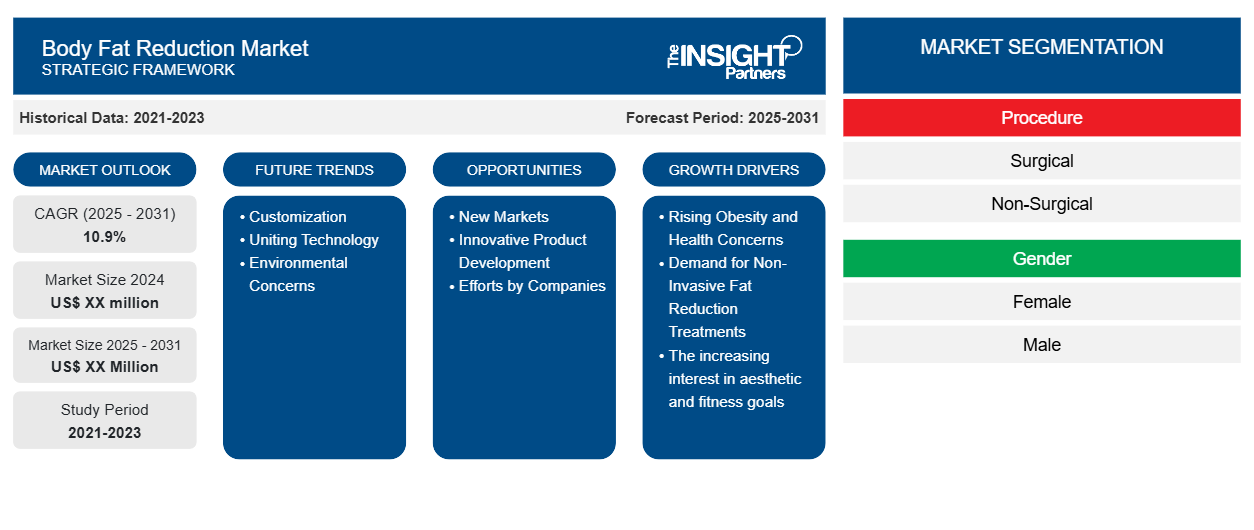

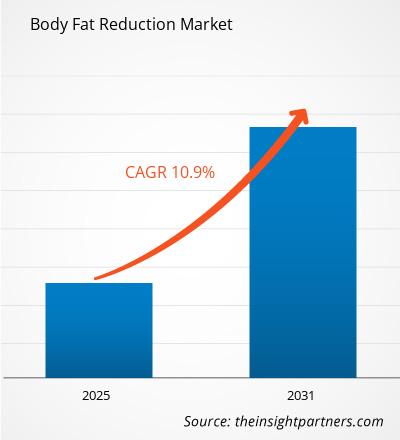

The Body Fat Reduction Market is expected to register a CAGR of 10.9% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Procedure (Surgical, Non-Surgical). The report further presents analysis based on Gender(Female, Male). The report is further segmented based on Service Provider (Hospitals & Clinics, Medical Spas, Others). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments.

Purpose of the Report

The report Body Fat Reduction Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Body Fat Reduction Market Segmentation

Procedure

- Surgical

- Non-Surgical

Gender

- Female

- Male

Service Provider

- Hospitals & Clinics

- Medical Spas

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Body Fat Reduction Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Body Fat Reduction Market Growth Drivers

- Rising Obesity and Health Concerns: The growing rates of obesity globally and subsequently the other problems such as heart disease, diabetes, and hypertension have prompted the growth in demand for body fat reduction solutions. As a result of health improvement or weight management needs, there is a gradual growth in demand for body fat reduction treatments, which involves non-invasive methods for fat reduction treatments and weight-loss products.

- Demand for Non-Invasive Fat Reduction Treatments: Rising demand for non-invasive cosmetic procedures has seen the demand for body fat reduction solutions like cryolipolysis, laser therapy, and injection-based treatments skyrocket. Solutions that promise fat loss without surgery attract those with visible results with minimal downtime, contributing to growth in this market.

- The increasing interest in aesthetic and fitness goals: The upsurge in culture of fitness and awareness regarding the body image is urging people to remove body fat stubbornly for aesthetically good reasons. This shift in consumer behavior, with the increasing popularity of social media influencers who propagate the message of body positivity and fitness, has increased demand for products and treatments in body fat reduction, which fuels market growth.

Body Fat Reduction Market Future Trends

- Customization: In recent times, there has been a rise in the popularity of weight loss solutions that are customized for the individual. More and more, people are seeking out specific programs that take into account their individual body structure, metabolism, and lifestyle. This will be a factor in growing the market for dietary and exercise specification development.

- Uniting Technology: The trend of utilizing applications and gadgets for fitness and nutrition tracking is ever-evolving. It is expected that the advent of these technologies will assist individuals in keeping track of their performance and, more importantly, provide the necessary motivation for individuals to cut down on fat.

- Environmental Concerns: New-age consumers are more concerned with the environment, and thus, there is an apparent shift towards the use of sustainable and ethically sourced products in the health and wellness industry. That includes wanting dietary supplements with naturally sourced ingredients and encouraging sustainable ways of keeping fit.

Body Fat Reduction Market Opportunities

- New Markets: Developing Nations: There is considerable potential for growth in developing countries as demand for body fat reduction products and services increases with improving disposable incomes and health consciousness. This trend, combined with improving access to health services, presents a lucrative opportunity for companies to enter untapped regions with tailored offerings.

- Innovative Product Development: Corporations that dedicate funds for innovative weight loss remedies research breakthroughs like new dietary supplements or advanced medical procedures stand to gain larger market share. Breakthroughs in research can lead to the development of effective, targeted solutions that address diverse consumer needs, from natural fat reduction to non-invasive treatments, driving sustained growth and brand loyalty in the competitive weight loss industry.

- Efforts by Companies: Strategic alliances of fitness centers, health food retail businesses, and technology firms are able to offer an integrated package that increases customer interaction and satisfaction, and hence the increased level of market penetration. Therefore, developing an integrated package of fitness and nutrition products to offer customers smart technology for tracking progress enables companies to engage with customers and increase their market penetration to pave the way for long-term prosperity in weight loss.

Body Fat Reduction Market Regional Insights

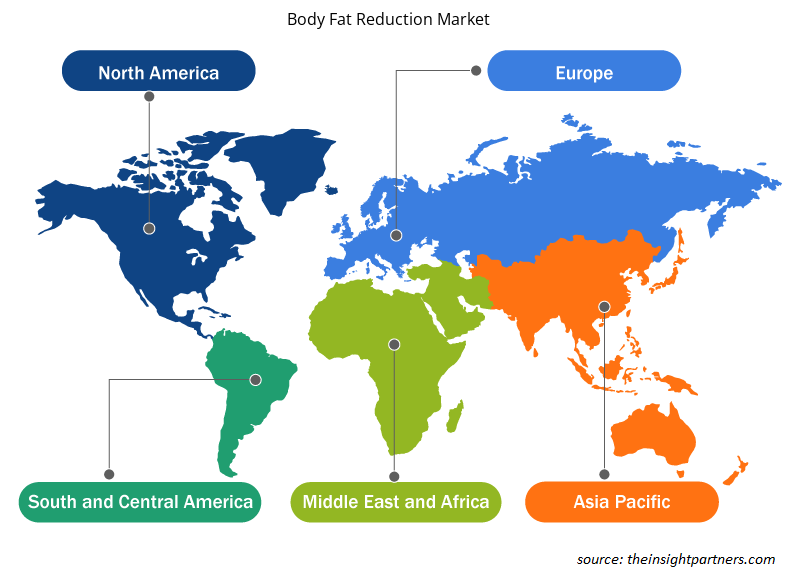

The regional trends and factors influencing the Body Fat Reduction Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Body Fat Reduction Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Body Fat Reduction Market

Body Fat Reduction Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Procedure

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

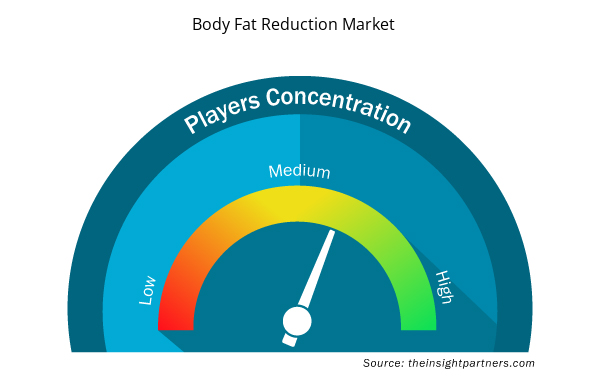

Body Fat Reduction Market Players Density: Understanding Its Impact on Business Dynamics

The Body Fat Reduction Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Body Fat Reduction Market are:

- Amirlak Plastic Surgery

- Apollo Cosmetic Clinics

- JK Plastic Surgery Center

- VLCC Welness and beauty

- The Plastic Surgery Clinic

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Body Fat Reduction Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Body Fat Reduction Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Body Fat Reduction Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The surgical segment accounts for the highest revenue in procedure segment of the body fat reduction market in 2023.

Amirlak Plastic Surgery, Apollo Cosmetic Clinics, JK Plastic Surgery Center, VLCC Welness and beauty, The Plastic Surgery Clinic, The Piazza Center for plastic surgery and advanced skin care, Transform Cosmetic Surgery, Waldman Schantz Plastic Surgery Center, Lumenis, Ultrashape Ltd are some of the major players operating in the market.

North America region dominated the body fat reduction market in 2023.

Asia Pacific region has the highest CAGR of the body fat reduction market.

The Body Fat Reduction Market is estimated to witness a CAGR of 10.9% from 2023 to 2031

The major factors driving the body fat reduction market are:

1. Rising Obesity Rate.

2. Health and Wellness.

3. Advancements in Technology.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Amirlak Plastic Surgery

2. Apollo Cosmetic Clinics

3. JK Plastic Surgery Center

4. VLCC Welness and beauty

5. The Plastic Surgery Clinic

6. The Piazza Center for plastic surgery and advanced skin care

7. Transform Cosmetic Surgery

8. Waldman Schantz Plastic Surgery Center

9. Lumenis

10. Ultrashape Ltd

Get Free Sample For

Get Free Sample For