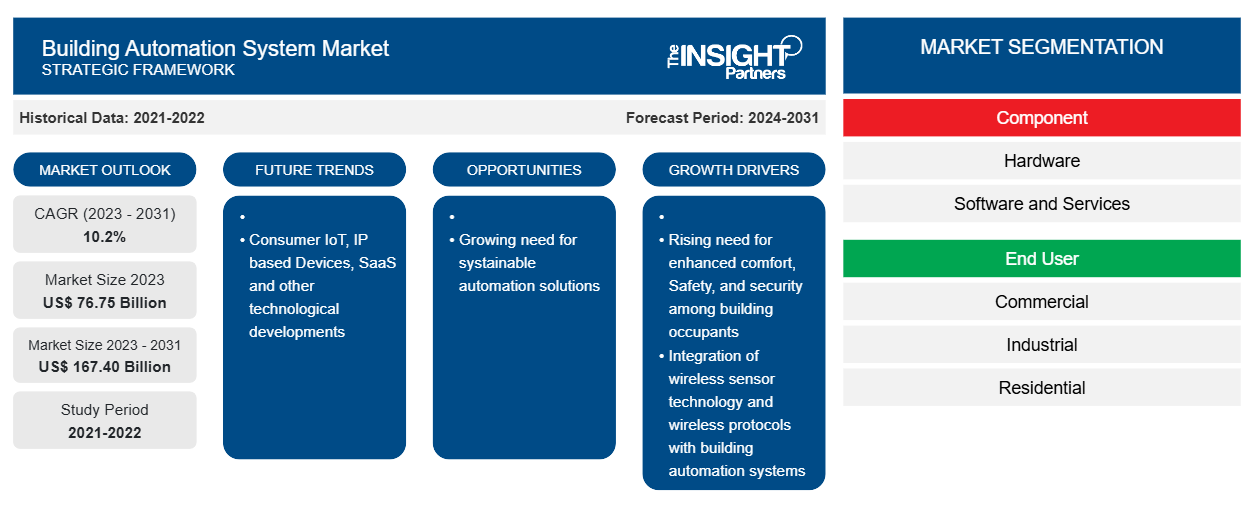

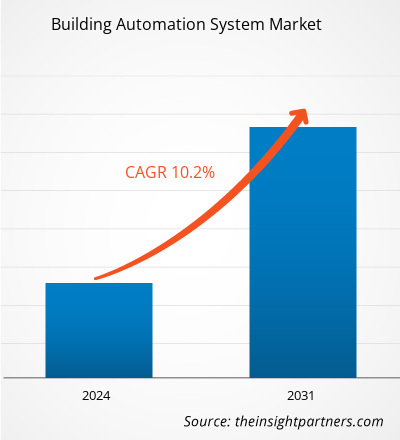

The building automation system market size is projected to reach US$ 167.40 billion by 2031 from US$ 76.75 billion in 2023. The market is expected to register a CAGR of 10.2% during 2023–2031. Consumer IoT, IP-based devices, SaaS, and other technological developments are likely to remain the key trends in the market.

Building Automation System Market Analysis

The growing construction activities and increasing demand for smart buildings worldwide are the major factors fueling the market growth. Building automation systems use sophisticated sensors, actuators, and networking technologies to provide centralized control and monitoring of building systems, such as HVAC, lighting, security, access control, and energy management. These technologies are designed to maximize building efficiency, lower energy usage, simplify facility management procedures, and guarantee adherence to regulations and standards, further raising its demand in the building automation system market. The rising technological advancements, such as the integration of IoT, IP-based devices, SaaS, machine learning, and other technologies, are also expected to bring new trends in the coming years.

Building Automation System Market Overview

A building automation system (BAS) enables an operator to access, control, and monitor all connected building systems via a single interface. BAS technology allows an owner to use networked electronic devices to obtain centralized management over the operations of their building. To maintain occupant comfort, the systems control ventilation, humidity, lighting, and temperature. Occupancy sensors and scheduling help to minimize energy waste by modifying environmental systems while not in use. Additionally, it ensures that every system is running at optimal efficiency and accurately. Operators are notified by sensors when preventative maintenance is necessary. The building's fire, access, and surveillance systems are all integrated to protect the safety of the building and its people.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Building Automation System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Building Automation System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Building Automation System Market Drivers and Opportunities

Growing Need for Enhanced Comfort, Safety, and Security

Building automation systems improve a building's security system by offering cutting-edge instruments and techniques. It provides better security to the building's occupants and helps to protect assets, corporate resources, property, and IT data. In addition to preventing property damage and theft, the system may guard against employee tampering and theft. The elevator access control system in the building restricts access to select floors and regions within the building that the management staff deems restricted. In addition, the system guards against security breaches and allows temporary traffic to be directed within the facility. Only authorized personnel are granted access through the use of time and day scheduling constraints in access control management. Furthermore, every activity occurring on the property grounds and within the building is recorded and stored by access control software. Moreover, the system can also be programmed to detect possible safety issues, such as gas leaks or fires, and take appropriate action to limit these risks.

Growing Need for Sustainable Building Automation Solutions

Sustainable buildings aim to minimize energy consumption and carbon emissions. BAS can monitor, control, and optimize HVAC, lighting, and other systems based on occupancy and environmental conditions. With an increasing shift toward renewable energy sources, such as solar and wind, BAS can intelligently manage the integration and utilization of these sources within building operations, ensuring optimal energy use and substantial cost savings. BAS provides real-time data on energy usage and environmental metrics, facilitating informed decision-making for energy conservation strategies and compliance with sustainability standards and regulations. Sustainable buildings prioritize occupant comfort and health. BAS can maintain indoor air quality, regulate temperature, and optimize natural lighting, contributing to enhanced occupant satisfaction and productivity. Also, sustainable BAS solutions result in cost savings due to reduced energy expenses, lower maintenance needs, and prolonged equipment life, making them financially attractive for building owners and operators. The use of sustainable solutions aligns with global sustainability goals, improving energy efficiency, enhancing occupant comfort, and offering significant economic benefits for building owners and operators. Thus, the growing need for sustainable building automation solutions across industries is expected to create significant opportunities for the building automation market growth during the forecast period.

Building Automation System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the building automation system market analysis are component and end users.

- Based on component, the market is segmented into hardware and software and services. The hardware segment held a larger market share in 2023. Building automation hardware uses sensors and controls to monitor and adjust a building's utilities, namely, electricity, heating and air-conditioning, and water and sewer. The hardware components of building automation systems include thermostats (used to control room temperature), occupancy sensors (used to control lighting), humidity sensors, fire and smoke detectors, and security and surveillance systems. The market for the hardware segment is further segmented into security and surveillance systems, facility management systems, fire protection systems, and others. Various companies offering building automation hardware include Bosch Sicherheitssysteme GmbH, Lutron Electronics Co. Inc, and Trane.

- Based on end user, the market is segmented into commercial, industrial, and residential. The commercial segment dominated the market in 2023. In commercial buildings, BAS is implemented to manage internal temperatures and lighting based on occupancy, time of year, or other significant parameters. Building control systems regulate the operations of heating and cooling equipment and lighting systems to maintain a conducive environment to stimulate the production of personnel appointed in the facility while also conserving energy when certain areas are not in use. In addition, using a commercial BAS proves to be beneficial for maintenance and administration workers. The team is notified upon the detection of abnormalities as system and component performance are regularly monitored.

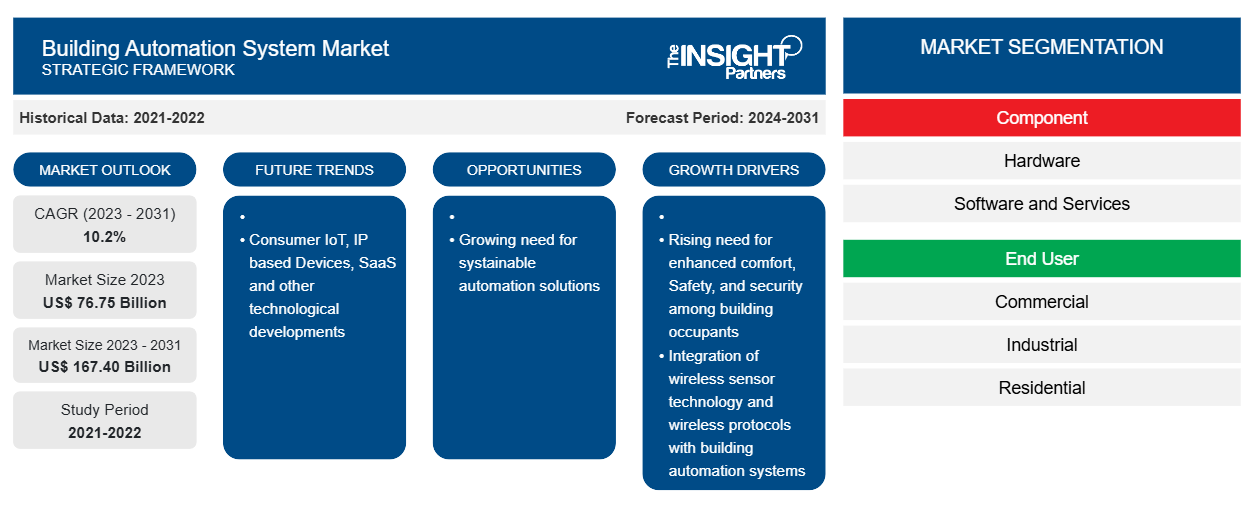

Building Automation System Market Share Analysis by Geography

The geographic scope of the building automation system market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held the largest share of the building automation system market in 2023, followed by Europe and Asia Pacific. The North America market is likely to grow during the forecast period due to an increase in construction activity across the region and the economic growth of several states. Building automation systems are widely used to achieve energy efficiency, as this directly correlates with financial savings. Countries such as the US and Canada are building smart cities at a rapid pace, which is expected to provide an opportunity for the growth of the building automation system market during the forecast period.

The construction industry has experienced tremendous growth in Europe, mainly in terms of new construction, which is expected to bolster the building automation system market in the region. The construction industry in Europe plays an important role in the economy, employing ~18 million people in the workforce and contributing to 9% of the total GDP of the European Union. The industry is focused on creating new residential, industrial, and commercial facilities, building infrastructure, and maintaining and repairing mature structures and buildings. Governments of various countries in Europe are increasingly involved in initiating various major construction projects, which is expected to boost the adoption of building automation systems in the European Union in the coming years.

Building Automation System Market Regional Insights

The regional trends and factors influencing the Building Automation System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Building Automation System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Building Automation System Market

Building Automation System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 76.75 Billion |

| Market Size by 2031 | US$ 167.40 Billion |

| Global CAGR (2023 - 2031) | 10.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Building Automation System Market Players Density: Understanding Its Impact on Business Dynamics

The Building Automation System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Building Automation System Market are:

- ABB Ltd

- Mitsubishi Electric Corporation

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc

- Schneider Electric

- Siemens AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Building Automation System Market top key players overview

Building Automation System Market News and Recent Developments

The building automation system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the building automation system market are listed below:

- Honeywell and Analog Devices, Inc. announced at CES 2024 that they have entered into a Memorandum of Understanding to explore the digitization of commercial buildings by upgrading to digital connectivity technologies without replacing existing wiring, which will help reduce cost, waste, and downtime. The strategic alliance would bring this new technology to building management systems for the first time.

(Source: Honeywell International Inc., Press Release, January 2024)

- Siemens Smart Infrastructure has launched Connect Box, an open and easy-to-use IoT solution designed to manage small to medium-sized buildings. The latest addition to the Siemens Xcelerator portfolio, Connect Box, is a user-friendly approach for monitoring building performance, with the potential to optimize energy efficiency by up to 30 percent and to substantially improve indoor air quality in small to medium-sized buildings such as schools retail shops, apartments or small offices. Siemens Xcelerator is an open digital business platform that enables customers to accelerate their digital transformation easier, faster and at scale.

(Source: Siemens, Press Release, March 2023)

Building Automation System Market Report Coverage and Deliverables

The “Building Automation System Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Building automation system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Building automation system market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Building automation system market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the building automation system market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Equipment Rental Software Market

- Occupational Health Market

- Battery Testing Equipment Market

- Dropshipping Market

- Drain Cleaning Equipment Market

- Emergency Department Information System (EDIS) Market

- Collagen Peptides Market

- Aerospace Forging Market

- Underwater Connector Market

- Automotive Fabric Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is anticipated to expand at a CAGR of 10.2% during 2023-2031.

Honeywell International Inc., Schneider Electric, Johnson Controls, ABB, and Siemens are major players in the market.

The market is expected to reach a value of US$ 167.40 billion by 2031.

North America dominated the building automation system market in 2023.

Consumer IoT, IP-based devices, SaaS, and other technological developments a key trend in the market.

The rise in need for enhanced comfort, safety, & security among building occupants and the integration of wireless sensor network technology & wireless protocols with building automation systems are driving the market growth.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Building Automation System Market

- ABB Ltd

- Mitsubishi Electric Corp

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc

- Schneider Electric SE

- Siemens AG

- Johnson Controls International Plc

- Carrier Global Corp

- Lutron Electronics Co., Inc

- Trane Technologies Plc

Get Free Sample For

Get Free Sample For