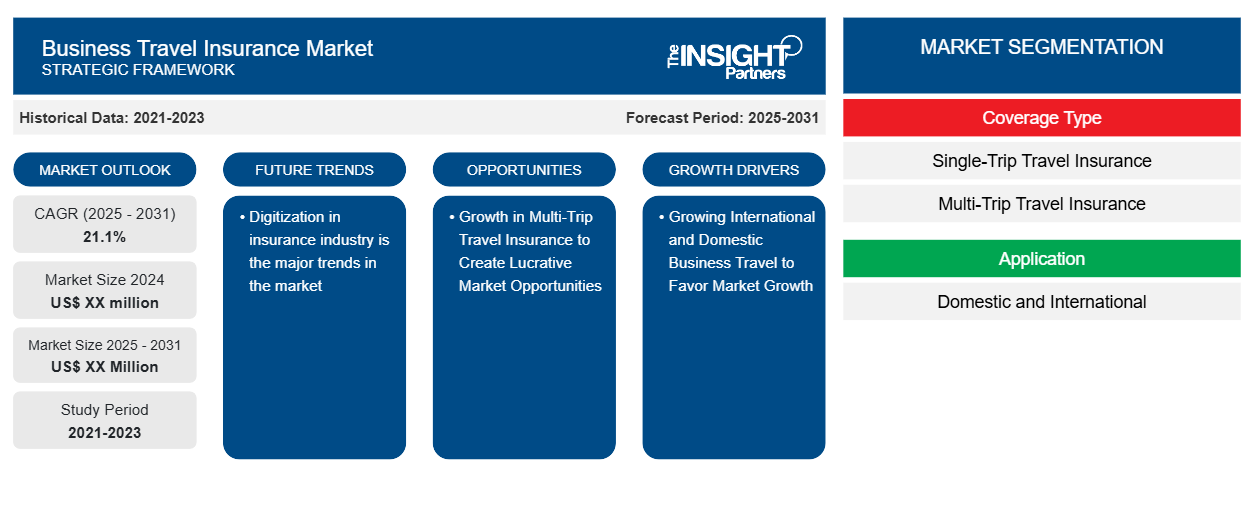

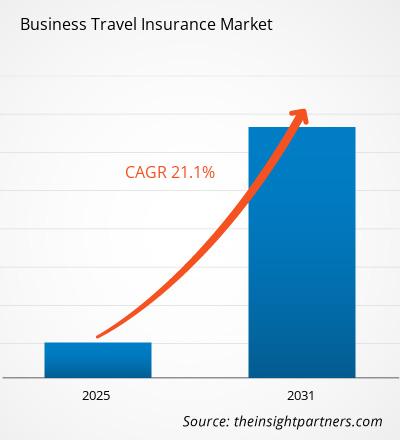

The business travel insurance market is expected to expand at a CAGR of 21.1% from 2025 to 2031. Growing usage of digital distribution channels among insurance providers is expected to be a key trends in the market.

Business Travel Insurance Market Analysis

Business travel has substantial economic ramifications, affecting industries such as hotels, transportation, and events. Increased travel leads to more demand for hotels, airlines, and venues, which promotes economic growth in these industries. The increase in business travel to emerging markets, particularly Asia Pacific, has implications for global market growth. Companies seeking prospects in these regions must adjust their tactics, opening up new options for collaboration and economic development. For instance, according to the Global Business Travel Association (GBTA), in 2023, Indian companies are projected to have spent US$ 32.3 billion on business meetings, trips, events, and conferences.

Business Travel Insurance Market Overview

Most businesses rely on business travel to develop their global footprint, which frequently includes trips to remote and isolated regions. Business travel insurance works similarly to personal travel coverage, protecting the policyholder against certain financial risks and losses that may arise during their journeys. The primary difference is that corporate travel insurance primarily covers business-related incidents. These policies generally protect against an extensive range of losses, from those resulting from minor incidents, such as delayed flights or luggage, to major occurrences, including medical emergencies and last-minute trip cancellations. Thus, the demand for business travel insurance is expected to grow during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Business Travel Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Business Travel Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Business Travel Insurance Market Driver and Opportunities

Growing International and Domestic Business Travel to Favor Market Growth

In a continually changing landscape, organizations seek to stay ahead of the competition and promote growth. Amidst this drive, business visits stand out as a strategic instrument with distinct advantages. For instance, according to the Global Business Travel Association (GBTA), business travel in India is gaining momentum. It is anticipated to grow by 18.3% in 2024 on the back of increasing foreign direct investment and corporate incomes. Further, European business travel spending is projected to reach US$ 450 Billion by 2031. Therefore, growing international and domestic business travel is expected to boost the market growth during the forecast period.

Growth in Multi-Trip Travel Insurance to Create Lucrative Market Opportunities

For organizations that require regular travel, acquiring multi-trip travel insurance coverage, often known as annual travel insurance, may be less expensive. This sort of policy offers coverage for several trips throughout the year. This type of insurance is different from a single-trip travel plan because it covers multiple trips over a longer period, generally one year. Multi-trip policies provide financial protection against a variety of risks, such as passport loss, baggage loss and delays, health crises, trip delays, personal accidents, missed connecting flights, and more. Thus, the demand for multi-trip travel insurance is expected to create lucrative growth opportunities during the forecast period.

Business Travel Insurance Market Report Segmentation Analysis

The key segments that contributed to the derivation of the business travel insurance market analysis are coverage type, distribution channel, and applications.

- By coverage type, the market is divided into single-trip travel insurance and multi-trip travel insurance.

- Companies that require fewer business visits per year may find that purchasing a single-trip travel insurance policy is sufficient. As the name suggests, this covers incidents that occur during a single business trip.

- By application, the market is bifurcated into domestic and international segments.

- By distribution channel, the market is segmented into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators.

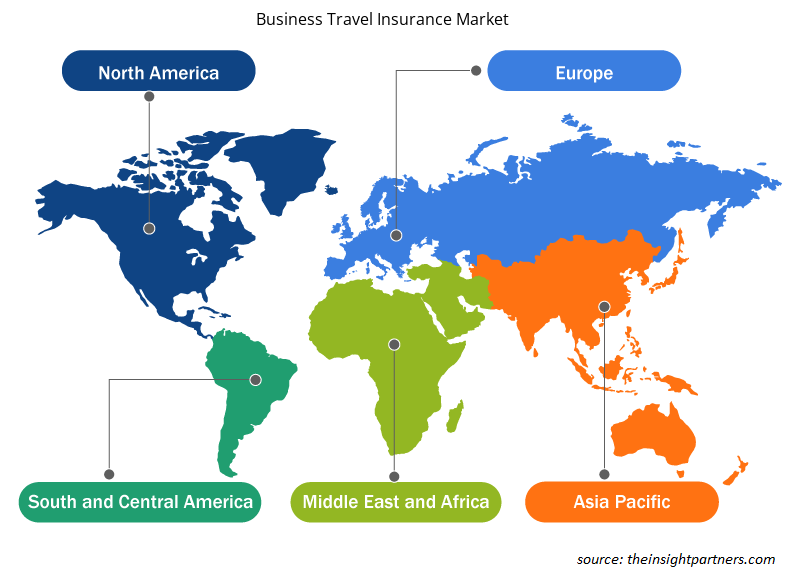

Business Travel Insurance Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Europe is expected to hold a significant share in the business travel market. For instance, according to Eurostat, business travel accounts for 13 % of total tourism expenditure in 2022. On the other hand, Asia Pacific is expected to grow substantially during the forecast period. For instance, according to the Global Business Travel Association (GBTA), business travel spending in the Asia Pacific region is forecast to reach over US $800 Billion by 2031.

Business Travel Insurance Market Regional Insights

The regional trends and factors influencing the Business Travel Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Business Travel Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Business Travel Insurance Market

Business Travel Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 21.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Coverage Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

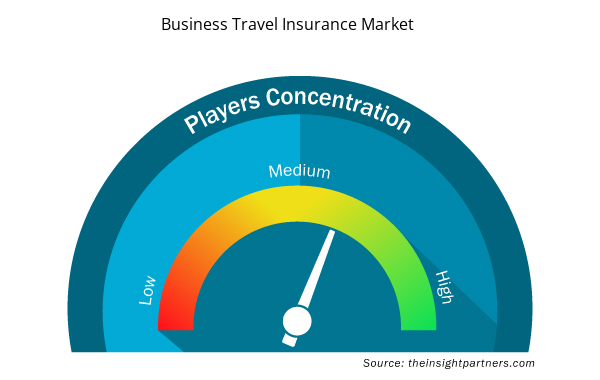

Business Travel Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Business Travel Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Business Travel Insurance Market are:

- ZURICH

- Allianz Group

- Seven Corners

- AXA

- USI Insurance Services

- Chubb

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Business Travel Insurance Market top key players overview

Business Travel Insurance Market News and Recent Developments

The business travel insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Business Travel Insurance market are listed below:

- Allianz Partners announced the launch of the Allyz mobile app, a digital platform providing travelers with trusted advice and expertise as well as access to the full suite of insurance benefits available to customers. The launch of the mobile app in France, Germany and the Netherlands is an important milestone in the expansion of Allianz Partners' digital platform, with the rollout of new digitally accessible services to continue across all lines of business until 2024. (Source: Allianz, Press Release, January 2024)

Business Travel Insurance Market Report Coverage & Deliverables

The business travel insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Business Travel Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Business travel insurance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Business travel insurance market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Business travel insurance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the business travel insurance market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

ZURICH, Allianz Group, Seven Corners, AXA, USI Insurance Services, Chubb, Nationwide, Generali Travel Insurance, AIG Travel, TravelSafe, Business Travel Insurance, ICICI, Star Health Insurance, Travelex, Trawick International, InsureMyTrip, VisitorsCoverage Inc., The Hartford, Gallagher, Travel Guard are the major market players.

Digitization in the insurance industry is the major trend in the market.

The global business travel insurance market was estimated to grow at a CAGR of 21.1% during 2023 - 2031.

The growing number of business travelers and increasing awareness among organizations are the major factors that drive the global Business Travel Insurance market.

Get Free Sample For

Get Free Sample For