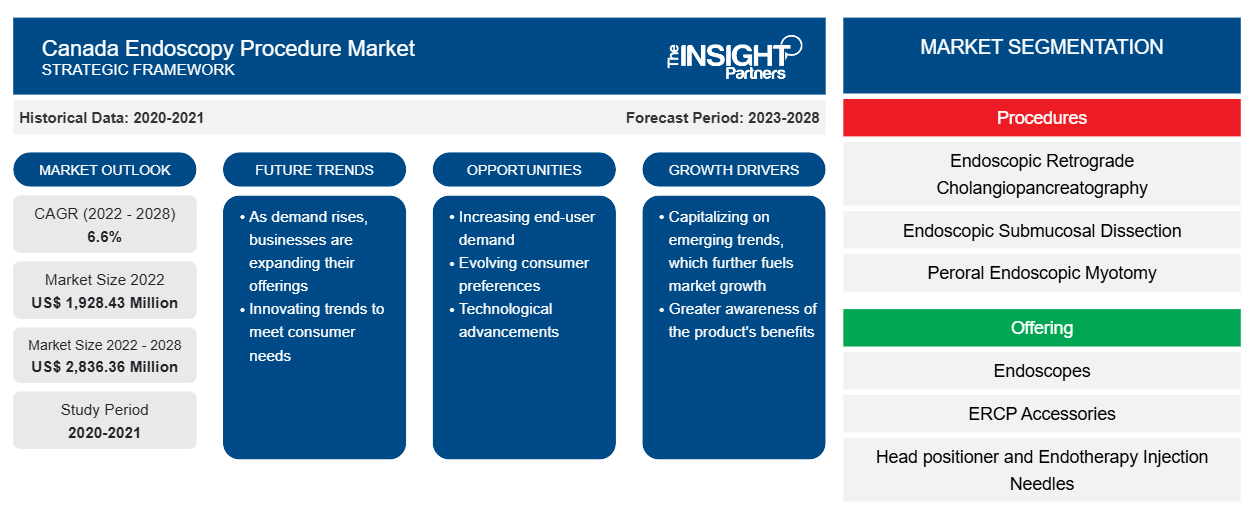

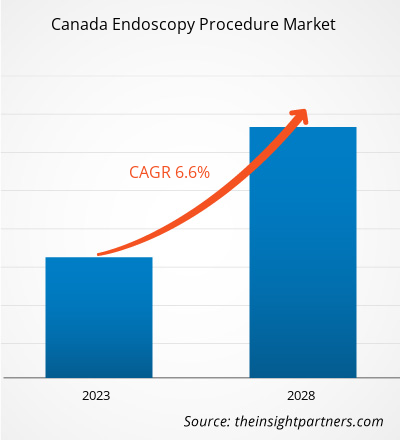

The Canada endoscopy procedure market is expected to grow from US$ 1,928.43 million in 2022 to US$ 2,836.36 million by 2028; it is estimated to register a CAGR of 6.6% from 2022 to 2028.

Endoscopy is a minimally invasive procedure used to examine a person's digestive tract through the mouth, anus, or in small incisions. The procedure uses an endoscope, a flexible tube with a light and camera attached. Most endoscopes are thin tubes with powerful light and a tiny camera at the end. Endoscopy helps diagnose body parts such as the esophagus, stomach, colon, ears, nose, throat, heart, urinary tract, and abdomen.

The Canada endoscopy procedure market is segmented based on procedures, offering, product type, and end user. Based on procedures, the market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. By offering, the market is segmented into endoscopes, ERCP Accessories, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound (EUS) guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostasis clip, polyp traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others (kits/stents/energy devices/transport pad/cleaning brush/OT lights etc.). Based on product type, the endoscopy procedure market is bifurcated into disposable and reusable. In terms of end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. This report offers insights and in-depth analysis of the market, emphasizing parameters, such as market trends and market dynamics along with the competitive analysis of the leading market players in Canada.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Use of Artificial Intelligence (AI) in Gastroenterology

The application of artificial intelligence (AI) in gastrointestinal (GI) endoscopy is drawing a great amount of attention because it has the potential to improve the quality of endoscopy at all levels, compensating for human errors and limitations by bringing more accuracy, consistency, and higher speed. It will make a breakthrough and a big revolution in the development of GI endoscopy. AI has the advantage of limiting inter-operator variability. It can compensate for the limited experience of novice endoscopists and the errors of even the most experienced endoscopists. Over the past four decades, the incidence of esophageal adenocarcinoma (EAC) has risen rapidly due to the increasingly prevalent excess body weight. AI assistance shows promising results in terms of improving the detection and diagnosis of esophageal adenocarcinoma (EAC), thus, reducing the mortality and morbidity related to this type of malignancy with a poor prognosis when diagnosed at an advanced stage.

The Canadian Association of Gastroenterology (CAG) has formed a special interest group (SIG) in AI to further develop and promote the use of AI. This CAG AI SIG core group comprises six gastroenterologists from five Canadian institutions across three provinces. They have started evaluating AI technologies using cohort studies and randomized controlled trials. They are in the process of establishing video and data biobanks to accrue raw data from which additional novel AI solutions can be created. Further activities of group members include developing and implementing AI curricula since the next generation of gastroenterologists needs to be trained to develop and implement AI solutions at institutions across Canada. The CAG AI SIG has an open model inviting new members and AI researchers to maximize this novel technology's potential in improving endoscopy quality and patient outcomes.

Recently, a few AI-driven endoscopy products were approved in Canada. For instance, in November 2021, Medtronic Canada ULC, a subsidiary of Medtronic plc, announced that it had received a Health Canada license for the GI Genius intelligent endoscopy module. GI Genius is a computer-aided detection (CADe) system that uses artificial intelligence (AI) to highlight regions of the colon suspected to have visual characteristics consistent with different types of mucosal abnormalities. Hence, the use of artificial intelligence (AI) in gastroenterology is likely to propel the market growth in near future.

Procedure Insights

Based on procedure, the Canada endoscopy procedure market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. The arthroscopy and bronchoscopy segment accounted for the largest market share in 2022. However, the endoscopic retrograde cholangiopancreatography (ERCP) segment accounted highest CAGR of the Canada endoscopy procedure market share.

Arthroscopy is a minimally invasive endoscopic method for the diagnosis and surgical treatment of joint injuries. Arthroscope is inserted into the joint cavity through 2 small incisions, which allows one to fully examine the joint, obtain information about its condition, and identify the presence of intra-articular damage. Arthroscopy allows arthroscopic treatment of injuries of the knee joint. This technique allows one to remove the damaged part of the meniscus, restore ligaments and damaged cartilage, and perform many other surgical interventions. Bronchoscopy is an endoscopic method for examining the upper and lower (trachea, bronchi) respiratory tract using a bronchoscope.

Endoscopy Procedure Market, by Procedure – 2022 and 2028

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Offering Insights

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on offering, the Canada endoscopy procedure market is segmented into endoscopes, ERCP Accessories, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound (EUS) guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostasis clip, polyp traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others (kits/stents/energy devices/transport pad/cleaning brush/OT lights, etc.). The endoscopes segment accounted for the largest market share in 2022. However, the ERCP accessories segment accounted highest CAGR of the Canada endoscopy procedure market share. Using an endoscope, a flexible tube with a light and camera attached to it, the doctor can get a view of the digestive tract on a color TV monitor.

Product Type Insight

Based on product type, the Canada endoscopy procedure market is bifurcated into disposable and reusable. The reusable segment held a larger market share of the market in 2022 and disposable segment is expected to register a higher CAGR during the forecast period. Reusable endoscopy products can be reprocessed using manual or automated endoscope reprocessors (AERs) and reused by healthcare providers on multiple patients. Products used in endoscopy procedures are suitable for reuse and are typically made of a stronger material than disposable products, which are typically made of a thinner material.

End User Insight

Based on end user, the Canada endoscopy procedure market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. In 2022, the hospitals and clinics segment held the largest market share of the market. However, the diagnostic laboratories segment is expected to grow fastest in the coming years.

Company Profiles

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- PENTAX Medical

- Erbe Elektromedizin GmbH

- Micro-Tech Nanjing Co Ltd

- Merit Medical Systems Inc

- Cook Medical LLC

- Stryker Corp

- Johnson & Johnson

Canada Endoscopy Procedure Market Regional Insights

The regional trends and factors influencing the Canada Endoscopy Procedure Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Canada Endoscopy Procedure Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Canada Endoscopy Procedure Market

Canada Endoscopy Procedure Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,928.43 Million |

| Market Size by 2028 | US$ 2,836.36 Million |

| Global CAGR (2022 - 2028) | 6.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Procedures

|

| Regions and Countries Covered | Canada

|

| Market leaders and key company profiles |

Canada Endoscopy Procedure Market Players Density: Understanding Its Impact on Business Dynamics

The Canada Endoscopy Procedure Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Canada Endoscopy Procedure Market are:

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- PENTAX Medical

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Canada Endoscopy Procedure Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Procedures, Offering, Product Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Endoscopy is a minimally invasive procedure used to examine a person's digestive tract through the mouth, anus, or in small incisions. The procedure uses an endoscope, a flexible tube with a light and camera attached. Most endoscopes are thin tubes with powerful light and a tiny camera at the end. Endoscopy helps in diagnosing the body parts such as the esophagus, stomach, colon, ears, nose, throat, heart, urinary tract, and abdomen.

The factors driving the growth of Canada endoscopy procedure market are the growing preference for minimally invasive surgeries and increasing prevalence of cancer.

The risks of infections associated with endoscopic procedures is expected to restrict the Canada endoscopy procedure market growth during the forecast period.

Canada endoscopy procedure market majorly consists of the players, such as Steris Plc, Conmed Corp, Olympus Corp, Boston Scientific Corp, PENTAX Medical, Erbe Elektromedizin GmbH, Micro-Tech Nanjing Co Ltd, Merit Medical Systems Inc, Cook Medical LLC, Stryker Corp, and Johnson & Johnson.

Based on procedures, the market is segmented into endoscopic retrograde cholangiopancreatography (ERCP), endoscopic submucosal dissection (ESD), peroral endoscopic myotomy (POEM), endoscopic ultrasound (EUS), interventional pulmonology and laparoscopy, arthroscopy and bronchoscopy, colonoscopy and colposcopy, proctoscopy and thoracoscopy, and others. In 2022, the arthroscopy and bronchoscopy segment accounted for the largest market share. However, the endoscopic retrograde cholangiopancreatography (ERCP) segment is anticipated to register the highest CAGR during the forecast period due to high demand of ERCP procedures for rising lung related infections in Canada.

Based on offering, the market is segmented into endoscopes, visualization systems, ERCP accessories, head positioner and endotherapy injection needles, sampling device and device clip and electrosurgical knife, endoscopic ultrasound (EUS) guided devices, guidewire, forceps, snare, irrigation/insufflation tubing systems, probes, hemostasis clip, polyp traps, single-use valves, trocar sleeves and tissue scissors and cutters, retrieval devices, and others (kits/stents/energy devices/ transport pad/cleaning brush/OT lights etc.). In 2022, the endoscopes segment held the largest share of the market. However, the ERCP accessories segment is expected to register the highest CAGR from 2022 to 2028.

Based on product type, the market is bifurcated into disposable and reusable. The reusable segment held the largest share of the market in 2022. Disposable segment is anticipated to register the highest CAGR during the forecast period.

Based on end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic laboratories, and others. In 2022, the hospital and clinics segment held the largest share of the market. While, the diagnostic laboratories segment is expected to register the highest CAGR from 2022 to 2028.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Canada Endoscopy Procedure Market

- Steris Plc

- Conmed Corp

- Olympus Corp

- Boston Scientific Corp

- PENTAX Medical

- Erbe Elektromedizin GmbH

- Micro-Tech Nanjing Co Ltd

- Merit Medical Systems Inc

- Cook Medical LLC

- Stryker Corp

- Johnson & Johnson

Get Free Sample For

Get Free Sample For