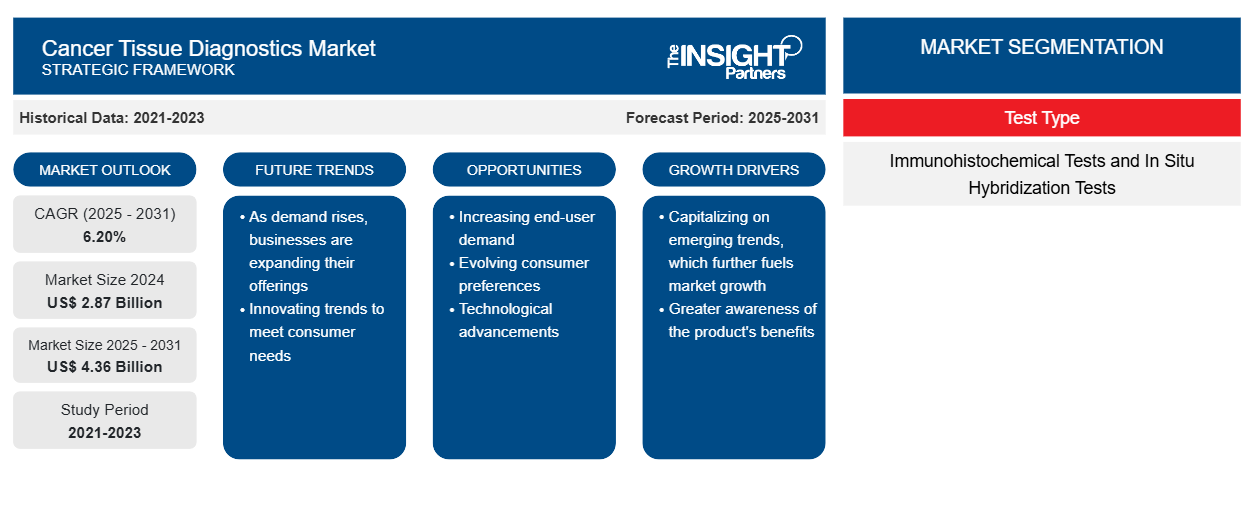

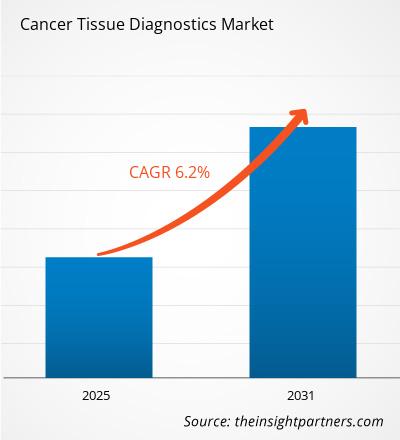

The cancer tissue diagnostics market is projected to reach US$ 3,640.87 million by 2031 from US$ 2,538.31 million in 2022; it is estimated to grow at a CAGR of 6.2% from 2022 to 2031.

Cancer tissue diagnostics techniques are used to detect a tumor in malignant tissues. In the last few years, immunohistochemistry (IHC) was used to increase the detection of specific antigens in tumor tissue. With the help of nonfluorescent chromogens, the screening is analyzed with conventional microscopy. There are recent techniques developed for cancer tissue diagnosis. Fluorescence in situ hybridization is used to examine a genetic abnormality in the genome. The hybridized deoxyribonucleic acid (DNA) is examined with particular probes.

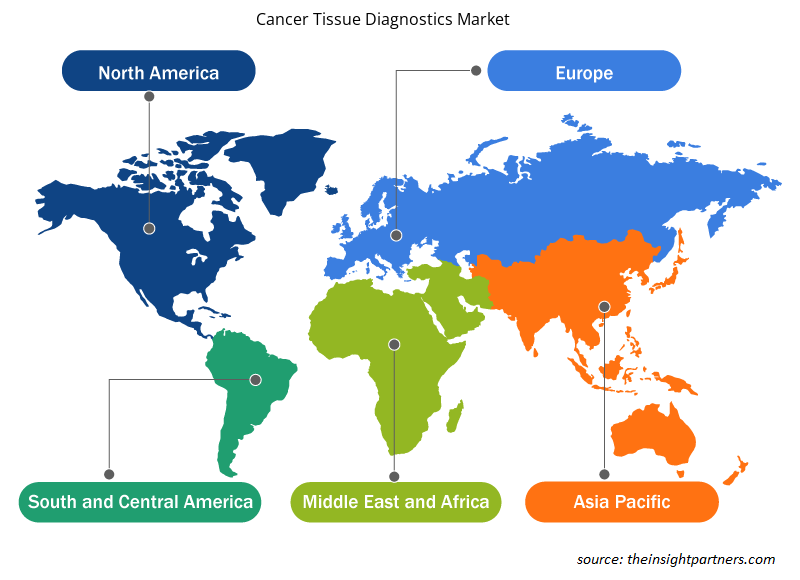

The cancer tissue diagnostics market is segmented on the basis of test type and geography. Based on test type, the market is segmented into immunohistochemical tests and in situ hybridization tests. In 2022, the immunohistochemical tests segment held a larger market share. The market in the same segment is also anticipated to grow at a faster rate in the coming years. By geography, the cancer tissue diagnostics market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in Asia Pacific is expected to grow at the highest rate during the forecast period owing to the rising prevalence of cancer and the increasing aging population in Asian countries. The Japanese Government has been formulating and laying down multiple initiatives and programs to enhance the quality of cancer treatment and increase awareness regarding cancer in the country. In China, as per data by the WHO, 45,68,754 new cancer cases were detected, and 30,02,899 cancer deaths were recorded in the country in 2021. The cancer tissue diagnostics report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, market dynamics, and the competitive analysis of the globally leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cancer Tissue Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cancer Tissue Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

New Product Launches and FDA Approvals and growing investments in Cancer Tissue Diagnostics to Fuel Cancer Tissue Diagnostics Market During Forecast Period

Most major market players are involved in manufacturing a wide range of cancer diagnostics products offering maximum advantages and early diagnosis. In June 2022, Roche announced the launch of the BenchMark ULTRA PLUS system, its newest advanced tissue staining platform. The system enables quick and accurate test results so clinicians can make timely decisions regarding a patient’s care journey.

In March 2022, Illumina launched a new in vitro diagnostic test in Europe designed to profile various cancer mutations and help direct patients to targeted therapies. Thus, the constant technological developments in diagnostics and FDA approvals accelerate the market growth.

Furthermore, tissue diagnostics is crucial in cancer treatment. Cancer tissue diagnostics play a significant role in determining the treatment pace and procedure. Early detection can help reduce the mortality rates of cancer; hence, medical professionals, market players, and government authorities implement new diagnostics and treatment facilities. Thus, the rise in investments and better policies of reimbursement favor the growth of the cancer tissue diagnostics market.

In May 2021, QIAGEN N.V. launched an expanded scope of companion diagnostic (CDx) claims for the therascreen KRAS RGQ PCR Kit (therascreen KRAS Kit) after it received U.S. regulatory approval as a companion diagnostic to aid in the identification of non-small cell lung cancer (NSCLC) patients that may be eligible for treatment with LUMAKRASTM (sotorasib), a newly approved therapy developed and marketed by Amgen Inc. (AMGN). Furthermore, In January 2021, Illumina and Roche signed a 15-year, non-exclusive collaboration agreement designed to realize NGS’ potential to transform cancer risk prediction, detection, diagnosis, treatment and monitoring. The value of the partnership—which includes in vitro diagnostic (IVD) and companion diagnostics (CDx) initiatives—was not disclosed. In 2021, the company launched AIforia cloud platform that accelerates image processing and provides automated pathology image analysis. Thus, the increasing collaborations and new technological platforms in cancer tissue diagnostics have led to the advent of breakthrough techniques, which are expected to fuel the growth of the market in the coming years.

Test Type-Insights

Based on test type, the cancer tissue diagnostics market is segmented into immunohistochemical tests and in situ hybridization tests. In 2022, the immunohistochemical tests segment held a larger market share. In addition, the market in the same segment is expected to grow at a faster rate in the coming years owing to the cost-effectiveness of the technique. Moreover, the technique is easily accessible, and growth in the number of products based on technology are further expected to drive the segment growth.

Product launches and collaborations are highly adopted strategies by the global cancer tissue diagnostics market players. A few of the recent key market developments are listed below:

- In June 2022, Roche announced the launch of the BenchMark ULTRA PLUS system, its newest advanced tissue staining platform. The system enables quick and accurate test results so clinicians can make timely decisions regarding a patient’s care journey.

- In March 2022, Illumina launched a new in vitro diagnostic test in Europe designed to profile various cancer mutations and help direct patients to targeted therapies.

- In May 2021, QIAGEN N.V. launched an expanded scope of companion diagnostic (CDx) claims for the therascreen KRAS RGQ PCR Kit (therascreen KRAS Kit) after it received U.S. regulatory approval as a companion diagnostic to aid in the identification of non-small cell lung cancer (NSCLC) patients that may be eligible for treatment with LUMAKRASTM (sotorasib), a newly approved therapy developed and marketed by Amgen Inc. (AMGN).

- In January 2021, Illumina and Roche signed a 15-year, non-exclusive collaboration agreement designed to realize NGS’ potential to transform cancer risk prediction, detection, diagnosis, treatment and monitoring. The value of the partnership—which includes in vitro diagnostic (IVD) and companion diagnostics (CDx) initiatives—was not disclosed.

- In June 2021, Agilent Technologies Inc. received the U.S. Food and Drug Administration (FDA) approval for its PD-L1 IHC 22C3 pharmDx assay. The assay is approved to identify patients with head and neck squamous cell carcinoma (HNSCC) for treatment with KEYTRUDA (pembrolizumab), anti-PD-1 therapy manufactured by Merck.

- In June 2021, Thermo Fisher Scientific's Oncomine Dx Target Test received reimbursement coverage from Japan's Ministry of Health, Labour and Welfare. The test is now commercially available in Japan. The reimbursement has helped the company to offer the diagnosis of NSCLC.\

- In May 2021, Roche launched the VENTANA ROS1 (SP384) Rabbit Monoclonal Primary Antibody, an in vitro diagnostic ROS1 immunohistochemistry (IHC) assay. The launch has enabled the company to offer better innovative products.

Company Profiles

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Bio Rad Laboratories Inc

- Abbott

- Enzo Life Sciences, Inc

- Agilent Technologies, Inc

- Cancer Genetics Inc

- Merck KGaA (Sigma-Aldrich Co. LLC)

- Danaher Corporation

- Abcam plc.

Cancer Tissue Diagnostics Market Regional Insights

The regional trends and factors influencing the Cancer Tissue Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cancer Tissue Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cancer Tissue Diagnostics Market

Cancer Tissue Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.87 Billion |

| Market Size by 2031 | US$ 4.36 Billion |

| Global CAGR (2025 - 2031) | 6.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Test Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

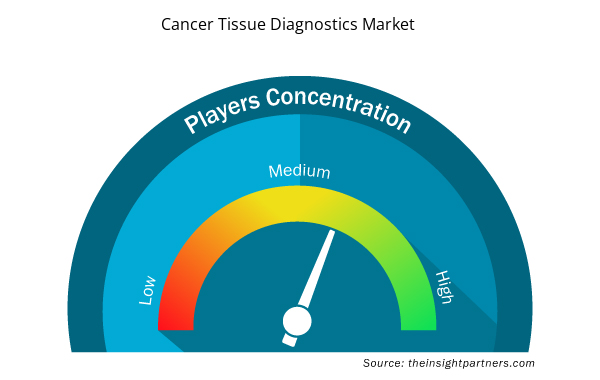

Cancer Tissue Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Cancer Tissue Diagnostics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cancer Tissue Diagnostics Market are:

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Bio Rad Laboratories Inc.

- Abbott

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cancer Tissue Diagnostics Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Quantitative Structure-Activity Relationship (QSAR) Market

- Environmental Consulting Service Market

- Real-Time Location Systems Market

- Smart Water Metering Market

- Medical and Research Grade Collagen Market

- Retinal Imaging Devices Market

- Vessel Monitoring System Market

- Adaptive Traffic Control System Market

- USB Device Market

- Virtual Pipeline Systems Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Test Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Bio Rad Laboratories Inc.

- Abbott

- Enzo Life Sciences, Inc.

- Agilent Technologies, Inc.

- Cancer Genetics Inc.

- Merck KGaA (Sigma-Aldrich Co. LLC)

- Abcam plc.

Get Free Sample For

Get Free Sample For