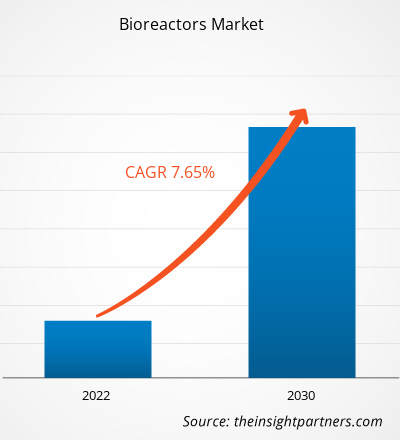

The bioreactors market size is projected to reach US$ 6,570.76 million by 2030 from US$ 3,643.00 million in 2022. The market is expected to register a CAGR of 7.65% during 2022–2031. Technological advancements in bioreactors are likely to remain a key trend in the market.

Bioreactors Market Analysis

Numerous cell types, such as mammalian cell lines, stem cells, and insect cells, can be grown on a large scale in bioreactors. Numerous uses for cell culture in bioreactors exist, such as the development of gene and cell therapies as well as the manufacture of vaccines, viral vectors, and antibodies. When establishing these bioprocesses, there are numerous things to take into account, such as optimizing crucial process variables, selecting the best feeding plan, and guaranteeing bioprocess scalability. The increasing adoption of single-use bioreactors and the rapid growth of the pharmaceutical and biotechnology industry are the key driving factors behind the market development.

Bioreactors Market Overview

The pharmaceutical sector has expanded at a rate never seen before in recent years. Large pharmaceutical corporations and contract research organizations, or CROs, are developing novel therapeutics and medications to address a broad spectrum of conditions. The market for biopharmaceuticals is expanding. The high demand for biologics and biosimilars has fueled the industry's rapid expansion. One of the biggest drivers of the economy is the biopharmaceutical sector. The United States leads the world in biopharmaceutical R&D and is the largest market for these products. The US holds the most significant number of patents for novel medications and conducts more than half of global pharmaceutical R&D (worth US$ 75 billion), according to the Pharmaceutical Research and Manufacturers Association (PhRMA). In addition to expanding economies, rising economies like Brazil, China, and India are experiencing fast expansion in their research environments. The sector is expanding due to factors like growing approvals for biologics, a growing pipeline for biosimilars, and more investment in research and development.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bioreactors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bioreactors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Bioreactors Market Drivers and Opportunities

Emerging Use of Single-use Bioreactors Favors the Market Growth

Single-use bioreactors shorten production turnaround times and lower the chance of contamination. Single-use bioreactors have become more common in contemporary biopharmaceutical processes in recent years due to their exceptional capacity to improve flexibility, lower investment, and control operating costs. Additionally, a lot of businesses have created single-use bioreactors that can produce a variety of medicines. Thermo Fischer Scientific, for example, introduced the 3,000 L and 5,000 L HvPerforma DvnaDrive single-use bioreactors in March 2021. One significant advantage of single-use bioreactors has been the reduction of validation time. The market is expanding due to the increasing use of single-use bioreactors for upstream bioprocessing. Sartorius AG provides a variety of single-use bioreactors, for example. The business offers Biostat STR for 50-2000L and Ambr 15 for micro bioreactors with a capacity of 10-15 mL. The growing acceptability of single-use bioreactors for the manufacturing of medicines is driving the market for bioreactors.

Rising Demand for Personalized Medicine

With precision medicine, a patient's genetic information is used to provide customized care for a specific condition. The need for biologics, medications for orphan diseases, and customized treatments has surged due to the growing incidence of several chronic illnesses. For example, the National Human Genome Research Institute (NHGRI) announced in February 2020 that it was going to launch a new program focused on genomics and precision medicine. The innovative use of genomics and informatics tools for improved disease diagnosis and treatment is the main focus of this program. It is projected that during the forecast period, the players in the bioreactors market will have substantial growth opportunities due to the increasing demand for personalized medicine.

Bioreactors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the bioreactors market analysis are scale, application, technology, and end user.

- Based on scale, the bioreactors market is divided into lab-scale production, pilot-scale production, and full-scale production. The lab-scale production segment held the most significant market share in 2022.

- By application, the market is categorized into microbial application, cell culture application, and others. The cell culture application segment held the largest share of the market in 2022.

- Based on technology, the bioreactors market is divided into fed-batch bioreactors and perfusion bioreactors. The fed-batch bioreactors segment held the most significant market share in 2022.

- By end user, the market is segmented into biopharma manufacturers, research and development organizations, and contract manufacturing organizations. The research and development organizations segment held the largest share of the market in 2022.

Bioreactors Market Share Analysis by Geography

The geographic scope of the bioreactors market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The US, Canada, and Mexico make up the three segments of the North American bioreactor market. The biopharmaceutical and biotechnology industries' growing need for bioreactor systems, the existence of market participants, and the expansion of R&D by numerous academic and research institutions are all factors contributing to the growth of the bioreactor systems market in North America. Furthermore, the bioreactors market in North America is anticipated to grow as a result of increased research being conducted by pharmaceutical and biotechnology companies. The Canadian market is strengthened by the abundance of pharmaceutical companies that sell their goods internationally. For example, businesses in British Columbia, Saskatchewan, Alberta, Manitoba, Ontario, and Quebec include Amgen, Xenon Pharmaceuticals, Zymeworks, Gilead Sciences, Abbott, Alphora Research, Amgen, Apotex, Astellas, Merck, AbbVie, Bristol-Myers Squibb, Caprion Biosciences, Charles River Laboratories, GlaxoSmithKline, Pharma, AstraZeneca, Baxter, Bayer, and Cipher Pharmaceuticals. The market has grown as a result of Canada's biopharmaceutical industry's notable expansion. Furthermore, large-scale research and development (R&D) endeavors by pharmaceutical companies via collaborations lead to supplementary investments in venture funds and small and medium-sized businesses (SMEs). The scope of the pharmaceutical sector market in Canada is further expanded by the increasing number of contract research organizations and contract manufacturing organizations (CROs and CMOs) that serve both domestic and foreign clients.

Bioreactors Market Regional Insights

The regional trends and factors influencing the Bioreactors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Bioreactors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Bioreactors Market

Bioreactors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3,643.00 Million |

| Market Size by 2030 | US$ 6,570.76 Million |

| Global CAGR (2022-2030) | 7.65% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Scale

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

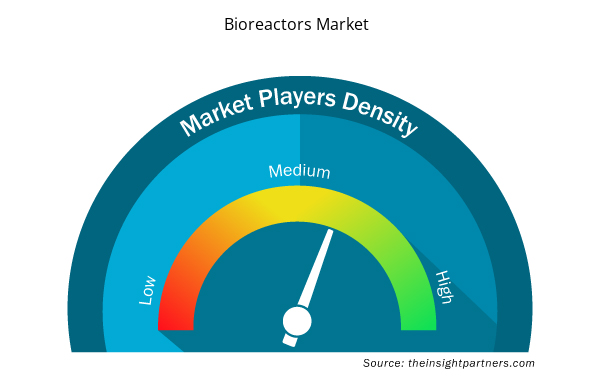

Bioreactors Market Players Density: Understanding Its Impact on Business Dynamics

The Bioreactors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Bioreactors Market are:

- Sartorius AG

- PBS Biotech

- Merck KGaA

- Cellexus International Ltd

- General Electric Co

- Thermo Fisher Scientific Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Bioreactors Market top key players overview

Bioreactors Market News and Recent Developments

The bioreactors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the bioreactors market are listed below:

- Getinge is extending its bioreactor offering by introducing the Single-Use Production Reactor (SUPR) system, which initially is available in 50-liter and 250-liter sizes. Based on the same proven platform as Getinge’s smaller bioreactors, the SUPR system helps operators to bring life-saving medicines faster to market, aiming to improve people’s quality of life. (Source: Getinge, Press Release, 2024)

- Global technology and software leader Emerson has collaborated with Sartorius, a leading international biopharmaceutical company, to natively integrate Sartorius’s Biostat STR Generation 3 family of bioreactors with Emerson’s DeltaV distributed control system (DCS). The Biostat STR Generation 3 for Emerson’s DeltaV, a variant of the Biostat STR Generation 3 family, is a pre-engineered solution that delivers intuitive connectivity for accelerating and simplifying the process of bringing therapies that improve patient quality-of-life to market. (Source: Emerson Electric Co., Press Release, 2023)

Bioreactors Market Report Coverage and Deliverables

The “Bioreactors Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Bioreactors market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Bioreactors market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Bioreactors market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the bioreactors market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Bioremediation Technology and Services Market

- Mail Order Pharmacy Market

- Unit Heater Market

- Online Exam Proctoring Market

- Industrial Inkjet Printers Market

- Aircraft Wire and Cable Market

- Artwork Management Software Market

- Queue Management System Market

- Electronic Data Interchange Market

- Sodium Bicarbonate Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Scale, Application, Technology, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Technological advancements in bioreactors are likely to remain a key trend in the market.

North America dominated the bioreactors market in 2022

Sartorius AG, PBS Biotech, Merck KGaA, Cellexus International Ltd, General Electric Co, Thermo Fisher Scientific Inc, bbi-biotech GmbH, Pall Corp, Applikon Biotechnology BV, and Solaris Biotechnology SRL

Key factors driving the market are the emerging use of single-use bioreactors and the rapid growth of the pharmaceutical and biotechnology industry.

The market is expected to register a CAGR of 7.65% during 2022–2030.

Get Free Sample For

Get Free Sample For