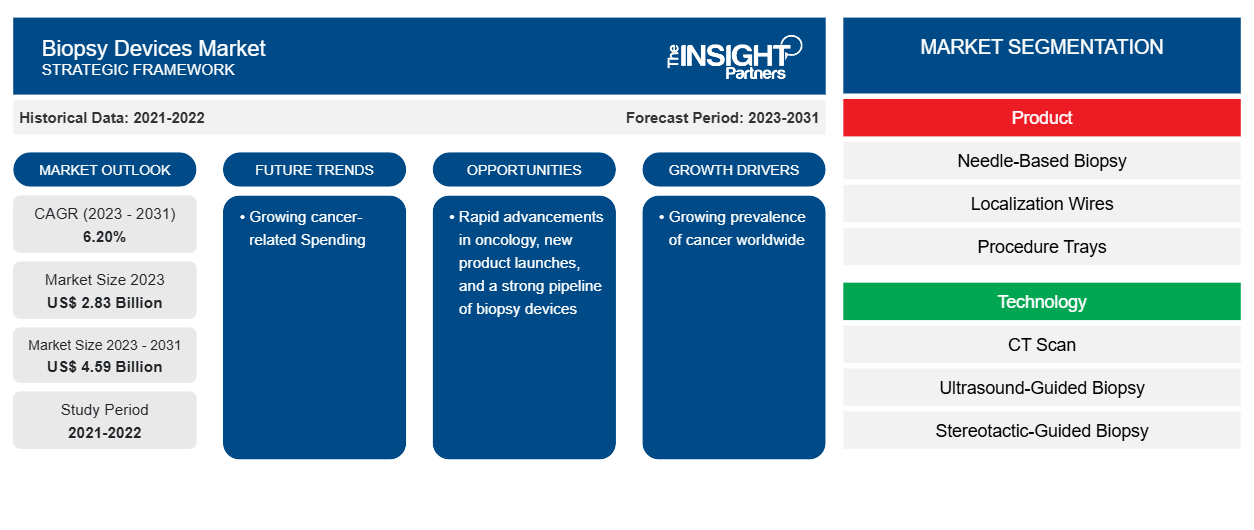

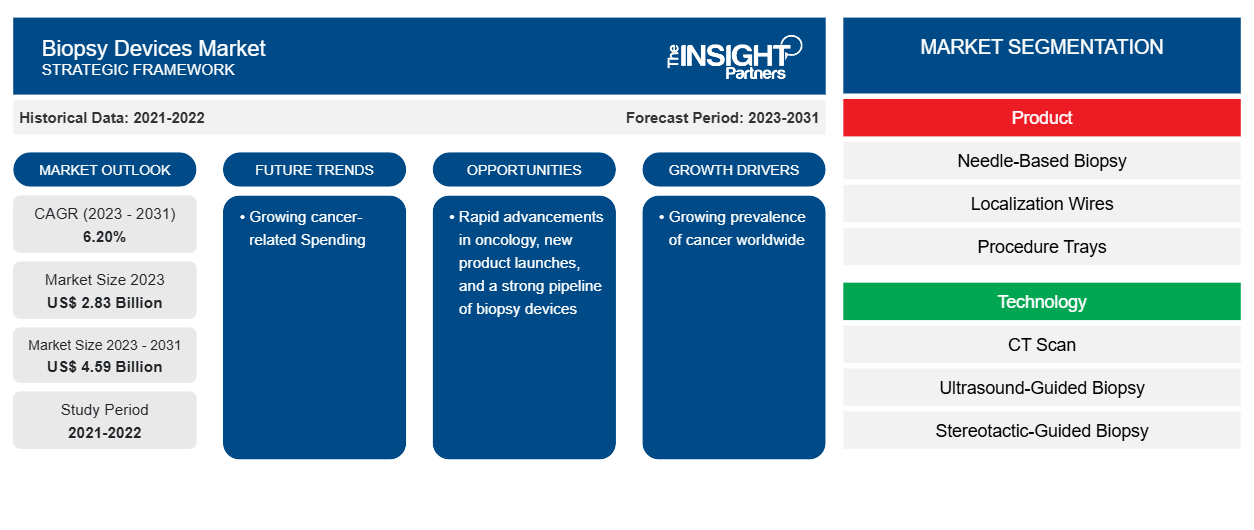

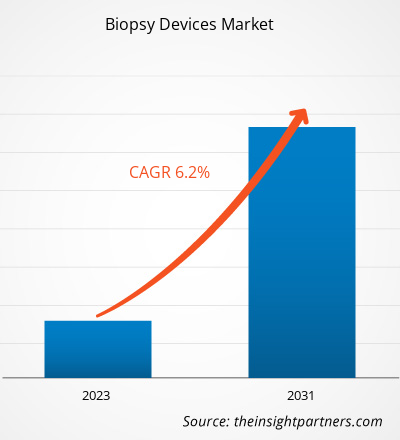

The Biopsy Devices Market size is projected to reach US$ 4.59 billion by 2031 from US$ 2.83 billion in 2023. The market is expected to register a CAGR of 6.20% in 2023–2031. The increasing prevalence of cancer cases, increasing number of biopsies, and technological advancements in biopsy devices are likely to remain key Biopsy Devices market trends.

Biopsy Devices Market Analysis

Factors such as the rising preference for minimally invasive procedures, the escalating number of cancer cases, and government initiatives undertaken for cancer diagnosis are fueling the market growth. Biopsy is one of the major diagnosis techniques for various cancer types such as breast, skin, and prostate cancer. According to the data retrieved from the Pan America Health Organization, the cancer burden is projected to increase by approximately 60% over the next two decades. The predicted global cancer burden will increase to about 30 million new cancer cases by 2040, especially in low- and middle-income countries. Therefore, with the increasing incidence of cancer cases and technological advancement in biopsy devices, the market is expected to increase in the forecast period.

Biopsy Devices Market Overview

North America is the largest market for Biopsy Devices market growth with the US holding the largest market share followed by Canada. Factors such as rising demand for minimally invasive biopsy procedures are also key contributing factors to the North American Biopsy Devices market growth. According to the data published by the American Society of Plastic Surgeons in 2022, there were approximately 23,672,269 cosmetic minimally invasive procedures carried out in the US. Hence, these procedures demand biopsy devices, which in turn is driving the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biopsy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biopsy Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Biopsy Devices Market Drivers and Opportunities

Rising Prevalence of Cancer Demanding for Biopsy Devices System Favors the Market

The increasing burden of cancer globally is a significant driving factor for the global biopsy device market. Cancer diagnosis requires precise and early-stage identification for optimal treatment, making biopsy an essential diagnostic tool. According to the World Health Organization, in 2022, there were an estimated 20 million new cancer cases and 9.7 million deaths, and about 1 in 5 people develop cancer in their lifetime. Therefore, biopsy devices are becoming vital in malignant tissue identification, helping physician plan their treatment strategy.

Technological Advancements in Biopsy Devices– An Opportunity in Biopsy Devices Market

Technological advancements in medical devices and rapid Innovations represent another major growth-inducing factor. With these advancements and innovations, the efficacy, speed, and safety of biopsy procedures have improved over the years. For instance, vacuum-assisted biopsy devices help in faster and more comfortable extraction of tissue samples. Additionally, the integration of real-time imaging techniques such as CT scans, ultrasound, or MRI with biopsy devices provides physicians with a more accurate target area, fewer procedural complications, and increased diagnostic reliability. Such technological advancements contribute to higher product adoption rates among healthcare professionals, which in turn is propelling the market growth of biopsy devices.

Biopsy Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Biopsy Devices Market analysis are product, technology, and application.

- Based on product, the Biopsy Devices market is segmented into Needle-Based Biopsy, Localization Wires, Procedure Trays, and Others. The needle-based biopsy devices held a larger market share in 2023. Increasing adoption of needle-based biopsy devices due to their advantages such as high accuracy with minimal injury is propelling the market growth of this segment.

- By technology, the market is segmented into CT Scan, Ultrasound-Guided Biopsy, Stereotactic-Guided Biopsy, MRI-Guided Biopsy, and Others. The Ultrasound-Guided Biopsy segment held the largest share of the market in 2023. However, the CT Scan segment recorded the fastest CAGR during the forecast period.

- Based on the application of Biopsy Devices market is segmented into Lung Biopsy, Kidney Biopsy, Liver Biopsy, Breast Biopsy, and Others. The Breast Biopsy segment held the largest share of the market in 2023.

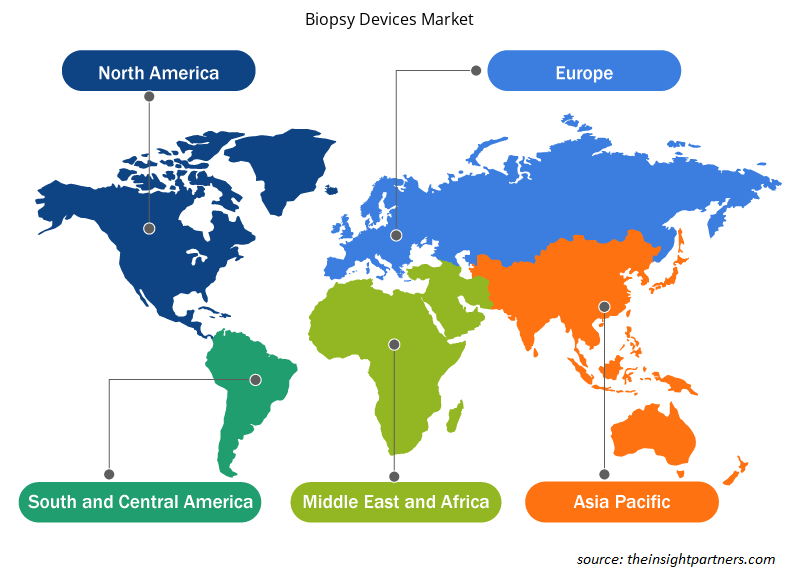

Biopsy Devices Market Share Analysis by Geography

The geographic scope of the Biopsy Devices Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the Biopsy Devices Market. The market growth can be attributed to the rising adoption of Biopsy Devices for various applications, the rising prevalence of cancer cases, the presence of major manufacturers involved in manufacturing Biopsy Devices systems, and the investment by pharma and biotech companies for medical devices in North American countries. For instance, according to the data published by the Pan America Health Organization (PAHO), Cancer is the second cause of morbidity and mortality in the Americas, after cardiovascular disease. An estimated 4 million people were newly diagnosed and 1.4 million people died from cancer in 2020. Hence, the increasing number of diagnosed cancer population will demand biopsy devices, in turn will fuel the market growth.

Biopsy Devices Market Regional Insights

The regional trends and factors influencing the Biopsy Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Biopsy Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Biopsy Devices Market

Biopsy Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.83 Billion |

| Market Size by 2031 | US$ 4.59 Billion |

| Global CAGR (2023 - 2031) | 6.20% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

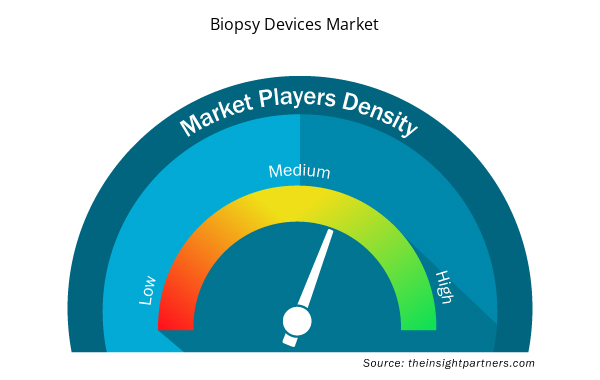

Biopsy Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Biopsy Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Biopsy Devices Market are:

- BD

- QIAGEN

- Hologic

- Bio-Rad Laboratories

- Cardinal Health

- Medtronic plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Biopsy Devices Market top key players overview

Biopsy Devices Market News and Recent Developments

The Biopsy Devices Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Biopsy Devices:

- TransMed7, LLC declared a “First in Human” clinical case of the commercial production version of a Heron XPS device. It is a member of the new Heron family of vacuum-assisted, single insertion/multiple collection soft tissue biopsy devices. (Source: Transmed7, Press Release/Company Website/Newsletter, August 2022)

- Boston Scientific Corporation announced the U.S. Food and Drug Administration approval for the latest-generation WATCHMAN FLX Pro Left Atrial Appendage Closure (LAAC) Device. Designed to advance further the procedural performance and safety of the WATCHMAN technology, which is indicated to reduce stroke risk in patients with non-valvular atrial fibrillation (NVAF) who need an alternative to oral anticoagulation therapy, the device now features a polymer coating, visualization markers, and a broader size matrix to treat a wider range of patients. (Source: Boston Scientific Corporation, Press Release/Company Website/Newsletter, September 2023)

- Mammotome, an operating company of Danaher Corporation, launched the Mammotome RevolveTM EX Dual Vacuum-Assisted Breast Biopsy System. It is the first vacuum-assisted biopsy device designed specifically for the excision of benign breast lesions and is twice as fast as traditional vacuum-assisted breast biopsy systems. This device is a minimally invasive solution and enables physicians to provide better care for patients with benign lesions by avoiding the risks and trauma of an open surgical procedure and creating little to no scarring. (Source: Danaher Corporation, Press Release/Company Website/Newsletter, Aug 2022)

Biopsy Devices Market Report Coverage and Deliverables

The “Biopsy Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product ; Technology ; Application ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For