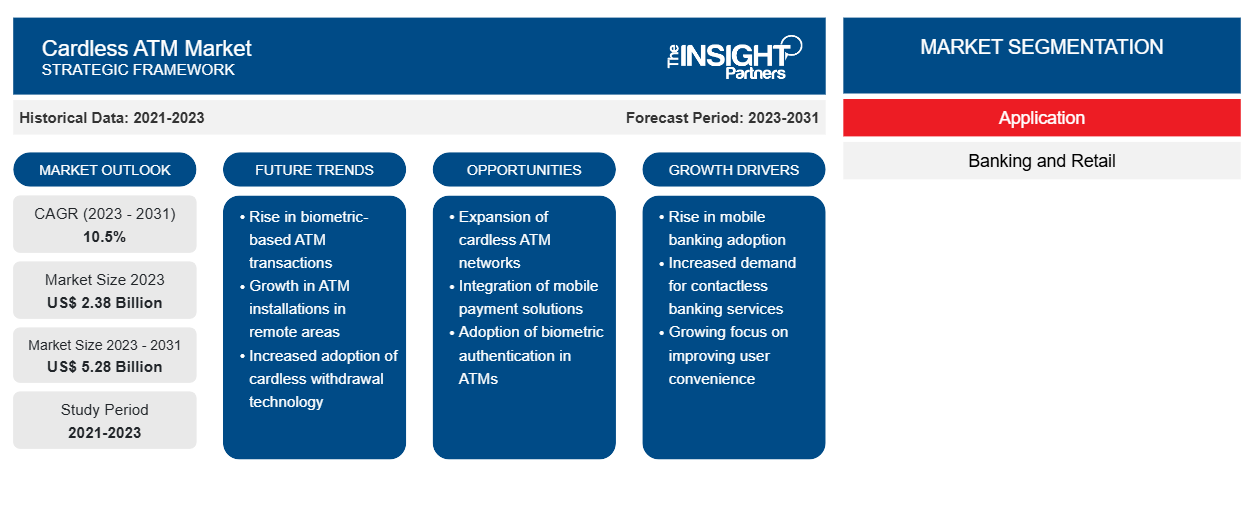

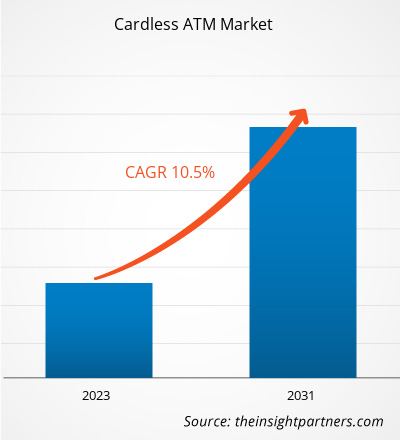

The Cardless ATM market size is expected to grow from US$ 2.38 billion in 2023 to US$ 5.28 billion by 2031; it is anticipated to expand at a CAGR of 10.5% from 2023 to 2031. The digital transformation has also impacted the banking sector for good. Technology is being adopted to increase the accessibility and convenience for consumers in the banking sector. In this direction, banks across the globe are increasingly introducing mobile platforms, digital banking, and biometric authentication to offer better and more accessible solutions to consumers. In the wake of these developments, the cashless ATM market share is also witnessing a surge across the globe.

Cardless ATM Market Analysis

The cardless ATM market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Digital technology has altered the banking industry, improving efficiency and accessibility. Although financial technology reduces the need for frequent cash transactions, it also makes it easier to obtain cash when the consumer needs it. Cardless ATMs allow customers to complete ATM transactions using their smartphone's bank app. They are a simple way to withdraw money from a bank account if one forgets their debit card or wants to reduce the number of times the consumer has to touch an ATM's screen. This is one of the major factors driving the cardless ATM market growth globally.

Cardless ATM

Industry Overview

- Cardless ATM accounts improve security by eliminating the need for actual cards, simplifying transaction processes, and providing mobile banking services. As more people use formal financial services, the banking industry is increasing its focusing on cardless ATM accounts.

- ATMs that use physical cards encounter difficulties like theft, loss, and unauthorized access, highlighting the need for new solutions.

- Cardless ATM accounts, which use mobile banking apps and biometric authentication, provide a secure alternative to physical cards. Advanced authentication mechanisms improve security and mitigate hazards connected with physical card usage.

- Cardless ATM accounts are popular due to their faster transaction process and convenience of use. Mobile devices provide safe transaction authorization without the need for physical cards, leading to increased banking accessibility.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cardless ATM Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cardless ATM Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cardless ATM Market Driver

Rise in Mobile Banking Across the Globe to Drive the Cardless ATM Market

- With the boom in digital banking and online transactions in the post-pandemic times, the reliance on ATMs was diminished. The application of ATMs is under question with the increasing movement towards cashless economies around the world. This prompted the banking sector and ATM providers to rethink the technology, and this pushed them to offer cashless ATMs to consumers.

- Cardless ATMs are seen as the "next big trend" in the banking industry. Major institutions such as Bank of America and Chase have already implemented cardless ATMs. According to Wilson Kerr of Unbound Commerce, "As biometric technology improves and secures smartphone access measures, innovations such as cardless ATMs will become the norm."

- Among the most recent advances, QR codes in cardless ATMs are expanding at an unprecedented rate.

- These cardless ATMs are significantly easier to install and less expensive to maintain. In December 2021, one of the world’s digital banking and payments platform providers, CR2, today announced that it has provided this zero-touch ATM cash withdrawal solution for one of the most progressive banks in the African continent today. Cashless ATMs appeal to the more sophisticated mobile banking users, and this has been driving the cardless ATM market growth.

Cardless ATM

Market Report Segmentation Analysis

- Based on technology, the cardless ATM market report is segmented into near-field communication (NFC), quick response (QR) codes, and biometric verification.

- The near-field communication (NFC) segment is expected to hold a significant Cardless ATM market share in 2023. When the user taps their mobile device against the contactless symbol at an ATM, near-field communication (NFC) launches their phone's digital wallet app. From the app screen, the user can select the card they want to use and enter the PIN to complete the ATM transaction.

Cardless ATM

Market Analysis by Geography

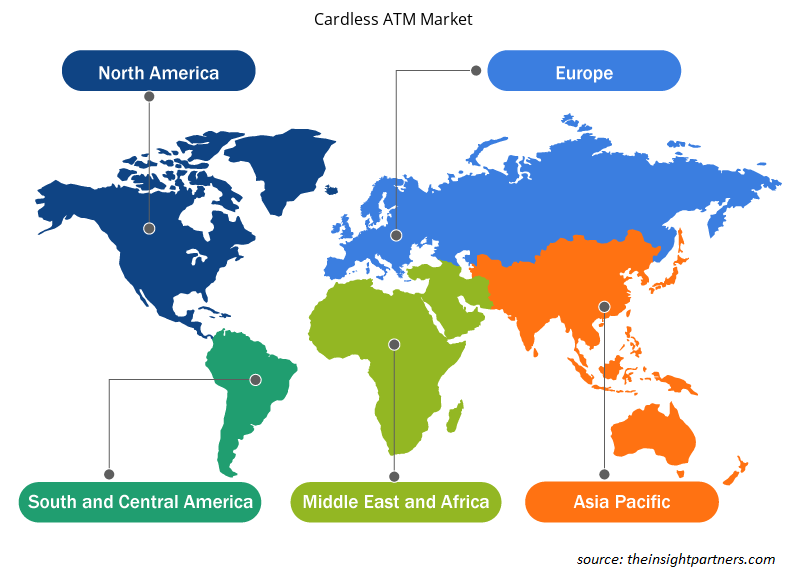

The scope of the Cardless ATM market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant Cardless ATM market share. The region's significant economic development and increasing use of mobile banking technology are driving the adoption of cardless ATMs in the region. According to a 2023 stat by Fortunly, 89% of American bank account holders use mobile banking for account management.

Cardless ATM

Cardless ATM Market Regional Insights

The regional trends and factors influencing the Cardless ATM Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cardless ATM Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cardless ATM Market

Cardless ATM Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.38 Billion |

| Market Size by 2031 | US$ 5.28 Billion |

| Global CAGR (2023 - 2031) | 10.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

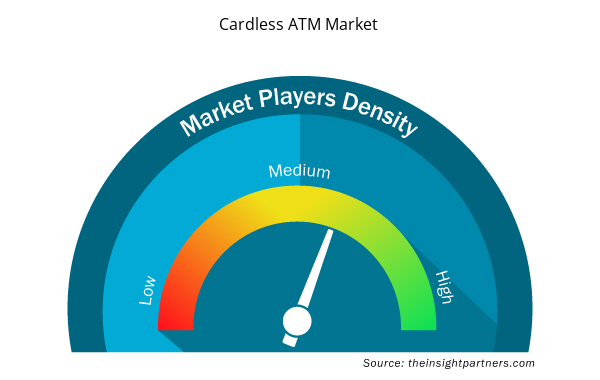

Cardless ATM Market Players Density: Understanding Its Impact on Business Dynamics

The Cardless ATM Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cardless ATM Market are:

- Citigroup Inc.

- JPMorgan Chase & Co.

- Wells Fargo

- NCR Corporation

- Fujitsu

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cardless ATM Market top key players overview

The "Cardless ATM Market Analysis" was carried out based on type, technology, application, and geography. In terms of type, the market is segmented into on-site ATMs, off-site ATMs, and others. Based on technology, the cardless ATM market is segmented into near-field communication (NFC), quick response (QR) codes, and biometric verification. Based on application, the cardless ATM market is segmented into banking and retail. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Cardless ATM

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Cardless ATM market. A few recent key market developments are listed below:

- In June 2016, Bank of America revealed Thursday that it has unveiled 19 ATMs in San Antonio that allow users to withdraw cash using their smartphones. Customers can make transfers and check balances at cardless ATMs by utilizing a digital debit card stored on their smartphone.

[Source: Bank of America, Company Website]

- In September 2020, HSBC created in-house AI-powered technology to optimize cash-filling operations at its ATMs, which are now outsourced to third-party contractors. The technique was successfully tested on the bank's 1,200 ATM network in Hong Kong. The bank saved up to US$ 1 million because the number of ATM refills decreased by 15% after implementing the "iCash" AI technology.

[Source: HSBC Holdings Plc, Company Website]

Cardless ATM

Market Report Coverage & Deliverables

The market report "Cardless ATM Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Explosion-Proof Equipment Market

- Cell Line Development Market

- Asset Integrity Management Market

- Battery Testing Equipment Market

- Online Exam Proctoring Market

- Human Microbiome Market

- Arterial Blood Gas Kits Market

- Bathroom Vanities Market

- Customer Care BPO Market

- Employment Screening Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global cardless ATM market are Citigroup Inc.; JPMorgan Chase & Co.; Wells Fargo; NCR Corporation; and Barclays Bank PLC.

The global cardless ATM market is expected to reach US$ 5.28 billion by 2031.

The global cardless ATM market was estimated to be US$ 2.38 billion in 2023 and is expected to grow at a CAGR of 10.5% during the forecast period 2023 - 2031.

Integration with AI technologies is impacting the cardless ATM, which is anticipated to bring new cardless ATM market trends in the coming years.

The rise in mobile banking across the globe, rising digitalization in banking operations, and rise in user convenience offerings are the major factors that propel the global cardless ATM market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Citigroup Inc.

- JPMorgan Chase & Co.

- Wells Fargo

- NCR Corporation

- Fujitsu

- Barclays Bank PLC.

- HSBC Bank A.S.

- GRG Banking

- Bank of America

- PNC Bank

Get Free Sample For

Get Free Sample For