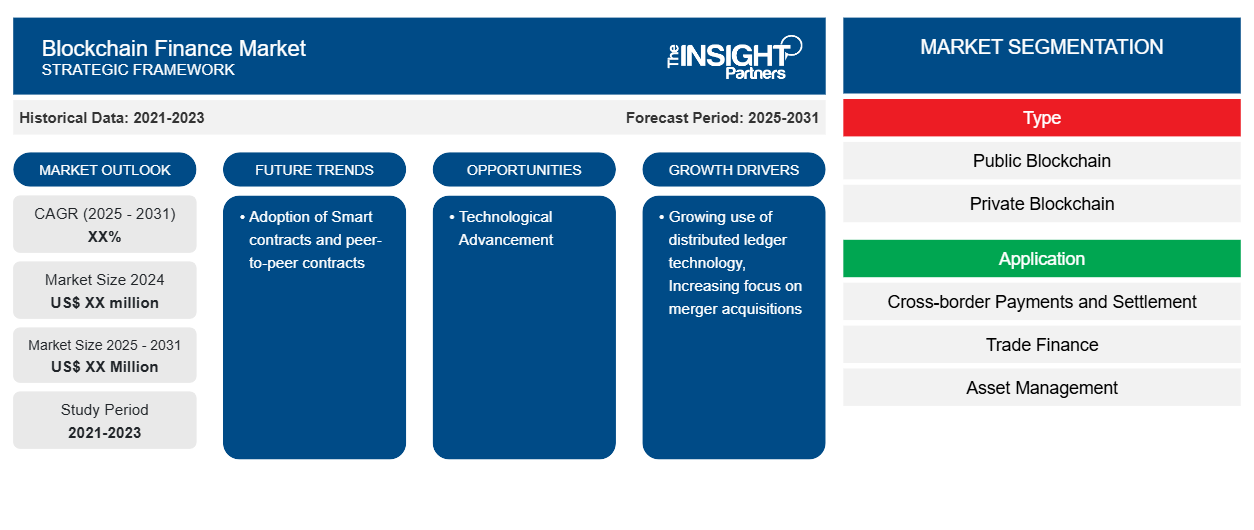

The blockchain finance market is expected to expand at a CAGR of XX% from 2025 to 2031. Blockchain technology delivers opportunities for cheaper, faster, and more protected payment processing in addition to a distributed ledger that can increase applicant trust. The most impactful application of blockchain in finance is its capability to professionally establish trust via smart contracts. Thus, the adoption of distributed leaders and technological advancement are expected to boost the market growth during the forecast period.

Blockchain Finance Market Analysis

Blockchain refers to the decentralized ledger of all transactions across a peer-to-peer network. By means of this technology, applicants can confirm transactions without the necessity of a central clearing authority. Blockchain, including a decentralized process and smart contracts, promises to bring accuracy, speed, and efficiency to the investment procedure. Thus, the blockchain finance market is expected to grow during the forecast period.

Blockchain Finance Market Overview

- Blockchain in Finance refers to the application of blockchain technology in the finance industry. The development of blockchain technology for financial services can lead to numerous benefits for the banking industry. Blockchain in financial services has also led to the introduction of decentralized finance. This, in turn, is expected to drive market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blockchain Finance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blockchain Finance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Blockchain Finance Market Driver and Opportunities

Growing Use of Distributed Ledger Technology to Drive Market Growth

- Blockchain and the concept of distributed ledger can help restructure all the information and data among several banking platforms via sharing the data internally and with other banking institutions. Distributed Ledger Technology (DLT) is a method of storing, managing, and sharing information and data over a distributed network. It is a type of database that allows numerous copies of a ledger to be shared between different organizations.

- DLTs can offer numerous benefits, including improved efficiency, increased security, and reduced costs in blockchain finance. Thus, the growing use of distributed ledger technology in blockchain finance is expected to drive market growth during the forecast period.

Growing Blockchain Technology Market to Create Lucrative Opportunities

- Blockchain can securely streamline claims processing, data verification, and disbursement, reducing processing time substantially. Blockchain is a public ledger that is capable of recording the movement, origin, and transfer of anything of value.

- Blockchain technology enables international payment processing services and other methods of transactions by means of encrypted distributed ledgers, which deliver real-time verification of transactions. As a result, there is no requirement for intermediaries like correspondent banks and clearing houses. Thus, technological advancement in the blockchain technology market is expected to create lucrative growth opportunities during the forecast period.

Blockchain Finance Market Report Segmentation Analysis

The key segments that contributed to the derivation of the blockchain finance market analysis are type and application.

- Based on type, the public blockchain segment held a prominent market share in 2023. A public blockchain is one where anybody is allowed to join and participate in the fundamental activities of the blockchain network.

- By application, the cross-border payments & settlement segment dominated the market share in 2023. Payments made across borders are referred to as cross-border payments. Merchants, people, enterprises, and businesses, among others, all rely on cross-border payments. Thus, the segment is expected to grow significantly during the forecast period.

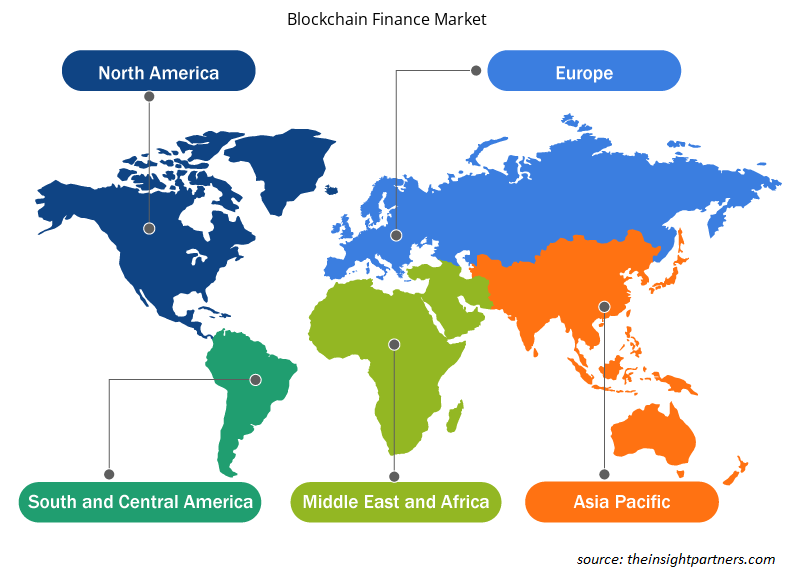

Blockchain Finance Market Share Analysis By Geography

- Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

- North America is expected to hold a prominent share in the blockchain finance market during the forecast period. This growth may be attributed to the presence of key market players and the early adoption of technology.

- Moreover, blockchain technology in banking and financial institutions (BFSI) enables cryptographic transparency and security, which results in decreased risk of fraud in banks and financial institutions. This, in turn, is also expected to boost the market growth in this region during the forecast period.

Blockchain Finance Market Regional Insights

The regional trends and factors influencing the Blockchain Finance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blockchain Finance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blockchain Finance Market

Blockchain Finance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Blockchain Finance Market Players Density: Understanding Its Impact on Business Dynamics

The Blockchain Finance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blockchain Finance Market are:

- GOLDMAN SACHS

- R3

- Accenture

- Microsoft Corporation

- JP Morgan Chase

- Deloitte Touche Tohmatsu Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blockchain Finance Market top key players overview

Blockchain Finance Market Report Coverage & Deliverables

The blockchain finance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Blockchain Finance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Wire Harness Market

- Redistribution Layer Material Market

- Fixed-Base Operator Market

- Vertical Farming Crops Market

- Lymphedema Treatment Market

- Social Employee Recognition System Market

- Hydrocephalus Shunts Market

- Flexible Garden Hoses Market

- Mesotherapy Market

- Medical and Research Grade Collagen Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific is anticipated to grow at a high growth rate during the forecast period.

The major players holding majority shares are Goldman Sachs, R3, Accenture, Microsoft Corporation, and JP Morgan Chase.

Smart contracts and peer-to-peer contracts are the major trends in the market.

Growing use of distributed ledger technology and increasing focus on merger acquisitions are the major factors that propel the global blockchain finance market.

The global blockchain finance market was estimated to grow at a CAGR of XX% during 2023 - 2031.

Get Free Sample For

Get Free Sample For