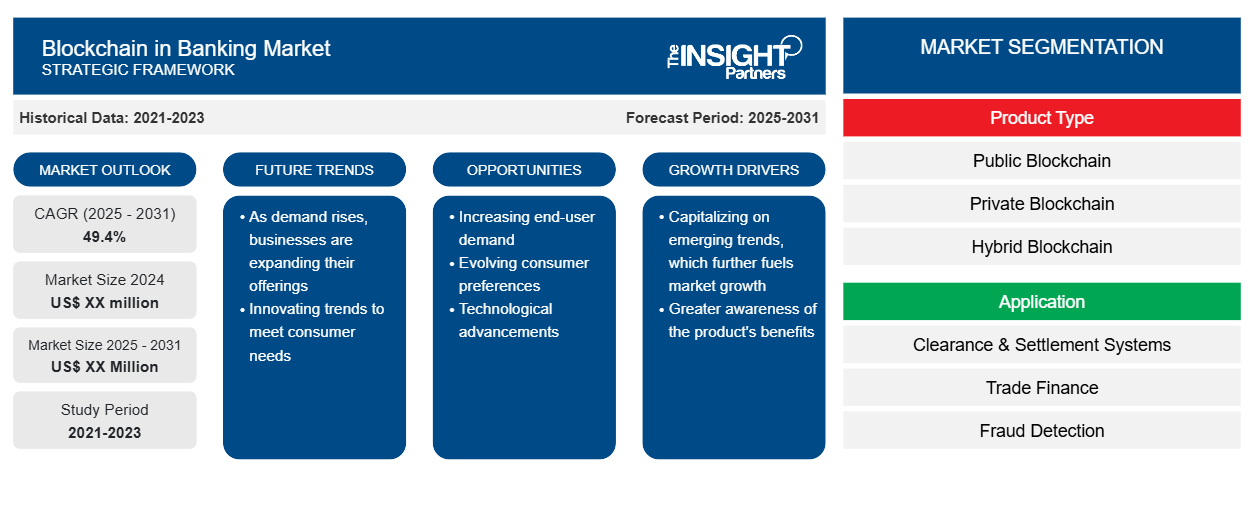

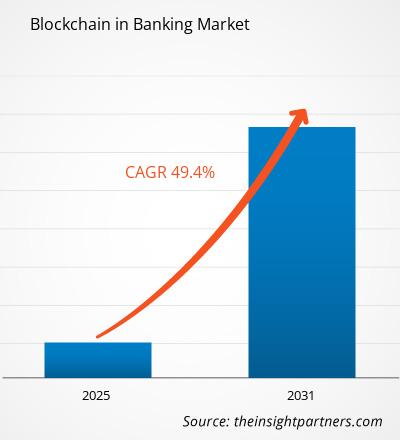

The blockchain in banking market is anticipated to expand at a CAGR of 49.4% from 2025 to 2031.The market's growth can be ascribed to the banking sector's growing desire for improved transaction speed, scalability, and lower processing costs.

Blockchain in Banking Market Analysis

The blockchain in banking market is expanding due to the growing use of distributed ledger technologies (DLT) in banking and financial services to improve transparency and accountability in transactions. An increasing need for digitalization in banking and financial services, mergers and acquisitions, and technological breakthroughs is driving the global blockchain technology industry. However, the high cost of implementing DLTs and the lack of consistency among providers limit industry expansion.

Blockchain in Banking Industry Overview

- Blockchain is a decentralized database that stores transactions from numerous nodes. Developed in 2008, it addresses security and integrity concerns for online transactions.

- Blockchain has gained popularity across businesses due to its safe and transparent transaction processing. The banking business has undergone substantial changes in recent years.

- New technologies are influencing how individuals engage with banks, leading to these changes. Blockchain technology creates safe and efficient digital ledgers for transactions between parties.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blockchain in Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blockchain in Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Blockchain in Banking Market Drivers and Opportunities

The Rise of Cryptocurrency Blockchain Adoption to Drive the Blockchain in Banking Market

Blockchain technology is gaining popularity in the banking and financial services industry due to the increasing use of Bitcoin. Cryptocurrency is a digital payment mechanism that does not require banks to authenticate transactions. This peer-to-peer technology allows anyone, anywhere, to make and receive payments. Cryptocurrency's moniker stems from its use of encryption for transaction verification. Encryption strives to ensure security and safety. Cryptocurrency payments are digital, with transactions recorded in an online database rather than actual currency. Cryptocurrency transfers are recorded in a public ledger. Cryptocurrency is held in digital wallets.

Blockchain in Banking Market Report Segmentation Analysis

- Based on product type, the blockchain in banking market is segmented into public blockchain, private blockchain, and hybrid blockchain.

- The public blockchain segment is expected to hold a substantial blockchain banking market share in 2023.

- A public blockchain allows anybody to join and participate in the blockchain network's basic functions. A private blockchain permits only selected and verified participants; the operator can veto, alter, or delete blockchain records.

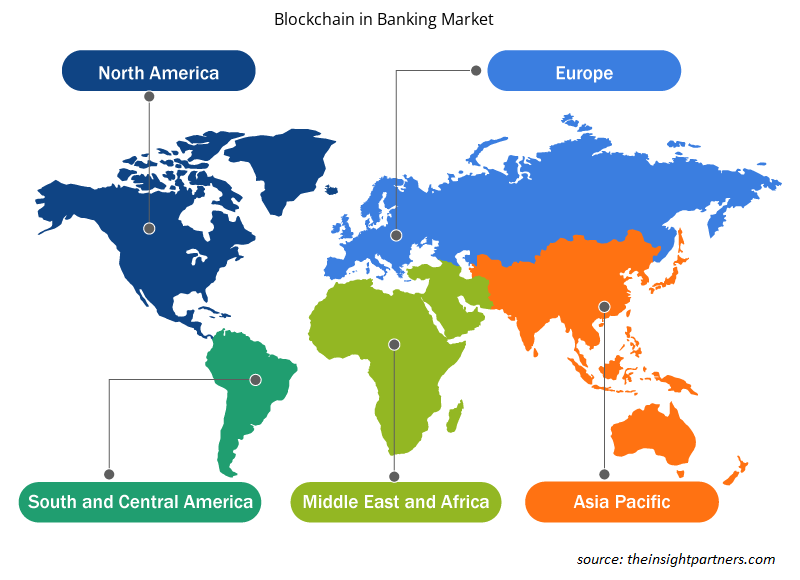

Blockchain in Banking Market Share Analysis By Geography

The scope of the blockchain in banking market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant blockchain in banking market share. This is mostly due to the presence of important market participants and continuous blockchain technology development in the region. Blockchain technology in banking and finance enhances security and transparency, reducing fraud and driving growth in the region. This region contains the highest concentration of banks and financial institutions, as well as numerous significant enterprises offering banking and financial services. These features make them ideal for implementing blockchain technology in the banking business.

Blockchain in Banking Market Regional Insights

Blockchain in Banking Market Regional Insights

The regional trends and factors influencing the Blockchain in Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blockchain in Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blockchain in Banking Market

Blockchain in Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 49.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

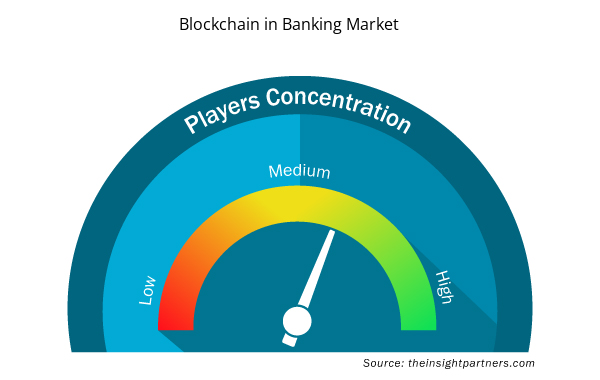

Blockchain in Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Blockchain in Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blockchain in Banking Market are:

- Microsoft Corporation

- Infosys Limited

- Hewlett Packard Enterprise

- Amazon Web Services Inc.

- IBM Corporation

- SAP SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blockchain in Banking Market top key players overview

The "Blockchain in Banking Market Analysis" was carried out based on product type, application, and geography. Based on the product type, the blockchain in banking market is segmented into public blockchain, private blockchain, and hybrid blockchain. In terms of application, the market is segmented into International and domestic. Based on application, the market is segmented into Clearance & Settlement Systems, Trade Finance, Fraud Detection, E-KYC, Smart Contracts, and Regulatory Reporting & Compliance. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Blockchain In Banking Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the blockchain banking market. The blockchain in banking market forecast can help stakeholders plan their growth strategies. A few recent key market developments are listed below:

- In June 2023, JPMorgan partnered with six Indian banks to explore the potential of blockchain technology to provide 24-hour settlement services for Indian financial institutions. The Indian banks include HDFC Bank, ICICI Bank, Axis Bank, Yes Bank, and IndusInd Bank. These banks are major players in the Indian financial sector, known for their broad range of financial services and dedication to using digital technology to satisfy consumer needs.

[Source: JP Morgan, Company Website]

- In June 2021, 15 banks collaborated to develop a new company to process inland letters of credit (LCs) with blockchain technology. The company, Indian Banks' Blockchain Infrastructure Co Pvt. Ltd. (IBBIC), is about to have 15 shareholders, each having an identical 6.66% ownership in the company. Four of these banks are public, 10 are private, and one is foreign.

[Source: Indian Banks' Blockchain Infrastructure Co Pvt. Ltd, Company Website]

Blockchain in Banking Market Report Coverage & Deliverables

The market report on “Blockchain in Banking Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global blockchain in banking market is expected to grow at a CAGR of 49.4% during the forecast period 2023 - 2031.

The incorporation of digital currency is anticipated to play a significant role in the global blockchain banking market in the coming years.

The rise of cryptocurrency blockchain adoption is the major factor that propels the global blockchain in banking market.

The key players holding majority shares in the global blockchain in banking market are Microsoft Corporation, Infosys Limited, Hewlett Packard Enterprise, Amazon Web Services Inc., IBM Corporation.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Microsoft Corporation

- Infosys Limited

- Hewlett Packard Enterprise

- Amazon Web Services Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- JPMorgan Chase and Co

- Accenture PLC

- AlphaPoint

Get Free Sample For

Get Free Sample For