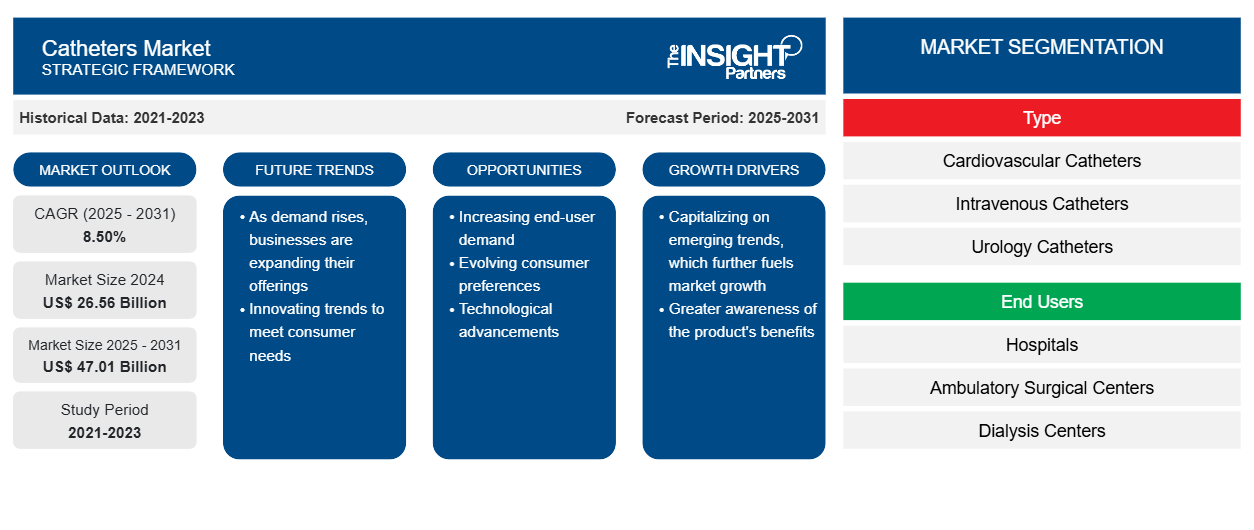

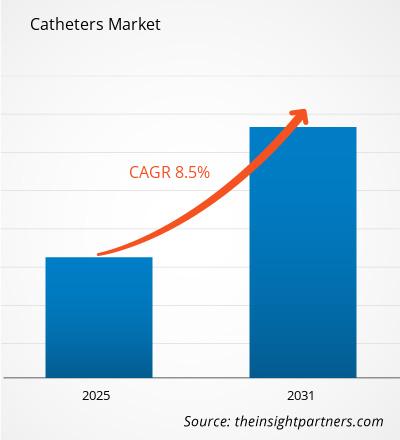

[Research Report] The global catheters market size is projected to surge from US$ 22.56 billion in 2022 to US$ 46.42 billion by 2031; the market is estimated to grow at a CAGR of 8.5% during 2022–2031.

Analyst Perspective:

Due to the increasing incidence of cardiovascular diseases, kidney diseases, urinary tract procedures, and increasing demand for minimally invasive surgeries, the demand for catheters is expected to remain high in the coming years. The high prevalence rate of chronic diseases leading to hospitalization has fueled the growth of the market. Furthermore, an increase in mid-sized catheter manufacturers looking to capture a higher market share, as well as an increase in funding from various government agencies for research and development activities, is expected to promote market growth during the forecast period. Furthermore, the growing geriatric population is also expected to be a major factor driving the demand for catheters in the near future. Additionally, increasing initiatives by key market players to launch their products is expected to further propel the growth of the market. For example, in July 2021, Medtronic plc launched its drug-eluting balloon catheter (DCB) Prevail under the CE mark (Conformité Européenne) in Europe. The newest coronary DCB on the market, the Prevail DCB, is used in percutaneous coronary intervention (PCI) to treat narrowed or blocked coronary arteries in patients with coronary artery disease (CAD). However, complications related to catheters and the presence of substitutes may hinder the growth of the market.

Market Overview:

Catheters are medical devices that can be injected into the body to treat illness or perform a surgical procedure. By changing and modifying the way catheters are manufactured, it is possible to adapt catheters for cardiovascular, urologic, gastrointestinal, neurovascular, and ophthalmic applications. Catheters are made from different materials and, therefore, can be left in place for many weeks. Various polymers are used in the manufacture of catheters, including silicone rubber, nylon, polyurethane, polyethylene terephthalate (PET), latex, and thermoplastic elastomers. Silicone is one of the most popular implantable options because it is inert and will not react to body fluids and a variety of medical fluids that it may come into contact with. Catheterization is a basic, common procedure performed along with various other medical procedures such as angioplasty, cardiac electrophysiology, and neurosurgery that use catheters. There are different types of catheters on the market, including cardiovascular catheters, neurovascular catheters, urinary catheters, intravenous catheters, and specialty catheters. In addition, among the catheters mentioned above, the cardiovascular catheter is the most commonly used.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Catheters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Catheters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rising Number Of Cases of Chronic Ailments Drive Global Catheters Market

According to the Brain Aneurysm Foundation, as of March 2021, approximately 500,000 deaths are caused by brain aneurysms worldwide each year, and half of these individuals are 50 years old or younger. The annual rupture rate is about 8-10 people per 100,000 or about 30,000 people in the United States. Therefore, with the increasing prevalence of neurovascular diseases, the demand for neurovascular catheter devices is also expected to increase. Cardiovascular, urological, and neurological diseases have been among the leading causes of morbidity and mortality rates worldwide over the past three decades. People who perform sedentary jobs are more likely to develop chronic conditions such as diabetes, cardiovascular diseases (CVDs), urological diseases (including end-stage renal disease or end-stage renal disease), and other diseases. According to the American Heart Association, around 19 million deaths worldwide were attributed to cardiovascular disease in 2021. Furthermore, it was estimated that 244 million people were living with ischemic heart disease (IHD) worldwide in 2021. The rise in cardiovascular disease will increase the number of hospitalizations and medical procedures, which in turn is expected to drive the adoption of catheters.

One of the most serious impacts of this trend is kidney failure, which is most commonly caused by chronic diseases such as high blood pressure and diabetes. Urinary tract infections, lupus, polycystic kidney disease, glomerulonephritis, and other kidney abnormalities are the most common causes of kidney problems. Poor lifestyle choices, including inadequate physical exercise, excessive alcohol consumption, smoking, obesity, and inconsistent dietary habits, are some of the causes of the increase in cardiovascular and neurovascular diseases. As these diseases spread, more and more people will need to use catheters, increasing demand over the forecast period. Hence, the rising number of cases of chronic ailments is driving the global catheters market growth.

Segmental Analysis:

Based on type, the catheters market is segmented into cardiovascular catheters, intravenous catheters, urology catheters, specialty catheters, and neurovascular catheters. The cardiovascular catheters segment held a larger market share in 2022. However, the market for urology catheters segment is anticipated to register a higher CAGR during 2022–2031 owing to the use of urological catheters increases due to the increasing prevalence of end-stage renal disease, kidney problems, and urinary tract infections.

The significant market share of cardiovascular catheters is due to several advantages that the catheters offer for chronic diseases. The catheters provide minimally invasive access to the vascular systems, reducing the need for open surgical procedures. The cardiovascular catheter segment is divided into electrophysiology catheters, percutaneous transluminal coronary angioplasty balloon catheters (PTCA), intravascular ultrasound (IVUS catheters), percutaneous transluminal angioplasty catheters (PTA), and others include guide catheters, angiography catheters, and pulmonary artery catheters. Cardiovascular catheters help with diagnostic purposes, such as angiography, in which a contrast agent is injected through the catheter to visualize blood vessels and assess blood flow. This allows healthcare professionals to diagnose and treat a wide range of cardiovascular diseases, improving patient outcomes and reducing the need for more invasive surgical procedures.

In addition, the urology catheter segment is divided into dialysis catheter and urinary catheter. The dialysis catheter segment is divided into hemodialysis catheter and peritoneal catheter. The urinary catheter segment is divided into a Foley catheter, an intermittent catheter, and an external catheter. The urinary catheters were used for surgical purposes, and the demand was partly affected by the temporary postponement of various elective surgeries. In addition, according to the study titled "Prevalence and associated factors of urinary incontinence among women living in China: a literature review," published in October 2021, approximately 43-349 million Chinese women were suffering from urinary incontinence (UI). The rising prevalence of urinary incontinence and the increasing number of surgical procedures are the major factors driving the demand for urology catheters, thereby fueling the growth of the segment.

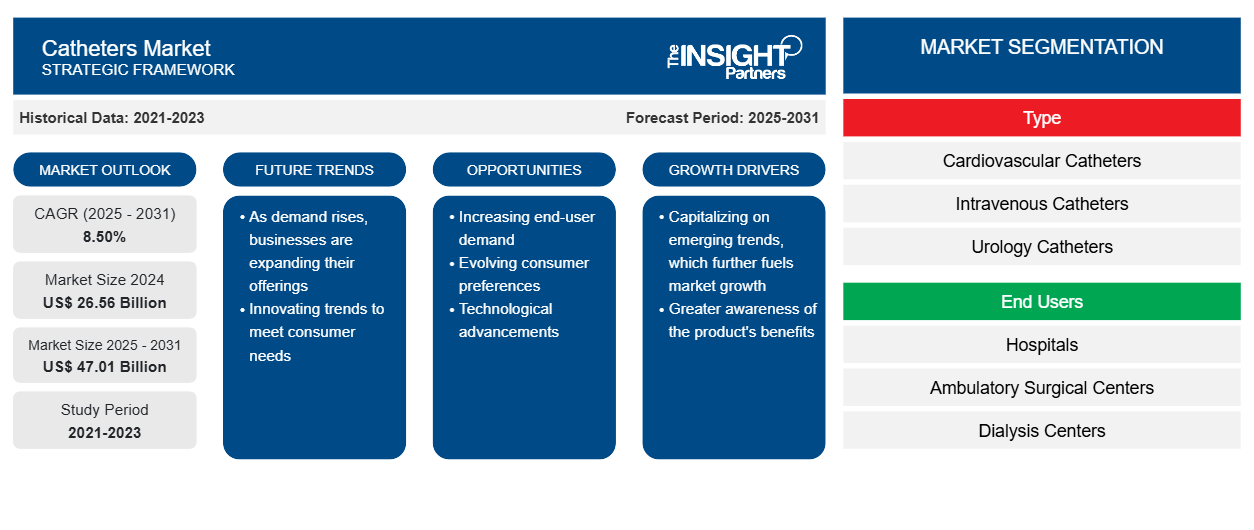

Regional Analysis:

The most developed market for catheters is in North America. Chronic diseases are becoming more common, government policies are supporting them, awareness is developing, competent, qualified doctors are available, and there are well-established healthcare facilities, all contributing to regional growth. In addition, increasing private research funding for innovative device R&D activities has a positive impact on the market expansion of this region. Other factors driving market expansion include a well-established healthcare infrastructure and an increase in lifestyle-related chronic diseases. The market rise in North America is partly due to an increasing number of patients undergoing surgical procedures and greater awareness of minimally invasive catheterization techniques.

Europe is the second largest region. Europe's robust healthcare system has transitioned from inpatient to outpatient care due to the increase in companies offering catheters. The market growth is expected to be largely influenced by the growing demand of the senior population for better healthcare facilities and the increasing interest of patients in less invasive procedures. The rapidly growing older population in this region is predicted to suffer from chronic diseases such as incontinence, peripheral vascular disease, and heart problems, and Europe's population is highly reliant on publicly supported health services.

The fastest-growing region is Asia Pacific. This is because kidney and cardiovascular problems are more common, medical facilities are better, and insurance policies are available. The key growth engines in Asia Pacific are China and India, while Japan's population is aging rapidly. Furthermore, China and India are projected to grow the fastest during the forecast period. However, a shortage of nephrologists and cardiac surgeons could hinder the industry's growth.

Key Player Analysis:

The catheters market analysis consists of players such as B. Braun Melsungen AG, Teleflex Incorporated, Cook Group, PACIFIC HOSPITAL SUPPLY CO. LTD, Johnson & Johnson Services, Inc., BD, Boston Scientific Corporation, Medtronic, Cardinal Health, and C. R. Bard, Inc.

Recent Developments:

Companies in the catheter market highly adopt inorganic and organic strategies such as mergers and acquisitions. A few recent key market developments are listed below:

- In June 2023, Inari Medical launched two new purpose-designed thrombectomy catheters to address the needs of venous stent thrombosis and venous thromboembolism (VTE), namely the Triever16 Curve catheter and the RevCore thrombectomy catheter.

- In February 2023, Teleflex announced that its Triumph catheter, which features a novel design that enables precise wire delivery and clear visualization, received 510(k) clearance from the US FDA. Additionally, the company said its GuideLiner coastal catheter saw its first clinical use at the UW Medicine Heart Institute in Seattle, Washington.

- In December 2022, Boston Scientific announced a strategic investment to acquire a majority stake in Chinese medical technology company Acotec Scientific Holdings Limited. The company is known in China for, among other things, its drug-coated balloons (DCBs), as well as thrombus aspiration catheters and RF ablation technologies. Boston Scientific aims to strengthen its position in the region with this deal.

- In March 2022, Shockwave Medical launched its Shockwave M5+ peripheral intravascular lithotripsy catheter after receiving both CE Mark and US Food and Drug Administration (FDA) approval.

- In March 2022, Cerus Endoscopic received US Food and Drug Administration (FDA) approval for its 027 microcatheters, available in two lengths, expanding its product portfolio, which includes the already FDA-approved 021 microcatheter platform heard.

- In February 2022, Teleflex announced that the company's specialty catheters and coronary guidewires received approval from the US FDA for an expanded indication for use in CTO PCI (percutaneous coronary interventions with chronic total occlusion). Devices receiving this clearance included the TrapLiner Catheter, Teleflex GuideLiner V3 Catheter, Specter Guidewire, Turnpike Catheters, Bandit Guidewire, Raider Guidewire, R350 Guidewire, and Warrior guide wire.

- In February 2022, Cerenovus, part of the Johnson & Johnson Medical Devices Companies, launched its Emboguard, a next-generation balloon guiding catheter for use in endovascular procedures, including those in patients with acute ischemic stroke.

- In January 2022, ICU Medical acquired Smiths Medical from Smiths Group plc. Smiths Medical specializes in providing syringe and outpatient infusion equipment, vascular access, and vital care solutions.

- In January 2022, Convatec announced the expansion of the Cure Ultra-portable and intermittent catheter range to include an option for women - the Cure Ultra Plus. The device with a length of 8 inches is designed to solve the problem of shortness of the traditional female catheter with a length of 6 inches, which becomes inconvenient to use.

Catheters Market Regional Insights

The regional trends and factors influencing the Catheters Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Catheters Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Catheters Market

Catheters Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 26.56 Billion |

| Market Size by 2031 | US$ 47.01 Billion |

| Global CAGR (2025 - 2031) | 8.50% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

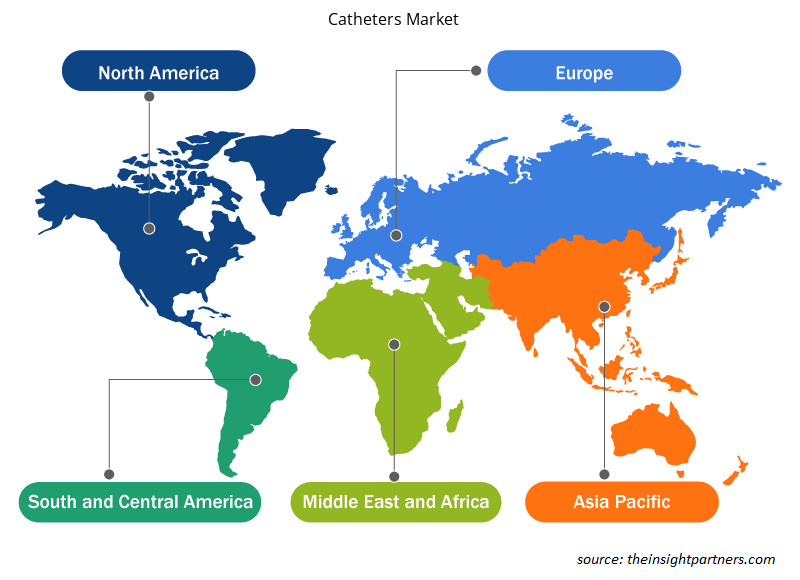

Catheters Market Players Density: Understanding Its Impact on Business Dynamics

The Catheters Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Catheters Market are:

- B. Braun Melsungen AG

- Teleflex Incorporated.

- Cook Group

- PACIFIC HOSPITAL SUPPLY CO. LTD.

- Johnson & Johnson Services, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Catheters Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Automotive Fabric Market

- Integrated Platform Management System Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Hydrogen Storage Alloys Market

- Virtual Pipeline Systems Market

- Nuclear Decommissioning Services Market

- Intradermal Injection Market

- Dealer Management System Market

- Pharmacovigilance and Drug Safety Software Market

- Medical and Research Grade Collagen Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. B. Braun Melsungen AG

2. Teleflex Incorporated.

3. Cook Group

4. PACIFIC HOSPITAL SUPPLY CO. LTD.

5. Johnson & Johnson Services, Inc.

6. BD

7. Boston Scientific Corporation

8. Medtronic

9. Cardinal Health.

10. C. R. Bard, Inc.

Get Free Sample For

Get Free Sample For