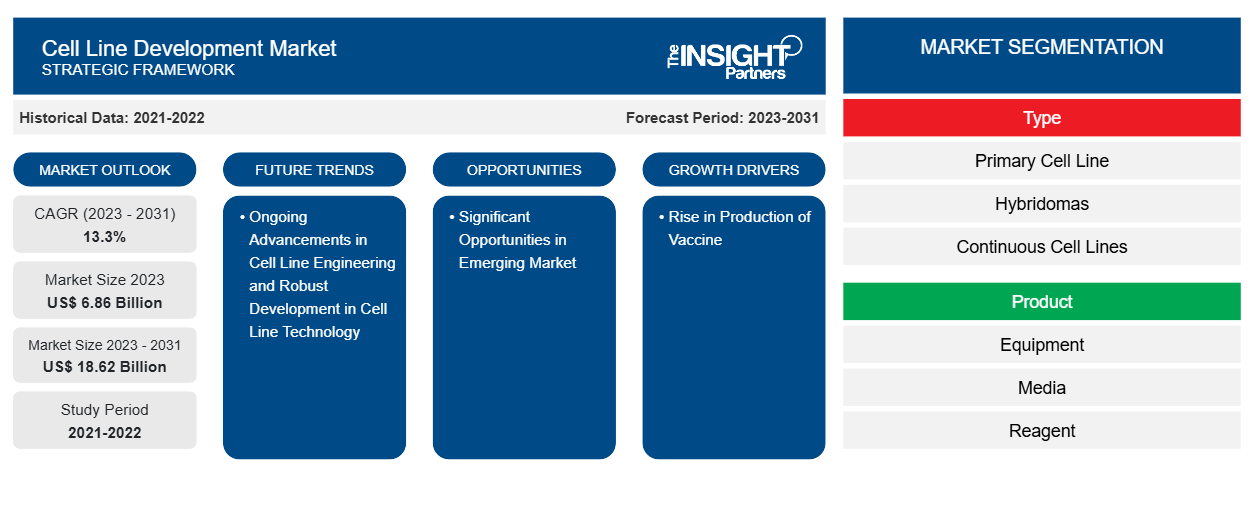

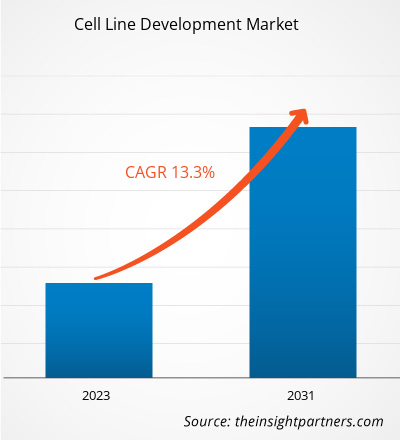

The cell line development market was valued at US$ 6.86 billion in 2023 and is expected to reach US$ 18.62 billion by 2031. The market is expected to register a CAGR of 13.3% in 2023–2031. Ongoing advancements in cell line engineering and robust development in cell line technology will likely remain key cell line development market trends.

Cell Line Development Market Analysis

Developing cell lines is crucial for assessing toxicity, in-vitro testing, and the effectiveness of discovering new medications. This procedure lowers the chance of medication failure during clinical trials by saving money, time, and effort. Recombinant proteins are generated throughout the cell line development procedure. These include vaccines, fusion proteins, growth factors, enzymes, bi-specific and monoclonal antibodies, and novel approaches to creating immunotherapies for cancer treatment. Researchers seek ways to move through the early stages of biotherapeutic discovery and candidate selection to reduce the costs associated with cell line development. This process is efficient because it quickly produces and selects cell lines that yield high-quality recombinant protein in large quantities and removes clone candidates that are likely to fail as soon as feasible. Technological developments in cell line development have accelerated the testing of different drug candidates in the early phases of development, saving time and money.

Additionally, businesses engaged in drug discovery and cell line development have been cooperating, expanding the sector. For example, Cytiva recently purchased CEVEC Pharmaceuticals, a top German technology supplier for producing viral vectors and high-performance cell lines. Bio-Techne Corporation declared in July 2022 that Namocell, Inc. had been fully acquired. Simple single-cell sorting and dispensing platforms that protect cell viability and integrity are made available by the Namocell acquisition. In numerous workflows in biotherapeutics and diagnostics, such as developing and commercializing cell and gene therapies, cell engineering, cell line development, single-cell genomics, antibody discovery, synthetic biology, and rare cell isolation, Namocell's tools and consumables are essential technologies.

Cell Line Development Market Overview

The process of choosing the cellular machinery to produce therapeutic biologics or other interesting proteins is called cell line development. Yeast, mammals, plants, and bacteria can use several expression systems to develop cell lines. Chinese hamster ovary (CHO) cells cultivated in suspension cultures are most frequently used to produce the complex protein. These cells are eventually used in bioreactors during the manufacturing stage. Small-scale suspension cultures are the first step in developing cell lines, eventually moving to large-scale bioreactors during manufacturing. The application of cell lines to generate therapeutic products transforms every aspect of the biopharmaceutical industry, from creating innovative gene therapies to producing state-of-the-art vaccines and cancer-fighting medications. This, in turn, creates significant opportunity in the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cell Line Development Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cell Line Development Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cell Line Development Market Drivers and Opportunities

Rise in Production of Vaccine to Favor Market

Many methods for producing large amounts of antigenic proteins have had to be developed in response to the increasing demand for vaccine products. Vaccine developers typically adhere to a linear process that includes thorough data analysis and verification to guard against historically high failure rates. Prominent producers of vaccines and antiviral medications are putting a lot of effort into creating new approaches to producing pandemic candidates and seasonal influenza vaccines. Until recently, most efforts have gone toward developing licensed egg-based vaccines. To meet the demands of the upcoming seasonal campaign and to produce pandemic vaccine prototypes for clinical trials, manufacturers have been focusing on increasing production capacities and automating parts of largely manual steps in egg-based vaccine technology. Thus, an increase in the production of vaccines is likely to drive the growth of the cell line development market.

Significant Opportunities in Emerging Market – An Opportunity in the Cell Line Development Market

Cell lines are needed for production because biologics and biosimilars are receiving more attention. Research and development opportunities in this field can be made possible through partnerships with government initiatives, biotech companies, and academic institutions. Furthermore, India is desirable for cell line development activities due to its highly skilled workforce and cheaper development costs than Western nations. For instance, through national funding organizations like the Department of Biotechnology (DBT), the Indian Council of Medical Research (ICMR), and the Department of Science and Technology (DST), the government supports the development of cell lines in developing nations like India.

Cell Line Development Market Report Segmentation Analysis

Key segments contributing to the cell line development market analysis derivation are type, product, and application.

- Based on type, the cell line development market is segmented into primary cell line, hybridomas, continuous cell lines, recombinant cell line. The recombinant cell line segment held a larger market share in 2023.

- By product, the market is segmented into equipment, media, reagent. The media & reagent segment held the largest share of the market in 2023.

- By application, the market is segmented into drug discovery, bioproduction, tissue engineering. The bioproduction segment held the largest share of the market in 2023.

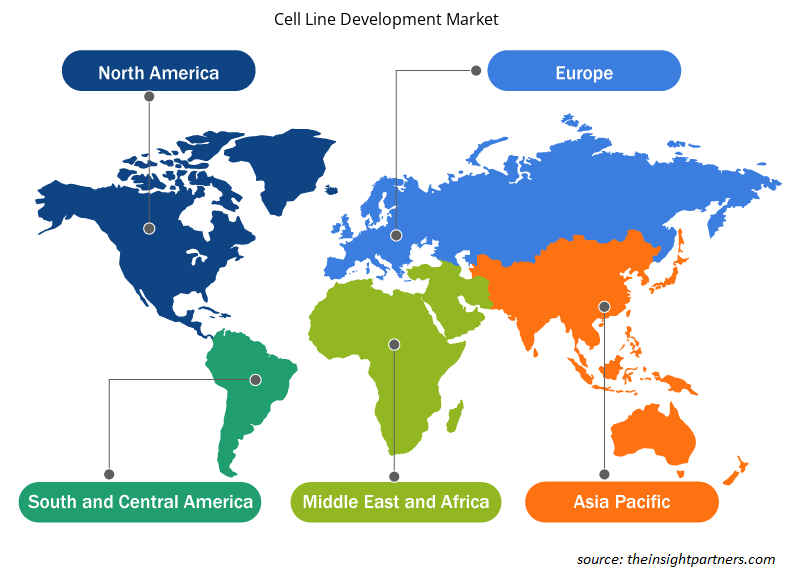

Cell Line Development Market Share Analysis by Geography

The cell line development market report's geographic scope is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the cell line development market. In North America, the US is the largest market for cell line development in 2023. The expansion of the US cell line development market is attributed to the different players in the industry, and the dynamic conditions established in this area have changed the dynamics of cell line development in the area. Key players in the market, a lot of research and development being done by different academic and research institutes, and a growing demand for novel products from biopharmaceutical and biotechnology companies are growth characteristics in North America. Furthermore, significant funding for genomic research from public and private entities, along with growing emphasis on the integration of advanced methods in healthcare and government and private initiatives to promote precision medicine, are anticipated to propel growth and generate exceptional revenue for the North American cell line development market. Due to numerous development initiatives and business plans that support the creation, discovery, or modification of diverse biomolecules and organisms through bioengineering techniques, medical biotechnology has experienced revolutions. The nation's new businesses with exciting and creative ideas have benefited from the Biotech Startup Revolution, which has also helped maximize revenue generation and North America's economic standing in the international cell line development market.

Cell Line Development Market Regional Insights

The regional trends and factors influencing the Cell Line Development Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cell Line Development Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cell Line Development Market

Cell Line Development Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.86 Billion |

| Market Size by 2031 | US$ 18.62 Billion |

| Global CAGR (2023 - 2031) | 13.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

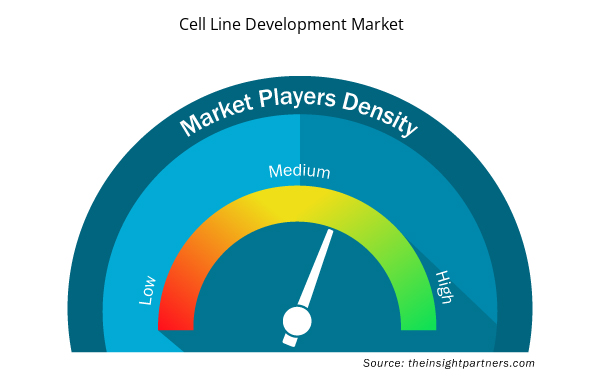

Cell Line Development Market Players Density: Understanding Its Impact on Business Dynamics

The Cell Line Development Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cell Line Development Market are:

- Thermo Fisher Scientific Inc

- Merck KGaA

- Selexis SA (JSR Corporation)

- BioFactura, Inc

- Corning Incorporated

- Sartorius AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cell Line Development Market top key players overview

Cell Line Development Market News and Recent Developments

The cell line development market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for cell line development and strategies:

- Abzena announced on Jan. 16, 2023 the launch of AbZelect and AbZelectPRO, its new cell line development (CLD) platforms, designed to speed up the generation of production cell lines for the manufacture of antibodies and recombinant proteins. The platforms are intended to enable the rapid progress of complex biologic drug programs towards clinical trials and investigational new drug (IND) application filing. (Source: Abzena Company Name, Newletter, 2023)

- Lonza announced the launch of its new GS Effex cell line for the development of therapeutic antibodies with enhanced potency. The GS Effex cell line was developed to meet pressing market needs originating from the shift towards more sophisticated therapeutic antibodies. Derived from Lonza’s leading GS Xceed cell line, GS Effex fits effectively into Lonza platforms. Combined with good cell growth and the ability to produce therapeutic antibodies with increased potency, the new cell line provides a solution for therapeutic development from discovery stage research through to commercial manufacturing. (Source: Lonza Company Name, Press Release, 2023)

Cell Line Development Market Report Coverage and Deliverables

The “Cell Line Development Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; By Product ; Application ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For