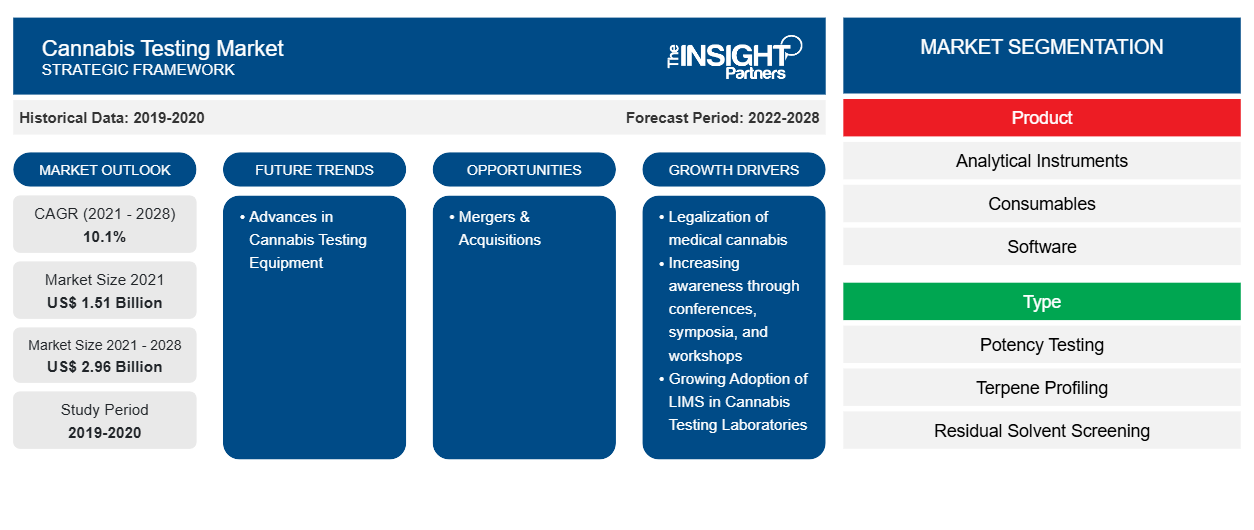

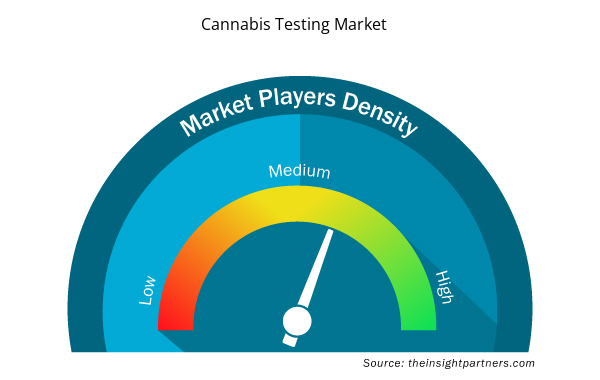

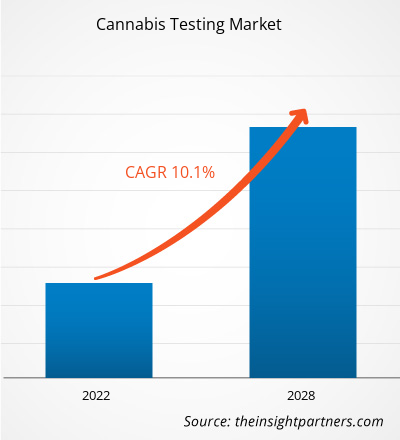

[Research Report] The cannabis testing market was valued at US$ 1,512.06 million in 2021 and is projected to reach US$ 2,960.20 million by 2028; it is expected to grow at a CAGR of 10.1% from 2021 to 2028.

Market Insights and Analyst View:

Cannabis testing is used in variety of applications that includes determining the concentration of cannabis in various analytical samples such as pharmaceutical drugs. It also helps in detection of contaminants such as bacteria and fungi. Furthermore, the cannabis testing is also performed for determination of trace metals such as arsenic, cadmium that can adversely impact health if remained unchecked. These tests are performed with the help of various analytical techniques that include chromatography analysis, spectrometry, ELISA, polymerase chain reaction (PCR) and others. Factors such as legalization of medical cannabis and increasing awareness through conferences, symposia, & workshops bolstering the cannabis testing market growth. Additionally, growing adoption of LIMS in cannabis testing laboratories are also driving the cannabis testing market growth.

Growth Drivers and Challenges:

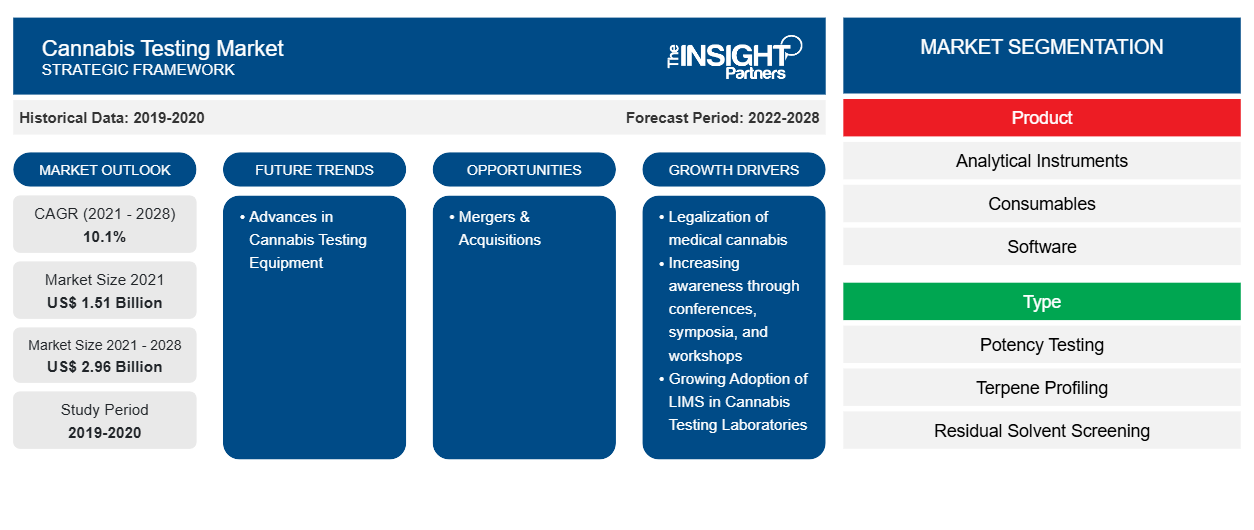

The cannabis testing market in the USA is anticipated to be the main driving force of growth of use of medical cannabis. 30 states of the United States of America have legalized the use of cannabis. These 30 states comprise of 60% of total population and have approved use of medical marijuana. This has become the driving force for the growth of cannabis testing marked in the entire North America region. Currently more than 8000 active licenses for cannabis businesses in USA. It is the only country with such number of market players. Europe is another region which has shown a decent growth rate for cannabis testing market. There has been an increase in the process of legalization of cannabis in European countries. In November 2018, Government of UK announced that medicinal cannabis is legal. The main force for growth in demand of cannabis is because of the use of cannabis in pesticides in Europe. Growing number of cannabis testing laboratories have fuelled the demand for cannabis in the Europe region.

The Asia Pacific region projects a great demand for cannabis testing market. This is because the medical use of cannabis to heal patients of various disease for example chronic neuropathic pain, and any spinal injury. It also helps to deal with anorexia in HIV AIDS which is a major challenge in this region. In December 2018, Thailand was the first country in Southeast Asia to legalize cannabis. There has been significant rise in investments in cannabis testing labs and recent law changes which have led to acceptance of marijuana and cannabis.

Similarly, in 2019, in Madhya Pradesh, India, the state government legalized the cultivation of hemp for industrial and medicinal purposes. Also, several other states in India are in the process of legalizing cannabis cultivation. For instance, In March 2021, the Chief Minister of Himachal Pradesh, announced that the state government is coming up with new policies to allow the cultivation of cannabis for medicinal and industrial use in order to boost the local economy. Further, the state government of Tripura, India, is forming an expert panel to legalize cannabis cultivation.

Thus, due to growing legalization of cannabis, the cannabis testing market is expected to grow at rapid pace.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cannabis Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cannabis Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cannabis Testing Market Segmentation and Scope:

The “Global Cannabis Testing Market” is segmented based on product, application, end use, portability, and geography. The cannabis testing market by product is segmented into analytical instruments, consumables, and software. Analytical instruments are further subsegmented as chromatography instruments, spectroscopy, and other analytical instruments. Based on application, the cannabis testing market is segmented into potency testing, terpene profiling, residual solvent screening, microbial analysis, pesticide screening, heavy metal testing, and genetic testing. Based on end use, the cannabis testing market is segmented into testing laboratories, drug manufacturers, and research institutes. Based on portability, the cannabis testing market is segmented into handheld devices, and stand alone. The cannabis testing market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on product, the cannabis testing market is segmented into analytical instruments, consumables, and software. Analytical instruments are further subsegmented as chromatography instruments, spectroscopy, and other analytical instruments. The analytical instruments segment held the largest share of the market in 2020; whereas the consumables segment is likely to grow at a highest rate during the forecast period. Patients and consumers rely on the products they are consuming to be safe and consistent. Consumables includes the majority of multiple user products that are used along with the chromatography and spectroscopy instruments to carry out several cannabis tests. The range of consumables used for the testing of cannabis includes chromatography columns, standards and CRMS, supplies and other accessories. The consumables segment is expected to witness the fastest growth in the global cannabis testing market as these products are purchased multiple times and majority of these cannot be re-used. Thus, the increasing study on cannabis is expected to lead to generate more requirement of consumables thereby resulting in the cannabis testing market growth.

Based on application, the cannabis testing market is segmented into potency testing, terpene profiling, residual solvent screening, microbial analysis, pesticide screening, heavy metal testing, and genetic testing. The potency testing segment held the largest share of the market in 2020; and the same segment is likely to grow at a higher rate during the forecast period. Cannabis is now a rapidly growing industry across the globe due to recent changes and attitudes in the laws for cannabis. Medicinal cannabis undergoes lab testing, requiring the hiring of qualified individuals who understand lab setup as well as various testing procedures. The potency of cannabis refers to the percentage of cannabinoids contained in the sample being tested. Depending on the state in which testing occurs, a sample’s THC and CBD levels, along with its tetrahydrocannabinolic and cannabidolic acids are required. Other labs may opt to test samples for their CBC and CBG as well. Testing for potency involves gas or liquid chromatography for a range of matrices.

Based on Based on end use, the cannabis testing market is segmented into testing laboratories, drug manufacturers, and research institutes. The testing laboratories segment held the largest share of the market in 2020; and the same segment is likely to grow at a higher rate during the forecast period. Appropriate cannabis testing is critical to demonstrate that these products do not contain harmful levels of contaminants or adulterants and are safe for public consumption. The number and size of testing laboratories operating in the United States and many other industrialized nations has increased significantly over the last few decades. There are myriad reasons for this growth, but observers generally point to the rise in product testing for the bulk of the increase. Safety, objectivity and economic considerations are the three integral parameters responsible for the growth of the segment in the coming years.

Based on portability, the cannabis testing market is segmented into handheld devices, and stand alone. The standalone segment held the largest share of the market in 2020; whereas the handheld segment is likely to grow at a higher rate during the forecast period. The levels of cannabinoids in fresh plants varies day to day. Thus, it is very difficult to choose the right time of harvesting. Also, several cultivators face several problems in monitoring their plants due to expensive or inaccurate test. Cultivators spend huge amount of money on laboratory tests. Thus, development of portable and affordable cannabis tester helps in avoiding the delay of forensic lab results.

Regional Analysis:

Based on geography, the cannabis testing market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2020, North America held the largest share of the global cannabis testing market, and Asia Pacific is estimated to register the highest CAGR during the forecast period. North America is largest market for Cannabis drug testing with the US holding the largest market share followed by Canada. The growth in North America is characterized by increase in the approval of cannabis medicinal products. Moreover, increasing drug investigation services, growing medicinal applications of cannabis and increasing number of toxicological laboratories are key factors contributing to the growth of cannabis testing market.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global cannabis testing market are listed below:

- In January 2023, Buffalo lab received approval for cannabis testing by The Office of Cannabis Management. Approved labs test for things like pesticides, heavy metals and moisture content.

- In January 2021, Agilent Technologies, Inc. announced that it has released MassHunter Workstation Plus 11.0, MassHunter BioConfirm, and MassHunter Networked Workstation 11.0. These products are comply with regulatory requirements from the EU EMEA and US FDA.

- In November 2020, Waters Corporation launched the new RADIAN ASAP System. It is a new direct mass detector engineered for non-mass spectrometry (MS) experts to conduct fast and accurate analyses of solids and liquids with minimal sample prep.

- In July 2020, Agilent Technologies, Inc. announced launch of Innovative online tool, and new consumables kits. The kit provides faster set up and analysis for Cannabis and hemp potency and pesticide/mycotoxin testing. The products are known as Cannabis and Hemp Potency Kit and the Cannabis Pesticide and Mycotoxin Kit in the market.

Cannabis Testing Market Regional Insights

The regional trends and factors influencing the Cannabis Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cannabis Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cannabis Testing Market

Cannabis Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.51 Billion |

| Market Size by 2028 | US$ 2.96 Billion |

| Global CAGR (2021 - 2028) | 10.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

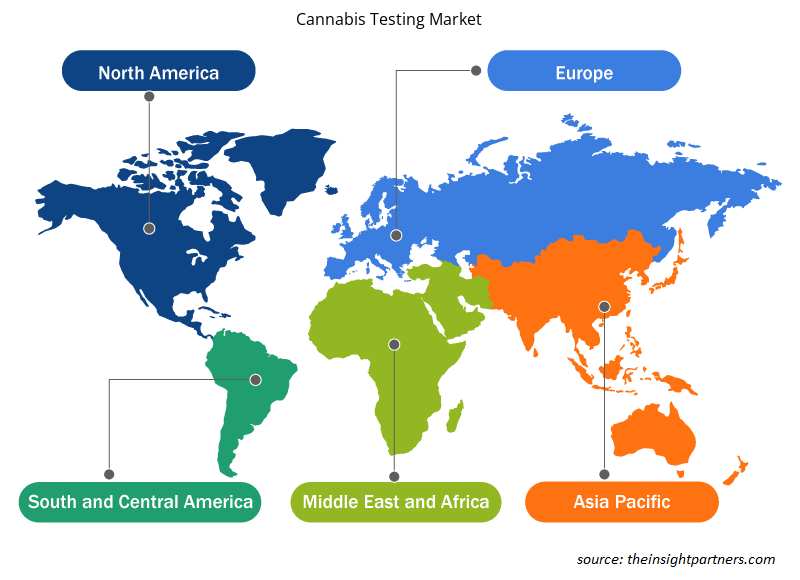

Cannabis Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Cannabis Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cannabis Testing Market are:

- Purpl Scientific

- Orange Photonics, Inc

- Agilent Technologies, Inc.

- SHIMADZU CORPORATION

- Merck KGaA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cannabis Testing Market top key players overview

Covid-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the healthcare industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and nonessential products including healthcare products and services. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. It also includes the impact of the COVID–19 pandemic on the market across all the regions. The impact of the pandemic and decreasing global research activities have also harmed the operations and financial execution of several companies in the cannabis testing market. The number of cannabis tests conducted in the laboratories decreased due to the shutting down of academic & research institutes and testing laboratories. For instance, according to a report issued by MJBizDaily in March 2020, most federally managed cannabis labs in Canada help COVID-19 testing, consequently impacting the number of cannabis tests performed in the labs. In addition, the cannabis market lost some revenue due to shop closures, testing laboratories closings, interrupted supply chains, global economic slowdown, and limited movement.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global cannabis testing market include Purpl Scientific, Orange Photonics Inc, Agilent Technologies Inc., Shimadzu Corporation, Merck KGaA, Restek Corporation, WATERS, CannaSafe Analytics, Accelerated Technology Laboratories, Inc, Digipath Inc. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product , Type , End User , and Portability and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The growth of the market is attributed to legalization of medical cannabis, increasing awareness through conferences, symposia, and workshops and growing adoption of LIMS in cannabis testing laboratories. However, the stringent regulatory framework for cannabis, and dearth of trained laboratory professionals hinder the market growth.

The types of cannabis testing are potency testing, terpene profiling, residual solvent screening, microbial analysis, pesticide screening, heavy metal testing, and genetic testing.

Cannabis testing is used in variety of applications that includes determining the concentration of cannabis in various analytical samples such as pharmaceutical drugs, and detection of contaminants such as bacteria and fungi. Furthermore, the cannabis testing is also performed for determination of trace metals such as arsenic, cadmium that can adversely impact health if remained unchecked. These tests are performed with the help of various analytical techniques that include chromatography analysis, spectrometry, ELISA, polymerase chain reaction (PCR) and others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Cannabis Testing Market

- Purpl Scientific

- Orange Photonics, Inc

- Agilent Technologies, Inc.

- SHIMADZU CORPORATION

- Merck KGaA

- Restek Corporation

- WATERS

- CannaSafe Analytics

- Accelerated Technology Laboratories, Inc.

- Digipath Inc

Get Free Sample For

Get Free Sample For