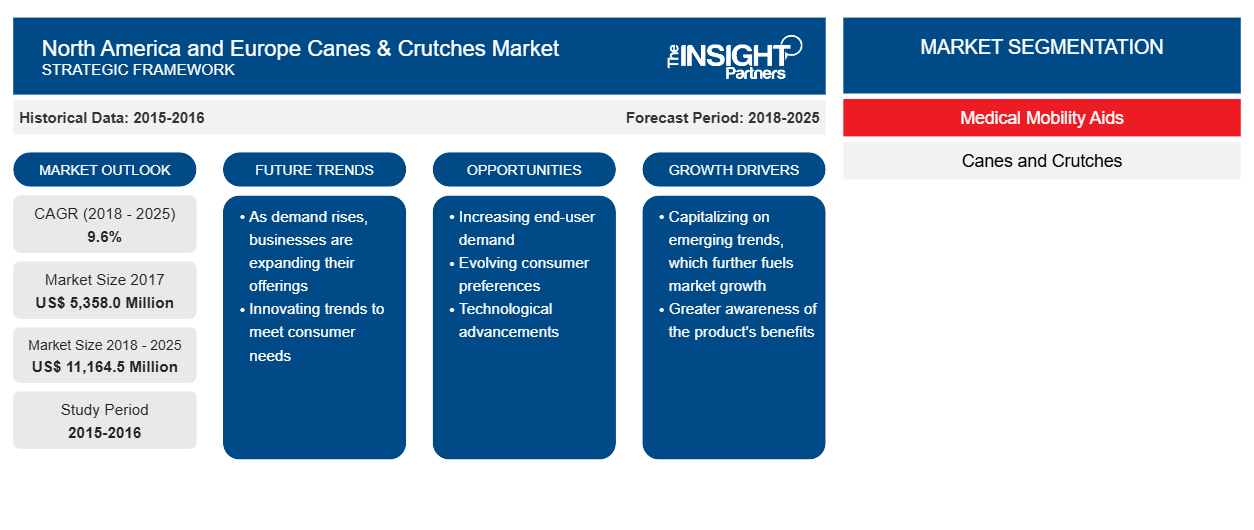

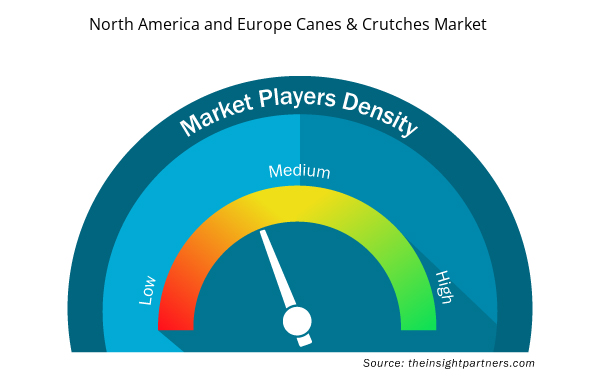

The canes & crutches market is expected to reach US$ 11,164.5 Mn in 2025 from US$ 5,358.0 Mn in 2017. The market is estimated to grow with a CAGR of 9.6% from 2018-2025.

Owing to factors such as growing awareness about canes & crutches and rising prevalence of orthopedic disabilities. North America is the largest geographic market and it is expected to be the largest revenue generator during the forecast period.

The North America canes & crutches market is expected to grow with CAGR of 9.9% to US$ 4,714.8 Mn 2025 from US$ 2,223.6 Mn in 2017. Factors such as, advancements of healthcare system, increasing number of people with orthopedic disabilities, increasing technological developments done in US and Canada, are likely to grow the market in the forecast period.

Lucrative Regional Markets

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increase in the Number of Orthopaedic Surgeries

The rise in the orthopedic surgeries is majorly driven by the surgeries done for the replacements of knee and hip. The surgeries are also been done for the amputations of the limbs due to the damages and injuries caused in the accidents or due to the various diseases. The number of the surgeries for the amputation is observed for the patients suffering from diabetes and have developed condition of gangrene. For instance, according to the U.S. Agency for Healthcare Research and Quality, in United States approximately 600,000 knee replacement surgeries are performed per year.

The knee replacement surgeries are being performed in the geriatric population for their deteriorating joints. Knee replacement, is among the most commonly performed orthopedic procedures. The rise in the conditions such as rheumatoid arthritis (RA) and ankylosing spondylitis (AS) and osteoporosis are driving to the number of the surgeries. For instance, according to a report published in 2018 of Healthline Media, rheumatoid arthritis (RA) affects 41 in every 100,000 people per year and near round 1.3 million Americans have RA. Likewise, data published by Spondylitis Association of America, states that in America, spondyloarthritis is found in approximately in 2.7million people which is 1 in 100 population. Similarly according to the International Osteoporosis Foundation, in 2018, osteoporosis is estimated to affect 200 million women across the world, among which near around one-tenth of women are above the age of 60, one-fifth of women aged more than 70, two-fifths of women aged above 80 and two-thirds of women aged more than 90.

Moreover, the number of surgeries are expected to be rising to the musculoskeletal disorders that are associated with sports, occupational injuries and age-related dysfunction. For instance, according to Arthritis Foundation, in 2017, approximately 54 million adults have been diagnosed with arthritis. In addition, approximately 300,000 babies and children have arthritis or a rheumatic condition. Also the common type of arthritis diagnosed is osteoarthritis, which affects approximately 31 million Americans. Therefore, according to the data and figures, the demand for canes and crutches as an aid for recovery post an orthopedic surgery is anticipated to increase during the forecast period.

Social Stigma Associated with the Use of Walking Canes and Crutches

In recent years, social stigma has been associated with the use of mobility aids such as, walkers, canes and crutches. In certain cultures, disability has been associated with curses, disease, dependence, and helplessness. Despite an increase in the number of people publicly using mobility aids such as sticks, frames and scooters, people still feel uneasy when they are faced with the prospect of using mobility equipment themselves. Assistive devices have been considered as a markers of incapacity to perform particular physical activities.

In some individuals, the use of canes and crutches have been associated with the loss of confidence, particularly in young people as well as the elder population. Since, the use of walking aids has been observed to be more in the young and elder people. Due to the stigma associated, the growth of the market is anticipated to witness challenges in its growth during the forecast period.

High Market Potential in Developing Nations

With increasing costs of manufacturing against their practices, the medical device manufacturers are struggling to generate enough revenue. The emerging markets in the developing economies are expected to be the crucial factor offering better and lucrative growth opportunities for the major players to expand their business and geographic reach.

The treatment of the orthopedic conditions and musculoskeletal diseases have become simpler due to the help of the advancement in the technologies. As compared to consuming heavy dose medicines and hectic therapies, the use of canes & crutches have helped the patients to regain their mobility. The advantages of canes & crutches has helped various patients to move along with the other normal people. Also the healthcare expenditure have created lots of opportunities for the developing nations to provides better and more services and facilities to their people.

Shiro Studio, situated in London manufactured the world's first fully 3D-printed walking stick in August, 2017. The company is an architecture practice, which has manufactured the ENEA walking stick to develop an innovative product for those who have difficulty moving around without support.

The regions are also witnessing rise in the start-up companies investing more on the healthcare sectors. In addition, the introduction of innovative products by startup companies is anticipated to offer significant growth opportunities in the canes & crutches market during the future years.

Medical Mobility Aids Insights

The medical mobility aids segment of the canes & crutches market is segmented into canes and crutches market. The crutches is the largest segment among the medical mobility aids segment in the canes & crutches market in 2017 and is also anticipated to hold the largest market in the year 2025. The crutches segment is the fastest growing segment and is accounted to grow at the CAGR of 9.6% over the forecast years.

Canes & crutches Market, by medical mobility aids

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America and Europe Canes & Crutches Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America and Europe Canes & Crutches Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Partnership/acquisition, and product launch & approvals were observed as the most adopted strategy in global canes & crutches industry. Few of the acquisition, partnership, product launches and approval made by the players in the market are listed below:

- 2018:Mobility Designed, LLC designed elbow crutch which provides users with offset handles and adjustable pivots for better control and movement.

- 2017:GF Health Products, Inc. established the new global headquarters in Atlanta, Georgia. The new facility stretches into two counties in the Atlanta region. The new headquarter unites customer showroom, and regional distribution center.

- 2016:Medline moved its corporate headquarters to Three Lakes Drive, US. The new space has helped the company to strengthen its ability in the healthcare environment in the nature.

- 2015:Ossenberg GmbH signed a distribution agreement with the Mobility Choices Ltd. for the distribution of Ossenberg crutches in UK. The Ossenberg crutches will be available for supplying through the Mobility Choices distributorship.

CANES & CRUTCHES – MARKET SEGMENTATION

By Medical Mobility Aids

- Canes

- Folding Canes

- Quad Canes

- Offset Canes

- Crutches

- Axillary Crutches

- Forearm/ Elbow Crutches

By Geography

North America

- U.S.

- Canada

Europe

- South Europe

- North Europe

Company Profiles

- Carex Health Brands (Compass Health Brands)

- DRIVE MEDICAL

- mikirad

- Ottobock

- Cardinal Health, Inc.

- Mobility+Designed, LLC

- GF Health Products, Inc.

- Medline Industries, Inc.

- BESCO Medical Co., Ltd.

- Ossenberg GmbH

North America and Europe Canes & Crutches Market Regional Insights

The regional trends and factors influencing the North America and Europe Canes & Crutches Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America and Europe Canes & Crutches Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America and Europe Canes & Crutches Market

North America and Europe Canes & Crutches Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 5,358.0 Million |

| Market Size by 2025 | US$ 11,164.5 Million |

| Global CAGR (2018 - 2025) | 9.6% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Medical Mobility Aids

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

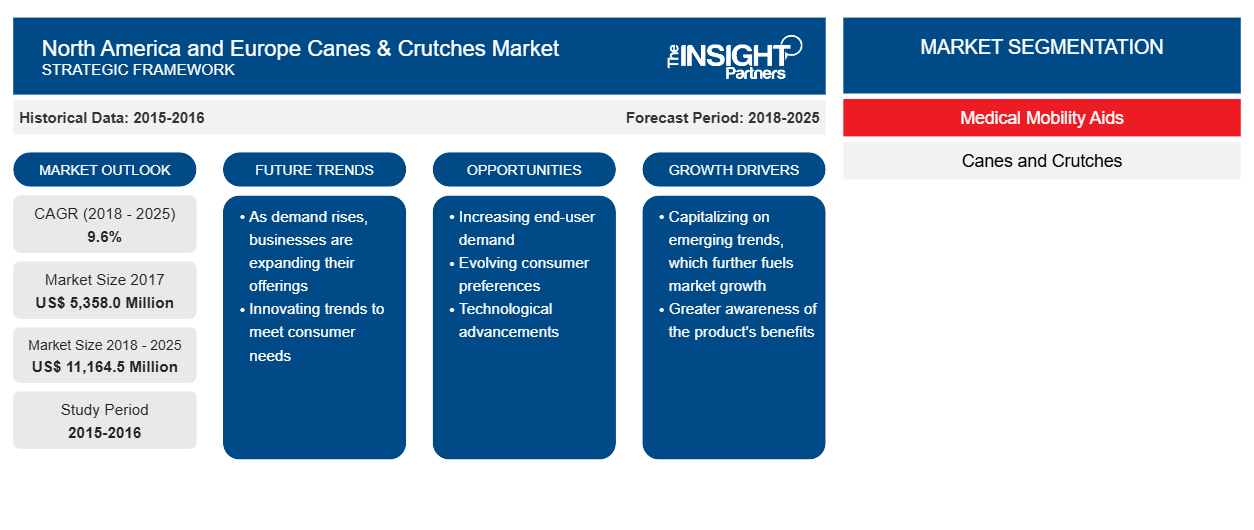

North America and Europe Canes & Crutches Market Players Density: Understanding Its Impact on Business Dynamics

The North America and Europe Canes & Crutches Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America and Europe Canes & Crutches Market are:

- Carex Health Brands (Compass Health Brands)

- DRIVE MEDICAL

- mikirad

- Ottobock

- Cardinal Health, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America and Europe Canes & Crutches Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Carex Health Brands (Compass Health Brands)

2. DRIVE MEDICAL

3. mikirad

4. Ottobock

5. Cardinal Health, Inc.

6. Mobility+Designed, LLC

7. GF Health Products, Inc.

8. Medline Industries, Inc.

9. BESCO Medical Co., Ltd.

10. Ossenberg GmbH

Get Free Sample For

Get Free Sample For