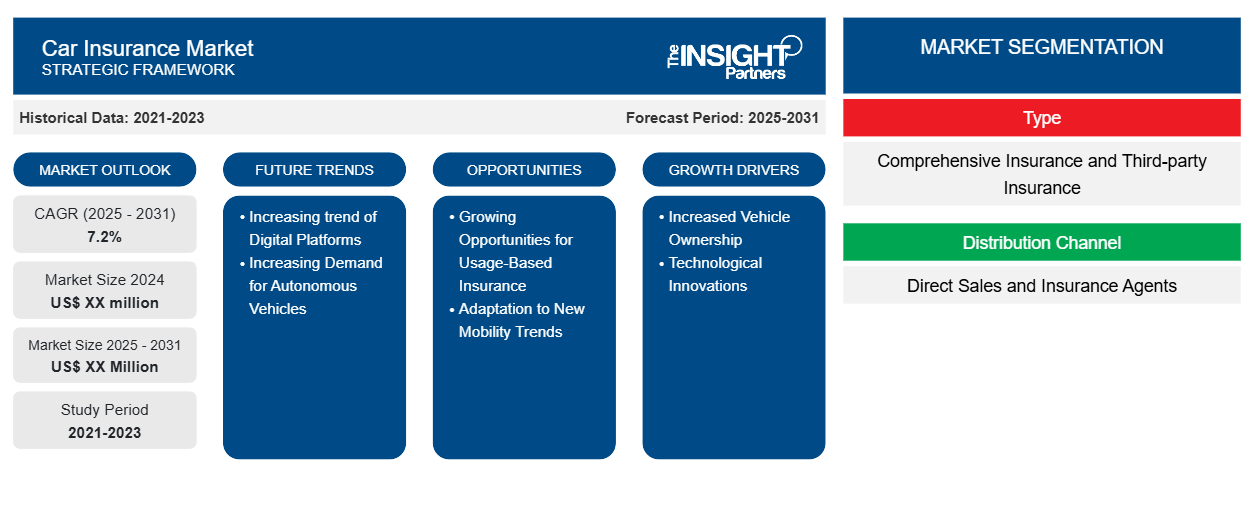

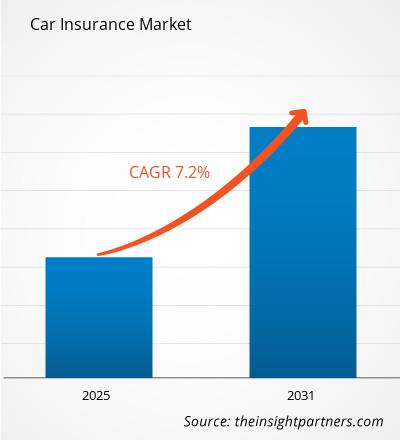

The Car Insurance Market is expected to register a CAGR of 7.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Comprehensive Insurance and Third-party Insurance). The report further presents analysis based on the Distribution Channel (Direct Sales and Insurance Agents). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Car Insurance Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Car Insurance Market Segmentation

Type

- Comprehensive Insurance and Third-party Insurance

Distribution Channel

- Direct Sales and Insurance Agents

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Car Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Car Insurance Market Growth Drivers

- Increased Vehicle Ownership: The most important driver of the car insurance market is an increase in vehicles on road. With the increase in number of vehicles, so is the demand for having cover as more people buy cars. This tends to be more in emerging markets where ownership of vehicles is growing at a very rapid rate.

- Technological Innovations: Telematics and usage-based models transform car insurance with technological innovation. Customers who are attracted to low-cost options now seek individualized premiums that reflect real driving behavior, and corporations make use of analytics better to measure risk, appealing better to consumers who want inexpensive options.

Car Insurance Market Future Trends

- Increasing trend of Digital Platforms: It becomes evident that the current time is paying much attention to customer experience since most insurers are improving experience through digital platforms and easier navigation of the process. More companies are investing in friendly applications and online services that are meant to make policy management and claims processing easy, including customer support for increased user experience with the insurer.

- Increasing Demand for Autonomous Vehicles: Autonomous vehicles are revolutionizing the car insurance market. As the technology of self-driving cars continues to advance, insurers are experimenting with new underwriting models and liability frameworks to manage the distinct risks associated with autonomous mobility. This will most probably change the nature of insurance product design and marketing in the near future.

Car Insurance Market Opportunities

- Growing Opportunities for Usage-Based Insurance: It goes without saying that enormous development opportunities exist for usage-based insurance as insurers can now formulate and promote usage-based products to this growing population who tend to pay insurance at what is essentially an incident-adjusted price rather than one in some amount.

- Adaptation to New Mobility Trends: Shared mobility services, such as ride-sharing and car-sharing, are giving insurers the chance to innovate and create products that will meet the new models of transportation. This includes coming up with policies that fit into new models of shared vehicles, which could easily take up a considerable share of the market.

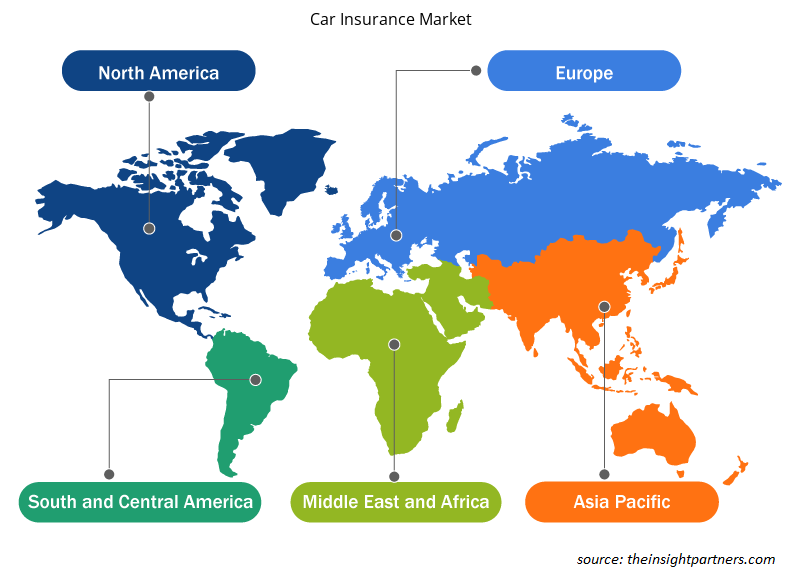

Car Insurance Market Regional Insights

The regional trends and factors influencing the Car Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Car Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Car Insurance Market

Car Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

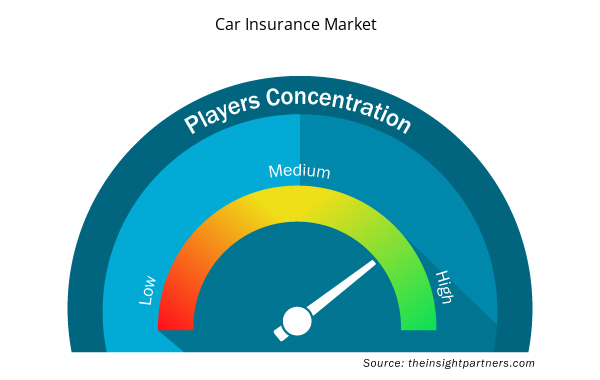

Car Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Car Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Car Insurance Market are:

- Allianz

- State Farm

- AXA

- Geico

- Progressive

- Zurich Insurance Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Car Insurance Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Car Insurance Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Car Insurance Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Increasing trend of Digital Platforms and Increasing Demand for Autonomous Vehicles are the key future trends of the Car Insurance Market

The leading players operating in the Car Insurance Market include Allianz, State Farm, AXA, Geico, Progressive, Zurich Insurance Group, Liberty Mutual Insurance Group, Travelers Companies Inc., Berkshire Hathaway Inc., Generali Group

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

The Car Insurance Market is estimated to witness a CAGR of 7.2% from 2023 to 2031

The major factors driving the Car Insurance Market are: Increased Vehicle Ownership and Technological Innovations

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Allianz

- State Farm

- AXA

- Geico

- Progressive

- Zurich Insurance Group

- Liberty Mutual Insurance Group

- Travelers Companies Inc.

- Berkshire Hathaway Inc.

- Generali Group

Get Free Sample For

Get Free Sample For