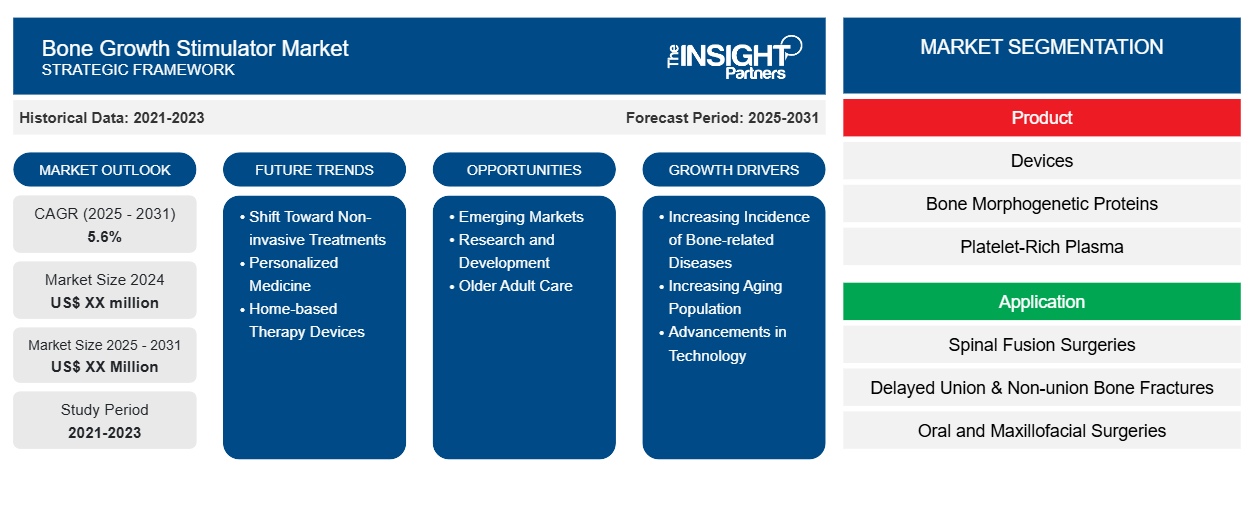

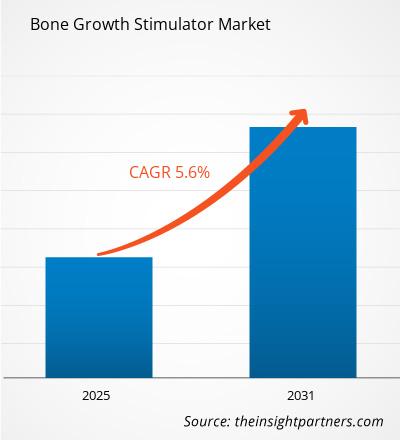

The Bone Growth Stimulator Market is expected to register a CAGR of 5.6% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Product {Devices [External Bone Devices, (Ultrasonic Bone Growth Stimulators, Implantable Bone Growth Stimulators)], Bone Morphogenetic Proteins, and Platelet-Rich Plasma}, Application (Spinal Fusion Surgeries, Delayed Union & Non-union Bone Fractures, Oral and Maxillofacial Surgeries, and Others), End User (Hospitals & Specialized Clinics, Ambulatory Surgery Centers, and Others)

Purpose of the Report

The report Bone Growth Stimulator Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Bone Growth Stimulator Market Segmentation

Product

- Devices

- Bone Morphogenetic Proteins

- Platelet-Rich Plasma

Application

- Spinal Fusion Surgeries

- Delayed Union & Non-union Bone Fractures

- Oral and Maxillofacial Surgeries

End User

- Hospitals & Specialized Clinics

- Ambulatory Surgery Centers

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bone Growth Stimulator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Bone Growth Stimulator Market Growth Drivers

- Increasing Incidence of Bone-related Diseases: The increasing occurrence of osteoporosis, arthritis, and bone fractures is boosting the need for bone growth stimulators as alternative treatments.

- Increasing Aging Population: As the population ages, there is a higher vulnerability to bone disorders and injuries, creating a greater demand for effective orthopedic treatments, including bone growth stimulators.

- Advancements in Technology: The rising preference for minimally invasive surgeries is driving the need for bone growth stimulators, as they can aid in faster recovery.

Bone Growth Stimulator Market Future Trends

- Shift Toward Non-invasive Treatments: There is a noticeable trend towards non-invasive and safer alternatives to traditional surgical options, shifting interest in non-surgical stimulators.

- Personalized Medicine: The trend towards tailored treatment plans and personalized medicine means that clinicians are increasingly considering bone growth stimulators as part of custom approaches to patient care

- Home-based Therapy Devices: The rise of portable, user-friendly home therapy devices is changing how patients use bone growth stimulators, making them more accessible.

Bone Growth Stimulator Market Opportunities

- Emerging Markets: The emerging markets show significant growth potential as access to orthopedic care improves, driven by rising incomes and healthcare infrastructure development.

- Research and Development: Continuous research and development can lead to the introduction of innovative products to the market. These may include novel materials and technologies that enhance the effectiveness of bone growth stimulators.

- Older Adult Care: With the global population aging, there are increasing opportunities to develop specialized products or programs targeting older adults. These are aimed at improving recovery outcomes and quality of life.

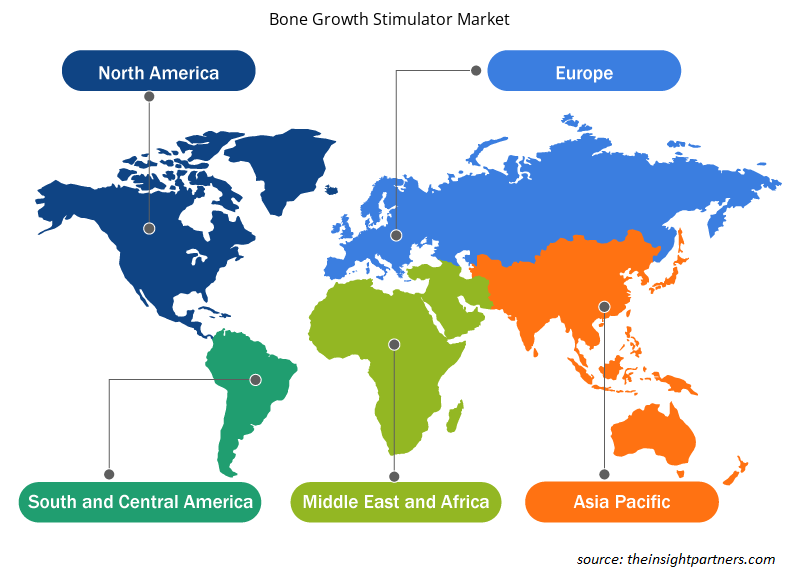

Bone Growth Stimulator Market Regional Insights

The regional trends and factors influencing the Bone Growth Stimulator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Bone Growth Stimulator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Bone Growth Stimulator Market

Bone Growth Stimulator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

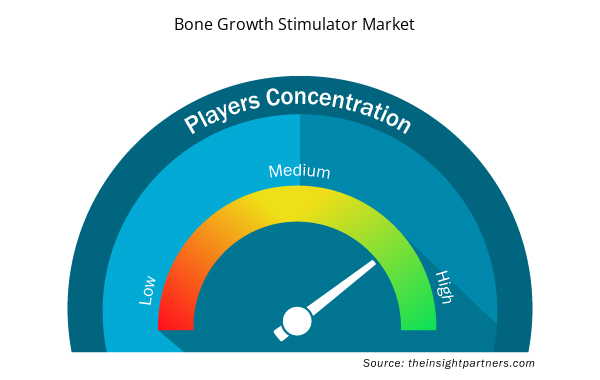

Bone Growth Stimulator Market Players Density: Understanding Its Impact on Business Dynamics

The Bone Growth Stimulator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Bone Growth Stimulator Market are:

- Zimmer Biomet

- DJO, LLC

- Arthrex, Inc.

- Smith & Nephew

- Orthofix Holdings, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Bone Growth Stimulator Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Bone Growth Stimulator Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Bone Growth Stimulator Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Bathroom Vanities Market

- Small Internal Combustion Engine Market

- Ceramic Injection Molding Market

- Lyophilization Services for Biopharmaceuticals Market

- Cling Films Market

- Rugged Phones Market

- Mobile Phone Insurance Market

- Saudi Arabia Drywall Panels Market

- Point of Care Diagnostics Market

- Personality Assessment Solution Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The bone growth stimulator market is estimated to grow with a CAGR of 5.6% from 2023 to 2031.

Asia Pacific region is likely to witness fastest growth rate during the forecast period.

The market drivers include Increasing Incidence of Bone-related Diseases and Increasing Aging Population are driving the bone growth stimulator market

The bone growth stimulator market majorly consists of the players such as Zimmer Biomet, DJO, LLC, Arthrex, Inc. among others.

Shift Toward Non-invasive Treatments are likely to remain the key trend during the forecast period

North America dominated the bone growth stimulator market in 2023

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Zimmer Biomet

2. DJO, LLC

3. Arthrex, Inc.

4. Smith & Nephew

5. Orthofix Holdings, Inc.

6. Ossatec Benelux BV

7. elizur Corporation

8. Medsource, LLC

9. Regen Lab SA

10. Ito Co., Ltd.

11. Bioventus LLC

12. Harvest Technologies Corporation

13. DePuy Synthes

14. Stryker

15. Altis Biologics

16. Medtronic

17. Johnson & Johnson Services, Inc.

Get Free Sample For

Get Free Sample For