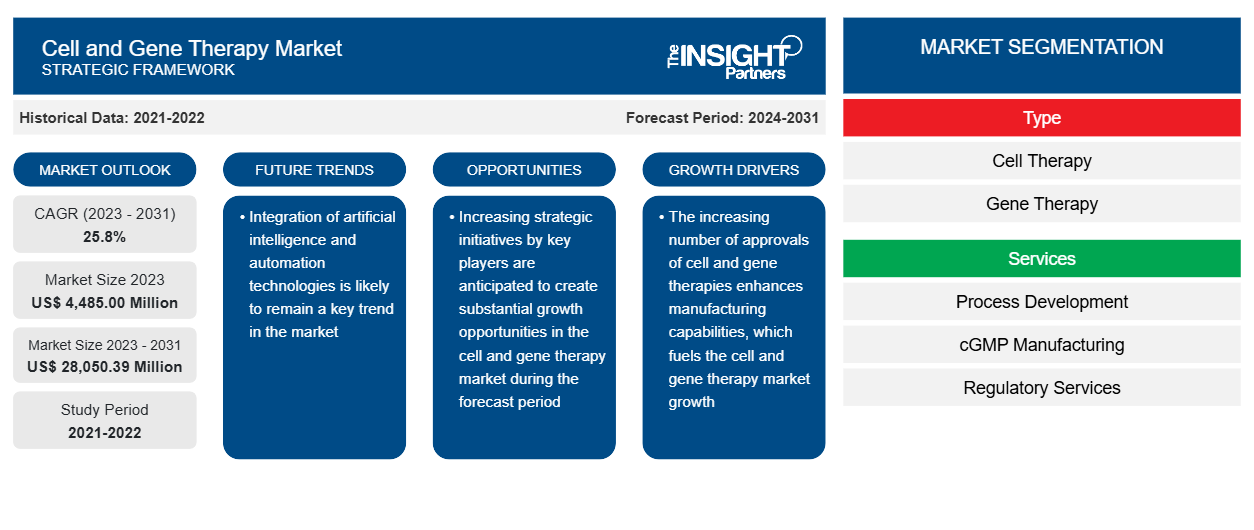

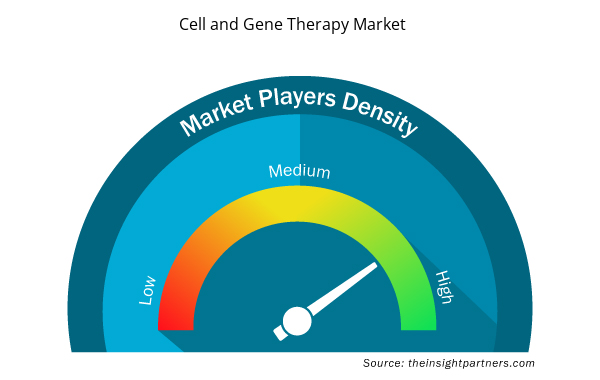

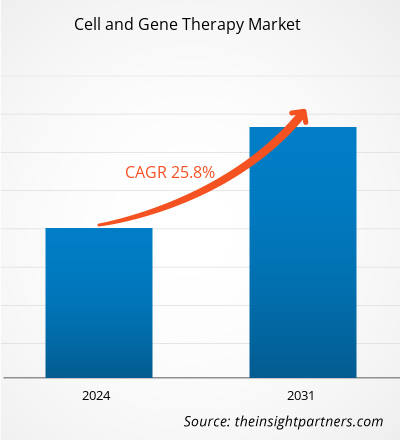

The cell and gene therapy market size is projected to reach US$ 28,050.39 million by 2031 from US$ 4,485.00 million in 2023. The market is expected to register a CAGR of 25.8% during 2023–2031. Integration of artificial intelligence (AI) and automation technologies is likely to bring new trends in the market during the forecast period.

Cell and Gene Therapy Market Analysis

The increase in the number of approvals of cell and gene therapies and the rapid popularity of outsourcing cell and gene therapy manufacturing are the factors favoring the cell and gene therapy market progress. Strategic initiatives by companies are also expected to benefit the market in the coming years.

Cell and Gene Therapy Market Overview

The advancements in biotechnology have led to the adoption of personalized treatments for a wide range of indications. Stem cell therapies are being used to treat cancer, neurological disorders, genetic disorders, and other chronic diseases. Further, the advantages of cell therapy include targeted treatment, rapid and efficient recovery, and reduced side effects. Cell therapies are widely adopted worldwide owing to the availability of Food and Drug Administration (FDA) approved products. A few of the cell and gene therapy products approved by the FDA in recent years are mentioned below:

- In April 2024, the FDA approved BEQVEZ for use by Pfizer Inc. to treat adults suffering from moderate to severe hemophilia B who are on factor IX (FIX) prophylaxis therapy. A FIX deficiency causes people with hemophilia B, a rare genetic bleeding illness, to bleed more frequently and for longer periods than healthy people. The disease hinders normal blood clotting.

- In 2023, the FDA approved VYJUVEK, manufactured by Krystal Biotech, Inc., for the treatment of wounds in patients ages 6 months and above with dystrophic epidermolysis bullosa, showing mutation(s) in the collagen type VII alpha 1 chain (COL7A1) gene.

Therefore, the increasing number of approvals of cell and gene therapies enhances manufacturing capabilities, which fuels the cell and gene therapy market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cell and Gene Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cell and Gene Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cell and Gene Therapy Market Drivers and Opportunities

Rapid Popularity of Outsourcing Cell and Gene Therapy Manufacturing Favors Market

Cell and gene therapy manufacturing is a complex process, which makes the proper execution and monitoring of the operation crucial. Cell and gene therapy manufacturers have a limited number of qualified personnel who know biological and process engineering. Moreover, for experienced teams, managing the attempts to reach the first clinical trial using a manual and open manufacturing method, as well as building a more commercially suitable process, can be challenging. Therefore, these manufacturers choose to work with contract development and manufacturing organizations (CDMOs) to accelerate their clinical studies and commercialization process. CDMOs support product development, manufacturing, clinical trials, and commercialization services to cell and gene therapy companies on a contract basis. Under the partnership with a CDMO, cell and gene therapy manufacturers support scalability, speed to market, access to technical expertise without overhead costs, and cost efficiencies.

Strategic Initiatives by Companies to Create Market Opportunities

Many companies involved in manufacturing cell and gene therapy products focus on collaborations, expansions, agreements, partnerships, new product launches, and other strategic developments. These strategic initiatives help them improve sales, expand geographic reach, and enhance capacities to cater to a large customer base. A few of the significant developments in the cell and gene therapy market are mentioned below.

- In September 2023, Agilent Technologies Inc. signed a Memorandum of Understanding (MOU) with the Advanced Cell Therapy and Research Institute, Singapore (ACTRIS). This agreement aims to improve cell and gene therapy advancements over the next three years.

- In March 2022, Cellevolve Bio partnered with Seattle Children’s Therapeutics to develop and commercialize new multiplex CARs for pediatric cancers. With this collaboration, the companies will focus on the BrainChild research program—a suite of five multiplex CARs—to treat pediatric central nervous system (CNS) malignancies. They aim to leverage the Seattle Children’s Cure Factory facility to conduct early clinical GMP research on new CARs.

The initiation of new businesses to remain competitive in the market through collaborations and partnerships can help accelerate the development of new platforms for cell and gene therapy manufacturing services. Thus, these strategic initiatives by key players are anticipated to create substantial growth opportunities in the cell and gene therapy market during the forecast period.

Cell and Gene Therapy Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cell and gene therapy market analysis are product type, application, and end user.

- Based on type, the cell and gene therapy market is segmented into bifurcated into cell therapy and gene therapy. The cell therapy segment held a larger market share in 2023.

- By services, the market is segmented into process development, cGMP manufacturing, regulatory services, and bioassay services. The process development segment held the largest share of the market in 2023.

- By scale, the market is bifurcated into pre commercial/R and D manufacturing and commercial scale manufacturing. The pre commercial/R and D manufacturing segment held a larger share of the market in 2023.

- By service provider, the market is divided into CDMOs and CMOs. The CDMOs segment dominated the market in 2023.

- Based on end user, the market is segmented into contract research organizations, pharmaceutical and biopharmaceutical companies, and academic and research institutes. The pharmaceutical and biopharmaceutical companies segment dominated the market in 2023.

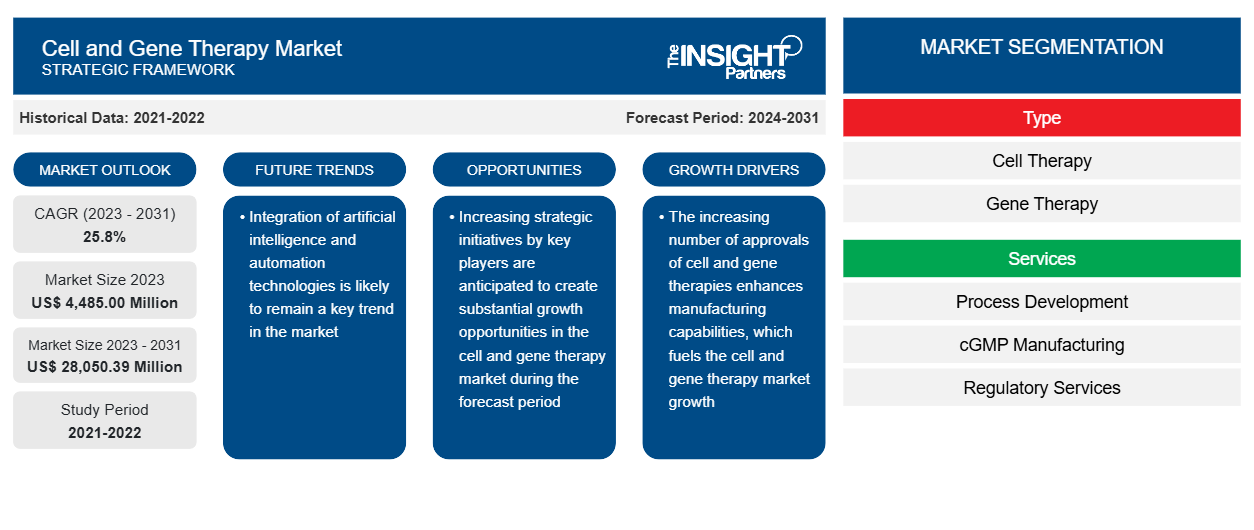

Cell and Gene Therapy Market Share Analysis by Geography

The geographic scope of the cell and gene therapy market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. The North America cell and gene therapy market has been analyzed on the basis of the US, Canada, and Mexico. The cell and gene therapies market growth in the US is attributed to the growing adoption of cell therapies such as stem cell, gene, and immune therapies. Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. According to the American Society of Gene & Cell Therapy (ASGCT), there are currently 3,633 therapies in the pipeline—55% are gene, 22% are non-genetically modified cells, and 23% are RNA—from preclinical through pre-registration. These are focused on various diseases and conditions, varying from cancer to genetic disorders to neurological conditions. As of February 2024, 19 cell and gene therapy products have been approved in the US for treating cancer, eye diseases, and rare hereditary diseases. Also, the country is experiencing an increasing number of start-ups innovating cell therapies. In addition, growing support from the government is promoting the growth of cell therapies, influencing the development of the market. For instance, the American Society of Gene & Cell Therapy (ASGCT), a public organization, offers memberships to scientists, physicians, professionals, and patient advocates who are engaged in gene and cell therapies. ASGCT aims to enhance knowledge, education, and awareness regarding the clinical application of cell and gene therapies.

Cell and Gene Therapy Market Regional Insights

The regional trends and factors influencing the Cell and Gene Therapy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cell and Gene Therapy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cell and Gene Therapy Market

Cell and Gene Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4,485.00 Million |

| Market Size by 2031 | US$ 28,050.39 Million |

| Global CAGR (2023 - 2031) | 25.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cell and Gene Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The Cell and Gene Therapy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cell and Gene Therapy Market are:

- Thermo Fisher Scientific, Inc.;

- Merck KGaA;

- Charles River Laboratories;

- Cell and Gene Therapy Catapult;

- Lonza;

- WuXi AppTec;

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cell and Gene Therapy Market top key players overview

Cell and Gene Therapy Market News and Recent Developments

The cell and gene therapy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the cell and gene therapy market are listed below:

- South Korean CDMO Lotte Biologics and Merck KGaA have signed a partnership deal focused on expanding biopharmaceutical production and process development. (Source: Lotte Biologics, Company Website, June 2024)

- Catalent launched a new case management service specifically designed to address the unique challenges associated with the safe and timely delivery of advanced therapies to patients by providing professional supply chain oversight from program start to finish. The supply chain logistics for advanced therapy medicinal products (ATMPs), such as cell and gene therapies, is complex because of their inherent sensitivity, high value, and certain patient-specific complexities of delivering each dose. (Source: Catalent, Company Website, January 2023)

Cell and Gene Therapy Market Report Coverage and Deliverables

The "Cell and Gene Therapy Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Cell and gene therapy market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cell and gene therapy market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cell and gene therapy market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the cell and gene therapy market.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Advanced Planning and Scheduling Software Market

- Volumetric Video Market

- Sleep Apnea Diagnostics Market

- USB Device Market

- Animal Genetics Market

- Pressure Vessel Composite Materials Market

- Medical Devices Market

- Investor ESG Software Market

- Employment Screening Services Market

- Blood Collection Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America dominated the market in 2023.

Key factors that are driving the market are the increase in number of approvals of cell and gene therapies and rapid popularity of outsourcing cell and gene therapy manufacturing.

Integration of artificial intelligence and automation technologies is likely to remain a key trend in the market.

Thermo Fisher Scientific, Inc.; Merck KGaA; Charles River Laboratories; Cell and Gene Therapy Catapult; Lonza; WuXi AppTec; Takara Bio Inc.; Bristol Myers Squibb; FUJIFILM Holdings Corporation; F. Hoffmann-La Roche Ltd.; and Catalent Biologics are among the key players operating in the market.

The cell and gene therapy market value is estimated to reach US$ 28,050.39 million by 2031.

The cell and gene therapy market is anticipated to record a CAGR of 25.8% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Cell and Gene Therapy Market

- Thermo Fisher Scientific, Inc.;

- Merck KGaA;

- Charles River Laboratories;

- Cell and Gene Therapy Catapult;

- Lonza; WuXi AppTec;

- Takara Bio Inc.;

- Bristol Myers Squibb;

- FUJIFILM Holdings Corporation;

- F. Hoffmann-La Roche Ltd.;

- Catalent Biologics

- Cell Therapies Pty Ltd

Get Free Sample For

Get Free Sample For