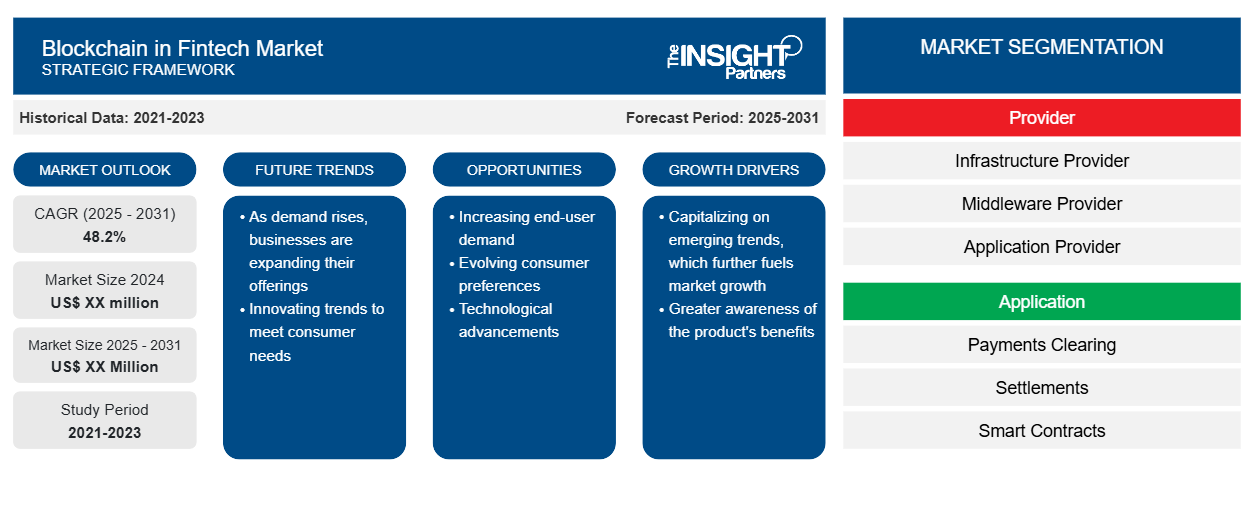

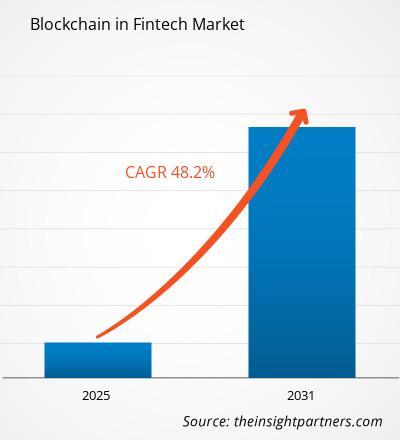

The blockchain in fintech market is anticipated to expand at a CAGR of 48.2% from 2025 to 2031. Increased investment in the FinTech sector to develop technologically advanced solutions for the financial and non-financial industries.

Blockchain in Fintech Market Analysis

The blockchain-related fintech business is expanding due to a variety of causes, including rising market capitalizations of cryptocurrencies and ICOs, increased demand for distributed ledger technology, and the deployment of advanced blockchain solutions in financial institutions.

Blockchain in Fintech Industry Overview

- Blockchain in finance organizes and manages information on digital transactions, preventing duplicates. It is intended to record financial data and manage financial transactions with a predetermined value.

- Fintech refers to the evolving integration of financial services and technology. Blockchain eliminates inefficiencies in most banks and financial organizations through operations such as settlement and clearing.

- The most significant impact on the fintech business is that blockchain technology minimizes bank fraud and cyberattacks. Blockchain reduces data breaches and comparative fraudulent operations, allowing financial companies to move or share secure and uninterrupted information via decentralized networks.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blockchain in Fintech Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blockchain in Fintech Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Blockchain in Fintech Market Drivers and Opportunities

Increase in Digitalization in Insurance Providers

to Drive the Blockchain in Fintech Market.

- Blockchain collaborates with the financial services industry, non-banking services, and insurance to improve the effectiveness of back-office services, increasing demand for blockchain in the fintech market.

- The increasing use of cryptocurrency market capitalization due to its secure and trustworthy usage is a major driver for blockchain in the finance industry.

- However, unknown legal norms and frameworks are impeding the expansion of blockchain in the fintech business. In contrast, the development of new mobile applications that facilitate online transactions is likely to accelerate the expansion of blockchain in the fintech business in the coming years.

Blockchain in Fintech Market Report Segmentation Analysis

- Based on the provider, the blockchain in fintech market is segmented into infrastructure provider, middleware provider, and application provider.

- The infrastructure provider segment is expected to hold a substantial blockchain in fintech market share in 2023.

- The raising demand for blockchain standards and protocols such as Openchain, Ethereum, and Hyperledger is driving market growth. Users require protocols because they enable consumers to securely and consistently send information across Bitcoin networks.

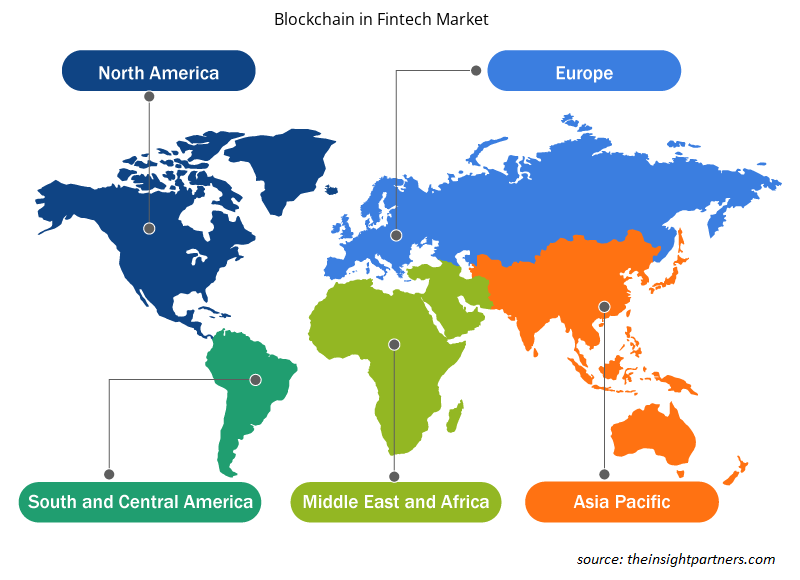

Blockchain in Fintech Market Share Analysis By Geography

The scope of the blockchain in fintech market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant blockchain in fintech market share. North America is predicted to dominate the market in 2024. North America is considered the most progressed region in terms of technology and infrastructure. The presence of important blockchain industry players in North America is fueling the growth of the FinTech blockchain market. Financial companies in the region are using blockchain technology.

Blockchain in Fintech Blockchain in Fintech Market Regional Insights

The regional trends and factors influencing the Blockchain in Fintech Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blockchain in Fintech Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blockchain in Fintech Market

Blockchain in Fintech Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 48.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Provider

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

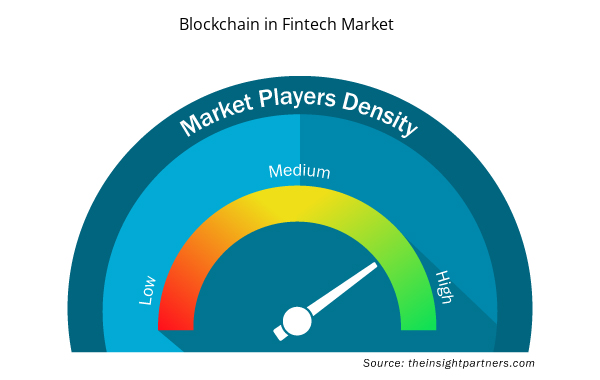

Blockchain in Fintech Market Players Density: Understanding Its Impact on Business Dynamics

The Blockchain in Fintech Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blockchain in Fintech Market are:

- AWS

- IBM

- Microsoft

- Ripple

- Earthport

- Bitfury

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blockchain in Fintech Market top key players overview

The "Blockchain in Fintech Market Analysis" was carried out based on card type, service provider, application, and geography. Based on the provider, the blockchain in fintech market is segmented into infrastructure provider, middleware provider, and application provider. In terms of application, the market is segmented into payments clearing, & settlements, smart contracts, identity management, exchange & remittance compliance management, and others. Based on end use, the market is segmented into banking, non-banking financial companies, and insurance. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Blockchain In Fintech Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Ablockchain in fintech market. The blockchain in fintech market forecast can help stakeholders plan their growth strategies. A few recent key market developments are listed below:

- In May 2022, A UK-based firm called Superscript and Lloyd's, a London-based insurance market broker, introduced a specific insurance product dubbed "Daylight" for cryptocurrency enterprises. This package combines technological liability and cyber insurance to defend against a variety of hazards, including ransomware attacks and unintentional copyright infringement.

[Source: Lloyd's, Company Website]

- In October 2022, Nubank, a Brazilian digital banking firm, revealed plans to launch its cryptocurrency, Nucoin, in Brazil in the first half of 2023. Nubank's decision is a key step toward realizing the transformational potential of blockchain technology and democratizing its benefits beyond the purchase, sale, and holding of cryptocurrencies in Nuapp.

[Source: Nubank, Company Website]

Blockchain in Fintech Market Report Coverage & Deliverables

The market report on “Blockchain in Fintech Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Europe Industrial Chillers Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Hair Wig Market

- Electronic Data Interchange Market

- Social Employee Recognition System Market

- Bioremediation Technology and Services Market

- Data Center Cooling Market

- Single Pair Ethernet Market

- Artificial Turf Market

- Aircraft MRO Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global blockchain in fintech market is expected to grow at a CAGR of 48.2% during the forecast period 2023 - 2031.

A new breed of programmable blockchain platform is anticipated to play a significant role in the global blockchain in fintech market in the coming years.

The growing peer-to-peer network and increasing use of blockchain in insurance are the major factors that propel the global blockchain in fintech market.

The key players holding majority shares in the global blockchain in fintech market are AWS, IBM, Microsoft, Ripple, and Earthport.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- AWS

- IBM

- Microsoft

- Ripple

- Earthport

- Bitfury

- Circle

- Oracle

- Factom

- Abra.

Get Free Sample For

Get Free Sample For