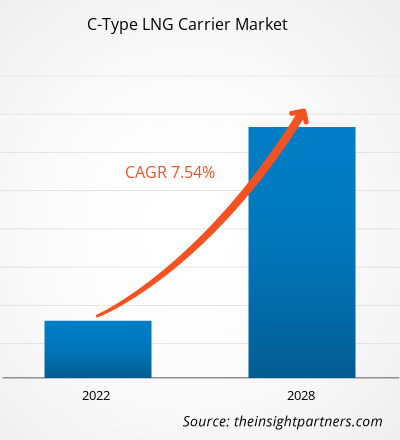

The C-type LNG carrier market size was valued US$ 3,920.84 million in 2021. It is expected to grow at a CAGR of 7.5% during 2022–2028.

The C-type tanks are insulated cylindrical, bi-lobe-shaped, or tri-lobe-shaped tanks that can be fully or partially pressurized, depending on the liquefied gas to be stored. These tanks are found onboard small and mid-sized LPG carriers and small-scale LNG carriers. Type C tanks can store LNG at a higher pressure than Type A and Type B tanks, though space optimization in these tanks is lower. The growing consumption of LNG across the world from many end users, such as the power generation industry and industrial activities, is increasing the LNG liquefaction capacity. The surge in newbuild contracting and fleet expansion and the increase in demand for clean energy supported by favorable government regulations for reducing carbon emissions are propelling the demand for LNG, driving the C-type LNG carrier market. The rise in energy demand is propelling the need for LNG across Asia Pacific countries. The traditional markets, such as Japan and South Korea, have held their leading position in terms of LNG consumption, as their domestic markets have changed under the influence of liberalization policies, which have led to different opportunities for the transportation of LNG.

Owing to the rising need for LNG transportation, many industry players are looking forward to building the next generation of cargo containment systems. The surge in long-term contracts in 2021, owing to a rise in trading activities after a decrease experienced in 2020. For instance, in 2021, China-based Sinopec Corp signed the most long-term LNG contracts, gaining 5 million tonnes per annum (MTPA) of imported LNG; Vitol Group signed the second-highest number of long-term LNG contracts, gaining 4.3 mtpa LNG; and Royal Dutch Shell signed the third highest, gaining 4.0 mtpa LNG. As per the Wood Mackenzie report, in the next decade, around two-thirds of expected growth in LNG demand will come from China, India, Pakistan, and Bangladesh, which are the world’s fastest-growing markets for LNG imports. Alongside China, India is also expected to dominate Asia’s LNG regasification capacity in the coming years, accounting for around 60% of the region’s total capacity between 2020 and 2024. Therefore, the significant demand for LNG is expected to increase the transportation activities of LNG, which is likely to drive the need for LNG carriers in the coming years. However, as per the IEA report, by 2025, gas prices are projected to increase, which may hinder the demand for LNG and hamper the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

C-Type LNG Carrier Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

C-Type LNG Carrier Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on C-Type LNG Carrier Market Growth

The COVID-19 pandemic negatively impacted the global C-type LNG carrier market. In North America, the COVID-19 pandemic impacted LNG investment and near- and longer-term fundamentals. For example, in the US market, there has been surged in importance over the past decade because of the shale boom. COVID-19 has delayed construction and liquefaction projects, impacting the production of LNG carriers, and LNG projects could be an attractive option for cutting costs. The growing demand for c-type LNG carriers from the rapidly expanding economies of Asia Pacific is expected to be a key driving force in producing momentum for a worldwide economic recovery from the effects of the COVID-19 pandemic. Along with China, India is expected to lead Asia's LNG regasification capacity additions in the next few years, accounting for 60.0% of the region's total between 2020 and 2024. Amid the COVID-19 pandemic, changes in the LNG carrier market will be significant for LNG importing countries as they may have to rely on large portfolio players. Governments may have to step in more directly if they need volumes to grow beyond 2025. Japan's commitment of US$ 10 billion toward LNG infrastructure is the first step in this direction. An average liquefaction train costs nearly US$ 8 billion (4 million tons at US$ 2,000/ton). All these initiatives are expected to fuel the c-type LNG carrier market growth post-pandemic.

Market Insight – C-Type LNG Carrier Market

Surge in New Shipbuilding Contracts and New Fleet Expansion

Market players are building new LNG carriers due to the rising demand for LNG. For instance, in January 2022, TGE Marine proudly announced the completion of the tank-building phase for two large LNG cargo tanks at Jiangnan Shipyard. Also, in August 2022, NYK Line announced a long-term time-charter contract with Qatar Energy for seven new LNG carriers. The companies also executed shipbuilding contracts for the seven 174,000 m3 LNG carriers with Hyundai Heavy Industries Co., Ltd. Thus, the rise in new shipbuilding contracts among the leading players is driving the C-type LNG carrier market.

Furthermore, in July 2022, Gaztransport & Technigaz (GTT) received a tank design contract from Samsung Heavy Industries (SHI), its South Korean partner, for designing a series of new LNG carriers. As per the contract, the Gaztransport & Technigaz (GTT) company will design the tank of 14 new LNGCs. Two of the ships are for a shipowner from Asia, while the other 12 are for an American shipowner. Similarly, in November 2021, Jiangsu Yangzijiang Shipbuilding launched the LNG-powered MSC Washington, which features a 12,300-cbm type C bi-lobe LNG tank. Thus, such contracts for the manufacturing of LNG carriers and expansion of new fleets are bolstering the C-type LNG carrier market growth.

C-Type LNG Carrier Market Regional Insights

C-Type LNG Carrier Market Regional Insights

The regional trends and factors influencing the C-Type LNG Carrier Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses C-Type LNG Carrier Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for C-Type LNG Carrier Market

C-Type LNG Carrier Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.92 Billion |

| Market Size by 2028 | US$ 6.47 Billion |

| Global CAGR (2021 - 2028) | 7.54% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

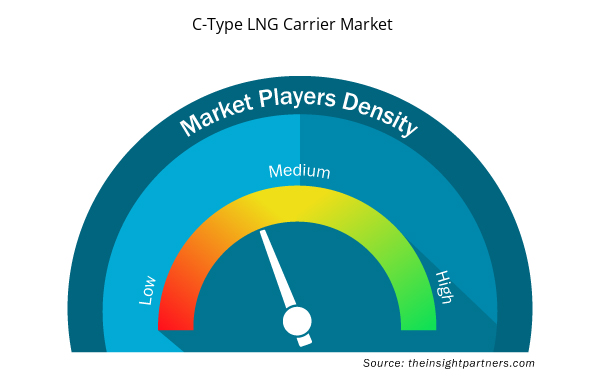

C-Type LNG Carrier Market Players Density: Understanding Its Impact on Business Dynamics

The C-Type LNG Carrier Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the C-Type LNG Carrier Market are:

- China Shipbuilding Trading Co., Ltd

- DSME Co., Ltd

- GAS Entec

- Gaslog Ltd

- HYUNDAI SAMHO HEAVY INDUSTRIES CO., LTD.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the C-Type LNG Carrier Market top key players overview

Product Type-based Insights

The C-type LNG carrier market is segmented based on product type and application. Based on product type, the C-type LNG carrier market is segmented into cylindrical, bi-lobe, and tri-lobe. The cylindrical segment held the largest market share in 2021, as it holds flexibility and strength over the temperature range of 50ºC–180ºC.

Players operating in the C-type LNG carrier market are mainly focused on the development of advanced and efficient products.

- In January 2022, Hyundai Samho Heavy Industries received an order worth US$ 1.3 billion for building seven ships—six very large container ships and one LNG carrier. Six 15,000 TEU (Twenty-foot Equivalent Unit) liquefied natural gas-powered container ships are projected to be delivered gradually to Europe-based shipping company in the first half of 2024.

- In June 2022, Daewoo Shipbuilding & Marine Engineering Co. (DSME) received a KRW 1.07 trillion (US$ 850 million) order to build four LNG carriers under a deal with a Qatar state oil firm, which will be done by 2025.

The analysis of the C-type LNG carrier market is based on product type and application. Based on product type, the market is segmented into cylindrical, bi-lobe, and tri-lobe. Based on application, the market is segmented into marine, oil and gas, petrochemical, and others.

The C-type LNG carrier market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America. In 2021, Asia Pacific led the market with a substantial revenue share, followed by Europe and North America. The C-type LNG carrier market analysis helps to understand the upcoming trends, new technologies, and macro and micro factors that influence the market growth.

The key players profiled in the C-type LNG carrier market study include DSME Co. Ltd; Hyundai Heavy Industries Co. Ltd; Mitsubishi Heavy Industries Ltd; TGE Marine AG; Gas Entec; Komarine Co.; Torgy LNG AS; China Shipbuilding Trading Co., Ltd.; Knutsen OAS Shipping; and HYUNDAI SAMHO HEAVY INDUSTRIES CO., LTD. The C-type LNG carrier market report provides detailed market insights which help the key players to strategize their growth.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- HVAC Sensors Market

- Bioremediation Technology and Services Market

- Precast Concrete Market

- Portable Power Station Market

- Integrated Platform Management System Market

- Data Annotation Tools Market

- Ceramic Injection Molding Market

- Unit Heater Market

- Identity Verification Market

- Genetic Testing Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The incremental growth rate of the global C-Type LNG carrier market is 7.5%.

The market for C-Type LNG carrier was valued at US$ 3,920.84 Mn in 2021.

Rising Demand for Natural Gas from Several Industries.

The driving factors for the market are:

Growing LNG Liquefaction Capacity Globally

Surge in New Shipbuilding Contracts and New Fleet Expansion

DSME Co. Ltd; Hyundai Heavy Industries Co. Ltd; Mitsubishi Heavy Industries Ltd; TGE Marine AG; and Gas Entec

Asia Pacific (APAC) is anticipated to grow with the highest CAGR over the forecast period.

The country of China is anticipated to hold the largest market share in 2021.

The countries anticipated to grow with the highest CAGR are US, Germany, Japan, Saudi Arabia, and Argentina.

The cylindrical segment held the largest share in 2021.

The market for C-Type LNG carrier was valued at US$ 6,469.02 Mn in 2028.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - C-Type LNG Carrier Market

- China Shipbuilding Trading Co., Ltd

- DSME Co., Ltd

- GAS Entec

- Gaslog Ltd

- HYUNDAI SAMHO HEAVY INDUSTRIES CO., LTD.

- Knutsen OAS Shipping

- Komarine Co

- Mitsubishi Heavy Industries, Ltd.

- TGE Marine Gas Engineering GmbH

- Torgy LNG AS

Get Free Sample For

Get Free Sample For