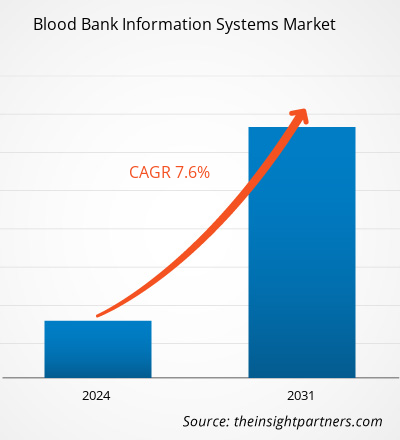

The blood bank information systems market size is projected to reach US$ 1.37 billion by 2031 from US$ 0.76 billion in 2023. The market is expected to register a CAGR of 7.60% during 2023–2031. Technological advancement is likely to remain a key trend in the market.

Blood Bank Information Systems Market Analysis

Businesses strive to introduce new goods, and increasing their operations through various methods should stimulate the market. Companies like Cerner Corporation, Allscripts Healthcare, LLC, Haemonetics Corporation, WellSky, Hemosoft, Integrated Medical Systems, Soft Computer Consultants, Inc., IT Synergistics, Psyche Systems Corporation, and Sunquest Information Systems, Inc. have implemented a variety of strategies, including product launches, product approvals, mergers and acquisitions, and market initiatives. For example, CliniSys announced in January 2022 that it had recently acquired HORIZON Lab Systems and combined with Sunquest Information Systems to become CliniSys.

Blood Bank Information Systems Market Overview

The increased global prevalence of hematological diseases drives up demand for blood donations. Every three minutes, in the US, a person is diagnosed with leukemia, lymphoma, or myeloma, according to the Leukemia and Lymphoma Society (LLS). Furthermore, in 2021, there were about 186,400 cases of leukemia, lymphoma, and myeloma reported in the US. Moreover, in 2021, blood cancer cases accounted for roughly 9.8% of the estimated 1,898,160 new cancer cases in the nation. Bone marrow cell transplants and blood transfusions are becoming increasingly common due to the rising incidence of blood cancers like leukemia. The American Red Cross estimates that every day, about 5,000 platelets, 6,500 units of plasma, and about 29,000 units of red blood are needed in the US for various hematologic disorders.

Furthermore, 16 million blood components are transfused annually in the United States to treat various blood-related diseases like blood cancer and others. Moreover, it has been reported that in 2020, over 1.8 million individuals received a cancer diagnosis. As a result, the need for blood transfusions is increasing due to the rise in hematologic diseases, driving the growth of the global blood bank information system market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blood Bank Information Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blood Bank Information Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Blood Bank Information Systems Market Drivers and Opportunities

Increasing Number of Blood Donors Favors, the Market Growth

Due to the increased frequency of accidents and the growing prevalence of hematological diseases, there is a growing global demand for blood. The World Health Organization (WHO) estimates that approximately 118.4 million units of blood are donated worldwide. Out of which, high-income nations collect 40% of the blood. Moreover, 106 million donations are reported annually by about 13,300 blood banks spread across 169 countries. Furthermore, according to the WHO, 33% of blood donors worldwide are female.

Additionally, the WHO reported that between 2013 and 2018, 156 countries reported an increase of 7.8 million voluntary unpaid blood donations. The regions with the most significant increases in voluntary, outstanding blood donations are Africa (23%) and the Americas (25%). Western Pacific reported the most significant increase in absolute donation numbers (2.67 million), followed by the Americas (2.66 million) and South-East Asia (2.37 million). Furthermore, voluntary unpaid blood donations account for over 90% of the blood supply in approximately 79 countries, comprising 38 high-income countries, 33 middle-income countries, and eight low-income countries. Furthermore, 62 nations obtain their blood supply from willing, unpaid donors.

Furthermore, more than half of the world's blood supply—56 nations, nine high-income nations, 37 middle-income nations, and 10 low-income nations—depend on paid and family donors. This increases the global need for blood bank information systems. As blood donors rise worldwide, blood banks manage and store blood in new and innovative ways. Blood bank information systems are mainly used to collect blood donations. For example, a report on developing a blood retrieval system to help manage blood donor records and regulate the distribution of blood in government hospitals was published in 2020 by Samson Oloruntoba and other publishers. The system offers donor records quick access to medical reports in a timely, efficient, and confidential manner. Its foundation is an Android- and web-based blood donation inventory system emphasizing lowering transfusion errors. These elements support the market expansion for blood bank information systems.

Strategies by Major Market Players to Expand Presence in Emerging Markets Creates Significant Opportunities in the Market

Due to the increasing number of blood donors in Asia-Pacific and South and Central America, the blood bank information system market players plan their growth across multiple areas. Deep learning has demonstrated promising performance in blood management by employing traditional blood donor management systems and blood bank transfusion service modules. Lately, the blood bank information system has drawn much research attention. In the upcoming years, it is anticipated that numerous businesses—including WellSky, Sunset Information Systems, SCC Soft Computer's Blood Bank, and Allscripts Healthcare Solutions—will keep expanding in these developing markets through mergers, acquisitions, and strategic alliances. In June 2018, one of the best pediatric hospitals in Colorado used WellSky's Mediware Software for blood management services. The software offers tools to support the procedures that guarantee kids get the variety of blood products they require. The hospitals implemented three blood management solutions from Mediware—HCLL, LifeTrak, and Trastem—to handle the blood supply chain. Psyche Systems Corporation, Cerner Corporation, Haemonetics Corporation, Hemosoft, and other companies have established service offerings over the years, indicating their strategic positioning in the region. Throughout the projection period, these market opportunities will support the expansion of the blood bank information system.

Blood Bank Information Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the blood bank information systems market analysis are type and end user.

- Based on type, the blood bank information systems market is segmented into blood donor management modules, blood bank transfusion service modules, and others. The blood donor management module segment held the most significant market share in 2023.

- By end user, the market is segmented into hospitals and blood banks. The hospitals segment held a significant share of the market in 2023.

Blood Bank Information Systems Market Share Analysis by Geography

The geographic scope of the blood bank information systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America blood bank information systems market is segmented into the US, Canada, and Mexico. North America dominates the worldwide blood bank information system market, which is expected to continue over the projected period. North America is expected to have the biggest market share during the projection period. This is due to the rising need for safe blood transfusions and the region's expanding number of hospitals and blood banks. This expansion has also been aided by increased public awareness of the importance of blood donation. Because the United States has a pluralistic blood collection system, there is no central data repository about the number of units of blood collected or the components produced or transfused. The American Red Cross (ARC) collects about 45 percent of the 14 Million units of whole blood available annually in the United States. Other community blood banks collect about 42 percent, hospitals collect about 11 percent, and the remaining 2 percent is imported. Hospital blood banks must have a computer-based information system to comply with requirements. This system simplifies blood bank management and ensures the safety of blood and blood component storage, distribution, and traceability. It allows the creation of a medical file for each transfused patient that contains the characteristics of the blood components transfused as well as the patient's immunopharmacological status, which is received from the blood institution via electronic data interchange.

Blood Bank Information Systems Market Regional Insights

The regional trends and factors influencing the Blood Bank Information Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blood Bank Information Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blood Bank Information Systems Market

Blood Bank Information Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 0.76 Billion |

| Market Size by 2031 | US$ 1.37 Billion |

| Global CAGR (2023 - 2031) | 7.60% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Blood Bank Information Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Blood Bank Information Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blood Bank Information Systems Market are:

- Hemosoft

- Cerner Corporation

- Allscripts Healthcare, LLC

- Haemonetics Corporation

- Integrated Medical Systems

- Soft Computer Consultants, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blood Bank Information Systems Market top key players overview

Blood Bank Information Systems Market News and Recent Developments

The blood bank information systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the blood bank information systems market are listed below:

- MAK-System, a worldwide leader in Blood Management systems, is proud to announce an extended and strategic partnership with New York Blood Center Enterprises (NYBCe). Under the agreement, MAK-System will operate the MAK.care platform as a managed service, running the entire digital ecosystem on behalf of NYBCe. The 10-year arrangement will transform how blood is managed and delivered to patients by leveraging the benefits of managed services. (Source: MAK-System, Press Release, June 2023)

- CliniSys has announced the recent acquisition of HORIZON Lab Systems and the combination with Sunquest Information Systems as CliniSys. This acquisition and Sunquest combination create one of the world’s largest organizations dedicated to diagnostic and laboratory informatics. (Source: Sunquest Information Systems, Inc., Press Release, January 2022)

Blood Bank Information Systems Market Report Coverage and Deliverables

The “Blood Bank Information Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Blood bank information systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Blood bank information systems market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Blood bank information systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the blood bank information systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Latent TB Detection Market

- Transdermal Drug Delivery System Market

- Enzymatic DNA Synthesis Market

- Advanced Planning and Scheduling Software Market

- Truck Refrigeration Market

- Airport Runway FOD Detection Systems Market

- Collagen Peptides Market

- Skin Graft Market

- Clear Aligners Market

- Aerosol Paints Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 7.60% during 2023–2031.

Hemosoft, Cerner Corporation, Allscripts Healthcare, LLC, Haemonetics Corporation, Integrated Medical Systems, Soft Computer Consultants, Inc.IT Synergistics, Psyche Systems Corporation, Wellsky

Technological advancements will likely remain a key trend in the market.

Key factors driving the market are the increasing number of blood donors and the rising prevalence of hematologic diseases.

North America dominated the blood bank information systems market in 2023

Get Free Sample For

Get Free Sample For