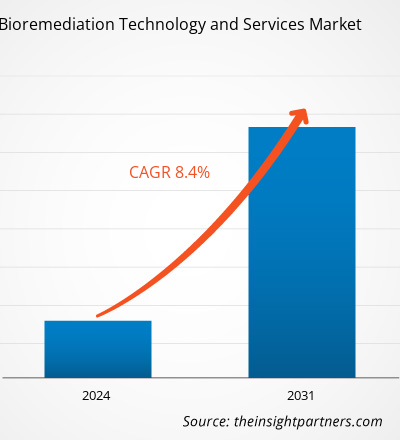

The bioremediation technology and services market size is projected to reach US$ 26.66 billion by 2031 from US$ 13.98 billion in 2023. The market is expected to register a CAGR of 8.40% during 2023–2031. Nanobiotechnology for bioremediation will likely remain a key trend in the market.

Bioremediation Technology and Services Market Analysis

The general public now views phytoremediation as an environmentally acceptable method of cleaning contaminated areas. Because bioremediation technology can remove a wide range of organic and inorganic contaminants from different environmental components, it has become more widely accepted in recent years. Environmental remediation is highly demanded for effective industrial operations due to the advancement of remediation technologies and the ongoing growth of the oil and gas industry.

Bioremediation Technology and Services Market Overview

With microorganisms, bioremediation is a waste management technique that eliminates harmful soil, water, and air chemicals. Government organizations may alter how organic chemical spills reduce their adverse environmental effects. The success of terrestrial bioremediation in Canada's north has prompted further study into the technology's possible application in the marine environment. Water scarcity can be lessened due to the appropriate policies and stringent regulations that governments have implemented. Water scarcity is a significant issue that government policies can reduce. To prevent countries from overusing water resources, governments implement projects and awareness campaigns highlighting water conservation's value. Numerous national and international organizations, as well as certain governments, are launching conservation initiatives. To improve constructed wetland treatment systems for the bioremediation of oilsands process-affected water (OSPW), for example, Dr. Doug Muench, a professor in the Department of Biological Sciences, co-led a multi-institutional grant valued at over US$ 6.3 million from Genome Canada in November 2021.

Therefore, the market is anticipated to be driven throughout the forecast period by rising awareness of the scarcity of natural resources like water and oil.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bioremediation Technology and Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bioremediation Technology and Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Bioremediation Technology and Services Market Drivers and Opportunities

Government Regulations and Funding for Research & Development Activities in Bioremediation Favors the Market Growth

The primary federal organization in the US responsible for enforcing environmental laws is the Environmental Protection Agency. Most nations have ecological protection organizations that support applying statutes about preserving the environment and public health. Governments from different countries are funding research and development efforts in bioremediation. The EiCLaR project, for example, was introduced in January 2021. For this USD 7.48 million project, the EU and PR China are working with 13 European and 5 Chinese partners. To treat a variety of pollutants, including pesticides, heavy metals, and chlorinated solvents, quickly, effectively, and affordably, EiCLaR will create scientific and technological advancements for in situ bioremediation technologies over the next 48 months. These advancements will be directly implemented into industrial processes. The University of Hawaii-led project, Technology Development and Training in Bioremediation, is funded by the Agriculture-Based Remediation Program (ABRP). The success of the program has been attributed to the United States Army Corps of Engineers Waterways Experiment Station, the United States Army Environmental Center (USAEC), and the United States Department of Agriculture's Cooperative State Research, Education, and Extension Service (USDA-CSREES) (USACE-WES). The project aims to increase local bioremediation expertise, develop a bioremediation industry capable of serving Hawaii and the Asia-Pacific area, and increase public knowledge of agriculture-based bioremediation technology. Therefore, the government's ongoing support of bioremediation research and development is anticipated to propel the market for bioremediation services and technologies.

Rising Level of Micro-Nano Plastics (MNPs) in Natural Ecosystem Creates Significant Opportunities in the Market

The global environment and biological health are negatively impacted by the growing amount of micro-nanoplastics (MNPs) in natural ecosystems. MNP infiltrates agroecosystems, fauna, flora, and human bodies through microbes' movement, ingestion, and inhalation, resulting in vascular blockage, infertility, and aberrant behavior. Consequently, using a fresh strategy to remove MNP from the environment is crucial. Microbial remediation is regarded as one of the more environmentally friendly methods of MNP remediation among the various currently used.

Many biotic and abiotic factors, including temperature, oxidative stress, pH, co-substrate concentration, substrates, and enzymatic mechanisms, commonly impact the microbial breakdown of plastics. Because plastic fragments are the only carbon source available to microbes for growth and development, it is imperative to recognize the critical pathways that these organisms have adopted. Therefore, it is anticipated that the increasing concentration of micro-nanoplastics (MNPs) in the natural ecosystem will increase demand for bioremediation. This will likely present several growth opportunities for companies in the bioremediation technology and services market throughout the forecast period.

Bioremediation Technology and Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the bioremediation technology and services market analysis are type, technology and service.

- Based on type, the bioremediation technology and services market is segmented into in situ bioremediation and ex-situ bioremediation. The in situ bioremediation segment held the most significant market share in 2023.

- By technology, the market is categorized into phytoremediation, biostimulation, bioaugmentation, bioreactors, fungal remediation, and land-based treatments. The phytoremediation segment held the largest share of the market in 2023.

- By service, the market is segmented into soil remediation, wastewater remediation, oilfield remediation, and others. The soil remediation segment held a significant share of the market in 2023.

Bioremediation Technology and Services Market Share Analysis by Geography

The geographic scope of the bioremediation technology and services market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America bioremediation technology and services market is segmented into the US, Canada, and Mexico. Some stringent environmental regulations were passed requiring polluters to limit emissions and reduce the risk of contamination on their premises. The United States government has established the Environment Protection Authority (EPA), responsible for treating and evaluating contaminated areas worldwide. The Environmental Protection Agency also operates a program called "Superfund," which assists in cleaning hazardous areas throughout the United States. Phytoremediation, or using plants to clean up the land, was recorded in far higher figures in the US.

Bioremediation Technology and Services Market Regional Insights

The regional trends and factors influencing the Bioremediation Technology and Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Bioremediation Technology and Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Bioremediation Technology and Services Market

Bioremediation Technology and Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.98 Billion |

| Market Size by 2031 | US$ 26.66 Billion |

| Global CAGR (2023 - 2031) | 8.40% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

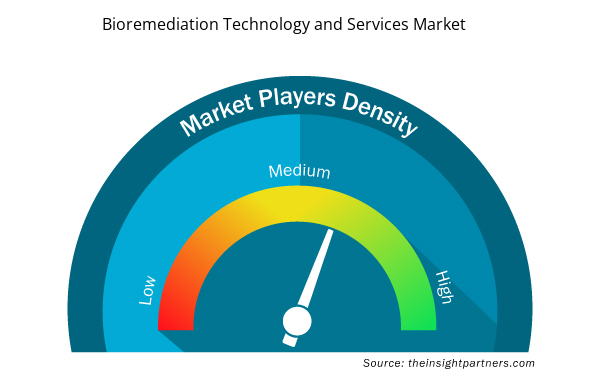

Bioremediation Technology and Services Market Players Density: Understanding Its Impact on Business Dynamics

The Bioremediation Technology and Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Bioremediation Technology and Services Market are:

- Xylem Inc.

- REGENESIS

- Aquatech International LLC.

- Drylet, Inc.

- Altogen Labs

- InSitu Remediation Services Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Bioremediation Technology and Services Market top key players overview

Bioremediation Technology and Services Market News and Recent Developments

The bioremediation technology and services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the bioremediation technology and services market are listed below:

- Global water technology leader Xylem announced it is sponsoring an innovative new funding mechanism for water utilities to deploy promising new technologies. The partnership with water consultancy Isle Utilities is a new approach to funding and scaling breakthrough water technologies called the “Trial Reservoir.” It provides water technology innovators access to capital for pilot projects, with an initial focus on technologies that reduce the carbon emissions of water systems. Technology trials and pilots are generally required in advance of full-scale implementations. (Source: Xylem Inc., Press Release, January 2022)

- Xylem Inc., a leading global water technology company dedicated to solving the world’s most significant water challenges, has announced an expanded commitment to Imagine H2O, the leading water innovation accelerator and ecosystem for water entrepreneurs. As a global partner, Xylem brings expanded support to Imagine H2O’s startup Accelerator and joins as the newest partner to Imagine H2O Asia, the organization’s Singapore-based initiative supporting water solutions across Southeast Asia. (Source: Xylem Inc., Press Release, October 2021)

Bioremediation Technology and Services Market Report Coverage and Deliverables

The “Bioremediation Technology and Services Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Bioremediation technology and services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Bioremediation technology and services market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Bioremediation technology and services market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the bioremediation technology and services market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Health Record Market

- Fill Finish Manufacturing Market

- Microcatheters Market

- Hair Wig Market

- Flexible Garden Hoses Market

- Mesotherapy Market

- Nitrogenous Fertilizer Market

- Advanced Planning and Scheduling Software Market

- Health Economics and Outcome Research (HEOR) Services Market

- Queue Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, and Service

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 8.40% during 2023–2031.

Xylem Inc., REGENESIS, Aquatech International LLC., Drylet, Altogen Labs, Probiosphere, Ivey International Inc., InSitu Remediation Services Limited, Sumas Remediation Services, Inc.

Nanobiotechnology for bioremediation will likely remain a key trend in the market.

Key factors driving the market are government regulations and funding for research & development activities in bioremediation and increased awareness about the scarcity of natural resources such as water and oil.

North America dominated the bioremediation technology and services market in 2023

Get Free Sample For

Get Free Sample For