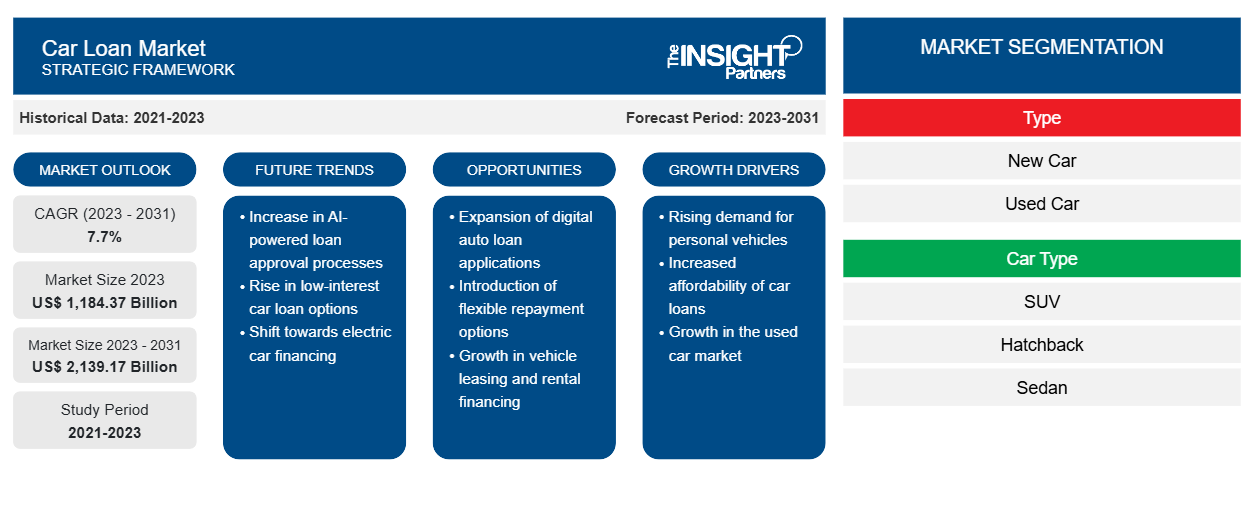

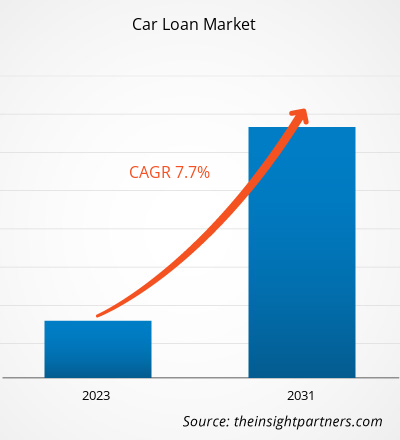

The car loan market size is expected to grow from US$ 1,184.37 billion in 2023 to US$ 2,139.17 billion by 2031; it is anticipated to expand at a CAGR of 7.7% from 2023 to 2031. The car loan market includes growth prospects owing to the current car loan market trends and their foreseeable impact during the forecast period. The car loan market is a large and expanding sector. The car loan market is growing due to factors such as an increase in demand for cars and increasing disposable income. Expanding electric vehicle launches and high replacement rate for vehicles provides lucrative opportunities for the car loan market growth. However, high interest rates restrain the market growth.

Car Loan Market Analysis

Ownership of cars, which used to be a status symbol long ago, has become a necessity in recent times. Thus, growing consumer preference for owning a vehicle is an important factor in the adoption of cars across the globe. Post-pandemic car loans have seen major transformations. The disposable income of consumers has significantly increased in many developing countries. Consequentially, the demand for vehicles has increased, bringing an increased need for car loans. Traditional and manual methods are insufficient to cater to this loan demand and digitalization is replacing at a rapid pace, bringing down the time needed to process loans from days to minutes. The widespread adaptation of digital technologies has empowered car loans by providing a quick and easy loan process.

Car Loan Industry Overview

- Car loans are secured loans where the car itself is used as a security. It is offered by lenders for used cars and new cars.

- Car loans are obtainable through credit unions, banks, and online lenders and need the vehicle to be used as security for the loan.

- A car loan is a kind of financing that can make it possible to buy a car and pay it off over time.

- The car loan market is expected to grow during the forecast period due to increasing innovations in the loan offerings by key market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Car Loan Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Car Loan Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Car Loan Market Driver

Growing Adoption Of Electric Vehicles To Provide Opportunities For The Car Loan Market

- The demand for electric vehicles is growing at a faster rate from 2021, owing to increasing investment in manufacturing plants. The growing demand for electric vehicles is primarily attributed to the increasing demand for low-emission vehicles, and growing supportive regulations for zero-emission vehicles through subsidies & tax rebates have compelled manufacturers to provide electric cars across the globe.

- As per the Global Electric Vehicle Outlook, sales of electric cars, including fully electric and plug-in hybrid vehicles, increased in 2021 to a new record of 6.6 million units. As per the same report, in China, electric car sales increased significantly in 2021 to 3.3 million, accounting for about half of the total global sales. EV sales also grew strongly in Europe by 65% to 2.3 million units, and the United States had doubled to 630,000 units in 2021.

- Bajaj Auto announced an investment worth US$ 40 million for manufacturing the Electric Vehicle plant in India with a production capacity of 500,000 electric vehicles per year.

- Thus, such growing production of electric vehicles is providing lucrative opportunities for the car loan market growth.

Car Loan Market Report Segmentation Analysis

- Based on type, the car loan market is segmented into new cars and used cars. The new car segment is expected to hold a substantial car loan market share in 2023.

- The new cars segment is also expected to hold the highest CAGR over the forecast period due to the rising disposable incomes of consumers and increasing standard of living of consumers which is increasing the need for car loans.

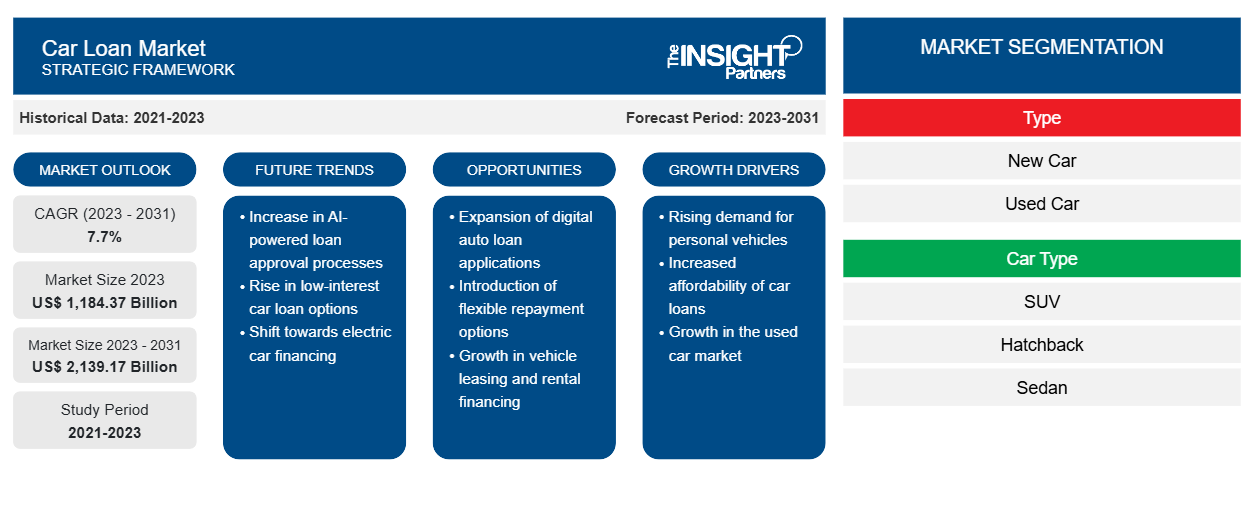

Car Loan Market Share Analysis By Geography

The scope of the car loan market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific is experiencing rapid growth and is anticipated to hold a significant car loan market share. The region's significant economic development, growing population, and increasing focus on risk management and insurance policies have contributed to the growth of the market in the region. The increasing demand for electric vehicles is further creating the demand for car loans. As per the report by the International Renewable Energy Agency, by 2025, around 20% of all vehicles on the road in Southeast Asia will be electric-operated, which includes 59 million two & three-wheelers and 8.9 million four-wheel cars. Also, in April 2021, the Indonesian government set a goal for adopting EVs to have a production of up to 20% of all domestic cars, which is approximately 400,000 e-cars, by 2025.

Car Loan Market Regional Insights

The regional trends and factors influencing the Car Loan Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Car Loan Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Car Loan Market

Car Loan Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,184.37 Billion |

| Market Size by 2031 | US$ 2,139.17 Billion |

| Global CAGR (2023 - 2031) | 7.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Car Loan Market Players Density: Understanding Its Impact on Business Dynamics

The Car Loan Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Car Loan Market are:

- Ford Motor Company

- Bank of America Corporation

- Hitachi Capital Corporation

- Toyota Financial Services

- General Motors Financial Company, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Car Loan Market top key players overview

The "Car Loan Market Analysis" was carried out based on type, car type, provider, and geography. On the basis of type, the market is segmented into new cars and used cars. Based on car type, the car loan market is segmented into SUVs, hatchbacks, and sedans. Based on provider, the market is segmented into banks, OEMs, credit unions, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Car Loan Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the car loan market. A few recent key market developments are listed below:

- In May 2023, HDFC Bank, India’s leading private sector bank, announced the launch of a mega ‘Car-loan Mela’ across North India. Over 300 bank branches in Haryana, Himachal Pradesh, and Chandigarh host the massive loan drive in partnership with leading automobile brands and regional dealerships.

[Source: HDFC Bank, Company Website]

- In May 2023, Sojitz Corporation, a pre-owned car dealer, acquired Albert Automotive Holdings Pty Ltd, a wholesale and retail used car business, to expand its reach into both foreign and domestic markets.

[Source: Sojitz Corporation, Company Website]

- In August 2021, Tata Motors partnered with Sundaram Finance to provide exclusive offers to customers electing to purchase its variety of passenger cars. Under this partnership with TATA Motors, Sundaram Finance agreed to offer 6 years of loans on the novel 'Forever' range of cars, and with 100% financing, that would require a minimum down payment.

[Source: Tata Motors, Company Website]

Car Loan Market Report Coverage & Deliverables

The car loan market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Car Loan Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Car Type, Provider and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global car loan market are Ford Motor Company, Bank of America Corporation, Hitachi Capital Corporation, Toyota Financial Services, and General Motors Financial Company, Inc.,

The global car loan market is expected to reach US$ 2,139.17 billion by 2031.

The global car loan market was estimated to be US$ 1,184.37 billion in 2023 and is expected to grow at a CAGR of 7.7 % during the forecast period 2023 - 2031.

Implementation of technologies in existing product lines is anticipated to play a significant role in the global car loan market in the coming years.

The increase in demand for cars and increasing disposable income are the major factors that propel the global car loan market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Ford Motor Company

- Bank of America Corporation

- Hitachi Capital Corporation

- Toyota Financial Services

- General Motors Financial Company, Inc.

- JPMorgan Chase & Co.

- Volkswagen Finance Private Limited

- Capital One

- Ally Financial Inc.

- Daimler AG

Get Free Sample For

Get Free Sample For