MARKET INTRODUCTION

Blockchain technology supports energy trading across a vast range of commodity markets, such as electric power, crude oil, natural gas, and refined products. Blockchain-powered solutions can be deployed within each business segment, helping to produce, refine, distribute, and retail trade information related to pricing, position management, logistics, and risk reporting. Implementation of blockchain technology will provide opportunities such as real-time transactions balance of supply & demand, and it will enable peer-to-peer energy trading and connect electric vehicle (EV) charging stations. As a result of these factors, utility organizations' interest in blockchain technology is rising.

MARKET DYNAMICS

The deployment of blockchain technology is expected to witness quick growth in the energy as well as the utilities sector owing to the amplified generation of renewable energy to back sustainable initiatives and the attempts made by oil and gas players to boost operational efficiency and security. The introduction of specially designed blockchain solutions for electricity grids and new decentralized producers of renewable energies are regularly producing massive data assisting the energy companies, tis is anticipated to boost the growth of the market.

MARKET SCOPE

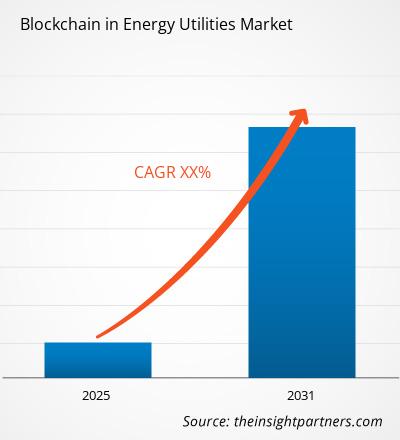

The "Global Blockchain In Energy Utilities Market Analysis to 2031" is a specialized and in-depth study of the blockchain In energy utilities market with a special focus on the global market trend analysis. The report aims to provide an overview of blockchain In energy utilities market with detailed market segmentation by component, deployment. The global blockchain In energy utilities market expected to witness high growth during the forecast period. The report provides key statistics on the market status of the leading blockchain In energy utilities market player and offers key trends and opportunities in the blockchain In energy utilities market.

MARKET SEGMENTATION

The global blockchain In energy utilities market is segmented on the basis of component, deployment. On the basis of component, market is segmented as solution, service. On the basis of deployment, market is segmented as proof of concept, pilot, production.

REGIONAL FRAMEWORK

The report provides a detailed overview of the industry including both qualitative and quantitative information. It provides overview and forecast of the global blockchain In energy utilities market based on various segments. It also provides market size and forecast estimates from year 2021 to 2031 with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America. The blockchain In energy utilities market by each region is later sub-segmented by respective countries and segments. The report covers analysis and forecast of 18 countries globally along with current trend and opportunities prevailing in the region.

The report analyzes factors affecting blockchain In energy utilities market from both demand and supply side and further evaluates market dynamics effecting the market during the forecast period i.e., drivers, restraints, opportunities, and future trend. The report also provides exhaustive PEST analysis for all five regions namely; North America, Europe, APAC, MEA and South America after evaluating political, economic, social and technological factors effecting the blockchain In energy utilities market in these regions.

MARKET PLAYERS

The reports cover key developments in the blockchain In energy utilities market organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as product launches, product approvals and others such as patents and events. Inorganic growth strategies activities witnessed in the market were acquisitions, and partnership & collaborations. These activities have paved way for expansion of business and customer base of market players. The market players from blockchain In energy utilities market are anticipated to lucrative growth opportunities in the future with the rising demand for blockchain In energy utilities market. Below mentioned is the list of few companies engaged in the blockchain In energy utilities market.

The report also includes the profiles of key blockchain In energy utilities market companies along with their SWOT analysis and market strategies. In addition, the report focuses on leading industry players with information such as company profiles, components and services offered, financial information of last 3 years, key development in past five years.

- IBM Corporation

- Greeneum

- Oracle Corporation

- Microsoft Corporation

- EnergiMine

- Accenture PLC

- Infosys Limited

- SAP SE

- LO3 Energy Inc.

- The Sun Exchange (Pty) Ltd.

The Insight Partner's dedicated research and analysis team consist of experienced professionals with advanced statistical expertise and offer various customization options in the existing study.

Blockchain in Energy Utilities Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. IBM Corporation

2. Greeneum

3. Oracle Corporation

4. Microsoft Corporation

5. EnergiMine

6. Accenture PLC

7. Infosys Limited

8. SAP SE

9. LO3 Energy Inc.

10. The Sun Exchange (Pty) Ltd.

Get Free Sample For

Get Free Sample For