Blood Pressure Monitoring Devices Market Overview and Growth by 2030

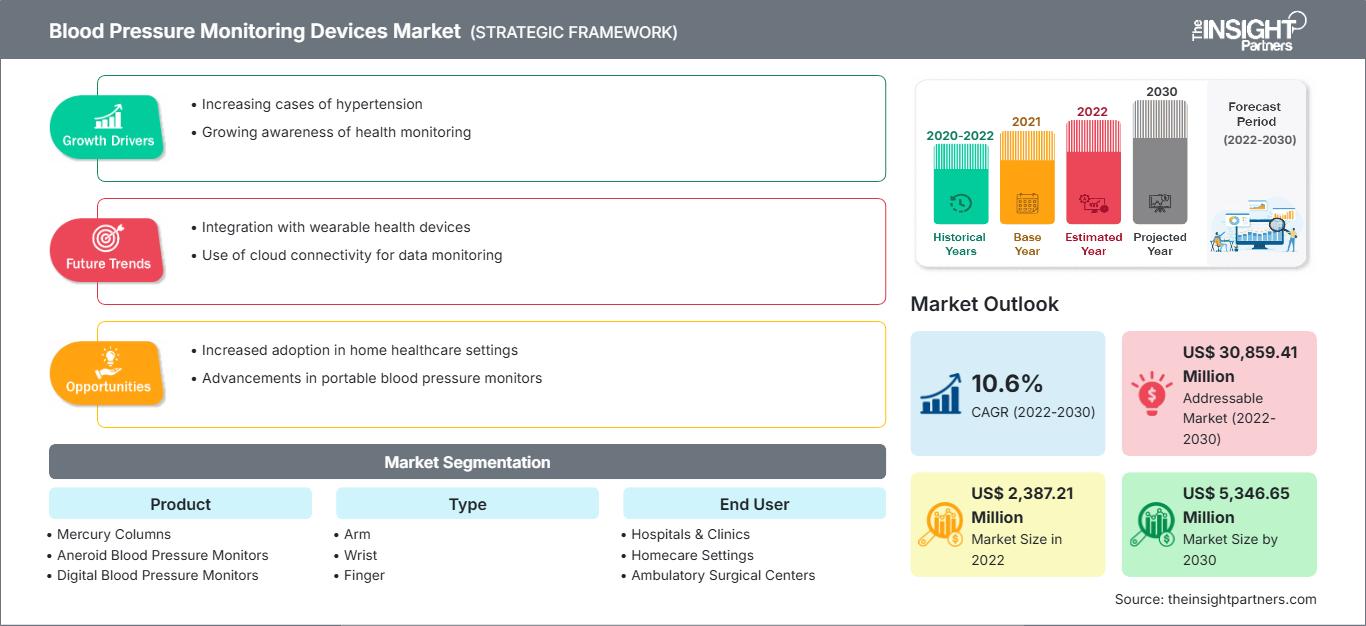

Historic Data: 2020-2022 | Base Year: 2022 | Forecast Period: 2022-2030Blood Pressure Monitoring Devices Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product (Mercury Columns, Aneroid Blood Pressure Monitors, and Digital Blood Pressure Monitors), Type (Arm, Wrist, Finger, and Others), End User (Hospitals & Clinics, Homecare Settings, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

- Report Date : Feb 2026

- Report Code : TIPMD00002666

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

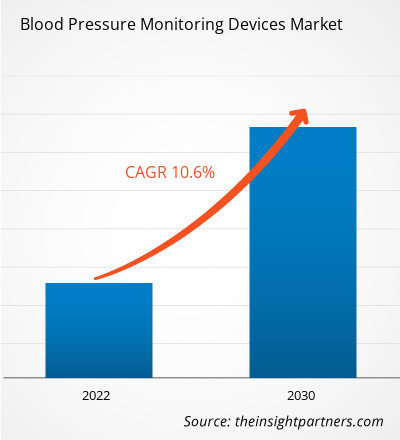

[Research Report] The blood pressure monitoring devices market size is projected to grow from US$ 2,387.21 million in 2022 to US$ 5,346.65 million by 2030; the market is estimated to record a CAGR of 10.6% during 2022–2030.

Market Insights and Analyst View:

Blood pressure monitoring devices determine hypertension in a patient’s body. Blood pressure is one of the major risk factors for strokes and chronic heart diseases, which are the principal cause of death around the world. In the last several years, there has been a surge in the use of blood pressure monitoring devices in home care settings. In addition, rising geriatric population, lifestyle changes, and technological advancements are among other notable growth enablers in the blood pressure monitoring devices market. These devices facilitate the early diagnosis of a patient’s deteriorating health condition. Moreover, advanced blood pressure monitoring devices developed for personal use help track patients’ health conditions remotely.

Growth Drivers:

Increase in Incidence of Cardiovascular Diseases Bolsters Blood Pressure Monitoring Devices Market Growth

In the last decade, the world has witnessed prominent developments in blood pressure monitoring devices, offering patients and physicians new methods to manage many diseases, including ventricular arrhythmias, atrial arrhythmias, and ventricular atrial fibrillation. The rising prevalence of cardiovascular diseases (CVDs) such as sudden cardiac arrest, coronary heart diseases, congenital heart diseases, pulmonary hypertension, heart failure, and pulmonary artery pressure (PA) favors the development of upgraded monitoring methods. The simplicity of use and the capability of quick detection of abnormalities are the key features of blood pressure monitoring devices. As per the World Health Organization (WHO), nearly 30 million people suffer stroke each year. The American Heart Association states that more than 130 million people in the US are estimated to have a type of CVD by 2035.

According to the European Society of Cardiology, atrial fibrillation is the most common arrhythmia, and it accounts for 0.28–2.6% of healthcare expenditure in European countries. It also stated that patients suffering from atrial fibrillation are at a 5-time greater risk of suffering a stroke, and 20–30% of total stroke cases in Europe are caused due to atrial fibrillation. According to a study conducted by the European Society of Cardiology in 2016, nearly 7.6 million people aged 65 and above suffered from atrial fibrillation in the EU, and the number is estimated to increase by 89% to reach ~14.4 million by 2060. The prevalence of atrial fibrillation is estimated to reach 9.5% by 2060 from 7.8% in 2016. According to the report named “The Impact of Atrial Fibrillation in Asia Pacific,” published by Biosense Webster in 2019, ~16 million people in Asia Pacific experience atrial fibrillation, and the number is predicted to reach nearly 72 million by 2050. This report also suggests that the middle-aged and geriatric population is at a greater risk of developing this condition.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blood Pressure Monitoring Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Blood Pressure Monitoring Devices Market” is segmented on the basis of product, type, and end users. Based on product, the market is segmented into mercury columns, aneroid blood pressure monitors, and digital blood pressure monitors. In terms of type, the blood pressure monitoring devices market is segmented into arm, wrist, finger, and others. On the basis of end user, the market is categorized into hospitals and clinics, home care settings, ambulatory surgical centers, and others.

Segmental Analysis:

Based on product, the blood pressure monitoring devices market is segmented into mercury columns, aneroid blood pressure monitors, and digital blood pressure monitors. In 2022, the digital blood pressure segment held a significant market share, and the same segment is estimated to register the fastest CAGR during 2022–2030. Digital blood pressure measuring devices are developed with excellence, and they are among the best blood pressure machines that deliver precise and accurate blood pressure and pulse readings. Digital monitors are preferred for measuring blood pressure. They are often easier to use than aneroid units. Digital monitors have a stethoscope and a gauge in a single unit, along with an error indicator. The blood pressure reading is displayed on a small screen; it may be easier to read than a dial. Digital monitors are suitable for hearing-impaired patients since there is no necessity to listen to heartbeats through stethoscopes.

Based on type, the blood pressure monitoring devices market is segmented into arm, wrist, finger, and others. In 2022, the arm segment held the largest share of the market and the same segment is estimated to register the fastest CAGR during 2022–2030. The finger-based blood pressure monitoring technology is similar to pulse oximetry, as it uses light that bounces off of the user’s finger to measure blood flow using a photoplethysmogram (PPG), which is interpreted with different algorithms. In May 2023, engineers at the University of California San Diego developed a simple, low-cost clip that uses a smartphone's camera and flash to monitor blood pressure at the user’s fingertip. The clip works with a custom smartphone app, and its production currently costs ~80 cents. The researchers estimate that the cost could be as low as 10 cents apiece when manufactured at scale. They claim that this device could help make regular blood pressure monitoring easy, affordable, and accessible to people in resource-poor communities. It could benefit older adults and pregnant women in managing conditions such as hypertension.

Based on end user, the blood pressure monitoring devices market is segmented into hospitals and clinics, home care settings, ambulatory surgical centers, and others. In 2022, the hospitals and clinics segment held a significant share of the market. The home care settings segment is estimated to register the fastest CAGR during 2022–2030. Hospitals and clinics are the primary healthcare providers in most countries. The American Heart Association, Inc. report states that the frequency of rhythm abnormalities in middle-aged to older adults is substantial. Atrial fibrillation, bradyarrhythmia, and conduction system diseases account for the majority of abnormal rhythm conditions. For example, cardiac arrhythmias affect at least 2.3 million people in the US, resulting in an increased risk of stroke and mortality. Additionally, 90,000 cases of supraventricular tachycardia are detected annually in the country, accounting for 25% of all emergency department visits for supraventricular tachycardia. An NCBI report states that 2,020 (36.1%) out of 5,585 hospital admissions for cardiac arrhythmias had concurrent arrhythmias. Thus, the rising number of multispecialty hospitals and people’s preference for hospitals and clinics over other healthcare facilities support the growth of the blood pressure monitoring devices market for this segment.

Regional Analysis:

Based on geography, the global blood pressure monitoring devices market is segmented into Asia Pacific, Europe, Middle East & Africa, North America, and South & Central America. In 2022, North America held the largest share of the global blood pressure monitoring devices market. Asia Pacific is expected to register the highest CAGR during 2022–2030.

The blood pressure monitoring devices market in North America is split into the US, Canada, and Mexico. The growth of the market in this region is attributed to factors such as an increase in the incidence of cardiac diseases and the ongoing R&D to build novel sensor-based patient monitoring systems. Moreover, many major companies in the blood pressure monitoring devices market are headquartered in the region, which favors the market expansion across the region.

The US is the largest contributor to the blood pressure monitoring devices market in North America and the world. Coronary heart disease is a primary cause of death in the US. As the US is the largest economy in North America and the world, the country's population trend has a significant impact on the regional market, both positively and negatively. The growing geriatric population indicates the use of a large number of patient monitoring equipment in the country.

Blood Pressure Monitoring Devices Market Regional InsightsThe regional trends and factors influencing the Blood Pressure Monitoring Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Blood Pressure Monitoring Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Blood Pressure Monitoring Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,387.21 Million |

| Market Size by 2030 | US$ 5,346.65 Million |

| Global CAGR (2022 - 2030) | 10.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Blood Pressure Monitoring Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Blood Pressure Monitoring Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Blood Pressure Monitoring Devices Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by leading players operating in the blood pressure monitoring devices market are listed below:

- In January 2023, Valencell launched its own branded product line in the Digital Health segment. The company’s first product candidate focuses on helping patients monitor and manage hypertension using an intuitive app combined with an innovative OTC device to precisely measure blood pressure from the finger without a cuff or calibration.

- In Oct 2022, OMRON Healthcare upgraded its portfolio of blood pressure monitors by converting them into “connected” devices. This major upgrade in the portfolio was meant to help users and healthcare practitioners gain seamless, effortless, more real-time, and accurate control over hypertension management. The connected devices allow the blood pressure data to transfer effortlessly through the OMRON Connect application (app).

Competitive Landscape and Key Companies:

Omron Healthcare Welch Allyn, Inc., A&D Medical Inc., SunTech Medical, Inc., American Diagnostics Corp., Withings, GE Healthcare, Microlife AG, GF Health Products, Inc., Spacelabs Healthcare, and Baxter are the prominent blood pressure monitoring devices market companies. These companies focus on new technologies, existing products advancements, and geographic expansions to meet the burgeoning consumer demand worldwide.

Frequently Asked Questions

Which segment is dominating the Blood Pressure Monitoring Devices Market?

Who are the major players in the Blood Pressure Monitoring Devices Market?

What is Blood Pressure Monitoring Devices Market?

What are the driving factors for the Blood Pressure Monitoring Devices Market?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For