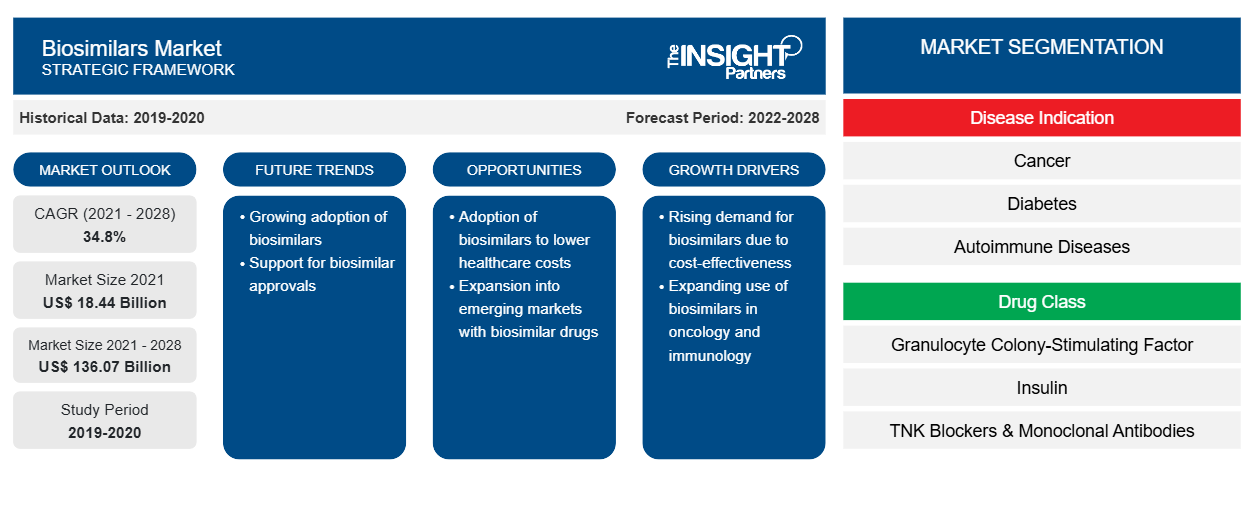

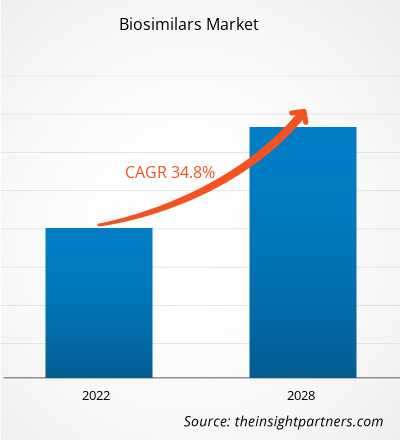

[Research Report] The biosimilars market size is expected to grow from US$ 18,435.89 million in 2021 to US$ 1,36,069.53 million in 2028; it is estimated to register a CAGR of 34.8% from 2022 to 2028.

Analyst Perspective

The major factors driving the growth of the biosimilars market are the growing incidence of chronic diseases, such as cancers, along. The growing burden of cancer and increasing deaths due to it creates the need for affordable treatment and thus boosts the growth of the biosimilars market. The key market players also anticipated market growth over the forecast period through various strategic activities, such as product launches, mergers, and acquisitions. An increase in the prevalence of autoimmune diseases such as ankylosing spondylitis and rheumatoid arthritis drives the growth of the Biosimilars Market Size. For instance, according to a paper published in “Scandinavian Journal of Rheumatology,” in 2020, titled ‘Prevalence of ankylosing spondylitis in Spain,’ about 7.3% population showed positive screening for ankylosing spondylitis. Biosimilars, such as infliximab-axxq (Avsola), infliximab-qbtx (Ixifi), infliximab-dyyb (Inflectra), and infliximab-abda (Renflexis) are used for the treatment of chronic pain in arthritis.

Market Overview

A biosimilar is a biological medicine highly similar to another already approved biological medicine (the 'reference medicine'). Biosimilars are approved according to the same standards of pharmaceutical quality, safety, and efficacy that apply to all biological medicines.Biosimilars are safe and effective treatment options for many illnesses, such as chronic skin and bowel diseases (like psoriasis, irritable bowel syndrome, Crohn’s disease, and colitis), arthritis, kidney conditions, and cancer. Biosimilars increase access to lifesaving medications at potentially lower costs. The primary drivers of the biosimilars market are increasing incidence of chronic diseases.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biosimilars Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biosimilars Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver

Rising Approvals of Biosimilars to Drive Global Biosimilars Market Growth

The Food and Drug Administration (FDA) approves biosimilar products and provides the scientific and regulatory advice needed to bring safe and effective biosimilars to market. The approval of biosimilar products can improve patient care by increasing the number of medication options at potentially lower costs.

A few recent approvals of biosimilar products are mentioned in the following table.

Biosimilars Name | Approval Date | Reference Product |

Alymsys (bevacizumab-maly) | April 2022 | Avastin (bevacizumab) |

Cimerli (ranibizumab-eqrn) | August 2022 | Lucentis (ranibizumab) |

Fylnetra (pegfilgrastim-pbbk) | May 2022 | Neulasta (pegfilgrastim) |

Stimufend (pegfilgrastim-fpgk) | September 2022 | Neulasta (pegfilgrastim) |

Vegzelma (bevacizumab-adcd) | September 2022 | Avastin (bevacizumab) |

Idacio (adalimumab-aacf) | December 2022 | Humira (adalimumab) |

Byooviz (ranibizumab-nuna) | September 2021 | Lucentis (ranibizumab) |

Rezvoglar (insulin glargine-aglr) | December 2021 | Lantus (insulin glargine) |

Semglee (Insulin glargine-yfgn) | July 2021 | Lantus (Insulin glargine) |

Yusimry (adalimumab-aqvh) | December 2021 | Humira (adalimumab) |

Hulio (adalimumab-fkjp) | July 2020 | Humira (adalimumab) |

Riabni (rituximab-arrx) | December 2020 | Rituxan (rituximab) |

Nyvepria (pegfilgrastim-apgf) | June 2020 | Neulasta (pegfilgrastim) |

Thus, the rising approvals of biosimilars are propelling the biosimilars market growth.

Segmental Analysis

Based on disease indication, the biosimilars market is segmented into cancer, diabetes, autoimmune disease, and other disease indication. The cancer segment held the largest market share in 2021 and autoimmune disease is anticipated to register the highest CAGR of 36.1% during the forecast period (2022–2028). Based on drug class, the biosimilars market is segmented as granulocyte colony-stimulating factors, human growth hormone, insulin, TNF blockers and monoclonal antibodies, and others (osteoporosis, etc). The granulocyte colony-stimulating factors drug class segment held the largest share of the market in 2021. Moreover, the other drug class segment is expected to grow at the highest CAGR during the forecast period. Based on application, the global biosimilars market is divided into intravenous, subcutaneous, and other applications. The intravenous segment held the largest share of the market in 2021 and is expected to grow at the highest CAGR during the forecast period. The biosimilars market, by end-user, is segmented into hospitals, specialty clinics, homecare, and other end users. The hospitals segment held the largest share of the market in 2021 and homecare segment is anticipated to register the highest CAGR of 36.6% in the market during the forecast period (2022–2028).

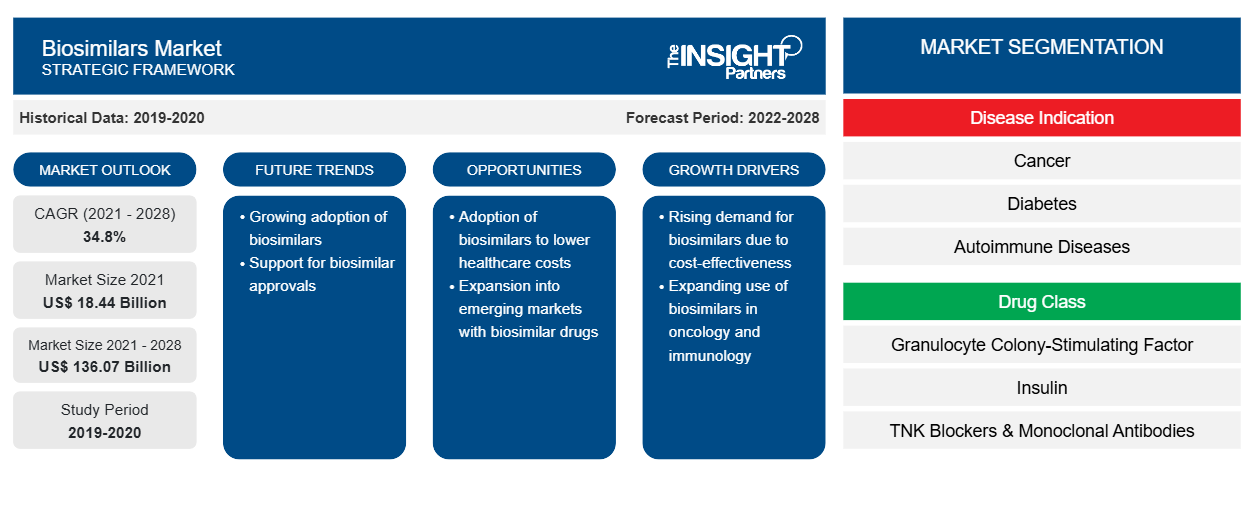

Regional Analysis

The North America biosimilars market was valued at US$ 5,479.84 million in 2021 and is projected to reach US$ 47,746.80 million by 2028; it is expected to grow at a CAGR of 37.3% during the forecast period. The North America biosimilars market is segmented into the US, Canada, and Mexico. The US held the largest share of the North American biosimilars market in 2019. increasing incidence of diabetes, infertility as well as rising product development in biosimilars market. According to NIH Autoimmune Diseases Coordinating Committee, in 2019, more than 24 million Americans suffer from autoimmune diseases. Eight million people have auto-antibodies, blood molecules that indicate a person's risk of developing autoimmune diseases. For unknown reasons, autoimmune diseases are affecting more people. According to the Clinical Research Branch at the National Institute of Environmental Health Sciences (NIEHS), in 2020, there is a significant increase in the prevalence of antinuclear antibodies (ANA), the most common biomarker of autoimmunity in the US. The study is the first to evaluate ANA changes in a representative sampling of the US population over time. It includes males, non-Hispanic whites, adults over 50, and adolescents. In the US, biosimilars are used to treat patients with cancers, kidney diseases, diabetes, and other autoimmune diseases such as rheumatoid arthritis and Crohn's disease. According to Cardinal Health, a total of 33 biosimilars have been approved by the FDA in the US and 21 are commercially available. Of the 21 biosimilars on the market, 17 are used for treatments associated with cancers, three are used to treat autoimmune conditions and one is used to treat diabetes.

Biologics are the most expensive medicines in the US with costs totaling tens of thousands of dollars each year per patient. Biosimilars are expected to be priced 15% to 30% lower than their reference product. In 2020 alone, biosimilars saved US$ 7.9 billion, with savings expected to grow significantly in the next few years as more biosimilars enter the market. According to Cardinal Health, it is expected that biosimilars are expected to reduce US drug expenditure by US$ 133 billion by 2025. Thus, in the US, biosimilars have immense potential, for lowering the costs of biologic medicine and making care more accessible to patients, and for creating new innovations and scientific breakthroughs, thereby driving the biosimilars market growth in this region

Key Player Analysis

The biosimilars market analysis consists of players, such as Amgen Inc, Celltrion Inc, Sanofi SA, Biocon Ltd, Pfizer Inc, Samsung Bioepis Co Ltd, Coherus BioSciences Inc, Eli Lilly and Co, Sandoz AG, Teva Pharmaceutical Industries Ltd, and Dr. Reddy's Laboratories Ltd. Among the players in the biosimilars market, Pfizer Inc. and Novartis, Inc are the top two players owing to the diversified product portfolio offered.

Biosimilars Market Regional Insights

The regional trends and factors influencing the Biosimilars Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Biosimilars Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Biosimilars Market

Biosimilars Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 18.44 Billion |

| Market Size by 2028 | US$ 136.07 Billion |

| Global CAGR (2021 - 2028) | 34.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Disease Indication

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Biosimilars Market Players Density: Understanding Its Impact on Business Dynamics

The Biosimilars Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Biosimilars Market are:

- Biocon Ltd

- Sanofi-Aventis

- Celltrion Inc.

- Amgen Inc.

- Pfizer Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Biosimilars Market top key players overview

Recent Developments

Inorganic and organic strategies such as mergers and acquisitions, product launches are highly adopted by companies in the biosimilars market. A few recent key market developments are listed below:

- In January 2022, Biocon Biologics a subsidiary of Biocon Ltd. Completed Acquisition of Viatris’ Global Biosimilars Business. The acquisition provides Biocon Biologics with direct commercial capabilities and supporting infrastructure in the advanced markets and several emerging markets, bringing it closer to patients, customers, and payors. With this acquisition Biocon Biologics emerges as a world leading biosimilars player with eight commercialized products.

- In October 2022, Biocon Biologics Out-Licenses Two Biosimilar Assets to Yoshindo for Commercialization in Japan. Under the terms of this deal, Yoshindo gets exclusive commercialization rights in Japan for bUstekinumab and bDenosumab developed and manufactured by Biocon Biologics, for an addressable market opportunity of US$ 700 million.

- In December 2022, Celltrion USA announced submission of the Biologics License Application (BLA) of novel subcutaneous formulation of CT-P13 to FDA. A subcutaneous formulation has the potential to enhance treatment options for the use of the infliximab drug by providing high consistency in drug exposure and a convenient method of administration.

- In September 2022, Celltrion USA received U.S. FDA approval for its oncology biosimilar Vegzelma for the treatment of six types of cancer such as metastatic colorectal cancer; recurrent or metastatic non-squamous non-small cell lung cancer (nsNSCLC); recurrent glioblastoma; metastatic renal cell carcinoma; persistent, recurrent, or metastatic cervical cancer; and epithelial ovarian, fallopian tube, or primary peritoneal cancer. Vegzelma is Celltrion’s third oncology biosimilar to receive approval from the U.S. FDA.

- In May 2022, Biocon Biologics and Viatris Launch Abevmy. Biocon Biologics Ltd., a subsidiary of Biocon Ltd., and Viatris Inc. announced that Abevmy (bBevacizumab) is available in Canada. Abevmy, co-developed by Biocon Biologics and Viatris, is a biosimilar to Roche’s Avastin (Bevacizumab) and has been approved by Health Canada across four oncology indications.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Disease Indication, Drug Class, Route of Administration, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

France, Germany, Italy, Spain, United Kingdom

Frequently Asked Questions

The Asia Pacific is expected to be the fastest-growing region in the Biosimilars market over the forecast period due to the increasing prevalence of chronic diseases and the cost-effectiveness of biosimilars drugs.

The Biosimilars market is estimated to be valued at US$ 22,676.15 million in 2022.

The Biosimilars market is expected to be valued at US$ 1,36,069.53 million in 2028.

Biosimilars are safe and effective treatment options for many illnesses such as chronic skin and bowel diseases (like psoriasis, irritable bowel syndrome, Crohn’s disease and colitis), arthritis, kidney conditions, and cancer. A biosimilar product is a biologic product that is approved based on demonstrating that it is highly similar to an FDAâ€approved biologic product, known as a reference product, and has no clinically meaningful differences in terms of safety and effectiveness from the reference product.

The CAGR value of the biosimilars market during the forecasted period of 2022-2028 is 34.8%.

The Biosimilars market majorly consists of the players, such as Biocon Ltd, Sanofi-Aventis, Celltrion Inc., Amgen Inc., Pfizer Inc., Samsung Bioepis, Sanofi SA, Coherus BioSciences Inc, Dr. Reddy’s Laboratories Ltd, Eli Lilly and Co, Sandoz AG, and Teva Pharmaceutical Industries Ltd.

The factors that are driving the growth of the biosimilars market are the increasing aging population, changing social behavior, and the rising adoption of a sedentary lifestyle by people with accelerating urbanization boost the prevalence of obesity and various chronic diseases, such as diabetes. Also,twin studies have long established that genes can cause chronic conditions such as cardiovascular disease (CVDs), diabetes, obesity, Alzheimer's disease (AD), and depression. These are some of the major factors contributing to the growth of the biosimilars industry.

The insulin segment held the largest share of the market in 2022. Also, the same segment is estimated to register the highest CAGR in the market during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Biosimilar Market

- Biocon Ltd

- Sanofi-Aventis

- Celltrion Inc.

- Amgen Inc.

- Pfizer Inc.

- Samsung Bioepis

- Sanofi SA

- Coherus BioSciences Inc

- Dr. Reddy’s Laboratories Ltd

- Eli Lilly and Co

- Sandoz AG

- Teva Pharmaceutical Industries Ltd.

Get Free Sample For

Get Free Sample For