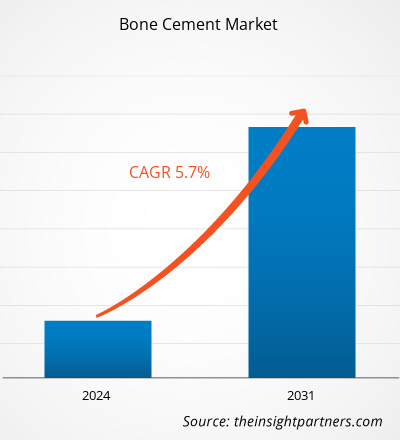

The bone cement market size is projected to reach US$ 1.92 billion by 2031 from US$ 1.23 billion in 2023. The market is expected to register a CAGR of 5.70% during 2023–2031. Antibiotic-loaded bone cement is likely to remain a key trend in the market.

Bone Cement Market Analysis

The competition between current suppliers will strengthen due to the increased focus on developing bone cement with superior features, high quality, and safety, such as antibiotic-loaded bone cement for arthroplasty and orthopedic joint fixations. Furthermore, the market is expanding because of the growing acceptance of procedures like kyphoplasty, arthroplasty, and vertebroplasty, which should significantly boost market growth. Additionally, the market is expected to expand due to the rising need for orthopedic bone cement and casting materials, particularly among older people.

Bone Cement Market Overview

The high frequency of osteoporosis, the rising need for kyphoplasty, arthroplasty, and vertebroplasty, and the sharply increasing aging population all contribute to the market's expansion. Furthermore, the companies have facilitated their growth through various inorganic and organic development initiatives. Companies have been using various organic strategies to expand their businesses, such as product launches. Businesses have used inorganic tactics such as partnerships, mergers, and acquisitions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bone Cement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bone Cement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Bone Cement Market Drivers and Opportunities

Rising Prevalence of Osteoporosis Leads to Increase in Arthroplasty, Kyphoplasty, and Vertebroplasty Procedures Favors the Market Growth

The risk of fractures is increased by osteoporosis. Osteoporosis cases have increased in the last few years. For instance, the International Osteoporosis Foundation states that almost one in two of the women surveyed had experienced an osteoporosis-related fracture, making these fractures a severe health concern, and approximately four million people in the UK have osteoporosis.

Significant Opportunities in Developing Regions

Increases in kyphoplasty, arthroplasty, and vertebroplasty surgeries are anticipated to increase bone cement sales. Prominent industry participants augment their manufacturing capabilities and broaden their distribution networks to enhance their market share in developing economies. For significant bone producers of cement, emerging markets in South Korea, Mexico, Brazil, and India are anticipated to present growth prospects. The aging population, high osteoporosis prevalence, rising disposable income, better healthcare systems, and the expansion of medical tourism in these nations create lucrative opportunities. Asia Pacific has developed into a hub that is flexible and friendly to business. Most participants are turning their attention to emerging markets as the US and European markets mature. Upgrading the newest technologies in emerging nations largely depends on significant health and life sciences research investments. This, in turn, reinforces the propensity to use bone cement.

Bone Cement Market Report Segmentation Analysis

Key segments that contributed to the derivation of the bone cement market analysis are type, application, and end user.

- Based on type, the bone cement market is divided into polymethyl methacrylate (PMMA) cement, calcium phosphate cement (CPC), and glass polyalkenoate cement (GPC). The polymethyl methacrylate (PMMA) cement segment held the most significant market share in 2023.

- By application, the market is categorized into arthroplasty, kyphoplasty, and vertebroplasty. The arthroplasty segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, ambulatory surgery centers (ASCS), and clinics. The hospitals segment held the largest share of the market in 2023.

Bone Cement Market Share Analysis by Geography

The geographic scope of the bone cement market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The market for bone cement in the US holds the largest share among the countries of North America. The growing incidence of osteoporosis is the main factor propelling this market's expansion. Numerous partnerships and joint ventures aimed at growing the US market for bone cement have been reported in recent years. For example, the Kyphon Products Division, a division of Medtronic's Spinal and Biologics business, has achieved a significant milestone by introducing KYPHON ActivOs 10 Bone Cement with Hydroxyapatite in the US market. With the release of this product, Medtronic's cement portfolio now gives surgeons an alternative for treating patients with vertebral compression fractures (VCFs). Therefore, the US's recent introduction of the bone cement market will probably help the nation's growth.

Numerous Canadian businesses are implementing diverse approaches to expand the bone cement industry. The market players have implemented various sustainable strategies, including product launches, geographic expansion, mergers and acquisitions, and strategic collaboration. Stryker, for example, introduced simplex Bone Cement to fix implants in various orthopedic and trauma surgeries.

Bone Cement Market Regional Insights

The regional trends and factors influencing the Bone Cement Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Bone Cement Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Bone Cement Market

Bone Cement Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.23 Billion |

| Market Size by 2031 | US$ 1.92 Billion |

| Global CAGR (2023 - 2031) | 5.70% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

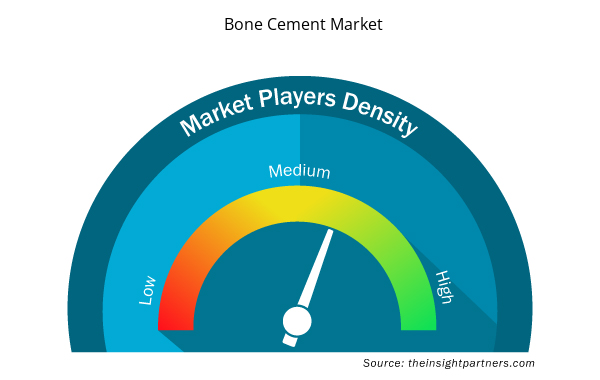

Bone Cement Market Players Density: Understanding Its Impact on Business Dynamics

The Bone Cement Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Bone Cement Market are:

- Zimmer Biomet

- DePuy Synthes

- Smith & Nephew

- DJO Global, Inc

- Arthrex, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Bone Cement Market top key players overview

Bone Cement Market News and Recent Developments

The bone cement market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the bone cement market are listed below:

- OsteoRemedies(R) LLC, an orthopedic company focused on providing simple solutions to complex disorders, has announced FDA clearance for expanded indications for the SPECTRUM(R) GV Bone Cement. The expanded indication covers the fixation of revision hip arthroplasty components, implanted in the second stage of a two-stage revision after the initial infection has been cleared. (Source: OsteoRemedies(R) LLC, Press Release, April 2024)

- Zimmer Biomet won a U.S. International Trade Commission case in which it was accused of stealing Heraeus trade secrets for bone cement, the compound used to fill the gap between an artificial joint and a bone. The commission rejected Heraeus Holding request to block the imports of Refobacin bone cements made in France that competes with Heraeus 's PALACOS product. (Source: Zimmer Biomet, Press Release, January 2021)

Bone Cement Market Report Coverage and Deliverables

The “Bone Cement Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Bone cement market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Bone cement market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Bone cement market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Bone cement market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the bone cement market in 2023

Key factors driving the market are the rising prevalence of osteoporosis, which leads to an increase in arthroplasty, kyphoplasty, and vertebroplasty procedures and growing demand for arthroplasty procedures.

Growing emphasis on adopting novel drug delivery systems is likely to remain a key trend in the market.

Zimmer Biomet, DePuy Synthes, Smith & Nephew, DJO Global, Inc, Arthrex, Inc, Tecres S.p.A, Heraeus Holding GmbH, Cardinal Health Inc., Teknimed, Stryker Corporation

The market is expected to register a CAGR of 5.7% during 2023–2031.

Get Free Sample For

Get Free Sample For