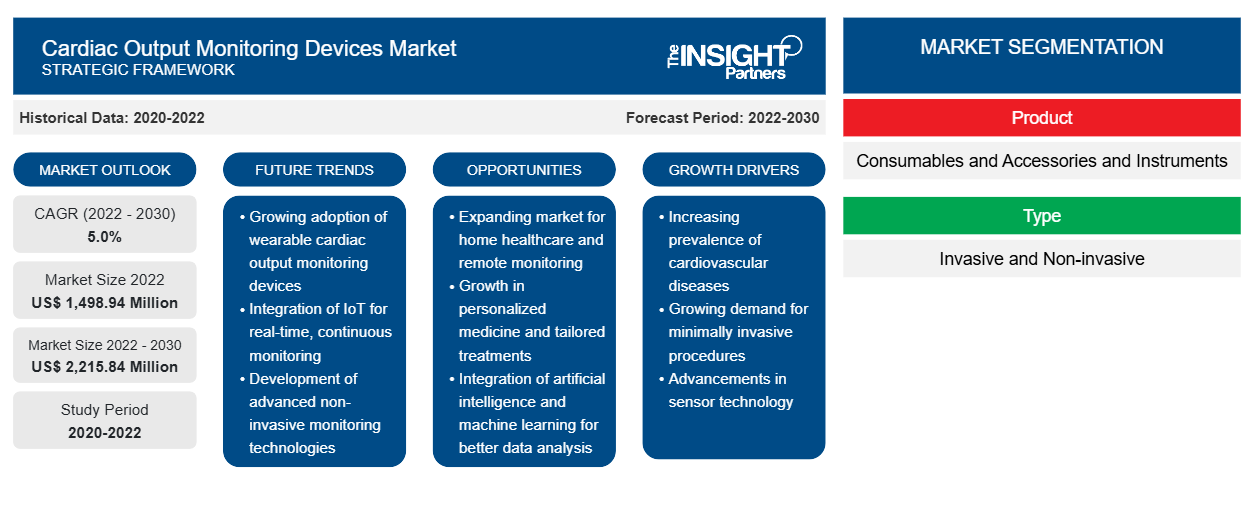

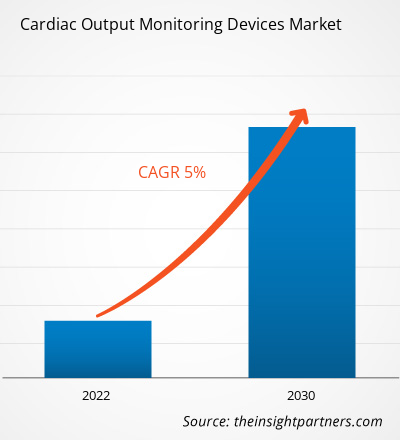

[Research Report] The cardiac output monitoring devices market size is projected to grow from US$ 1,498.94 million in 2022 to US$ 2,215.84 million by 2030; the market is anticipated to record a CAGR of 5.0% from 2022 to 2030.

Market Insights and Analyst View:

The amount of blood pumped by the heart's left or right ventricle in a minute is known as cardiac output. It is reliant on both stroke volume and heart rate. Bioimpedance, pulse contour analysis, thermodilution, FloTrac monitoring, PiCCO cardiac output monitoring, Doppler, and the Ficks principle are the foundations of cardiac output monitoring techniques. Using cardiac output monitoring devices is an important part of assessing patients in the operating room, critical care unit, and other settings. The lithium dilution approach has made continuous real-time cardiac output (CO) monitoring possible thanks to technological developments. During the projection period, the cardiac output monitoring devices market is anticipated to experience exponential growth for this technique.

Growth Drivers and Challenges:

Cardiovascular diseases (CVDs) and other significant health issues that require constant monitoring and intensive care are increasingly common in the senior population. A few of the main risk factors for CVD are age, ethnicity, and family history. Smoking, high blood pressure (hypertension), high cholesterol, obesity, inactivity, diabetes, poor diet, and alcohol consumption are additional risk factors.

As a result, during the estimated period, it is expected that the world's aging population will drive the cardiac output monitoring device market. According to the World Health Organization (WHO) projections, by 2030, there will be 1.4 billion persons over 60 in the world. With age, people become more susceptible to mobility limitations, as a result of which they require medical assistance or aid to avoid dependence on other individuals. The global population is aging rapidly, and the number of older adults is expected to increase significantly in the coming years. According to the 2020 Census, in the US, the population aged 65 and above surged at a rate nearly five times faster than the overall population growth during 1920–2020. In 2020, 55.8 million Americans, i.e., 16.8% of the total population, were aged 65 and above. Further, 13% of Brazil's population—more than 30 million seniors—is aged 60 or more; this population is expected to reach ~50 million by 2030, i.e., 24% of the country's population. Thus, the increasing geriatric population prone to CVD is a significant factor expected to drive the growth of the cardiac output monitoring devices market.

On the other hand, patients and healthcare professionals are particularly concerned about cybersecurity flaws in devices, particularly those like computerized image extraction devices (CIEDs), where there is a chance that the gadget may be reprogrammed or rendered inoperable. The Food and Drug Administration (FDA) of the US stated in 2023 that Medtronic was recalling ~350,000 implantable cardiac devices because of persistent problems with their capacity to provide high-voltage therapy when required.

An advisory on the FDA website states that "a reduced-energy shock, or no shock at all, may fail to correct a life-threatening arrhythmia, which can lead to cardiac arrest, other serious injury, or death." "If a patient with one of these devices requires additional surgical procedures to remove and replace the device, there are additional risks of harm." All cardiac resynchronization therapy defibrillators (CRT-Ds) and implanted cardioverter defibrillators (ICDs) with a glassed feedthrough produced after 2017 are covered by this recall. The use of these devices "may cause serious injuries or death," according to the FDA, which has classified this as a Class I recall. Thus, all these factors hinder market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cardiac Output Monitoring Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cardiac Output Monitoring Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

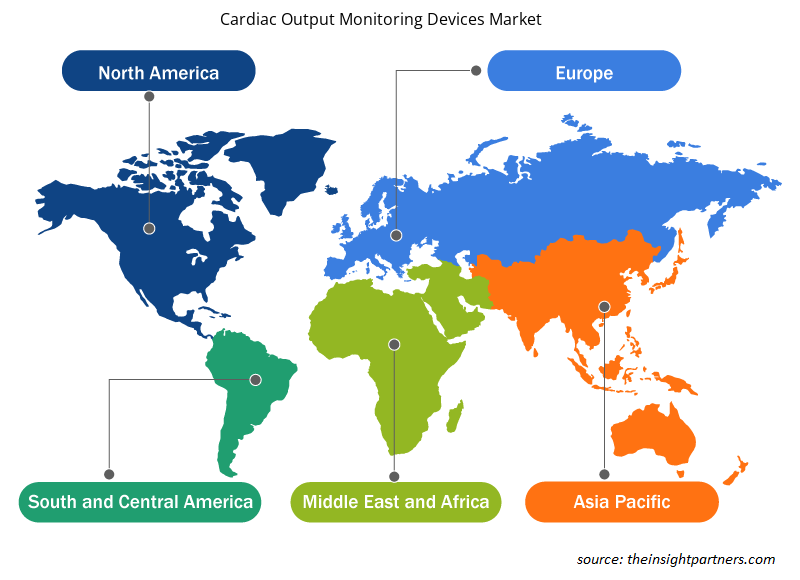

The cardiac output monitoring devices market is segmented on the basis of product, type, and end user. Based on product, the market is segmented into consumables and accessories and instruments. The cardiac output monitoring devices market, by type, is segmented into invasive and non-invasive. By end user, the cardiac output monitoring devices market is segmented into hospitals, ambulatory surgical centers, and others. Based on geography, the cardiac output monitoring devices market is divided into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

In terms of revenue, the consumables and accessories category accounted for the largest share of the global market in 2022. Due to the increased demand for consumables and the rising frequency of cardiac disorders, it is expected that this category will dominate the global market. Manufacturers rent equipment to end users, who then install cardiac output monitoring devices at their facilities. The agreement states that in order for end customers to utilize these devices, they must buy disposables. As a result, throughout the projected period, there will probably be an increase in the installation base of cardiac output monitoring devices and a rise in the prevalence of cardiovascular disorders worldwide.

The market for cardiac output monitoring devices has been bifurcated into invasive and non-invasive categories based on type. Owing to its accurate and consistent outcomes, which are crucial in critical care environments, the invasive category held a significant market share in 2022. Surgical rooms and critical care units frequently use invasive devices to measure cardiac output in patients with serious cardiac and pulmonary issues. These devices, which are inserted into the patient's body through an artery or vein, allow for the direct assessment of cardiac output. The growing prevalence of cardiovascular diseases, such as heart failure, cardiac arrest, and pulmonary embolism, is expected to drive demand for invasive cardiac output monitoring devices during the forecast period.

On the basis of end user, the hospital segment dominated the cardiac output monitoring devices market in 2022 because of the large number of patients requiring cardiac monitoring as well as the availability of state-of-the-art healthcare infrastructure and medical personnel. Hospitals are equipped with modern monitoring equipment that allows for continuous monitoring of patients with cardiac issues. Improved patient outcomes, timely intervention, and early detection of cardiac issues are made possible by the use of these techniques. Additionally, the growing requirement for less invasive procedures and the increasing frequency of cardiovascular illnesses are expected to drive growth in the market for cardiac output monitoring devices in hospitals.

Regional Analysis:

Based on geography, the cardiac output monitoring devices market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the most significant contributor to the growth of the global market. In terms of the global market for cardiac output monitoring devices, North America held the biggest share in 2021. This can be attributed to the rising prevalence of CVDs, increasing healthcare costs, growing disposable income, rising health consciousness, and easy accessibility of cutting-edge medical technology in the region. The number of older adults in the US is expected to rise from 52 million in 2018 to 95 million by 2060, according to the Population Reference Bureau. Compared to 16% in 2018, the elderly population is projected to account for 23% of the US population overall in 2060.

Asia Pacific is expected to register the highest CAGR in the cardiac output monitoring devices market from 2022 to 2030. The market growth in this region is ascribed to increasing investments in research and development activities in countries such as China, India, Japan, and South Korea, which are emerging as key pharmaceutical and biotechnology hubs. Furthermore, the presence of a large pool of skilled researchers and scientists, along with lower operating costs compared to Western countries, makes Asia Pacific an attractive destination for medical tourism. The increasing prevalence of CVD and the need for innovative medications to address unmet medical needs are creating demand for new devices, thereby benefiting the cardiac output monitoring devices market growth in the region.

Cardiac Output Monitoring Devices Market Regional Insights

Cardiac Output Monitoring Devices Market Regional Insights

The regional trends and factors influencing the Cardiac Output Monitoring Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cardiac Output Monitoring Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cardiac Output Monitoring Devices Market

Cardiac Output Monitoring Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,498.94 Million |

| Market Size by 2030 | US$ 2,215.84 Million |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

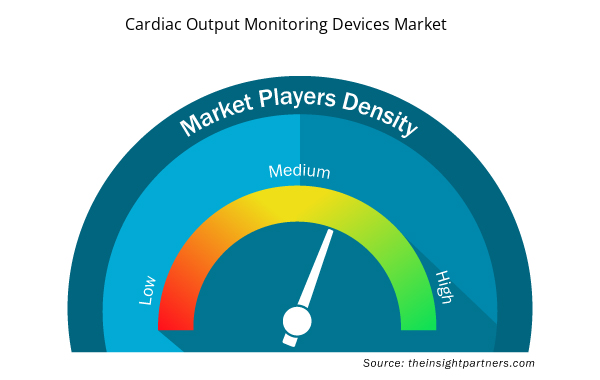

Cardiac Output Monitoring Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Cardiac Output Monitoring Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cardiac Output Monitoring Devices Market are:

- Getinge AB

- GE Healthcare

- Baxter International Inc.

- Edward Lifesciences Corporation

- Osypka Medical GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cardiac Output Monitoring Devices Market top key players overview

Competitive Landscape and Key Companies:

Getinge AB, GE Healthcare, Baxter International Inc., Edward Lifesciences Corporation, Osypka Medical GmbH, LiDCO Group plc, Deltex Medical Group plc, ICU Medical, Inc., Uscom, and CNSystems Medizintechnik GmbH are a few prominent players operating in the cardiac output monitoring devices market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market for cardiac output monitoring devices has been split into invasive and non-invasive categories based on type. Owing to its accurate and consistent outcomes, which are crucial in critical care environments, the invasive category held a significant market share in 2022. Surgical rooms and critical care units frequently use invasive devices to measure cardiac output in patients with serious cardiac and pulmonary issues. These devices, which are inserted into the patient's body through an artery or vein, allow for the direct assessment of cardiac output. The growing prevalence of cardiovascular diseases, such as heart failure, cardiac arrest, and pulmonary embolism, is expected to drive demand for invasive cardiac output monitoring devices during the forecast period.

The cardiac output monitoring devices market is expected to be valued at US$ 2,215.84 million in 2030.

On the basis of end user, the hospital segment dominated the cardiac output monitoring devices market in 2022 because of the large number of patients requiring cardiac monitoring, the availability of state-of-the-art healthcare infrastructure, and the availability of medical personnel. Hospitals are equipped with modern monitoring equipment that allows for continuous monitoring of patients with cardiac issues. Improved patient outcomes, timely intervention, and early detection of cardiac issues are made possible by the use of these techniques. Additionally, the growing requirement for less invasive procedures and the increasing frequency of cardiovascular illnesses are expected to drive growth in the market for cardiac output monitoring devices in hospitals.

The cardiac output monitoring devices market has major market players, including Getinge AB, GE Healthcare, Baxter International Inc., Edward Lifesciences Corporation, Osypka Medical GmbH, LiDCO Group plc, Deltex Medical Group plc, ICU Medical, Inc., Uscom, and CNSystems Medizintechnik GmbH.

In terms of revenue, the consumables and accessories category accounted for the largest share of the global market in 2022. Because of the increased demand for consumables and the rising frequency of cardiac disorders, it is expected that this category will dominate the global market. Manufacturers rent equipment to end users, who then install cardiac output monitoring devices at their facilities. The agreement states that in order for end customers to utilize these devices, they must buy disposables. As a result, throughout the projected period, there will probably be an increase in the installation base of cardiac output monitoring devices and a rise in the prevalence of cardiovascular disorders worldwide.

The cardiac output monitoring devices market was valued at US$ 1,498.94 million in 2022.

The amount of blood pumped by the heart's left or right ventricle in a minute is known as cardiac output. It is reliant on both stroke volume and heart rate. Bioimpedance, pulse contour analysis, thermodilution, FloTrac monitoring, PiCCO cardiac output monitoring, Doppler, and the Ficks principle are the foundations of cardiac output monitoring techniques. Using cardiac output monitoring devices is an important part of assessing patients in the operating room, critical care unit, and other settings. The lithium dilution approach has made continuous real-time cardiac output (CO) monitoring possible thanks to technological developments. Throughout the projection period, the market for cardiac output monitoring devices is anticipated to experience exponential growth for this technique.

Factors driving the market include technological advancement, an increase in the prevalence of cardiac diseases, patient awareness, and an increase in the number of unmet medical requirements in emerging and underdeveloped nations. However, the high cost of devices hinders the cardiac output monitoring devices market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Cardiac Output Monitoring Devices Market

- Getinge AB

- GE Healthcare

- Baxter International Inc.

- Edward Lifesciences Corporation

- Osypka Medical GmbH

- LiDCO Group plc

- Deltex Medical Group plc

- ICU Medical Inc.

- Uscom

- CNSystems Medizintechnik GmbH

Get Free Sample For

Get Free Sample For