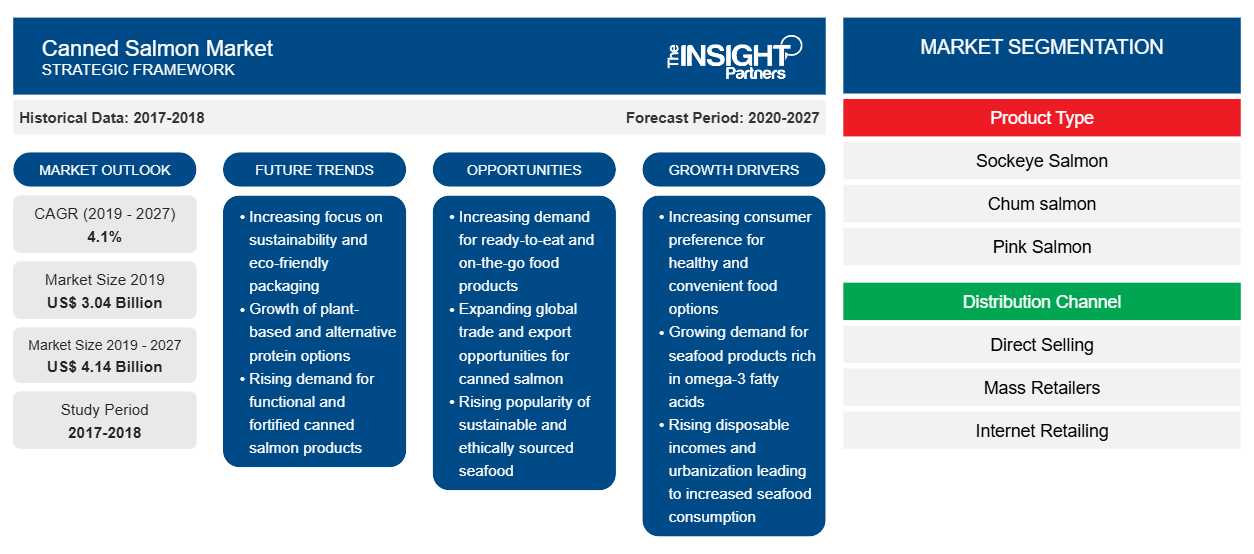

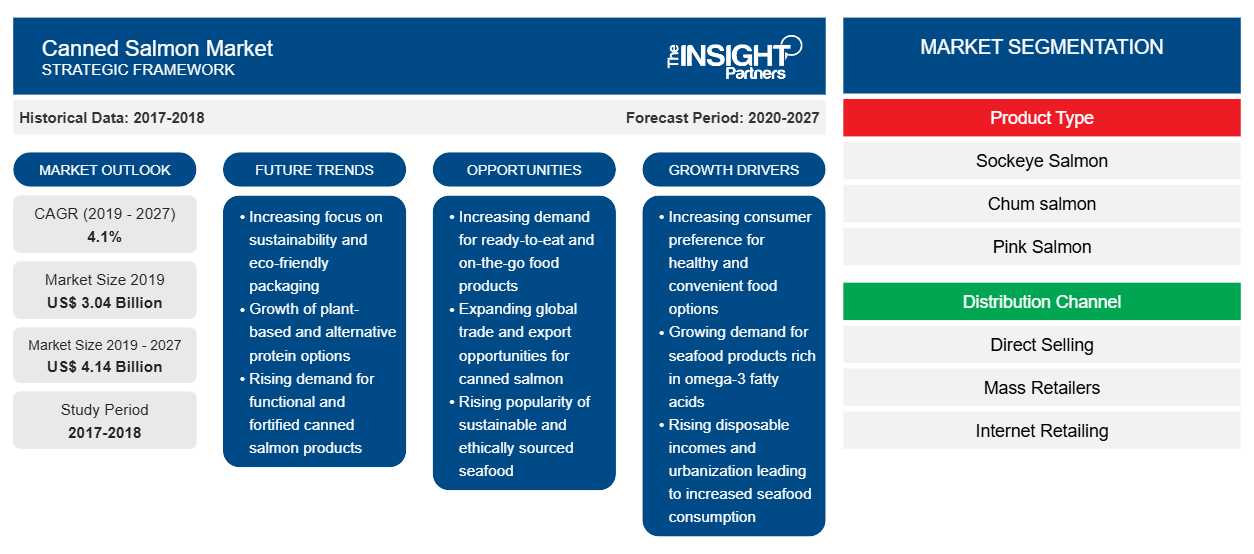

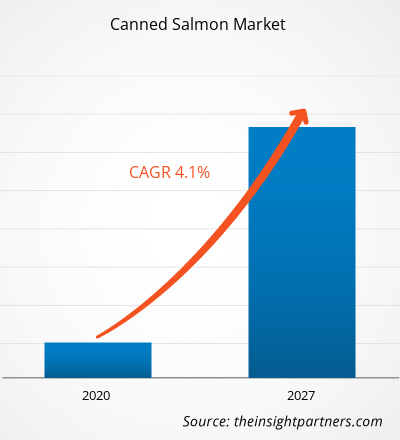

The canned salmon market was valued at US$ 3,039.67 million in 2019 and is projected to reach US$ 4,136.52 million by 2027; it is expected to grow at a CAGR of 4.1% from 2020 to 2027.

Canned fish are an important food source. They are rich in protein and other essential nutrients, such as omega-3 fatty acids. Canned salmon is processed and sealed in an airtight container and subjected to heat. Canning of food product helps to preserve the food and increases the shelf life of food product. Consumers are seeking minimally processed foods that are free from synthetic preservatives and obnoxious residues of fertilizers and antibiotics. Canned foods are, thus, the best alternatives for health-conscious consumers, particularly athletes. Canned salmon has been perceived in order to increase its shelf life along with feasibility to store it & to import it to other countries or continents where salmon fish is not easily available due to lack of resources. Increasing popularity of canned salmon among consumers worldwide would put the market on necessary thrust and escalate the market growth

Europe is expected to grow at the highest CAGR of 4.5% during the forecast period.Europe has become a significant market for the canned salmon due to increasing disposable incomes, growing urbanization, and rising demand for health beneficiary. Increase in disposable income coupled with changing lifestyle is one of the major driving factors for canned salmon market in European region. The demand for canned salmon in Europe is growing at a high pace over the past few years. Further, presence of prominent manufacturers in Europe is also proliferating the growth of the market.

COVID-19 first began in Wuhan, China, during December 2019, and since then, it has spread across the globe at a fast pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the most affected countries in confirmed cases and reported deaths as of October 2020. COVID-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The food industry is one of the significant sectors suffering severe disruptions, such as supply chain breaks, disruptions in manufacturing due to lockdown, and office shutdowns, resulting from this outbreak. For instance, China is the global hub of manufacturing and the largest raw material supplier for various industries. The lockdown of different plants and factories in leading regions—such as Asia Pacific and North America—is affecting the global supply chains and negatively impacting the manufacturing, delivery schedules, and sales of various goods. All these factors have significantly affected the global canned salmon market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Canned Salmon Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Canned Salmon Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Consumption of Salmon due to Its Health Benefits

Salmon consumption helps prevent heart disease; lower cholesterol and blood pressure; boost brain function; and reduce the risk of cancer, stroke, depression, Alzheimer’s disease, arthritis, Crohn’s disease, and asthma. Rising shift toward healthy eating habits, which consist of a variety of protein foods, including more seafood, is driving the growth of the canned salmon market. As per the Seafood Nutrition Partnership, the dietary guidelines recommend eating around 8 ounces of seafood to get at least 250 mg per day of omega-3 fatty acids. Also, pregnant women are advised to eat at least 8 ounces of seafood every week for improved infant health. The salmon consumption is increasing at an unprecedented rate worldwide. For instance, as per the World Wildlife Fund, salmon consumption worldwide is three times higher than it was in 1980. Furthermore, salmon aquaculture has become the fastest-growing food production system—accounting for 70% (2.5 million metric tons) of the market, and generating billions of dollars in revenue in local economies globally. Surge in demand for seafood in emerging countries and rise in healthy and nutritious food have increased the salmon consumption globally. For instance, as per the Global Salmon Initiative, animal protein consumption would rise by approximately 73% worldwide by 2050. Also, the growth of salmon farming has provided earning opportunity to several people in coastal and remote areas.

Product TypeInsights

Based on product type, the canned salmon marketis segmented intosockeye salmon, chum salmon, pink salmon, and Coho salmon.The sockeye salmonsegment accounted for the largest share ofthe global canned salmon market in 2019, and expected to grow at the highest CAGR during the forecast period. The sockeye salmon is also known as red salmon. They range in size from 24 to 33 inches in length and weigh between 5 and 15 pounds. Red salmon have a firm texture and higher oil content. These are expensive and are not widely available as compared to pink and chum salmon. Red salmon has the highest amount of omega 3, with approximately 2.7 grams per 100-gram portion. Therefore, just one serving per week can help lower cholesterol and the risk of heart disease. The red salmon run in Bristol Bay, Alaska, an area with saltwater bays and freshwater lakes. The Bristol Bay Regional Seafood Development Association is a fisherman-funded group with the objective to increase the value through education, quality outreach, and marketing. In 2017, Bristol Bay, Alaska, yielded a harvest of over 37 million sockeye salmon. The projected harvest was 27 million sockeyes. Bristol Bay sockeye represents nearly 75% of all sockeye salmon harvested in Alaska.

Distribution Channel Insights

Based on distribution channel, the canned salmon marketis segmented into direct selling, mass retailers, internet retailing, and others. The direct sellingsegment accounted for the largest share of the global canned salmon market in 2019, and is expected to register the fastest growth rate during the forecast period.In direct sales, manufacturers can directly sell their products through an online or offline channel in the absence of an intermediary, thereby avoiding profit erosion. The direct sales channel allows manufacturers to communicate with client personnel to develop a suitable product directly. Thus, it allows the company to maintain strong relationships with its customers and enable them to provide efficient after-sales support. Additionally, customer benefits from the direct sales as the representative can efficiently educate them about the specific products and services, leaving out the superfluous details and highlighting what might be of real, which is not the case with the distributor sales channels. In today’s market, online presence is an important aspect of conducting business. A significant number of millennials are accustomed to searching for information or shopping on the Internet. For the seafood dealers and retailers who want to connect more directly with the public, a website is practically necessary.

Mergers and acquisition and research & development are commonly adopted strategies by companies to expand their footprint worldwide, which is further impacting the size of the market. The players present in the canned salmon marketare implementing mergers and acquisition and research &development strategies to enlarge the customer base and to gain significant market share across the world, which also permits the players to maintain their brand name globally.

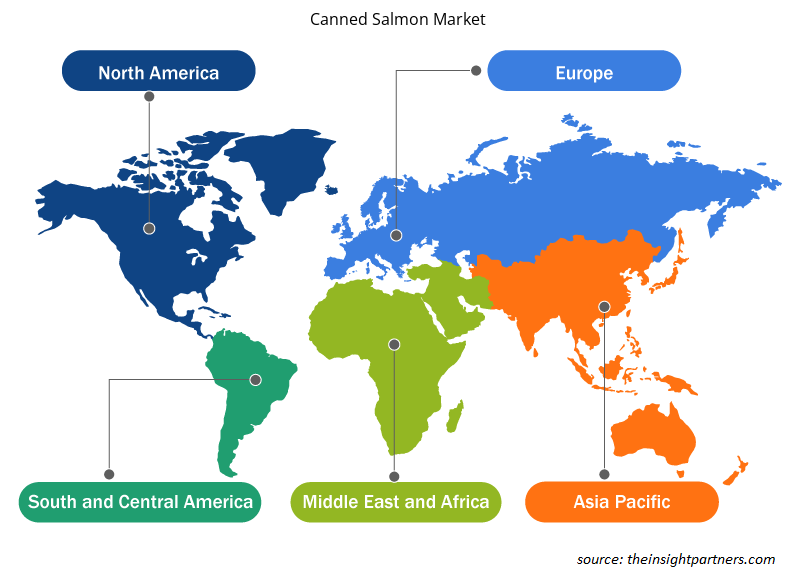

Canned Salmon Market Regional Insights

The regional trends and factors influencing the Canned Salmon Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Canned Salmon Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Canned Salmon Market

Canned Salmon Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 3.04 Billion |

| Market Size by 2027 | US$ 4.14 Billion |

| Global CAGR (2019 - 2027) | 4.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

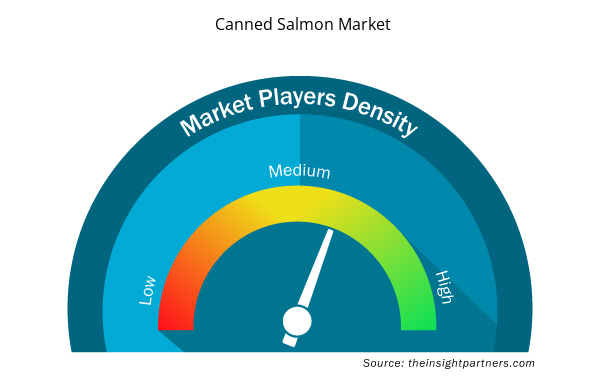

Canned Salmon Market Players Density: Understanding Its Impact on Business Dynamics

The Canned Salmon Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Canned Salmon Market are:

- Austevoll Seafood ASA

- Beijing Princess Seafood International Trading

- Bumble Bee Foods

- EQUA Seafoods

- Freedom Foods Group Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Canned Salmon Market top key players overview

Report Spotlights

- Progressive industry trends in the global canned salmon market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global canned salmon market from 2018 to 2027

- Estimation of global canned salmondemand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict the market growth

- Recent developments to understand the competitive market scenario and global canned salmon demand

- Market trends and outlook coupled with factors driving and restraining the growth of the global canned salmon market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global canned salmon marketgrowth

- Global canned salmon marketsize at various nodes of market

- Detailed overview and segmentation of the global canned salmon market, as well as its dynamics in the industry

- Global canned salmon market size in various regions with promising growth opportunities

Global Canned Salmon Market – by Product Type

- Sockeye Salmon

- Chum salmon

- Pink Salmon

- Coho Salmon

Global Canned Salmon Market – by Distribution Channel

- Direct Selling

- Mass Retailers

- Internet Retailing

- Others

Company Profiles

- Austevoll Seafood ASA

- Bumble Bee Seafood

- Golden Prize Canning Co., Ltd.

- FREEDOM FOODS GROUP LIMITED

- Pure Alaska Salmon Co LLC

- Princes Foods

- Raincoast Trading

- Wild Planet Foods

- Peter Pan Seafoods

- Alaska Seafood Company

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoSCAM, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

In 2019, sockeye salmon segment held the largest share in the global canned salmon market. The high demand can be attributed to increasing health conscious population, increasing awareness regarding benefits of protein and omega-3, wide range of products, and high availability on online and offline platforms.

In 2019,the canned salmon marketwas dominated by Asia Pacific region at theglobal level.Asia Pacific contributed to the largest share in the global canned salmon market. APAC continent comprises of several developing economies such as China, Japan, South Korea, Australia, among others. These developed countries are witnessing rapid growth in the middle-class population, along with growth in urbanization, which offers several opportunities for the key market players in the canned salmon market. Factors such as changing consumer taste preferences and increasing demand for processed fish products, as well as the availability of numerous product variants has boosted the growth of the canned salmon market in the Asia Pacific region.

The major players operating in the globalcanned salmon marketareAustevoll Seafood ASA, Bumble Bee Seafood, Golden Prize Canning Co., Ltd., FREEDOM FOODS GROUP LIMITED, Pure Alaska Salmon Co LLC, Princes Foods, Raincoast Trading, Wild Planet Foods, Peter Pan Seafoods, Alaska Seafood Company and among others.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Canned Salmon Market

- Austevoll Seafood ASA

- Beijing Princess Seafood International Trading

- Bumble Bee Foods

- EQUA Seafoods

- Freedom Foods Group Limited

- Mogster Group

- Peter Pan Seafoods

- Princes Group

- Raincoast Trading

- Wild Planet

Get Free Sample For

Get Free Sample For