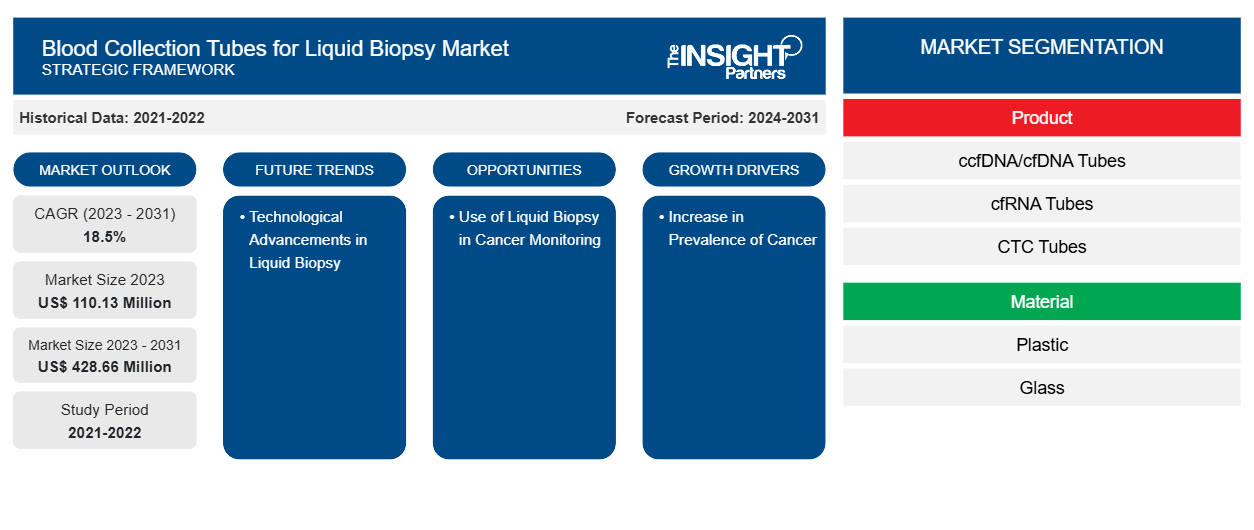

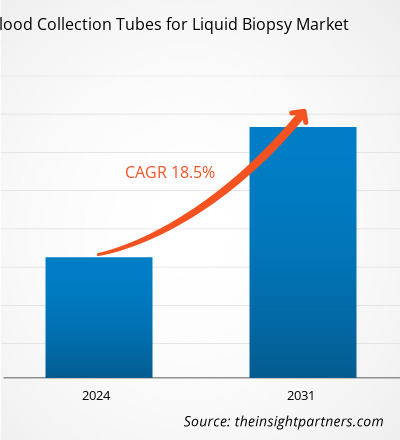

The blood collection tubes for liquid biopsy market size is projected to reach US$ 428.66 million by 2031 from US$ 110.13 million in 2023. The market is expected to register a CAGR of 18.5% during 2023–2031. With the increasing incidence of chronic diseases that require blood tests for diagnosis and disease progress monitoring, technologically advanced blood collection tubes for liquid biopsy are likely to remain key trends in the market.

Blood Collection Tubes for Liquid Biopsy Market Analysis

One of the key drivers for the blood collection tubes for liquid biopsy market growth is the increasing prevalence of cancer alongside the surging demand for noninvasive diagnostic tools. The blood collection tubes for liquid biopsy market is also expanding with ongoing R&D activities for the development of new biomarkers for early disease detection. The development of throughput blood collection tubes indicate a significant improvement in blood collection tubes designed for liquid biopsy procedures.

Blood Collection Tubes for Liquid Biopsy Market Overview

With the rising incidence of cancer, the demand for highly sophisticated, less invasive diagnostic techniques such as liquid biopsies is on the rise in India. These procedures can be performed more frequently than traditional tissue biopsies due to their minimally invasive nature. Thus, the blood collection tubes for liquid biopsies market is expanding significantly in India with an upsurge in the number of liquid biopsy procedures performed in the country. According to the Indian Council of Medical Research, an estimated 1.46 million new cases of cancer were diagnosed in India in 2022. In India, 1 in 9 people are projected to receive a cancer diagnosis at a point in their lives. Breast cancer is the most common cancer in women, while lung cancer is the most common type in men. Lymphoid leukemia was found to be the most common type of cancer among children, affecting 29.2% of boys and 24.2% of girls from the age group of 0–14 years. Ongoing advancements such as enhanced detection techniques and more sensitive equipment are making liquid biopsy procedures more dependable and accessible. Moreover, the surging awareness of advantages of liquid biopsies, which include early detection, treatment efficacy monitoring, and recurrence prevention, is expected to benefit the market in developing countries such as India in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blood Collection Tubes for Liquid Biopsy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blood Collection Tubes for Liquid Biopsy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Blood Collection Tubes for Liquid Biopsy Market Drivers and Opportunities

Advantages of Liquid Biopsy over Other Diagnostic Testing Techniques Favor Market Growth

Invasive diagnostic procedures increase the risk of hematoma, hemorrhage, and tissue damage, seeding tumor cells in surrounding tissues. As a result, there is a growing preference for noninvasive or minimally invasive tests among patients for diagnostic purposes. Researchers can trace all genetic and epigenetic changes in solid tumors through the liquid biopsy of blood samples. Patients are at a lesser risk with liquid biopsies, since it is a noninvasive technique of diagnosis. Moreover, clinicians can readily conduct these tests multiple times, as the procedures don’t subject patients to much discomfort. Patients prefer minimally invasive procedures due to the use of advanced instruments, which allow clinicians or laboratory personnel to perform more delicate and complex work without causing much pain, scarring, and other risks. Liquid biopsy has recently gathered considerable interest as a noninvasive alternative to tissue biopsy in cancer patients, owing to technological advancements contributing to improved feasibility and reduced processing times.

Computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET) scan, among other imaging techniques, are expensive and time-consuming. Moreover, they expose patients to external radiation, intravenous contrast, and radioactive tracers, among others. Imaging studies also fail to provide any information about the phenotype of the tumor, which can change with the treatment given. Although tissue biopsy techniques can offer information on tumor phenotype, it is not feasible to perform serial tissue biopsies, considering cost limitations and risks to patients. Liquid biopsy, on the contrary, could provide a virtually continuous assessment of cancer burden and phenotype information at a relatively low cost. Liquid biopsy offers noninvasive or minimally invasive means of assessing various physiological or pathophysiological processes, thereby replacing tissue biopsy or other invasive procedures. Liquid biopsy, in this case, could circumvent the need for endoscopy, needle biopsy, or surgery by analyzing a blood sample for circulating tumor cells or circulating free nucleic acids.

Use of Liquid Biopsy in Cancer Monitoring to Offer Growth Opportunities for Market

Researchers are highly focused on exploring the ability of liquid biopsy procedures to monitor cancer growth, detect genetic mutations, identify the signs of relapse, and predict sensitivity to immunotherapy. The early detection of cancer results in better outcomes; for example, patients with early detection show higher remission and survival rates than those with late-stage or malignant cancer. However, it is impractical to perform serial radiological testing or invasive procedures for cancer surveillance to detect cancer in the early stages when symptoms are not evident. Liquid biopsy unlocks the possibility of periodic cancer screening through routine blood draws or urinalyses. It can identify highly specific and circulating markers for early cancer detection.

Liquid biopsy procedures are also employed for post-treatment monitoring of cancer patients. Cancer cells may persist in the body after treatment at levels below the resolution and detection levels of imaging studies; the condition is termed a minimal residual disease. This disease is considered a principal cause of cancer remission. Similar to that in cancer screening and early detection, the clinical application of liquid biopsy is limited by the sensitivity and specificity of current tests. This limitation in terms of sensitivity renders liquid biopsy techniques more suitable for detecting minimal residual disease for solid tumors than blood cancers. With the help of liquid biopsy, the healthcare professional can monitor the case of reoccurrence of cancer, which can then be treated early with the help of proper diagnosis.

Tumors that are initially susceptible to specific tyrosine kinase inhibitors, including gefitinib, erlotinib, crizotinib, and ceritinib, often mutate and develop resistance to these drugs. Liquid biopsy detects the changes in the tumor status and helps doctors modify the treatment strategies to avoid the development of resistance to any medication in the patient’s body. Thus, liquid biopsy allows the early detection of cancer and helps healthcare professionals determine the exact course of action for treatment. In addition, it helps monitor treatments and the condition of the patient after the treatment. Thus, there is an increase in focus on the use of liquid biopsy in the monitoring of cancer patients, which is likely to create a significant demand for blood collection tubes for liquid biopsy procedures during the forecast period.

Blood Collection Tubes for Liquid Biopsy Market Report Segmentation Analysis

Key segments that contributed to the derivation of the blood collection tubes for liquid biopsy market analysis are product, material, application, and end user.

- Based on product, the blood collection tubes for liquid biopsy market is divided into ccfDNA tubes, cfRNA tubes, CTC tubes, gDNA tubes, Intracellular RNA tubes, and others. The ccfDNA/cfDNA tubes segment held the largest market share in 2023.

- Based on material, the blood collection tubes for liquid biopsy market is divided into glass and plastic. The plastic segment held a larger market share in 2023.

- By application, the market is bifurcated into in-vitro diagnostics (IVD) and research. The in-vitro diagnostics (IVD) segment held a larger share of the market in 2023.

- Based on end user, the blood collection tubes for liquid biopsy market is divided into genetic diagnostic labs, R&D centers, conventional diagnostic centers, and others. The genetic diagnostic labs segment held the largest market share in 2023.

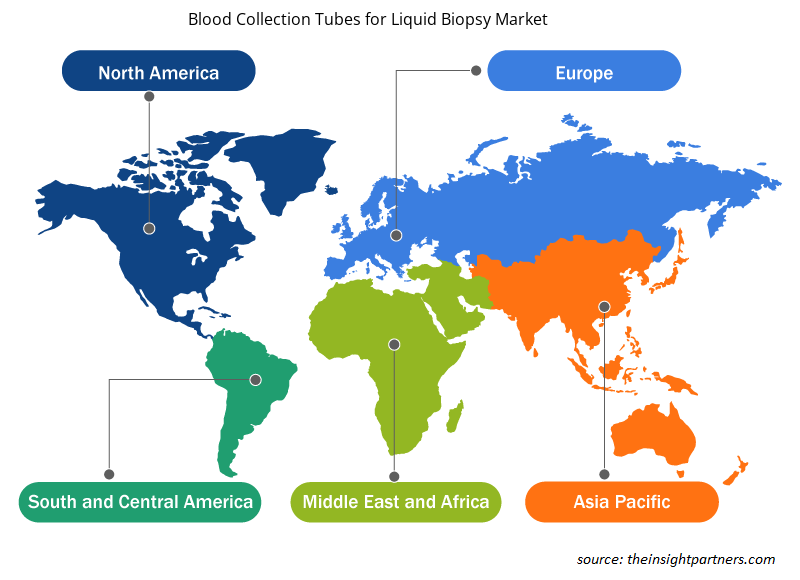

Blood Collection Tubes for Liquid Biopsy Market Share Analysis by Geography

The geographic scope of the blood collection tubes for liquid biopsy market report is mainly divided into five regions: North America, Asia Pacific, Europe, the South & Central America, and the Middle East & Africa. North America dominated the market in 2023. The burgeoning acceptance of technologically advanced products, a rise in research and development activities, the presence of large-scale healthcare businesses, and the increasing number of approvals from the FDA for liquid biopsy are among the key factors bolstering the blood collection tube for liquid biopsy market in North America. Asia Pacific is anticipated to register the highest CAGR during the forecast period. The market for liquid biopsy procedures is proliferating in the US with the surging prevalence of cancer, high spending on the development of innovative diagnostics solutions, and the presence of significant market players.

Blood Collection Tubes for Liquid Biopsy Market Regional Insights

The regional trends and factors influencing the Blood Collection Tubes for Liquid Biopsy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blood Collection Tubes for Liquid Biopsy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blood Collection Tubes for Liquid Biopsy Market

Blood Collection Tubes for Liquid Biopsy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 110.13 Million |

| Market Size by 2031 | US$ 428.66 Million |

| Global CAGR (2023 - 2031) | 18.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

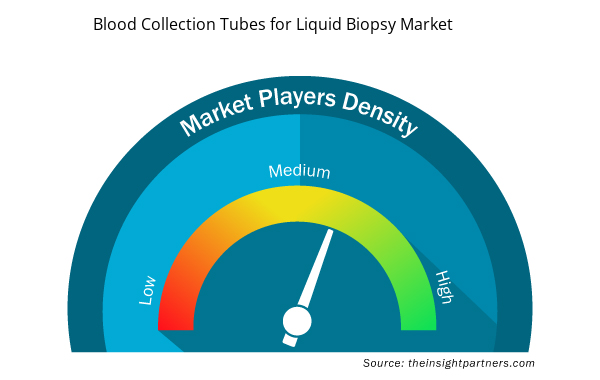

Blood Collection Tubes for Liquid Biopsy Market Players Density: Understanding Its Impact on Business Dynamics

The Blood Collection Tubes for Liquid Biopsy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blood Collection Tubes for Liquid Biopsy Market are:

- Biocept Inc

- F. Hoffmann-La Roche Ltd

- Streck Inc

- Norgen Biotek Corp

- Exact Sciences Corp

- MagBio Genomics Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blood Collection Tubes for Liquid Biopsy Market top key players overview

Blood Collection Tubes for Liquid Biopsy Market News and Recent Developments

The blood collection tubes for liquid biopsy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. One of the major developments in the market that took place in recent years is mentioned below:

- Exact Science Corporation announced its Haystack Oncology facility in Baltimore, Maryland. The new venture recently raised US$ 56 million in funding led by New York-based investment firm Catalio Capital Management. Haystack is developing a blood test that can detect trace amounts of circulating DNA from solid tumors, indicating the presence of cancer and its possible recurrence. (Source: Exact Science Corporation, Company Website, November 2022)

Blood Collection Tubes for Liquid Biopsy Market Report Coverage and Deliverables

The “Blood Collection Tubes for Liquid Biopsy Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Blood collection tubes for liquid biopsy market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Blood collection tubes for liquid biopsy market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Blood collection tubes for liquid biopsy market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the blood collection tubes for liquid biopsy market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Arterial Blood Gas Kits Market

- Small Molecule Drug Discovery Market

- Energy Recovery Ventilator Market

- Nuclear Waste Management System Market

- Health Economics and Outcome Research (HEOR) Services Market

- Architecture Software Market

- Saudi Arabia Drywall Panels Market

- Medical Enzyme Technology Market

- Digital Pathology Market

- Point of Care Diagnostics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Material, Application, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Biocept Inc, F. Hoffmann-La Roche Ltd; Streck Inc; Norgen Biotek Corp; Exact Sciences Corp; MagBio Genomics, Inc; Zymo Research Corporation; Apostle Sciences; QIAGEN NV; and Greiner Bio-One International GmbH are among the key players in the market.

The estimated value of the market would be US$ 428.66 million by 2031.

The market is expected to register a CAGR of 18.5% during 2023–2031.

Technological advancements in liquid biopsy would bring new growth trends in the market in the coming years.

North America dominated the market in 2023.

An increase in the prevalence of cancer and the advantages of liquid biopsy over other diagnostic testing techniques are among the most influential factors propelling the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Collection Tubes for Liquid Biopsy Market

- Biocept Inc

- F. Hoffmann-La Roche Ltd

- Streck Inc

- Norgen Biotek Corp

- Exact Sciences Corp

- MagBio Genomics, Inc

- Zymo Research Corporation

- Apostle Sciences

- QIAGEN NV

- Greiner Bio-One International GmbH

Get Free Sample For

Get Free Sample For