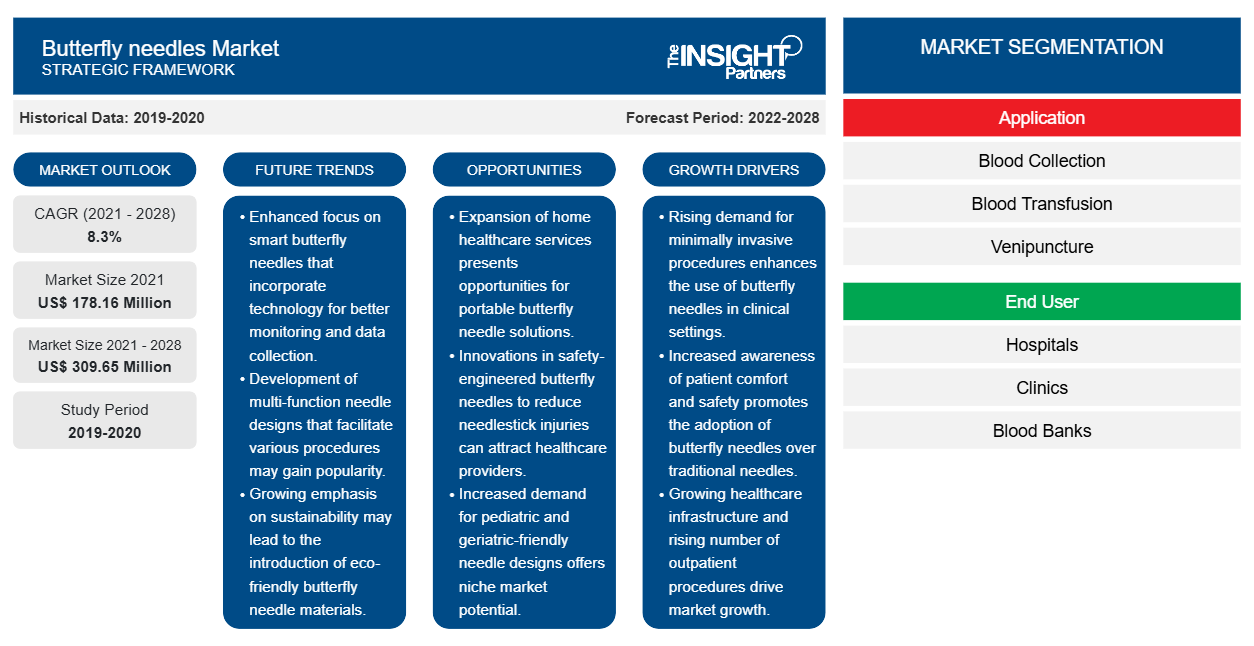

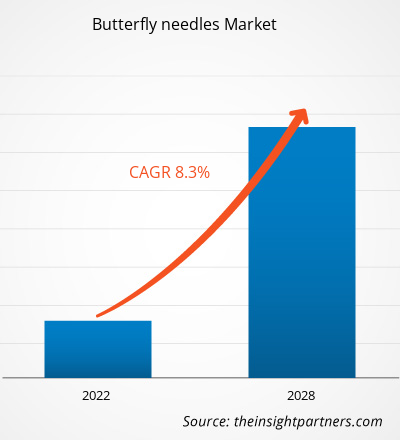

The butterfly needles market is expected to grow from US$ 1,78,164 thousand in 2021 to US$ 3,09,647 thousand by 2028; it is estimated to grow at a CAGR of 8.3% from 2022 to 2028.

Butterfly needles are devices used for drawing blood or administering medications in veins. Patients who may be difficult to venipuncture, such as older adults, infants, and children, are often given butterfly needles. A butterfly needles is also known as a winged infusion set or a scalp vein set, as it has plastic wings on either side of the hollow needle. With their winged tubing structure, which allows greater flexibility, butterfly needles are much easier to use and less painful. Additionally, butterfly needles are commonly used to draw blood or administer medication for babies, young children, and the elderly.

Market Insights

Increasing Organic and Inorganic Strategies by Key Players

The key butterfly needles market players are taking up various organic and inorganic strategies, including mergers and acquisitions, expansions, and new product launches, to stay competitive.

- In January 2022, ICU Medical Inc. acquired Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringes, ambulatory infusion devices, and vascular access and vital care products. The company offers Saf-T Wing butterfly needles, a single-use needle for drawing blood from venous. ICU Medical has become a leading infusion therapy company with a larger global footprint after adding the Smiths product line to its portfolio.

- In October 2020, Nipro Corporation announced that its consolidated subsidiary Nipro Medical Europe NV, established Nipro Medical Morocco in the Kingdom of Morocco, in Northern Africa, to sell Nipro medical devices. Nipro Corporation is a medical equipment manufacturing company that offers a wide range of butterfly needles. This expansion will help promote the butterfly needles market in North Africa.

- In June 2020, Becton Dickinson Benelux NV launched BD Vacutainer UltraTouch Push Button Blood Collection Set with Pre-Attached Holder. A pre-attached holder prevents accidental needlestick injury due to the nonpatient (tube-side) needle and helps ensure compliance with OSHA's single-use holder requirements.

Thus, many organic and inorganic strategies in the butterfly needles market enable healthcare professionals to provide improved services. These strategies help key players meet the rising demand for butterfly needles that can efficiently manage patients suffering from chronic disease conditions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Butterfly needles Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Butterfly needles Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

In the past several decades, countries in the Middle East & Africa have strengthened their health systems and upgraded public and commercial healthcare. However, the limited availability of resources—including trained staff and medical equipment—and the burden of noncommunicable diseases harm the overall healthcare system in the region. In 2020, the COVID-19 pandemic significantly impacted the delivery and accessibility of social services, education, health and nutrition, healthcare spending, and well-being and development-related businesses in the Middle East & Africa. Due to the region's dependence on trade and tourism and struggles with substantial youth unemployment, the global crisis led to serious long-term effects on the region. Governments in the Middle East & Africa allocated funds to prevent the overburdening of their health systems and decelerate the spread of COVID-19; a few countries also emphasized on increasing the number of intensive care units and hospital beds

Further, according to a report in November 2020 by Organization for Economic Co-operation and Development (OECD), the report says that prevention and treatment services for cardiovascular disease, cancer, and diabetes have been severely disrupted since the pandemic began. Additionally, in September 2021, the American College of Cardiology reported that diagnostic cardiovascular procedures declined an average of 47% in Asia in March 2020 compared to March 2019. The decline in the region was severe among all low-income countries, and some Asian countries even saw an 80% decline. According to a report, “COVID-19 and older people in Asia Pacific: 2020 in review”, Asia Pacific accounted for the highest number of older people's death during COVID-19 in all countries. Thus, there has been a negative impact on the butterfly needles market during the first quarter of the COVID-19 period due to the lockdown and limited access to healthcare-related settings. However, post-COVID, there has been a high demand for butterfly needles owing to the rising demand for cardiovascular disease, cancer, and diabetes treatment that contributes to the butterfly needles market’s future growth.

Application Insights

Based on application, the global butterfly needles market is divided into blood collection, blood transfusion, venipuncture, IV rehydration, and delivery of medications. The blood collection segment held the largest share of the butterfly needles market in 2021 and is expected to grow at the highest CAGR during the forecast period. The major driving factors for the segment's growth are the blood donation camps and key players' contributions to promote the butterfly needles market growth for the segment.

End User Insights

Based on end user, the butterfly needles market is segmented into hospitals, clinics, diagnostics laboratories, academic and research institutes, and others. The hospitals segment held the largest share of the market in 2021. The rise in chemotherapy, the increase in the number of hospitals, and the rise in surgical procedures for various CVDs across the globe are driving the hospitals segment of the global butterfly needles market.

Inorganic developments such as mergers and acquisitions are highly adopted strategies by companies in the Butterfly needles Market. A few of the recent key market developments are listed below:

- In January 2022, ICU Medical Inc. acquired Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringes, ambulatory infusion devices, vascular access, and vital care products.

- In October 2020, Nipro’s consolidated subsidiary Nipro Medical Europe N.V. established the local subsidiary Nipro Medical Morocco in the Kingdom of Morocco, located in the northwestern part of North Africa, to engage in sales of Nipro medical devices. The new sales subsidiary started operations on October 1, 2020.

- In June 2020, Becton Dickinson Benelux N.V. launched BD Vacutainer UltraTouch Push Button Blood Collection Set with Pre-Attached Holder. A pre-attached holder prevents accidental needlestick injury due to the nonpatient (tube-side) needle and helps ensure compliance with OSHA's single-use holder requirement.

Butterfly Needles Butterfly needles Market Regional Insights

Butterfly needles Market Regional Insights

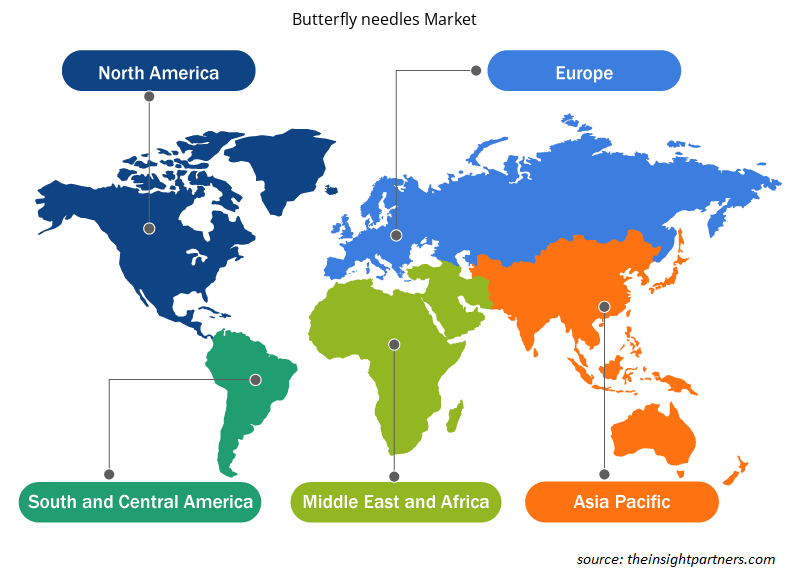

The regional trends and factors influencing the Butterfly needles Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Butterfly needles Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Butterfly needles Market

Butterfly needles Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 178.16 Million |

| Market Size by 2028 | US$ 309.65 Million |

| Global CAGR (2021 - 2028) | 8.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Butterfly needles Market Players Density: Understanding Its Impact on Business Dynamics

The Butterfly needles Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Butterfly needles Market are:

- B. Braun SE

- Becton Dickinson and Co

- Nipro Corp

- Cardinal Health Inc

- Medline Industries Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Butterfly needles Market top key players overview

Company Profiles

- Braun Melsungen AG

- Becton, Dickinson And Company

- Nipro Corporation

- Cardinal Health, Inc

- Medline Industries, Inc.

- Terumo Corporation

- Kawasumi Laboratories, Inc

- IUC Medical

- ISO-MED Inc

- Vogt Medical Vertrieb Gmbh

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aquaculture Market

- Rugged Phones Market

- Adaptive Traffic Control System Market

- Health Economics and Outcome Research (HEOR) Services Market

- Predictive Maintenance Market

- Integrated Platform Management System Market

- Electronic Signature Software Market

- Retinal Imaging Devices Market

- Carbon Fiber Market

- Artwork Management Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global butterfly needles based on regions is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In 2021, the North American area held the largest market share. However, the Asia Pacific region is estimated to grow at the fastest CAGR of 9.1% during the forecast period

The global butterfly needles based on the application are segmented into blood collection, blood transfusion, venipuncture, IV rehydration, and delivery of medications. The blood collection segment held the largest share of the market in 2021 and is expected to grow at the highest CAGR during the forecast period.

The butterfly needles majorly consist of the players, such as B. Braun SE, Becton Dickinson and Co, Nipro Corp, Cardinal Health Inc, Medline Industries Inc, Terumo Corp, SB-Kawasumi Laboratories Inc, ICU Medical Inc, ISO-MED Inc, and Vogt Medical Vertrieb GmbH among others.

Risks associated with butterfly needlestick injuries are expected to restrict the butterfly needles market growth during the forecast period.

The factors driving the growth of butterfly needles are increasing prevalence of chronic diseases and advantages of butterfly needles over straight needles.

Butterfly needle also called as winged infusion set or a scalp vein set is used to access a vein to draw blood or give medications. The advantages of butterfly needless over straight needle are that it allows for more precise placement, particularly in hard-to-access veins. Growth of the global butterfly needless market is majorly driven by rise in prevalence of chronic diseases and advantages of butterfly needless over straight needles. However, risk associated with butterfly needlestick injuries is hampering market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Butterfly Needles Market

- B. Braun SE

- Becton Dickinson and Co

- Nipro Corp

- Cardinal Health Inc

- Medline Industries Inc

- Terumo Corp

- SB-Kawasumi Laboratories Inc

- ICU Medical Inc

- ISO-MED Inc

- Vogt Medical Vertrieb GmbH

Get Free Sample For

Get Free Sample For